Smoking is a dangerous habit that can have serious consequences for your health and your finances. It is a leading cause of preventable diseases and deaths worldwide. If you start smoking after taking out term insurance, you may be classified as a smoker by your insurance company, which could result in higher premiums or even policy cancellation. It is important to be honest about your smoking habits to avoid potential issues with your insurance policy and to secure your family's financial future. Informing your insurance company of any changes in your smoking habits is crucial to ensure smooth claim settlement in the future.

| Characteristics | Values |

|---|---|

| Impact on health | Smoking increases the risk of lung disease, cancer, heart disease, stroke, etc. |

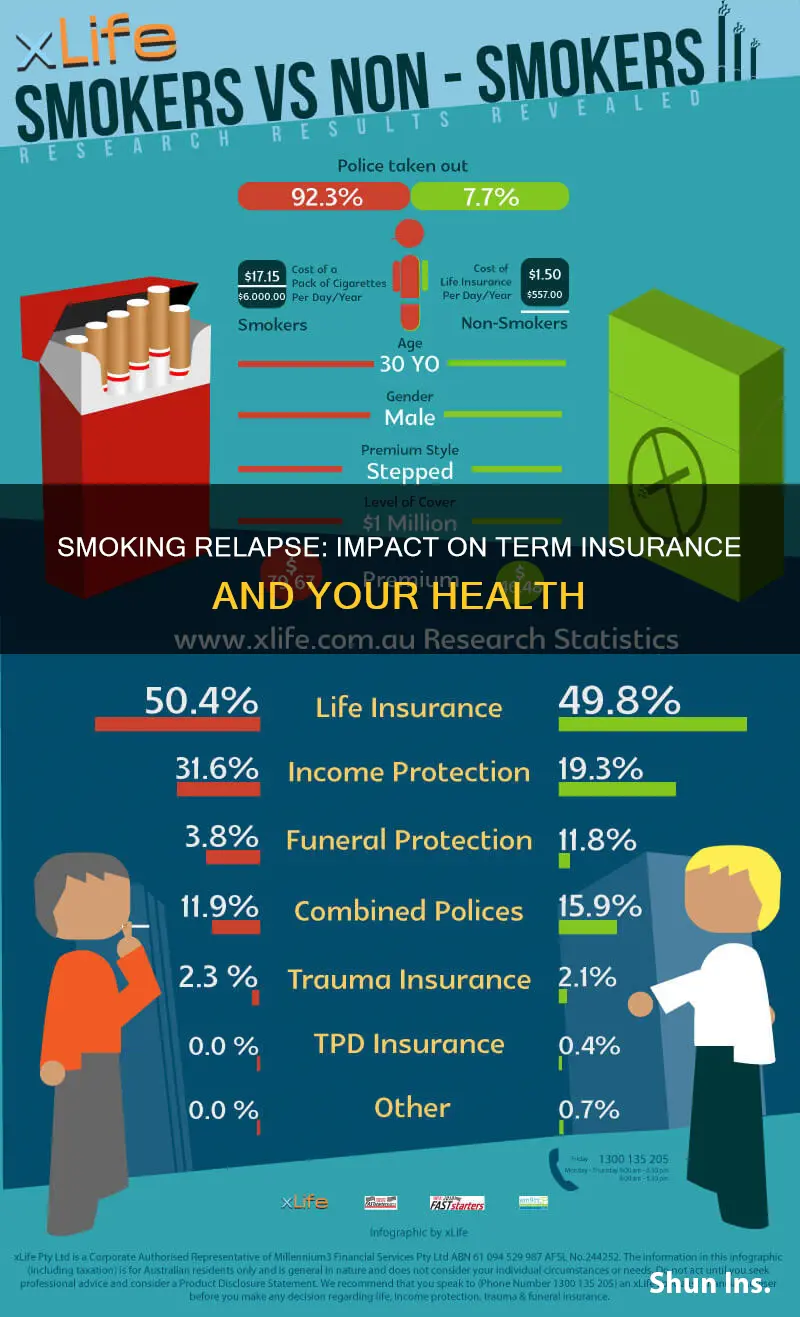

| Impact on finances | Smokers pay higher life insurance rates than non-smokers. |

| Impact on insurance policy | If you start smoking after taking out a term insurance policy, you should inform your insurer. If you don't, and something happens during the policy term, the insurance company may delay the payout until they can verify the claim request. |

| Definition of a smoker | A smoker is anyone who consumes nicotine or tobacco-related products or has done so in the past. This includes cigarettes, cigars, cigarillos, e-cigarettes, nicotine patches, and chewing tobacco. |

| Classification of smokers | Insurers classify smokers into different categories, such as table-rated smokers, preferred smokers, and typical smokers, based on their smoking habits and health complications. |

| Impact on family | Starting smoking puts your life at risk and can leave your family/dependents unsecured financially. |

What You'll Learn

- Insurers may increase your premium if you start smoking after taking out term insurance

- You are not obliged to inform your insurer if you start smoking, but it is recommended to avoid potential issues

- If your insurer discovers that you started smoking and did not inform them, they may delay your payout

- If you lie about smoking, your insurer may cancel your policy and leave your family unprotected

- If you quit smoking, you may be able to ask your insurer to recalculate your premium at a lower rate

Insurers may increase your premium if you start smoking after taking out term insurance

Smoking is a dangerous habit that can have severe health consequences, including lung disease, cancer, heart disease, and stroke. It is a leading cause of preventable diseases and premature deaths worldwide. Due to these risks, insurers consider smokers high-risk individuals and often provide them with separate term plans that attract higher premiums.

When you purchase term insurance, you are typically asked about your smoking status, and it is crucial to be truthful in your response. If you start smoking after taking out term insurance, your insurer may increase your premium. Here's why:

Health Risks and Increased Premiums

Smoking increases your risk of developing various health issues, which can lead to higher claims for the insurer. To compensate for this increased risk, insurers may re-evaluate your policy and charge you a higher premium. The premium increase will depend on various factors, including your age, gender, and the coverage amount.

Impact on Claim Settlement

If you do not inform your insurer about your change in smoking habits and something happens during the policy term, the insurer may view it as fraud. They could delay or deny the claim, causing issues for your beneficiaries. Being honest about your smoking status helps avoid such complications and ensures a smoother claim settlement process.

Contestability Period

Most insurance companies have a contestability period during which your life insurance benefits can be questioned or adjusted. If you pass away during this period and the insurer discovers that you did not disclose your smoking status, they may deny the claim or adjust it to account for the higher premiums that should have been paid as a smoker.

Medical Examinations

Term insurance policies often require medical examinations upon renewal or when obtaining additional coverage. These exams can detect nicotine use, and if it is found that you have started smoking, your insurer may re-evaluate your policy and increase your premium accordingly.

Lapses and Revivals

If your term insurance policy lapses and you need to revive it, disclosing your smoking habit becomes mandatory. Insurance companies will require you to provide any changes in your health status, including smoking, during the revival process. Failing to disclose this information may lead to issues with claim settlement later on.

In conclusion, it is always best to be honest with your insurer about your smoking status, even if you start smoking after taking out term insurance. While your premium may increase, you can avoid potential issues with claim settlement and ensure that your beneficiaries receive the intended benefits without unnecessary delays or complications.

The Unspoken Truths: Term Insurance's Limitations Revealed

You may want to see also

You are not obliged to inform your insurer if you start smoking, but it is recommended to avoid potential issues

While you are not obliged to inform your insurer if you start smoking after taking out term insurance, it is highly recommended that you do so to avoid potential issues.

Term insurance plans are usually long-term plans, and it is common for an individual's habits to change over time. If you did not smoke when you first purchased your policy, but later develop the habit, it is advisable to inform your insurer. This proactive approach will ensure that you remain in good standing with your insurer and avoid any complications that may arise due to smoking-related medical complications.

When you notify your insurer about your new smoking habit, they may decide to continue your coverage without any changes or revise your premium based on their terms and conditions. It is important to note that insurers classify individuals into different types of smokers, such as table-rated smokers, preferred smokers, and typical smokers, based on their health complications (if any) related to smoking.

Additionally, if your term insurance plan has lapsed and you are reviving it, disclosing your smoking habit becomes mandatory. Insurance companies require you to inform them about any significant changes during the policy revival process. Therefore, if you started smoking after initially purchasing the term plan, you must disclose this information during the revival process.

Being transparent about your smoking habits demonstrates your commitment to upholding the principle of good faith in your relationship with the insurance company. This honesty will also ensure a hassle-free claim settlement process in the future.

In summary, while it is not mandatory to inform your insurer about starting smoking after taking out term insurance, doing so is strongly recommended to maintain policy compliance and avoid potential issues related to medical complications and claim settlements.

Minimizing the Cost of Nylon-Term Insurance: Strategies for Savvy Consumers

You may want to see also

If your insurer discovers that you started smoking and did not inform them, they may delay your payout

If you start smoking after taking out a term insurance plan, it is important to inform your insurer as soon as possible. While it is not a requirement to disclose this change in habit, being transparent can help avoid potential issues in the future.

Failing to inform your insurer about your new smoking habit may lead to complications and delays in the event of a claim. If the insurer discovers that you have been smoking and did not inform them, they may view this as a breach of good faith or even fraud. This could result in a delayed payout or, in some cases, a denied claim.

To avoid such issues, it is advisable to be honest and inform your insurer about any changes in your smoking habits. The insurer may then decide to continue the coverage without any changes or revise the premium based on their terms and conditions. This proactive approach ensures that your beneficiaries do not face any unexpected challenges when filing a claim.

Additionally, if your term insurance plan has lapsed and you are reviving it, disclosing your smoking habit becomes mandatory. Insurance companies require you to provide any relevant updates during the revival process. Therefore, if you started smoking after initially taking out the policy, be sure to inform the insurer when reviving the plan.

Understanding the Role of Short-Term Insurance in Meeting FRS Requirements

You may want to see also

If you lie about smoking, your insurer may cancel your policy and leave your family unprotected

Insurers may also conduct medical tests to identify smokers, as nicotine can be detected in blood, saliva, hair, and urine samples. If you lie about smoking and your insurer finds out after your death, your beneficiaries could lose out on the full amount of the policy benefit. This is because the insurance company may delay or deny the claim as they investigate the circumstances.

It is always best to be honest about your smoking habits when applying for term insurance. While your premiums may be higher, you can rest assured that your family will receive the full benefit amount in the event of your death.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

If you quit smoking, you may be able to ask your insurer to recalculate your premium at a lower rate

In India, most insurers do not allow policyholders to change their term insurance status from smoking to non-smoking during the policy period. Hence, quitting smoking may not always lead to a lower premium. However, some insurers do provide discounts to policyholders who quit smoking and can prove their non-smoking status through medical tests.

If you decide to quit smoking, it is advisable to contact your insurer and inquire about the possibility of lowering your premium. Be sure to review the terms and conditions of your policy, as well as any applicable laws and regulations, to understand your rights and options fully.

Understanding Extended Term Insurance: Unlocking the Benefits of Long-Term Coverage

You may want to see also

Frequently asked questions

You don't have to inform your insurer if you start smoking after taking out term insurance. However, it's always best to be honest to avoid potential issues later. If you don't inform your insurer and something happens during the policy term, they might delay the payout until they can verify the claim request.

Lying about smoking when taking out term insurance is considered fraud and can lead to serious consequences. The insurance company may cancel the existing policy, leaving your family without financial protection. They may also file a complaint of insurance fraud against you.

If you start smoking after taking out term insurance and then stop, you can request that your insurance company reconsiders your premium rate. They will likely ask for medical test reports to confirm your changed smoking habits and may adjust your premium accordingly. However, some insurers do not allow changes to the plan during the term, and you may have to wait until renewal to see any adjustments.