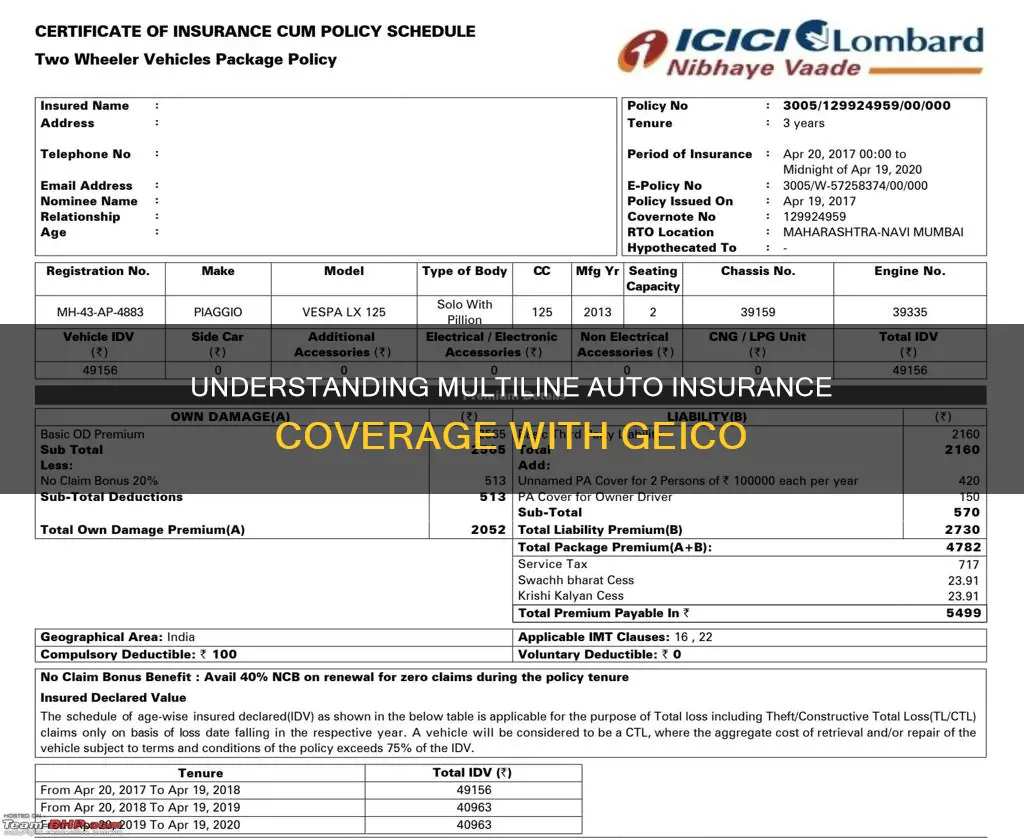

Multiline insurance, also known as multi-policy or bundling insurance, is when a customer purchases multiple types of insurance policies from the same provider. GEICO offers multiline insurance, allowing customers to bundle their auto insurance with other types of policies such as renters, homeowners, condo, or mobile home insurance coverage. By bundling insurance policies, customers can often save up to 15% on their insurance premiums. GEICO also offers a Multi-Vehicle Insurance Policy Discount, where customers can save money by insuring multiple vehicles with the company.

| Characteristics | Values |

|---|---|

| Definition | Multi-line insurance is when a customer buys multiple insurance policies from the same provider. |

| Other names | Multi-policy insurance, bundling |

| Discount | Up to 15% across all insurance products |

| Providers | GEICO, State Farm, Allstate, Progressive |

| Types of insurance that can be bundled with auto | Condo, farm, health, homeowners, life, renters, boat, travel |

| GEICO-specific types of insurance that can be bundled with auto | Renters, homeowners, condo, mobile home |

| Other GEICO discounts | Multi-vehicle discount, good student discount, anti-theft device discount |

What You'll Learn

Multiline insurance discounts

A multiline insurance discount, also known as a multi-policy or bundling discount, is offered to customers who buy multiple insurance policies from the same provider. This discount is often applied to auto policies and home policies, but can also be used to bundle renters insurance, life insurance policies, and more.

GEICO offers multiline insurance discounts to its customers. When you bundle your home and auto insurance or auto and renters insurance with GEICO, you could save time and money. GEICO also offers a Multi-Vehicle Insurance Policy Discount, where you could be eligible for a discount if you have other insurance policies with the company.

The savings for a multiline insurance discount vary from provider to provider and depend on where you live, but the average policyholder saves 15% when they bundle home and auto insurance. GEICO offers a flat 3% discount on the type of policy you bundle, as long as it is a renters, condo, mobile home, or homeowners policy.

Insurance companies prefer multi-line insurance policies because they can get more money and better understand a policyholder's circumstances and potential risk factors. Meanwhile, you get all the insurance coverage you need at a discounted rate, while also limiting the amount of paperwork you have to fill out.

One downside of multi-line discounts is that they are harder to get insurance quotes for. You won't always be able to use an online tool to apply for a quote, and instead will have to call an insurance agent to get an accurate estimate.

Reporting Auto Insurance Fraud in New Jersey

You may want to see also

Multiline insurance pros and cons

Multiline insurance is a type of insurance policy that allows customers to bundle different types of insurance coverage under a single contract. This is also referred to as a multi-policy, multi-line discount, or bundling.

GEICO, for example, offers a flat 3% discount when customers bundle multiple insurance policies, such as renters, condo, mobile home, or homeowners insurance.

Pros of Multiline Insurance

Multiline insurance has several benefits for customers:

- Discounted rates: Customers can save money by bundling multiple insurance policies together. The average policyholder saves 15% when bundling home and auto insurance.

- Convenience: Customers only have to deal with one insurer, which can improve the customer service experience and make it easier to manage policies and claims.

- One-stop shop: Customers can get all their insurance needs met by a single provider, who has a complete picture of the customer's circumstances and risk factors.

- Less paperwork: Customers only have to fill out paperwork for one insurer.

Cons of Multiline Insurance

There are also some potential downsides to multiline insurance:

- Harder to get quotes: It may be more difficult to get insurance quotes for multiline policies, as customers usually have to call an insurance agent instead of using an online tool.

- Specialization: Not all insurance companies specialize in all types of insurance coverage. A company that excels in auto insurance may have homeowners' insurance as a secondary product line. In this case, a customer with a bundled policy might have a better experience claiming for a car accident than for a home burglary.

- Limited choice: Customers are restricted to the insurance products offered by their chosen provider.

Canceling Geico: A Quick Guide

You may want to see also

Multiline insurance and multi-car insurance

Multiline insurance, also known as multi-policy insurance, is when a customer purchases multiple types of insurance from the same provider. This can include combining home and auto insurance or bundling auto insurance with another type of policy, such as renters, homeowners, condo, mobile home, life, boat, or travel insurance. By bundling these policies together, customers can often receive a multiline discount, which reduces their total insurance rates. The discount offered varies by company, with some companies offering a flat discount, such as GEICO's 3% discount, while others offer a range of discounts, such as Allstate's discounts of up to 25%. On average, customers can expect to save around 15% on their insurance premiums by taking advantage of multiline discounts.

GEICO also offers a multi-car insurance discount, which is different from the multiline discount. The multi-car discount applies when a customer insures two or more vehicles on the same GEICO policy. This discount can be combined with the multiline discount, allowing customers to save even more on their insurance premiums. The multi-car discount is applied to each car's premium and can include secondary vehicles such as motorcycles, RVs, and boats. However, it is important to note that the discount does not compound, so adding more vehicles will not result in a larger discount.

Auto Insurance Statements: What to Check and Why

You may want to see also

Multiline insurance and single-line insurance

Multiline insurance refers to complex insurance that bundles multiple similar types of exposure to risk into a single insurance contract. This can apply to both individual and corporate insurance policies. For example, an individual may bundle their auto, marine, and homeowners insurance into a multiline contract, while a company may bundle their business property and casualty risks. This type of insurance is meant to reduce the overall premium and simplify year-end accounting. It also allows insurance companies to better predict the insured's level of risk and build long-term relationships with customers.

On the other hand, a monoline or single-line insurance policy covers only one specific risk. For instance, a single auto insurance policy covering just one vehicle. Some insurance companies may only offer monoline policies, depending on the types of risks they cover. Monoline policies are often used for unique or high-risk properties or vehicles that cannot be placed on a standard policy. They can also provide more direct contact with a broker or agent who specializes in that specific risk.

The main difference between multiline and single-line insurance is the number of risks or lines of insurance covered by the policy. Multiline insurance covers multiple risks, while single-line insurance covers just one. This distinction also applies to insurance companies, with mono-line companies writing only one line of insurance and multi-line companies offering multiple lines.

While multiline insurance can provide convenience and potential discounts for customers, it is important to consider the potential drawbacks. One concern is the moral hazard, where a business with a comprehensive multiline policy may become less vigilant in monitoring and addressing risk factors. Additionally, in the event of a single claim, a company with a multiline policy may end up paying a higher deductible than they would have with separate policies.

In contrast, single-line insurance may be more suitable for certain situations, such as insuring classic or collectible vehicles that require specialized coverage. It can also be a more cost-effective option compared to bundled policies, especially for high-risk properties or vehicles. Ultimately, the choice between multiline and single-line insurance depends on an individual's or business's specific needs and risk profile.

Commission Earnings of Auto Insurance Agents

You may want to see also

Multiline insurance and insurance quotes

Multiline insurance refers to buying multiple types of insurance, such as home and auto coverage, from the same company. This is also known as a "bundle". By combining these policies, you can benefit from a reduction in your overall premiums.

A multiline insurance contract is a type of insurance policy that bundles different exposures to risk and covers them under a single agreement. This provides increased convenience and premium discounts for policyholders, who can save anywhere from 5-15% on their total insurance rates. For example, an individual who bundles their auto and home insurance saves an average of 15% annually.

Most of the larger insurance companies, such as State Farm, Progressive, Amica, and Nationwide, offer multiline discounts. However, smaller statewide or regional firms that only deal in car insurance might not be able to offer this type of discount.

When purchasing multiline insurance, you may have to consult an agent to figure out the exact savings. Some companies, like Nationwide, allow you to see the savings when you add multiple policies to your quote online. Other companies, like Amica and Geico, require you to contact an agent to determine the savings.

In addition to the financial benefits, having multiline insurance can also simplify the insurance process by allowing you to manage all your policies in one place. This means dealing with fewer companies and potentially improving your customer service experience.

Insuring Your Vehicle: Tax and Insurance Days

You may want to see also

Frequently asked questions

A multiline insurance policy, also known as a multi-policy or bundling discount, is when a customer purchases multiple insurance policies from the same provider.

You can bundle your auto insurance with other types of policies such as renters, homeowners, condo, mobile home, or life insurance coverage.

The savings vary depending on the provider and your location, but on average, customers save around 15% when they bundle home and auto insurance. GEICO offers a flat 3% discount on renters, condo, mobile home, or homeowners policies.

A multiline insurance policy can help you save money on your insurance premiums, and you get all the coverage you need from a single provider. It also limits the amount of paperwork you have to fill out.