It is commonly believed that auto insurance rates decrease when a driver turns 25. While this is true, it is not necessarily the case that rates will drop significantly or immediately when a driver reaches this age. In fact, according to MoneyGeek, car insurance premiums decrease the most at ages 19 and 21, and rates stabilise at 25. Progressive reports that their rates drop by 9% on average at age 25, while ValuePenguin puts the average drop across insurers at 11%.

What You'll Learn

- Auto insurance rates are cheaper for 25-year-olds compared to younger drivers

- The biggest drops in auto insurance rates occur when drivers turn 19 and 21

- Auto insurance rates are lowest for drivers in their 50s

- Male and female drivers' premiums get closer as they age

- Drivers with a clean record are likely to see their auto insurance rates go down every year

Auto insurance rates are cheaper for 25-year-olds compared to younger drivers

Auto insurance rates are generally cheaper for 25-year-olds compared to younger drivers. This is because insurance companies consider drivers under 25 to be riskier to insure due to their relative inexperience. Statistically, younger drivers are more likely to be involved in accidents, with drivers aged 16-20 being the most likely to die in a car crash, followed by those aged 21-24.

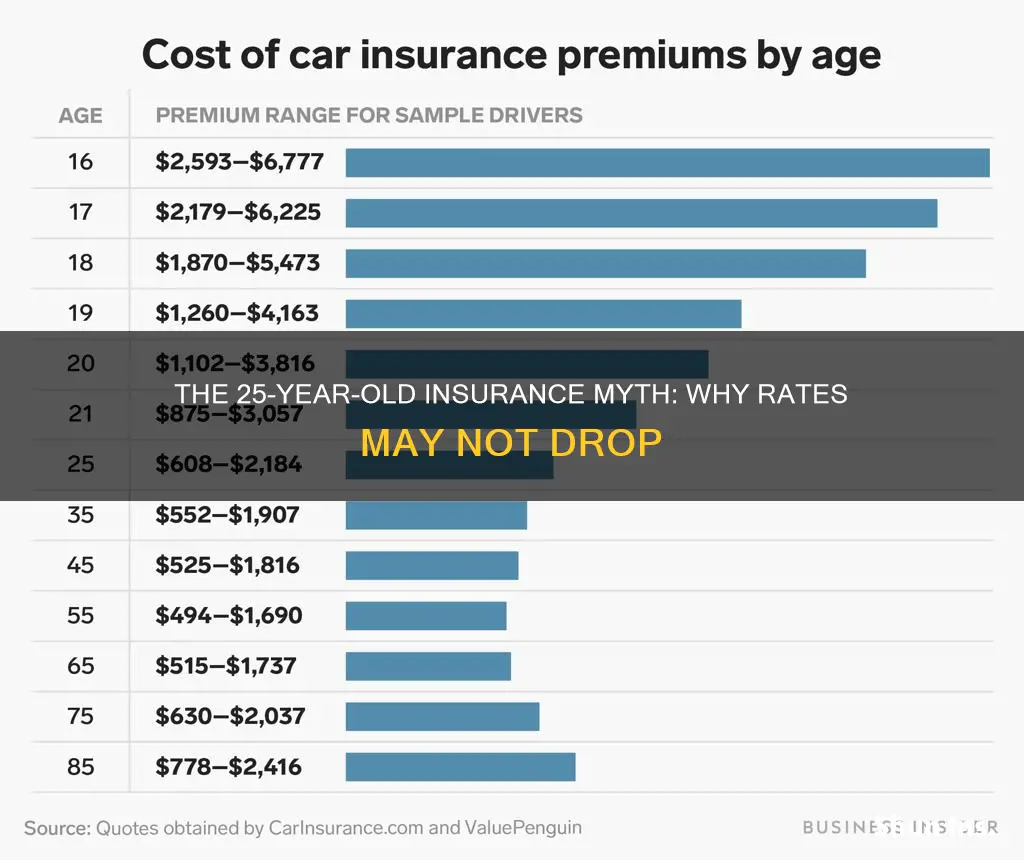

The cost of insurance decreases each year for drivers between 16 and 24, with the most significant drops occurring when drivers turn 19 and 21. While insurance rates are likely to be lower for 25-year-olds, this is not a guarantee, as other factors are considered when setting rates. These include marital status, location, vehicle type, driving record, annual mileage, and credit history.

Insurance rates typically continue to decrease until the driver reaches the age of 75, at which point they begin to rise again due to the increased risk of accidents caused by physical, cognitive, or visual impairments.

It's worth noting that some states, such as Hawaii and Massachusetts, do not allow a driver's age to be a factor in determining their insurance premium. In these states, age is not a contributing factor in the cost of car insurance.

Insurance Data: Vehicle Identification Accuracy

You may want to see also

The biggest drops in auto insurance rates occur when drivers turn 19 and 21

While many people believe that auto insurance rates drop when a driver turns 25, this is not necessarily the case. In fact, the biggest drops in auto insurance rates occur when drivers turn 19 and 21.

Auto insurance rates are typically higher for young drivers, as they are considered riskier to insure due to their inexperience. As drivers age, their insurance rates tend to decrease, reflecting the reduced risk associated with older, more experienced drivers.

According to data from MoneyGeek, the cost of car insurance decreases each year for drivers between the ages of 16 and 24, with the most significant drops occurring at ages 19 and 21. This is contrary to the common belief that rates drop significantly once a driver turns 25. While rates may continue to lower slightly after age 25, they tend to stabilize and remain roughly the same until the driver reaches their 50s.

The Zebra also supports this finding, stating that the most substantial reductions in auto insurance rates typically occur when teen drivers turn 18 or 19. As drivers age, their insurance rates continue to decline, especially once they pass the age of 25.

There are several reasons why auto insurance rates tend to drop when drivers turn 19 and 21. Firstly, younger drivers are seen as riskier to insure due to their lack of experience behind the wheel. As drivers gain more experience and mature, they are less likely to engage in risky behaviours associated with younger drivers, such as not wearing seatbelts and driving under the influence. Additionally, insurance companies consider drivers between the ages of 16 and 24 to be part of a high-risk group, and once a driver turns 25, they are no longer in this category, resulting in more affordable rates.

It is important to note that age is just one of many factors that insurance companies consider when determining rates. Other factors include gender, driving experience, driving record, marital status, vehicle type, annual mileage, credit history, and coverage level. These factors can also significantly impact the cost of auto insurance, and it is always a good idea to shop around and compare rates from multiple insurance providers.

Vehicle Insurance OD: Understanding Own Damage Cover

You may want to see also

Auto insurance rates are lowest for drivers in their 50s

Age is one of the most crucial factors in determining auto insurance rates. Younger drivers, especially those below 25, are generally considered more likely to take risks and be involved in accidents. As a result, insurance companies often charge higher premiums to offset the potential costs of claims arising from youthful drivers. However, as drivers mature and gain more experience, their insurance rates tend to decrease. This trend continues until around the age of 50, when drivers enjoy the lowest insurance rates.

The downward trend in insurance premiums is influenced by several factors. Firstly, drivers in their 50s have accumulated years of driving experience, making them more skilled and cautious on the road. They are also more likely to have established safe driving habits and a clean driving record, which insurers favour. Additionally, older drivers are less likely to engage in risky behaviours, such as speeding or aggressive driving, which further reduces their risk profile.

Furthermore, improvements in vehicle safety technology and road safety infrastructure have contributed to making driving safer for all age groups. Modern vehicles are equipped with advanced safety features, such as collision avoidance systems, lane departure warning systems, and improved airbag technology. These advancements have significantly reduced the severity of accidents and lowered the risk of fatal crashes, benefiting drivers of all ages, including those in their 50s.

It is worth noting that while insurance rates are generally lowest for drivers in their 50s, other factors can still influence individual premiums. For example, drivers with a history of accidents or traffic violations may face higher rates, regardless of their age. Additionally, insurance rates can vary based on factors such as marital status, vehicle type, annual mileage, and credit history.

To summarise, auto insurance rates are typically lowest for drivers in their 50s due to their experience, lower risk tolerance, and improved road safety measures. However, individual factors can still influence insurance premiums, and it is always advisable to shop around and compare rates from multiple insurers to find the best coverage for your specific circumstances.

Auto Insurance Binder: Temporary Proof of Coverage

You may want to see also

Male and female drivers' premiums get closer as they age

Auto insurance rates are influenced by a variety of factors, including age and gender. While age is one of the most significant considerations, gender also plays a role in determining premiums, particularly for young and inexperienced drivers.

Young male drivers, especially teenagers, are considered high-risk due to their propensity for accidents and risky driving behaviours. As a result, they often pay significantly higher premiums than their female counterparts. For example, 16-year-old males pay, on average, $843 more than 16-year-old females. However, as drivers age and gain experience, the gender gap in insurance rates narrows and eventually closes.

By the time male drivers reach their late twenties, the difference in insurance costs between genders decreases significantly. At age 25, the gap narrows to an average of $107, according to Insurance.com's rate analysis. This trend continues as drivers enter their thirties, with male and female drivers paying roughly the same premiums.

While age is a critical factor in determining insurance rates, it is not the only consideration. Insurance providers also take into account factors such as driving record, marital status, residence, vehicle type, credit history, and annual mileage. Additionally, it is worth noting that some states, such as California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, prohibit insurers from using gender as a factor in calculating premiums.

In summary, while male and female drivers may start off with significantly different insurance premiums during their teenage years, these differences diminish as they gain driving experience and age. By the time they reach their thirties, the gender gap in insurance rates has largely disappeared, and other factors play a more prominent role in determining their premiums.

Bank Sharing Customer Address with Auto Insurance

You may want to see also

Drivers with a clean record are likely to see their auto insurance rates go down every year

According to Robert Passmore, vice president of personal line policies for the American Property Casualty Insurance Association, insurance rates typically improve for drivers once they turn 25 and then again at 30, provided they maintain a clean driving record. This trend is supported by data from various insurance carriers, which show that the average cost of car insurance for 25-year-olds is lower compared to younger drivers.

Additionally, insurance companies view older, more experienced drivers as less risky to insure. As a result, car insurance rates tend to decrease as drivers age, especially after passing the age of 25. This decrease in rates continues until around age 75, when rates may start to increase again due to the higher risks associated with older drivers.

However, it's important to note that other factors can also impact insurance rates. For example, drivers who maintain a good credit score, choose a higher deductible, or bundle multiple policies with the same insurer may be able to lower their premiums. On the other hand, factors such as accidents, traffic violations, comprehensive claims, and adding new vehicles or drivers to a policy can cause rates to increase.

In conclusion, while age is a significant factor in determining insurance rates, it is crucial to maintain a clean driving record and consider other factors that can influence premiums to ensure the lowest possible auto insurance rates.

Michigan's Insured Vehicles: How Many?

You may want to see also

Frequently asked questions

Yes, auto insurance rates typically decrease when a driver turns 25, as drivers in this age group are considered less risky.

On average, auto insurance rates drop by 9-11% when a driver turns 25. However, this varies depending on the insurance company and other factors.

Younger drivers are statistically more likely to get into accidents and file insurance claims. Insurance companies consider drivers under 25 to be high-risk, so they charge higher rates.

Yes, other factors that can impact auto insurance rates include driving experience, marital status, vehicle type, driving record, annual mileage, and credit history.

To get cheaper auto insurance, you can shop around for quotes from different insurance companies, improve your credit score, take a defensive driving course, or bundle your auto insurance with other types of insurance, such as renters or homeowners insurance.