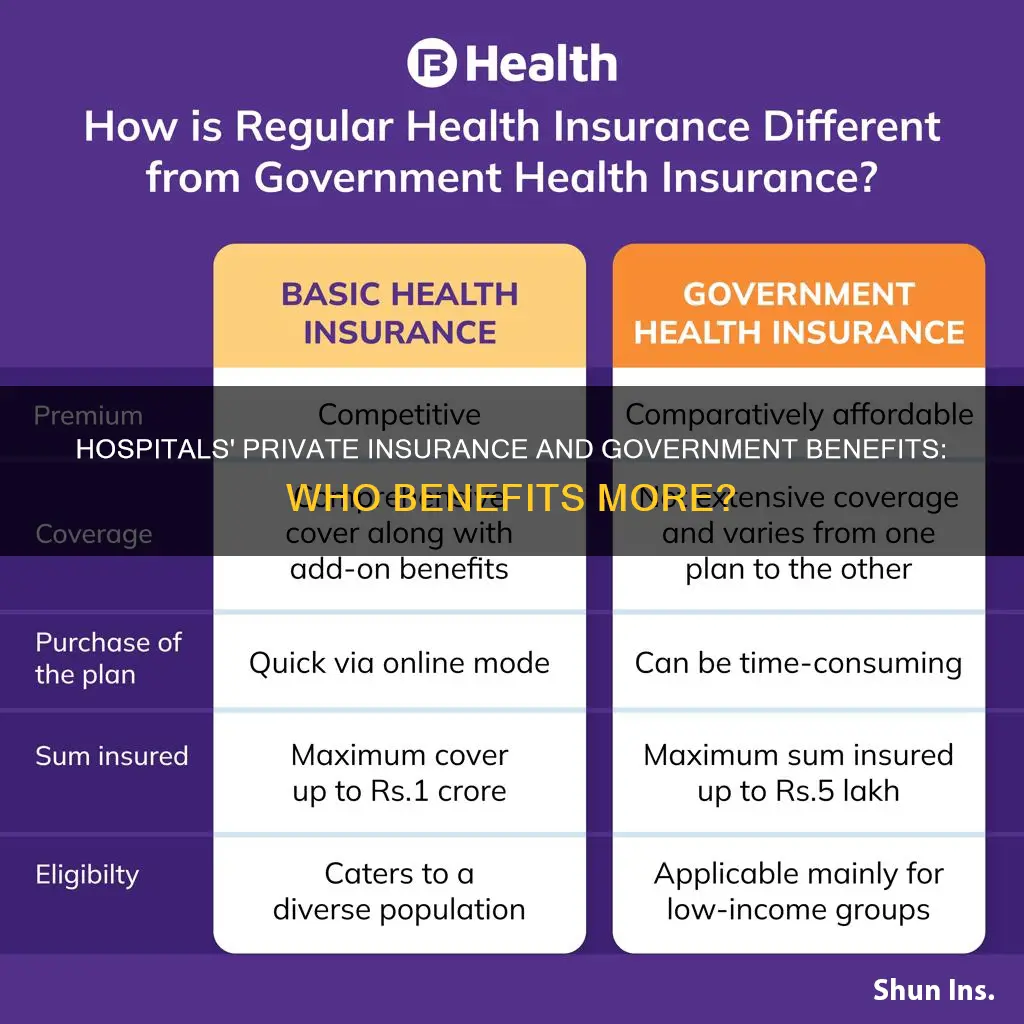

The choice between public and private healthcare is a complex issue that depends on various factors, including a person's healthcare needs, financial situation, and location. In this paragraph, we will explore the differences between hospitals' earnings from private insurance versus government benefits and how these impact patient care. Private health insurance typically covers medical expenses not included in government schemes, such as Medicare, and can provide faster access to treatment and more comfortable facilities. However, private insurance premiums can be costly and vary based on age, chosen coverage, and other factors. On the other hand, government-funded healthcare, like the UK's NHS, offers free treatment to all, but patients may face longer waiting times and more limited choices. Hospitals' earnings from private insurance often provide faster and more luxurious treatment options, while government benefits ensure equitable access to essential healthcare for all, especially those from low-income backgrounds.

| Characteristics | Values |

|---|---|

| Waiting times | Private insurance offers faster access to treatment and shorter waiting times. |

| Comfort | Private insurance provides more comfortable and modern facilities, including hotel-like amenities. |

| Choice | Private insurance offers a wider choice of hospitals, treatments, and locations. |

| Cost | Private insurance is generally more expensive than government benefits, but costs vary depending on location, age, and chosen coverage. |

| Coverage | Private insurance may cover additional services not included in government benefits, such as dental, physiotherapy, and optical. |

| Accessibility | Private insurance is available to anyone, regardless of age, while government benefits may have age restrictions. |

| Dependents | Private insurance often allows coverage for dependents, while government benefits typically cover only individuals. |

What You'll Learn

Private insurance covers 'extras' like dental, physiotherapy, and optical

Private insurance is a popular option for those seeking to cover the costs of medical services that are not typically covered by public healthcare systems, such as Medicare in Australia. Extras cover is a type of private insurance that helps with the cost of out-of-hospital health services, including dental, physiotherapy, and optical treatments. These extras are essential for maintaining one's health and well-being but are not always covered by public healthcare.

Dental care is a prime example of an extra that many people require but is not fully covered by public health systems. Dental check-ups, fillings, and even more expensive procedures like root canals or braces can quickly add up, and extras cover can help reduce these out-of-pocket expenses. Similarly, optical care, such as eye exams and glasses or contact lenses, can be costly, and extras insurance can provide significant savings in this area. Physiotherapy is another common extra that people may need, especially if they are recovering from an injury or managing a chronic condition. Extras cover can make these necessary treatments more affordable.

The benefits of extras cover can vary depending on the policy and insurer. Some policies offer 50% back on expenses up to an annual limit, while others provide 100% cover for select services. More comprehensive policies may offer higher benefits, such as 60% or 70% back on expenses, but these tend to come with higher premiums. It's important to note that extras cover may not cover all costs, and there may be item limits or annual caps on certain treatments.

When considering extras cover, it's essential to review the policy details carefully. Some policies may have preferred providers or loyalty bonuses that can increase the benefits over time. Additionally, some insurers offer percentage benefits, which increase as the fees for services increase, ensuring that the policy doesn't lose value over time. It's also worth noting that extras cover can be purchased separately from hospital cover, allowing individuals to customise their insurance to their specific needs.

In summary, extras cover is a valuable option for individuals who want to budget for and reduce their out-of-pocket expenses on essential health services like dental, physiotherapy, and optical care. By understanding the benefits, limits, and variations in policies, individuals can make informed choices to ensure they get the best value for their specific needs.

Becoming a Private Insurance Adjuster: Steps to Success

You may want to see also

Private insurance can be tailored to your needs

Secondly, private insurance allows you to select the type of plan that best meets your needs and preferences. You can choose from various plan options, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs). Each of these plan types offers different cost structures and provider networks, giving you the flexibility to customize your coverage.

Additionally, private insurance provides the advantage of choice when it comes to doctors and hospitals. With private insurance, you often have a broader selection of healthcare providers, allowing you to select doctors, specialists, and hospitals that align with your preferences and healthcare requirements.

Moreover, private insurance offers comprehensive coverage options with different tiers and levels. This means you can choose a plan that suits your healthcare needs and budget. Private insurance typically covers a wide range of medical services, including hospital stays, doctor's visits, preventive care, prescription drugs, and more. Some plans even offer additional benefits, such as dental, vision, and mental health coverage.

Lastly, private insurance can be tailored to your needs by providing access to advanced treatments and reducing wait times. Private insurance plans may cover innovative treatments that are not always available through public healthcare programs, ensuring that individuals with complex or rare medical conditions receive the care they need. Additionally, private insurance often provides faster access to healthcare services, allowing you to schedule appointments and undergo medical procedures more promptly compared to relying solely on public healthcare systems.

In conclusion, private insurance offers flexibility and customization by providing a range of plan options, coverage levels, and provider choices. It allows you to make informed decisions about your healthcare based on your specific needs, budget, and preferences.

Private Insurance: Boosting Economy Through Individual Support

You may want to see also

Private insurance is more expensive

Private health insurance is more expensive as it provides cover for healthcare not covered by government-funded healthcare. For example, in Australia, private health insurance covers the costs of treatment in a private hospital and other medical services such as dental, physiotherapy, and optical. In the US, private insurance can be purchased from a private company or through the Affordable Care Act (ACA) Marketplace. The average monthly premium for an individual in the US is $477, but costs can vary depending on factors such as age, family size, and location.

The cost of private insurance also depends on the level of cover chosen. For instance, a Platinum plan in the US has higher premiums but lower out-of-pocket expenses, whereas a Bronze plan has lower premiums but higher out-of-pocket costs. In the UK, private health insurance can be tailored to include only the required health benefits, which can help reduce costs. However, private insurance is generally more expensive than government-funded healthcare as it often includes additional benefits such as hotel-like facilities, private accommodation, and greater food choices.

Furthermore, private insurance can be more expensive due to the shorter waiting times it offers compared to government-funded healthcare. With most private health insurance plans, individuals can access virtual GPs and receive treatment more promptly. In contrast, government-funded healthcare may have longer waiting lists, especially for non-critical procedures.

Overall, private insurance is more expensive than government-funded healthcare due to the additional benefits, shorter waiting times, and coverage for treatments not included in government-funded healthcare plans.

Understanding Private Insurance Services Reimbursement and Payment Methods

You may want to see also

Private insurance may be better for those with dependents

Private insurance also offers faster access to medical care, with reduced wait times for appointments and procedures. This is advantageous for individuals with dependents, as prompt treatment minimizes potential risks associated with delayed medical attention. Furthermore, private insurance plans can be customized to align with unique requirements, providing a more tailored healthcare solution for families.

The cost of adding dependents to a private insurance plan is typically higher, but it may be worth considering for those with dependents. Private insurance plans often have higher prices compared to public options, making them less affordable for those with lower incomes. However, private insurance can be a good option for those with dependents who require comprehensive coverage and faster access to care.

It is important to note that the decision between private and public health insurance depends on specific healthcare needs and financial circumstances. Both options have their advantages and limitations, and it is crucial to research and compare available plans to make an informed choice.

Private Insurance Industry: Profitable, But How?

You may want to see also

Private insurance is available to anyone, regardless of age

Private insurance can be purchased through private insurance companies or, in some cases, through a government-facilitated marketplace like the Health Insurance Marketplace in the US. The availability of private insurance plans and the associated costs can vary based on age, location, and individual circumstances. For instance, some providers may have upper age limits for new policies, while others may offer coverage regardless of age. Additionally, the cost of private insurance tends to increase with age, as older individuals are more likely to experience health issues.

When considering private insurance, it's essential to review the terms and conditions carefully. Some plans may not cover pre-existing conditions or may have waiting periods before coverage for certain conditions becomes effective. It's also worth noting that private insurance typically doesn't cover out-of-hospital medical services like specialist consultations or diagnostic imaging and tests.

Private insurance can provide benefits such as faster access to medical treatment, more comfortable facilities, and a wider choice of hospitals and treatment times. However, it's important to weigh these advantages against the potential costs, as private insurance can be expensive, especially for comprehensive coverage.

In conclusion, while private insurance is available to anyone regardless of age, it's crucial to carefully evaluate the options, understand the limitations and exclusions, and consider the affordability and value of the coverage provided.

Champva Private Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Private health insurance is provided by private companies and typically covers healthcare costs not covered by government insurance, such as Medicare in the US or the NHS in the UK. It can also help cover 'extras' like dental, physiotherapy, and optical services. Government health insurance is provided and funded by the government and offers free or low-cost healthcare to residents.

Private health insurance often allows for faster access to healthcare services and more comfortable and modern facilities. It can also provide access to drugs and treatments not covered by government insurance.

Private health insurance can be more expensive, especially if you require coverage for your dependents. It may also not cover chronic conditions or emergency services, which are typically covered by government insurance.

Yes, it is possible to have both types of insurance. In this case, the insurance companies will coordinate who pays what portion of your healthcare costs.