When applying for car insurance, the company will want to know how much of a risk you are. One of the most important factors they will check is your driving record, which gives them an indication of how you drive and how responsible you are on the road. They will also check your Claims Loss Underwriting Exchange report, which tells them how often you have made insurance claims and helps them predict your future claim risk.

Your driving record is one of the key factors that affects how much you pay for car insurance. A good driving record results in lower premiums, while a history of accidents or serious traffic violations will mean you are likely to pay more.

Insurance companies will check your driving record when you apply for a new policy and at renewal. They will also check it if you ask to change the level of coverage, change your car, or add an extra driver to the same coverage.

| Characteristics | Values |

|---|---|

| How often driving records are checked | When applying for a new policy, getting a new quote, or renewing an existing policy |

| What is checked | Driving history, including accidents, claims, and tickets; Claims Loss Underwriting Exchange report; international driving records in some cases |

| Impact on insurance rates | Accidents can increase rates by $80/month, speeding tickets by $45/month; DUI charges can stay on record for up to 10 years and significantly raise rates |

| Permission to drive other vehicles | Verbal consent or reasonable belief of permission is generally required; full coverage may not extend to rented or borrowed vehicles |

| Coverage for other drivers | Spouse, parents, siblings, children, and other household members are typically covered; friends and extended family may be covered with consent |

What You'll Learn

Driving history: accidents, claims, and tickets

Driving records are a major factor in determining car insurance premiums. A history of accidents, claims, and tickets can result in higher insurance rates as they indicate a higher risk of future incidents. Insurance companies typically check an individual's driving record when they apply for a new policy and at renewal. The frequency and severity of driving violations and collisions are considered in assessing the driver's risk level.

Accidents, regardless of fault, are reported to the Department of Motor Vehicles (DMV) and become part of an individual's driving record. The length of time an accident remains on a driving record varies by state, typically ranging from three to five years. For example, in California, accidents remain on record for three years, while in New York, it is three years from the end of the year in which the accident occurred.

In addition to accidents, insurance companies consider all types of traffic violations such as speeding tickets, DUIs, and driving without a license or seatbelt. These violations can also lead to increased insurance rates. The duration of these violations on a driving record depends on their severity and state regulations. For instance, speeding tickets typically stay on a driving record for three years, while a DUI conviction can remain for up to ten years in some states.

It is important to note that insurance companies do not report accidents to the DMV. However, insurance companies may communicate with the DMV if an individual's insurance lapses, does not meet certain standards, or if they are convicted of a serious driving offense.

To summarize, a driving record encompassing accidents, claims, and tickets plays a crucial role in determining auto insurance rates. Insurance companies assess the frequency and severity of these incidents to gauge the risk associated with insuring a driver. By understanding the impact of their driving history, individuals can make informed decisions about their auto insurance and work towards maintaining a clean driving record.

How to Identify Another Driver's Auto Insurance Company

You may want to see also

Employment status and driving courses

Driving records are a major factor in determining car insurance premiums. Insurance companies check driving records when drivers apply for a new policy and at renewal. They do this to assess the risk associated with insuring a driver. A poor driving record can lead to higher insurance rates or even a denial of coverage.

Employment Status and Driving Records

In some cases, employers may also request to check an individual's driving record, especially if driving is part of their job responsibilities or if they travel and work independently. A driving record search may reveal information that some courts do not classify as criminal, such as alcohol-related offenses.

Driving Courses and Insurance Rates

Taking a defensive driving course can be a great way to improve your driving skills and potentially lower your insurance rates. Many insurance companies offer discounts to drivers who take these courses, with the most common eligibility being drivers under 25 or over 60. The courses typically cover safety information, driving techniques, and local driving laws. They can be taken online or in person, with online courses generally being cheaper and more flexible.

It's important to note that eligibility for insurance discounts after taking a driving course varies by state law and insurance company. Some companies may also require a clean driving record to qualify for a discount.

Defensive driving courses can help you become a safer driver, and potentially save you money on your insurance premiums. It's worth checking with your insurance provider to see what discounts or requirements they have in place.

Insurance: Transporting Vehicles

You may want to see also

Vehicle storage location

If you're not using your car for a long time, you may want to consider storing it. This could be because you're spending the winter in a warmer climate, taking a long vacation, or sharing one vehicle within your household. In any case, it's recommended that you keep your auto insurance policy active by purchasing car storage insurance. This will help you avoid higher premiums in the future and ensure you're protected against any damage that can occur to your vehicle while it's in storage.

Car storage insurance is sometimes referred to as parked-car insurance. However, most insurance companies call it "comprehensive-only coverage". This type of insurance covers anything that can happen to your vehicle while it's stored or parked, including theft, hail, fire, or other mishaps. It's important to note that car storage insurance doesn't actually exist as a separate policy; it's just a term used to describe minimum coverage for a vehicle in storage.

When you purchase car storage insurance, you can reduce your coverage to only what is necessary. This means dropping liability, collision, and uninsured motorist coverage, and keeping only comprehensive coverage. However, many states and lenders won't allow you to have comprehensive-only coverage, even if your vehicle is in storage. In this case, you can still save money by reducing these coverages to the lowest possible level.

There are a few drawbacks to cancelling your auto insurance policy entirely while your vehicle is in storage. Firstly, you'll create a gap in your auto insurance history, which can cause insurance companies to regard you as a high-risk driver and result in higher premiums when you reinstate your policy. Secondly, without auto insurance, you'll be completely responsible for any damage that occurs to your vehicle while it's in storage. Finally, you may not be allowed to cancel your car insurance policy at all. If you're financing your vehicle, you may be required to maintain insurance as a condition of your car loan.

In conclusion, if you're planning to store your vehicle for an extended period, it's recommended that you purchase car storage insurance to protect your vehicle and maintain your auto insurance history. Speak with your insurance agent to discuss your policy options and ensure you're complying with the law.

Vehicle Insurance: Owners' Purchasing Guide

You may want to see also

Claims Loss Underwriting Exchange report

A Claims Loss Underwriting Exchange (CLUE) report is a claims-information report generated by LexisNexis, a consumer-reporting agency. The report contains up to seven years of personal auto and personal property claims history. It includes the insured's personal information, policy number, type and date of loss, claim status, amount paid, and insured property or vehicle information.

Insurance companies use CLUE reports to determine premiums and in the underwriting process. The report helps them assess the risk associated with insuring an individual. The company uses your claims history to decide if it will offer you coverage and how much you'll pay. A history of accidents or traffic violations will result in a higher-risk rating and increased premiums.

You can request a copy of your CLUE report from LexisNexis. It is important to review your report for any inaccuracies and dispute any incorrect information, as this can impact your insurance rates.

Vehicle Insurance Expired? Here's What to Do

You may want to see also

Driving license number

A driving license number is a crucial piece of identification that serves multiple purposes. This number is typically located on the front of your driver's license card, and it remains the same even if you renew your license or move to a different state. Here are some scenarios where you might need to provide your driving license number:

Insurance Purposes

Auto insurance companies often require your driver's license number to check your driving record and determine your insurance rates. They use this number to retrieve information about your driving history, including accidents, traffic violations, and claims. This information helps them assess your risk as a driver and set your insurance premiums accordingly. Most companies look back at the previous five years of your driving record when setting insurance rates.

Vehicle Registration

In some places, your driver's license number will be listed on your vehicle registration documents. This information is usually required to be kept in your vehicle. Therefore, you can refer to your registration papers if you need to locate your license number.

Personal Record-Keeping

It is always a good idea to keep a record of important documents, such as expired driver's licenses. If you have any old licenses, they will likely have the same number as your current one, making it easy to find your current license number.

Financial Records

If you write personal checks, your driver's license number may be written on those checks by retailers. You can review canceled checks or their digital images through your bank to locate your license number.

Replacement License

In the unfortunate event that you lose your driver's license, you may need to know your license number to obtain a replacement. You can contact the agency that issued your license to inquire about the process, and they may provide you with your license number over the phone after verifying your identity. Alternatively, you can visit their office in person and provide the necessary identification documents to get a replacement license.

Grandchildren's Auto Insurance: USAA Eligibility

You may want to see also

Frequently asked questions

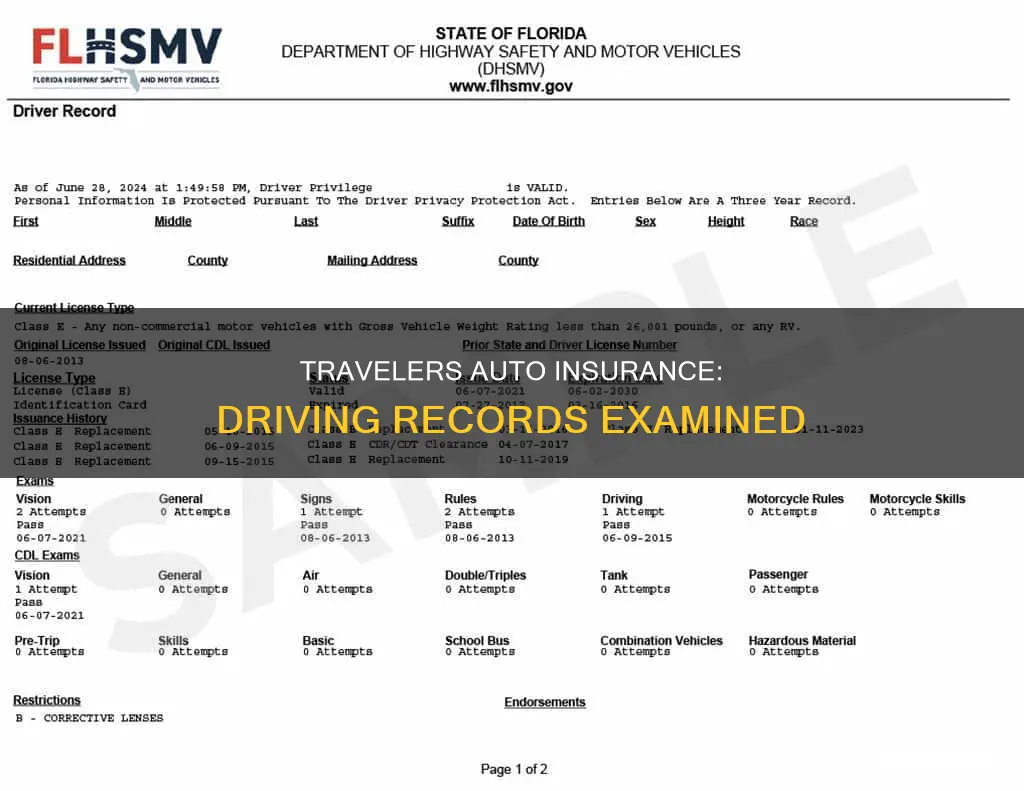

Travelers Auto Insurance will ask for your driver's license number to check your driving record through the DMV. They will likely ask for this when you request quotes online or when you buy a policy.

This depends on your state's department of insurance. In most states, they will only look into the past three years, but it is possible that they will check further. For example, in California, a DUI remains on your record for 10 years.

Travelers Auto Insurance will check your driving record when you apply for a new policy and at renewal. They will also check if you request a new quote, change the level of coverage, change your car, or add an extra driver to the same coverage.