Lying about a speeding ticket on your insurance can have serious consequences. It's important to understand the potential risks and legal implications of such actions. When you provide false information to your insurance company, it can lead to increased premiums, policy cancellations, and even legal penalties. Additionally, if you're caught, the insurance company may deny claims or refuse to cover any related expenses. This can result in financial losses and a damaged reputation. It's always best to be honest and transparent with your insurance provider to avoid these potential issues.

| Characteristics | Values |

|---|---|

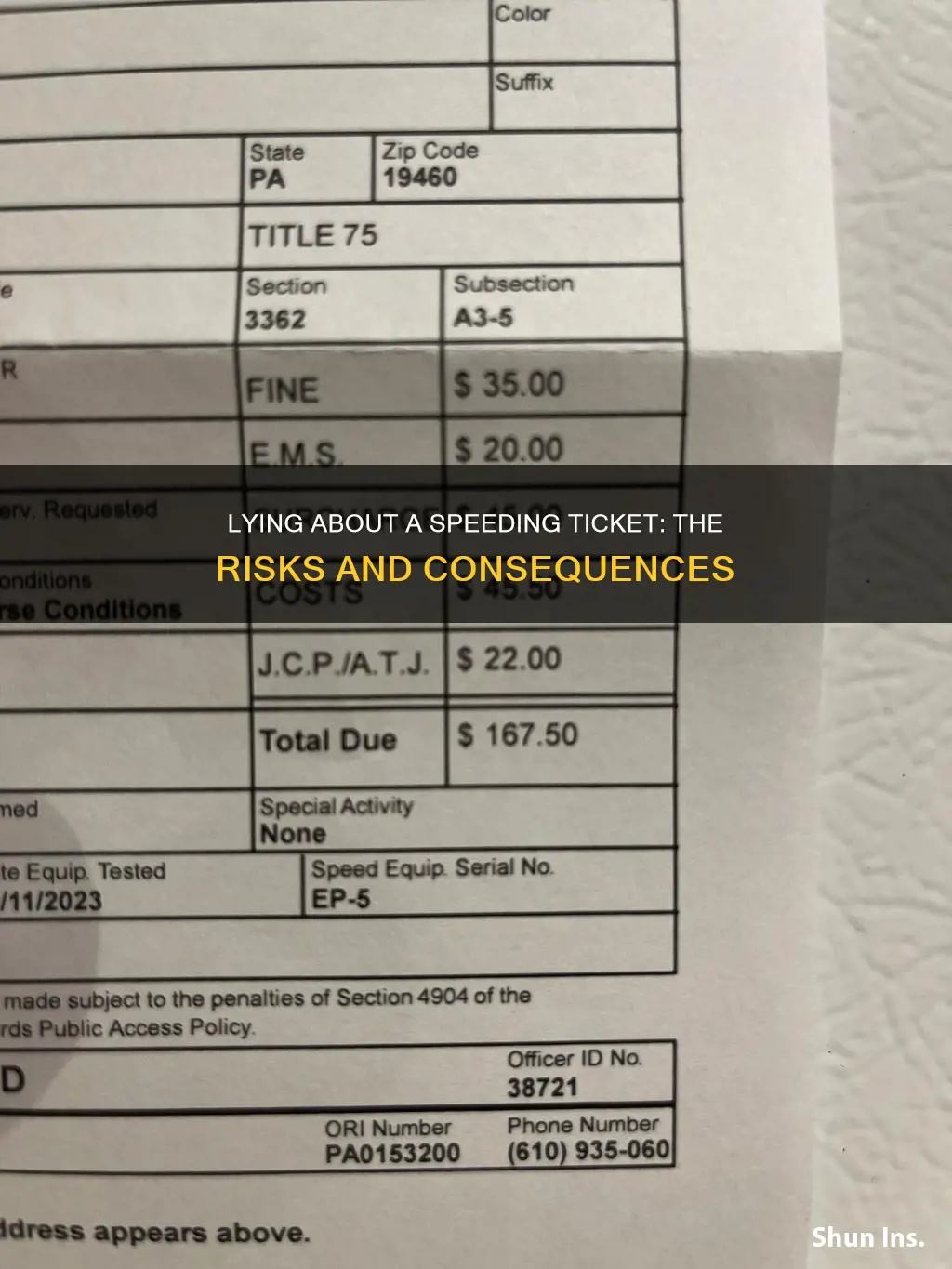

| Legal Consequences | Lying about a speeding ticket can have serious legal repercussions. It may be considered fraud, which is a crime in most jurisdictions. If caught, you could face fines, penalties, and even imprisonment. |

| Insurance Premiums | Insurance companies often use driving records to determine premiums. If you lie about a speeding ticket, your insurer may discover the truth and increase your premiums significantly. This could lead to higher costs for future insurance coverage. |

| Trust and Reputation | Dishonesty about a speeding ticket can damage your reputation. Insurance adjusters and underwriters may view you as a high-risk individual, making it harder to obtain insurance or secure favorable terms in the future. |

| Claims Processing | If you make a claim after lying about a speeding ticket, the insurance company may deny the claim or investigate thoroughly. This could result in delays, additional paperwork, and potential rejection of your claim. |

| Driving Record Accuracy | Lying about a speeding ticket can lead to an inaccurate driving record. This may affect future insurance rates, job opportunities, and even legal proceedings if the lie is exposed. |

| Ethical Considerations | Honesty is a fundamental principle in insurance. Lying about a speeding ticket goes against ethical standards and can have long-lasting negative consequences on your personal and professional life. |

| Financial Penalties | Insurance companies may impose financial penalties for fraudulent activities. These penalties can be substantial and may be added to your insurance premiums or claimed directly from you. |

| Impact on Future Insurance | A history of lying about a speeding ticket can make it challenging to obtain insurance coverage in the future. Insurance providers may be hesitant to offer policies to individuals with a history of dishonesty. |

What You'll Learn

- Legal Consequences: Lying about a speeding ticket can lead to legal penalties and fines

- Insurance Fraud: Misrepresenting a speeding ticket is considered insurance fraud and can result in penalties

- Policy Cancellation: Insurance companies may cancel policies if they discover false information

- Increased Premiums: Expect higher insurance premiums if you lie about a speeding ticket

- Driver's Record: A lie about a speeding ticket can impact your driving record and future insurance rates

Legal Consequences: Lying about a speeding ticket can lead to legal penalties and fines

Lying about a speeding ticket on your insurance application can have serious legal consequences and may result in a range of penalties. When you provide false information to an insurance company, it is considered fraud, which is a criminal offense in most jurisdictions. The legal implications can be severe and may include fines, penalties, and even potential jail time.

One of the primary legal consequences is the risk of being charged with insurance fraud. Insurance fraud laws are designed to protect the integrity of the insurance system and ensure that claims are legitimate. If an insurance company discovers that you have lied about a speeding ticket, they may report the incident to the authorities, leading to a formal investigation. This can result in criminal charges, which could have long-lasting effects on your record and future opportunities.

The penalties for insurance fraud vary depending on the jurisdiction and the severity of the lie. In many places, insurance fraud is considered a felony, carrying significant fines and potential imprisonment. For example, in the United States, the penalties for insurance fraud can include fines of up to $10,000 or more, and imprisonment for several years. The specific amount and duration of the penalty will depend on the value of the claim involved and the jurisdiction's laws.

Additionally, lying about a speeding ticket can also lead to civil consequences. Insurance companies may deny or cancel your policy if they find out about the deception. This could result in financial losses, as you may be left without coverage during a critical time. Furthermore, the insurance company may sue you for the damages incurred due to the false information provided.

It is important to understand that the legal system takes insurance fraud very seriously, and the consequences can be far-reaching. Lying about a speeding ticket or any other incident on your insurance application is not worth the risk. It is always best to provide accurate and honest information to maintain a reliable and trustworthy relationship with your insurance provider.

Home Insurance and Auto Accidents: What's Covered?

You may want to see also

Insurance Fraud: Misrepresenting a speeding ticket is considered insurance fraud and can result in penalties

Lying about a speeding ticket on your insurance application is a serious offense and can lead to significant legal and financial consequences. Insurance fraud is a crime that involves deliberately providing false information to an insurance company, and it carries severe penalties. When you misrepresent a speeding ticket, you are essentially committing fraud by not disclosing a material fact that could impact your insurance premium and coverage. This act can have far-reaching implications for both the individual and the insurance provider.

In many jurisdictions, insurance fraud is treated as a white-collar crime, often resulting in fines, imprisonment, or both. The severity of the punishment depends on the jurisdiction and the specific circumstances of the case. For instance, if the fraud is deemed to be a felony, the penalties can be much harsher, including longer prison sentences. Misrepresenting a speeding ticket can be seen as an intentional attempt to deceive the insurance company, which could lead to a criminal investigation and prosecution.

The consequences for the individual are immediate and long-lasting. Once the fraud is uncovered, the insurance company may deny any claims made by the policyholder, especially if the speeding ticket was related to the incident. This could result in financial losses for the individual, as they would have to bear the costs associated with the accident or incident. Furthermore, the individual's reputation and credit score may be affected, as insurance companies often report such incidents to credit bureaus.

Additionally, insurance companies have sophisticated methods to detect fraud, including advanced data analytics and investigative techniques. They may review driving records, witness statements, and other evidence to verify the accuracy of the information provided. If a speeding ticket is found to have been misrepresented, the insurance company can take legal action, cancel the policy, and even sue the policyholder for any losses incurred.

To avoid these penalties and potential legal issues, it is crucial to be transparent and honest when dealing with insurance. Providing accurate and complete information is essential to maintaining a fair and reliable insurance system. If you have a speeding ticket, it is advisable to disclose this information to your insurance provider, as they can help you understand the implications and find suitable solutions to manage your premium and coverage effectively.

Understanding Auto Liability Insurance: How Much Coverage Do You Need?

You may want to see also

Policy Cancellation: Insurance companies may cancel policies if they discover false information

If you provide false information to your insurance company, especially regarding a speeding ticket, it can have serious consequences, including the potential cancellation of your policy. Insurance companies rely on accurate and honest information to assess risk and determine premiums. When you lie or misrepresent facts, it undermines the integrity of the relationship between you and the insurer.

When an insurance company discovers that you have lied about a speeding ticket, they may view this as a breach of trust. Insurance policies often require policyholders to disclose relevant information, and failing to do so or providing false details can be considered a violation of the terms and conditions. This violation can lead to immediate policy cancellation as a penalty. The company may terminate the policy, leaving you without coverage and potentially facing financial losses if an accident or claim occurs.

The consequences of policy cancellation can be severe. You may be required to pay any outstanding premiums and any additional fees associated with the cancellation. In some cases, the insurance company might also refuse to provide coverage in the future, making it challenging to obtain insurance for other risks. This could result in a higher premium or even a denial of coverage for other insurance needs.

Furthermore, lying about a speeding ticket can have legal implications. Insurance fraud is a serious offense, and providing false information to an insurance company is considered fraudulent activity. This could lead to legal action, fines, and even criminal charges, depending on the jurisdiction and the severity of the lie. It is essential to understand that honesty and transparency are crucial when dealing with insurance companies to avoid such legal and financial repercussions.

To avoid these issues, it is advisable to always provide accurate and honest information to your insurance provider. If you have any doubts or concerns about what to disclose, consult with your insurance agent or broker. They can guide you through the process and ensure that you understand your obligations. Being transparent and truthful will help maintain a healthy relationship with your insurance company and protect your interests in the long run.

U.S. DOT Numbers: Unraveling the Auto Insurance Mystery

You may want to see also

Increased Premiums: Expect higher insurance premiums if you lie about a speeding ticket

Lying about a speeding ticket on your insurance application can have significant financial consequences, particularly in the form of increased insurance premiums. Insurance companies rely on accurate information to assess risk and determine the cost of coverage. When you provide false details, such as denying a speeding violation, it can lead to a higher risk profile in the eyes of the insurer. This is because insurers use driving records and claims history to calculate premiums, and any discrepancies or untruths can trigger a review of your policy.

The impact of lying about a speeding ticket can be immediate and long-lasting. Firstly, if the insurance company discovers the deception, they may deny coverage or cancel the policy altogether. This could result in a loss of protection and potentially leave you liable for any claims or accidents that occur during the period of deception. Moreover, the insurer may also increase your premiums as a penalty for the fraudulent behavior. The premium hike is often substantial and can remain in effect for an extended period, even after the initial lie is uncovered.

Insurance companies have sophisticated methods to verify information, including checking with law enforcement agencies and reviewing driving records. If you lie about a speeding ticket, the insurer may investigate further, which could lead to additional fees and penalties. In some cases, the increased premiums may be more than the cost of the ticket itself, making it a costly mistake. It is essential to understand that insurance fraud, including lying about traffic violations, is taken very seriously by regulators and insurance providers.

To avoid these complications, it is advisable to be transparent and accurate when providing information to your insurance company. Disclose any traffic violations, including speeding tickets, as required by law. While it may be tempting to hide such incidents, the potential risks and financial burdens far outweigh the temporary relief of lower premiums. Being honest with your insurer ensures that you receive fair coverage and helps maintain a positive relationship with your insurance provider.

Grubhub Delivery: Auto Insurance Requirements

You may want to see also

Driver's Record: A lie about a speeding ticket can impact your driving record and future insurance rates

Lying about a speeding ticket on your insurance application can have significant consequences for your driving record and future financial commitments. When you provide false information to an insurance company, it is considered fraud, and the repercussions can be severe. Insurance fraud is a serious offense, and the penalties can vary depending on the jurisdiction and the nature of the lie. In many places, insurance fraud is a crime, and those found guilty may face fines, imprisonment, or both.

One of the immediate impacts of lying about a speeding ticket is the potential damage to your driving record. Insurance companies thoroughly investigate the information provided by applicants. If they discover that you have lied about a traffic violation, they may take several actions. Firstly, they might reject your application, as fraud is a serious red flag. Even if your application is approved, the insurance provider may still report the lie to relevant authorities, which could lead to legal consequences for you.

The consequences for your driving record can be long-lasting. Insurance companies often use driving records as a primary factor in determining premiums. A lie about a speeding ticket could result in a poor driving record, which might lead to higher insurance rates for years to come. When you file a claim in the future, the insurance company will likely review your entire driving history, and any false information could be grounds for increased premiums or even a denial of coverage.

Furthermore, lying about a speeding ticket can create a pattern of dishonesty, which may raise suspicions about your overall credibility. Insurance companies want to ensure that policyholders are truthful and reliable. If they perceive you as a high-risk individual due to the lie, they might impose additional restrictions or higher premiums to mitigate the perceived risk.

In summary, lying about a speeding ticket on insurance is a risky and potentially damaging practice. It can lead to legal issues, a poor driving record, and increased insurance costs. It is essential to provide accurate and honest information to insurance companies to maintain a good driving record and ensure fair treatment in the long term. Always remember that honesty is the best policy when dealing with insurance matters.

Understanding Auto Insurance Denial: What You Need to Know

You may want to see also

Frequently asked questions

Lying about a speeding ticket is considered fraud and can have severe consequences. Insurance companies rely on accurate information to assess risk and set premiums. If you're caught, you may face legal penalties, including fines and potential jail time. Additionally, your insurance provider might deny claims or cancel your policy, leaving you financially vulnerable in case of an accident.

No, it's not worth the risk. Insurance companies have sophisticated methods to verify information. They can cross-reference your details with traffic violation records, and if there's a discrepancy, they will investigate. It's best to be honest, as providing false information can lead to a loss of trust and future complications.

Lying about a speeding ticket can significantly impact your insurance rates. Insurance companies view traffic violations as a red flag, indicating a higher risk of accidents. By lying, you're essentially hiding a negative factor that could increase your premiums. It's a short-term gain that may result in long-term financial losses.

Omitting information on an insurance application is still considered fraud. Even if it was an oversight, it's crucial to disclose all relevant details. Insurance companies have the right to investigate and may penalize you for any undisclosed violations. It's best to be proactive and inform your insurer promptly.

No, there are no advantages to lying. The potential risks far outweigh any perceived benefits. Insurance fraud is a serious offense and can have long-lasting consequences on your financial and legal standing. It's always best to be transparent and honest with your insurance provider.