Guaranteed Asset Protection (GAP) insurance is an optional, add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in specific situations. GAP insurance is intended to cover this difference, or gap, when a car is stolen or deemed a total loss, and the loan balance is higher than the value of the vehicle. This type of insurance is particularly relevant for drivers who owe more on their car loan than the car is worth, and it can be purchased at the same time as buying or leasing a new car.

| Characteristics | Values |

|---|---|

| Full Form | Guaranteed Asset Protection insurance |

| Type | Optional, add-on coverage |

| Coverage | Covers the "gap" between the financed amount owed on a car and its actual cash value (ACV) in the event of a covered incident where the car is declared a total loss |

| Applicability | Applicable if the loan amount is more than the vehicle is worth |

| Cost | $200-$300 if purchased independently; $20-$40 if bundled with an existing policy |

What You'll Learn

When to get GAP insurance

GAP insurance, or Guaranteed Asset Protection insurance, is an optional add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a total loss. This type of insurance is particularly useful when a driver owes more on their car loan than the car is worth.

- When you owe more on your car loan than the car's current value: If you are making car loan payments and your loan balance exceeds the car's current cash value, GAP insurance can help bridge the financial gap in the event of a total loss. This scenario typically arises when you have a small down payment, a long payoff period, or a combination of both.

- When your car loan or lease agreement requires GAP insurance: Some loan or lease providers mandate GAP insurance from the outset, regardless of the loan amount or vehicle value. In such cases, purchasing GAP insurance is necessary to fulfil the requirements of your loan or lease contract.

- When you lease a vehicle: Leasing companies often require GAP insurance as a protective measure. In some cases, GAP insurance may already be included in the price of the lease, so it's essential to review the terms of your lease agreement.

- When you purchase a new vehicle: GAP insurance is typically available for brand-new vehicles or models that are less than three years old. If you are financing a new vehicle, especially with a substantial loan amount, GAP insurance can provide valuable protection in case of a total loss.

- When you have a high-interest auto loan: If you have an auto loan with a high-interest rate, the amount you owe on the loan can quickly exceed the car's value, creating a financial gap. GAP insurance can help mitigate this risk.

- When you have a long-term auto loan: Longer loan terms mean it will take you longer to build equity in your vehicle. During the initial years of your loan, when your loan balance is high, GAP insurance can provide peace of mind in case of an accident or theft.

- When you purchase a vehicle that depreciates rapidly: Some vehicles, such as luxury cars or certain SUVs, tend to depreciate faster than others. If you buy a vehicle that is known for rapid depreciation, GAP insurance can help protect you from owing more than the car's value.

- When you want peace of mind and financial protection: Even if your loan amount is not significantly higher than your car's value, unexpected events like accidents or theft can leave you with a financial burden. GAP insurance provides reassurance that you won't be stuck with a large bill if something happens to your vehicle.

Remember, GAP insurance is not required by law, and you should assess your individual circumstances before purchasing it. It is recommended to consult with your insurance agent or financial advisor to determine if GAP insurance is suitable for your situation.

Does Your Auto Insurance Cover You in Mexico?

You may want to see also

What does GAP insurance cover?

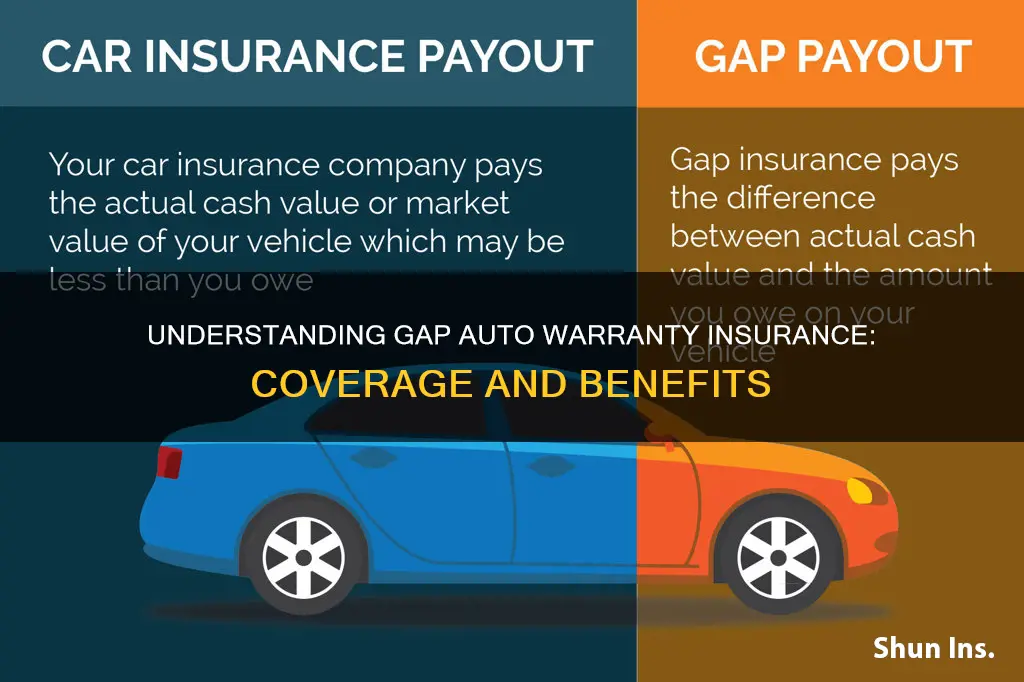

GAP insurance, or Guaranteed Asset Protection insurance, is an optional add-on to your existing auto insurance policy. It covers the difference between the amount you owe on your auto loan and the amount your insurance company pays if your car is stolen or totaled.

For example, if you have an auto loan balance of $30,000 on a brand new vehicle and it is totaled in an accident, your insurance company will only pay you the current actual cash value of the vehicle, let's say $25,000. Without GAP insurance, you would still owe $5,000 on the loan. With GAP insurance, the $5,000 difference would be covered, and you would owe nothing.

GAP insurance is intended to cover the loss you would suffer if your loan balance is higher than the value of your vehicle. It is important to note that GAP insurance does not cover any interest, late fees, missed loan payments, or extended warranties added to your auto loan.

When purchasing or leasing a car, GAP insurance is one of several optional add-on products that a dealer may offer, such as extended warranties or credit insurance. The cost of GAP insurance can vary greatly, and it is important to compare prices and coverage before purchasing. You can purchase GAP insurance through your auto insurance company or directly from a lender.

Iranian Motorists and the Insurance Question

You may want to see also

Pros and cons of GAP insurance

GAP insurance, or guaranteed auto protection insurance, is an optional supplemental insurance policy that covers the difference between the depreciated value of a car and the loan amount owed in the event of an accident, theft, or total loss. While it is not required, GAP insurance can provide significant financial protection in certain situations. Here are some pros and cons to help you decide if GAP insurance is right for you:

Pros:

- Financial Protection: GAP insurance ensures you don't owe money to a lender or lessor after a total loss by covering the difference between the car's depreciated value and the outstanding loan balance.

- Peace of Mind: It provides peace of mind, especially if you have a new car or have saved up for a while to make the down payment.

- Low Cost: GAP insurance is relatively inexpensive, often costing just a few dollars per month or around $100 per year.

- Facilitates Expensive Vehicle Purchases: With GAP insurance, you can potentially purchase a more expensive vehicle with less worry about financial risk.

Cons:

- Extra Expense: GAP insurance is an additional cost on top of your regular insurance premiums and car upkeep expenses.

- Not Always Necessary: If you have made a large down payment or own a vehicle that holds its value well, GAP insurance may not be necessary as the gap between the car's value and the loan amount will be smaller.

- Limited Coverage: GAP insurance only applies if your car is totaled and does not cover repairs, medical costs, or situations where the car can be repaired.

- Specialized Policy: It is a specialized type of coverage that may not be offered by all insurance companies or dealerships.

- May Be Required for Certain Vehicles: Lenders or leasing companies may require GAP insurance for certain vehicles, especially those that depreciate quickly, which can increase your overall costs.

Auto Insurance Options: Understanding Your Coverage Choices

You may want to see also

How much does GAP insurance cost?

The cost of GAP insurance depends on several factors, including the age and location of the driver, the value of the car, and the insurance company. It is typically cheaper to purchase GAP insurance as an add-on to an existing full-coverage insurance policy, rather than as a standalone policy.

In the US, insurance companies charge an average of $20 to $40 per year for GAP insurance when bundled with an existing insurance policy. This option increases comprehensive and collision insurance costs by about 5 to 6%. If you want to buy a standalone GAP insurance policy, you can expect to pay between $200 and $300.

Lenders and dealerships also sell GAP insurance, but at higher rates. They usually charge a flat rate between $500 and $700, plus interest since the sum is rolled into the loan.

The cost of GAP insurance also depends on the specific insurance company. For example, Progressive's GAP insurance covers 25% of the vehicle's actual cash value and can be added to an existing car insurance policy for as low as $5 per month. On the other hand, Allstate's GAP insurance covers up to $50,000 of the difference between a primary auto insurance settlement and the money owed on the vehicle loan.

In Florida, the average cost of GAP insurance is significantly higher at $2,923 per year, according to a 2023 rate analysis by Insurance.com. The cheapest provider in Florida is Geico, at about $1,684 per year on average. The cost of GAP insurance in Florida also varies by city, with Miami having the most expensive rates at $3,499 per year.

In Illinois, a full-coverage policy costs an average of $183 per month, and adding GAP insurance typically costs $2 more per month.

Haven Auto Insurance: The Road to Peace of Mind

You may want to see also

Is GAP insurance worth it?

GAP insurance stands for Guaranteed Asset Protection insurance. It is an optional add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value (ACV) in the event of a total loss. GAP insurance is worth considering if you fall into one of the following categories:

- Drivers who owe more on their car loan than the car is worth: If you are currently making car loan payments, calculate the loan balance and compare it to your car's current cash value. If there is a gap, then GAP insurance is strongly recommended.

- Drivers whose car loan or lease requires GAP insurance: Some loan or lease providers may require GAP insurance as a protective measure or even include it in the price of the lease. In these cases, purchasing GAP insurance is necessary to comply with the terms of your agreement.

- Drivers who buy a car above the Manufacturer's Suggested Retail Price (MSRP) without a down payment: If you pay above the MSRP and don't make a down payment, GAP insurance can provide valuable protection in case of a total loss. However, it is important to consider your financial situation and whether you can afford the additional cost of GAP insurance.

- Drivers with a long finance period or a vehicle that depreciates quickly: If you have a long finance period, your car's value may depreciate faster than the amount you owe on your loan, creating a "gap." Similarly, if your vehicle depreciates quickly, the gap between its value and the loan amount can widen over time.

- Drivers who want peace of mind and protection against financial loss: GAP insurance provides reassurance that you won't be left with a significant financial burden if your vehicle is stolen or totaled. It is a relatively inexpensive way to protect yourself from unexpected events that are beyond your control.

However, there are also circumstances where GAP insurance may not be worth the additional cost:

- If you own your car outright or owe less than its current value: In this case, there is no "gap" to cover, and standard car insurance will provide sufficient protection.

- If you have a large down payment or significant equity in your vehicle: A substantial down payment can reduce the risk of owing more than your car's value, making GAP insurance less necessary.

- If you have a short finance period or a vehicle that depreciates slowly: In this case, the gap between the amount you owe and the car's value may not be significant enough to justify the additional cost of GAP insurance.

- If you are confident in your driving skills and don't anticipate a total loss: If you believe the chances of your vehicle being stolen or totaled are slim, you may decide that the cost of GAP insurance is unnecessary.

Ultimately, the decision to purchase GAP insurance depends on your individual circumstances, including your financial situation, the terms of your car loan or lease, and your comfort level with risk. It is important to carefully consider your options, compare prices and coverage, and make an informed decision that aligns with your needs and budget.

Auto Insurance Claims: Occurrence or Claims-Made Policies?

You may want to see also

Frequently asked questions

GAP stands for Guaranteed Asset Protection insurance. It is an optional add-on coverage that can help certain drivers cover the difference between the financed amount owed on their car and the car's actual cash value, in the event of a covered incident where their car is declared a total loss.

Gap insurance is a good option for drivers who owe more on their car loan than the car is worth. It is also useful for drivers who want protection against depreciation, especially if they have a longer financing term.

If your car is stolen or deemed a total loss, GAP insurance will pay the difference between the amount you owe on your auto loan and what your insurance pays.