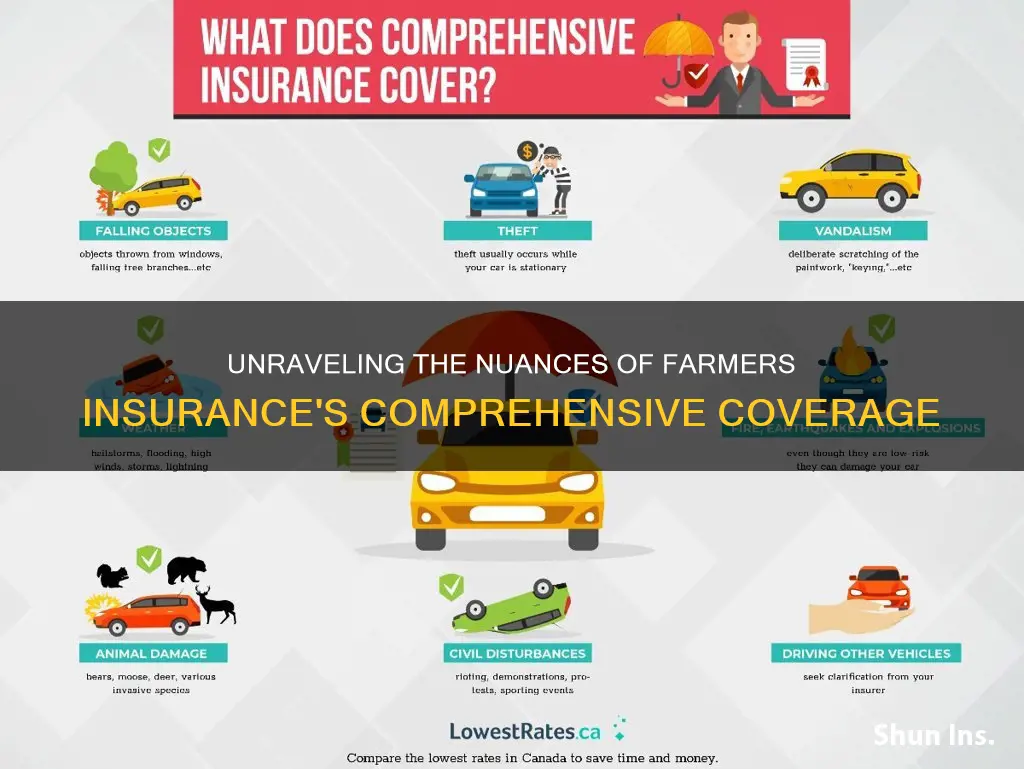

Comprehensive insurance covers damage to the policyholder's car caused by something other than a collision, such as vandalism, theft, or a natural disaster. It also covers damage from falling objects, animal damage, and glass damage not caused by a car accident. Comprehensive insurance is typically purchased alongside collision insurance, which covers repairs or replacements after a car accident, regardless of who was at fault.

| Characteristics | Values |

|---|---|

| Type of damage covered | Damage caused by something other than a collision, such as vandalism, natural disasters, falling objects, animal damage, hail, fire, theft, and civil disturbances. |

| What it covers | The cost of repairing or replacing the covered vehicle, up to the actual cash value of the vehicle minus any deductible. |

| When to buy | Comprehensive insurance is not mandatory but is required by dealerships and lenders for leased and financed cars. It is often purchased together with collision insurance. |

| Add-ons | Glass coverage with a low deductible, full windshield coverage with a $0 deductible, and spare parts coverage. |

What You'll Learn

Comprehensive insurance covers damage from natural disasters and weather events

Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. This includes damage from natural disasters and weather events.

Comprehensive insurance covers damage to the policyholder's car caused by something other than a collision, such as vandalism or a natural disaster. It covers damage from falling objects, like trees, animal damage, including collisions with deer, and glass damage not caused by a car accident.

Comprehensive insurance covers a wide range of natural disasters, including hurricanes, tropical storms, hail, flooding, earthquakes, tornadoes, wildfires, volcanic eruptions, landslides, lightning strikes, and wind damage.

It is important to note that comprehensive insurance does not cover damage to other vehicles or people. It also does not cover damage caused by a collision with another vehicle or object, or injuries to a passenger or another person. Additionally, comprehensive insurance does not cover damage due to potholes or any personal items stolen from your car.

Comprehensive insurance is optional, but it is often purchased along with collision insurance. If you lease or finance a vehicle, your lender may require you to purchase comprehensive insurance to protect their investment. Additionally, if you live in an area prone to natural disasters or weather events, comprehensive insurance can provide valuable protection.

Tiger's Return: Will He Roar at the Farmers Insurance Open?

You may want to see also

It covers theft and damage from theft

Comprehensive insurance covers theft and damage from theft. This includes the theft of the vehicle itself, as well as the theft of certain car parts, such as catalytic converters. It also covers damage caused by a break-in, such as broken windows or damaged door locks.

Comprehensive insurance will pay to replace a stolen car, up to the actual cash value of the vehicle, minus any deductible. It will also pay to repair damage done by thieves and replace stolen car parts, although it usually won't cover custom parts or equipment added by the driver.

It's important to note that comprehensive insurance does not cover the theft of personal belongings from inside the vehicle. For that, you would need to file a claim with your homeowners or renters insurance policy.

Comprehensive insurance is typically required by lenders if you're leasing or financing your vehicle. If you own your car outright, comprehensive coverage is usually optional. However, it's a valuable addition to your policy as it provides coverage for events outside your control that are not caused by a collision, such as theft, vandalism, and weather damage.

Farmers and Boat Insurance: Navigating Coverage Options

You may want to see also

It covers vandalism and civil disturbances

Civil disturbances, protests, and riots can be very distressing for those involved, especially if they result in vandalism and damage to personal property. Comprehensive insurance from Farmers Insurance can help to mitigate the financial burden of such incidents.

Comprehensive insurance covers events outside your control that are not caused by a collision, such as vandalism and civil disturbances. This includes deliberate damage to your vehicle, home, or business caused by rioting and civil unrest. It also covers damage to your vehicle from falling objects, such as trees or debris, during a riot.

In the context of auto insurance, comprehensive coverage is optional and separate from collision coverage and the mandated liability insurance under the Financial Responsibility Laws in California. However, it is worth noting that dealerships and lenders generally require comprehensive insurance on leased and financed cars to protect their investment.

For homeowners, standard policies typically cover damage to the property, including the structure and personal possessions, caused by civil disturbances, riots, and vandalism. This coverage may be subject to exclusions, such as vacancy of the property for an extended period.

Business owners can also benefit from comprehensive insurance during civil disturbances. Standard business owners' policies typically cover damage to the physical premises and its contents caused by riots, civil commotion, or vandalism. Additionally, businesses that are forced to suspend operations or limit hours due to rioting may have coverage for lost income under business interruption insurance.

Farmers Insurance: Exploring Coverage Options in Massachusetts

You may want to see also

It covers damage from falling objects

Comprehensive insurance covers damage to your car from events outside your control that are not caused by a collision. This includes damage from falling objects, such as trees, ice, snow, hail, meteorites, or even airplane parts. If you have comprehensive coverage and your car is damaged by a falling object, your insurance company will pay for the repairs, minus any applicable deductible.

Comprehensive coverage is not mandatory in any state, but it is often required by dealerships and lenders for leased and financed cars to protect their investment. It is typically purchased together with collision coverage, which covers damage to your car resulting from a collision with another vehicle or object.

When it comes to falling objects, comprehensive insurance covers damage caused by objects that fall onto your car. This includes natural disasters, such as earthquakes, tornadoes, and hurricanes, as well as objects falling from other vehicles or structures. For example, if a sheet of ice falls from another vehicle and damages your car, comprehensive coverage would apply.

It's important to note that comprehensive insurance covers damage caused by falling objects to your car, but it may not cover all types of falling objects or scenarios. For instance, if you have a rotting tree on your property that falls on your car during a windy day, the insurance company may argue that you were negligent and did not take preventive measures. In such cases, the damage may not be covered.

Additionally, comprehensive insurance covers the cost of repairing or replacing your car's windshield and glass, which can be expensive. It's worth noting that glass coverage may be subject to a separate deductible or specific conditions, so it's important to review your policy carefully.

Comprehensive insurance provides valuable protection against unforeseen events and falling objects. It gives you peace of mind, knowing that you're covered for damages beyond your control. Remember to carefully review the terms, conditions, and exclusions of your comprehensive insurance policy to fully understand what is and isn't covered when it comes to falling objects and other perils.

Farmers Insurance Lowers Rates for Low-Mileage Drivers: Here's How to Qualify

You may want to see also

It covers animal damage

Farmers Insurance® offers comprehensive insurance coverage for damage to your vehicle caused by something other than a collision. This includes animal damage, such as collisions with deer or other animals, as well as damage caused by animals inside or on top of your car. This coverage also extends to damage caused by your own pet.

Comprehensive insurance can provide coverage for a wide range of animal-related incidents, from scratches and dents caused by stray dogs to interior damage from rodents or wild animals. It also covers damage caused by collisions with birds or other animals while driving.

In addition to animal damage, comprehensive insurance covers theft, vandalism, fire, weather events, and glass breakage. It is often purchased together with collision insurance, which covers damage resulting from accidents with other vehicles or objects.

Comprehensive insurance is not mandatory but is usually required by lenders and leasing companies. It can be added to your auto policy for an additional premium, and you can choose a deductible amount that suits your budget.

Farmers Insurance also offers farm and ranch insurance, which includes coverage for livestock. This coverage protects against financial loss or damage to livestock due to covered perils, such as attacks by dogs or wild animals, floods, or earthquakes.

The Pekin Insurance and Farmers Insurance Connection: Partners or Rivals?

You may want to see also

Frequently asked questions

Comprehensive insurance covers damage to the policyholder's car caused by something other than a collision, such as vandalism or a natural disaster.

Farmers comprehensive insurance covers damage caused by civil unrest, falling objects, animal damage, natural disasters, and glass damage not caused by a car accident. It also covers theft, including the cost of replacing stolen parts.

Comprehensive insurance is used to pay for repairs or replacements of covered vehicles that are stolen or damaged by something other than a collision.

Comprehensive insurance is not mandatory in any state. However, dealerships and lenders generally require it for leased and financed cars.