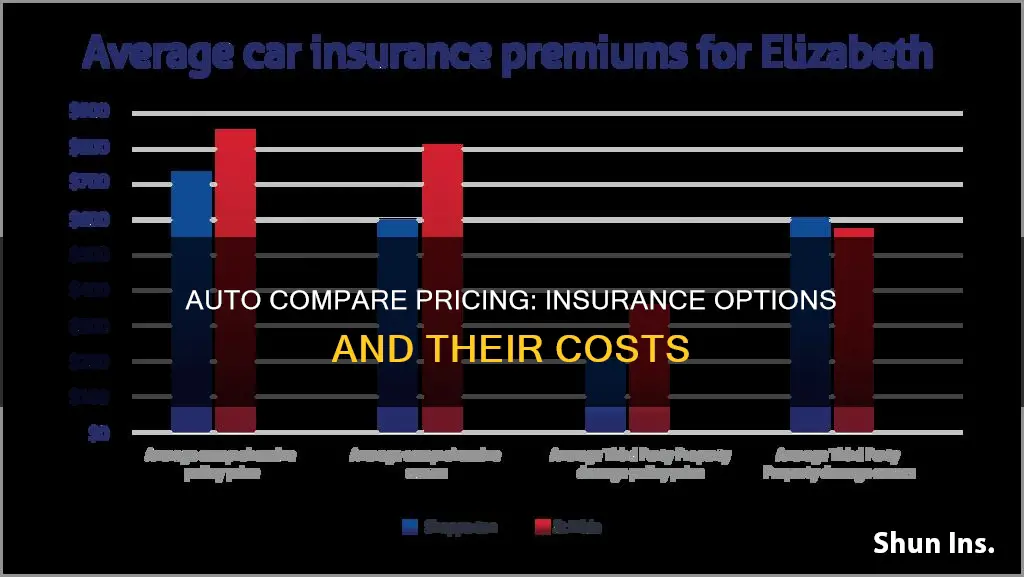

Auto insurance pricing is determined by a variety of factors, including a driver's age, gender, location, credit score, vehicle type, driving history, and the level of coverage they choose. Comparing insurance rates from different companies is crucial to finding the best price, as each company has its own unique way of pricing coverage. Online insurance comparison sites, such as The Zebra, NerdWallet, and Progressive, offer tools to help consumers compare rates from multiple insurers at once. By gathering quotes from various sources and considering their specific needs, drivers can make informed decisions about their auto insurance policies and find the most affordable option.

| Characteristics | Values |

|---|---|

| Company | Progressive, The Zebra, NerdWallet, US News, ValuePenguin |

| Compare with other companies | Yes |

| Compare with own rates | No |

| Compare with average rates | No |

| Compare with state minimum | No |

| Compare with other users | No |

| Compare with previous years | No |

What You'll Learn

Compare prices from different insurance companies

Comparing prices from different insurance companies is an effective way to save money on your insurance plan. Here are some steps you can follow to compare prices and find the best deal:

Determine your budget:

Before you start comparing quotes, it's important to have a clear idea of your budget and the type of insurance you need. The average U.S. driver pays $135 per month for car insurance, so you can use that as a starting point. Knowing your budget will help you quickly narrow down the options and focus on insurers that fit within your price range.

Gather relevant information:

Make sure you have all the necessary information on hand, such as your Social Security number, driver's license number, Vehicle Identification Number (VIN), and details of your current insurance coverage. Having this information readily available will make the process of comparing quotes smoother and faster.

Use an insurance comparison website:

Insurance comparison websites are designed to make your life easier by allowing you to compare prices and coverage options from different companies in one place. However, be cautious of lead-generation websites that sell your personal information. Reputable comparison sites like Compare.com, Insurify, and Jerry partner with insurance companies to provide you with real-time and accurate quotes.

Research companies with the best quotes:

Don't just settle for the first few quotes you receive. Take the time to research and compare multiple insurance companies. Consider using third-party websites like J.D. Power and AM Best, which provide valuable insights into customer satisfaction, claims satisfaction, financial strength, and other key factors. These sites can help you make a more informed decision about which company offers the best combination of pricing and service.

Select the best quote for your needs:

After thorough research and comparison, it's time to choose the insurance company that best meets your coverage needs and budget. Review the quotes once again and select the one that offers the most suitable coverage at the most affordable price. Then, proceed to complete the application for your new policy.

Compare quotes at renewal:

Don't forget to compare quotes again when your policy comes up for renewal. Insurance rates can change over time, and you want to make sure you're still getting the best deal. Typically, you'll receive a renewal notice about 30 days before the renewal date, which is a good time to start shopping around for new quotes.

By following these steps, you can effectively compare prices from different insurance companies and find the best value for your money. Remember, it's not just about the price; consider the coverage options, customer service, and claims handling process as well when making your decision.

Keep Auto Insurance Records Safe and Handy

You may want to see also

Compare prices for different levels of coverage

Comparing car insurance quotes is the best way to find the most affordable insurance policy for your needs. Prices can vary widely depending on factors such as your age, gender, driving history, location, and the type of car you drive. By comparing quotes, you can find the company that offers the best coverage at the lowest price.

When comparing car insurance rates, it's important to consider the level of coverage you need. Most states require drivers to carry a minimum amount of liability coverage, but you may want to opt for additional coverages such as comprehensive and collision insurance to protect your vehicle.

- Determine your budget and coverage needs: Before you start comparing quotes, decide on your budget and the type of insurance you need. This will help you weed out overpriced insurance companies and focus on those that fit your budget.

- Gather relevant information: Make sure you have your driver's license number, Social Security number, vehicle identification number (VIN), and current coverage details on hand.

- Use an insurance comparison website: Comparison websites allow you to compare quotes from multiple companies at once, making the process faster and easier. Just be sure to use a reputable site that provides real-time quotes and doesn't sell your personal information.

- Research companies with the best quotes: Don't just go with the cheapest option. Research the companies with the best quotes to ensure they have good customer reviews and a strong financial rating.

- Select the best quote: Choose the quote that offers the coverage you need at a price you can afford.

- Compare quotes at renewal: Don't forget to compare quotes again when your policy comes up for renewal. This will help you ensure you're still getting the best deal.

By following these steps, you can make sure you're getting the best value for your money and that your coverage meets your needs. Comparing car insurance quotes can save you a significant amount of money, so it's worth taking the time to find the right policy for you.

Direct Auto Insurance: Affordable Coverage?

You may want to see also

Compare prices for different driver profiles

Comparing car insurance prices for different driver profiles can help identify the best company and coverage options for individual needs. Various factors, including age, gender, driving history, vehicle type, and location, influence insurance rates.

Young or new drivers often face higher insurance costs due to increased collision risks. Statistics show that drivers under 25 are more likely to be involved in accidents, with the casualty rate for young drivers being more than double that of older motorists. As a result, new drivers may benefit from black box or telematics insurance policies, which monitor driving behaviour and offer lower premiums for safer driving.

Comparing quotes from multiple companies is essential for finding cheaper insurance. Websites like Compare.com, Insurify, and Jerry provide real-time quotes from numerous insurers, allowing for easy price and coverage comparisons. Additionally, advanced driving courses and a clean driving record can help reduce insurance costs for young drivers.

Marital status also impacts insurance rates, with married drivers often paying less than single drivers. Other factors, such as credit score and driving history, play a role in determining rates. Comparing insurance prices involves considering the desired coverage level, including liability, collision, and comprehensive options, as well as additional coverages like uninsured motorist protection and roadside assistance.

When comparing prices, it's important to have relevant information readily available, such as your Social Security number, driver's license number, Vehicle Identification Number (VIN), and current coverage details. By gathering quotes from multiple companies and considering their customer satisfaction ratings, you can make an informed decision about which insurance provider best suits your driver profile and budget.

Chase Auto Loans: Gap Insurance Coverage

You may want to see also

Compare prices for different locations

Comparing car insurance prices for different locations is essential, as rates can vary significantly depending on where you live. Car insurance is regulated at the state level, and each state has its own unique laws, coverage requirements, and minimum limits. This means that the cost of car insurance can differ significantly from state to state. For example, Vermont and Wyoming have the cheapest car insurance rates, while Florida and Louisiana are the most expensive.

Additionally, your specific location within a state can also impact your insurance rates. Insurance companies often charge higher premiums in areas with a higher risk of weather-related claims, such as floods, hurricanes, or wildfires. For instance, living in a storm-prone state like Louisiana or Florida might result in higher insurance rates.

When comparing car insurance prices for different locations, it's essential to use a reputable comparison site or a licensed insurance agent. They can help you understand the unique factors that influence insurance rates in your area and ensure you're getting accurate quotes. It's also crucial to compare quotes from multiple insurance companies, as rates can vary significantly between insurers. By shopping around and comparing prices, you can find the best coverage at the most affordable price for your specific location.

Switching Auto Insurance: A Smooth Transition

You may want to see also

Compare prices for different types of insurance

Comparing prices for different types of insurance can help you find the best deal. This is because insurance companies weigh factors such as age, location, driving record, level of education, and vehicle type differently, resulting in varying premiums. For instance, young and inexperienced drivers typically pay more for car insurance than other age groups. Similarly, rates differ depending on location, with drivers in urban areas often filing more car insurance claims, leading to higher rates.

When comparing insurance prices, it is essential to have certain information ready to obtain accurate quotes. This includes personal details such as age, address, occupation, and driving history, as well as vehicle information like mileage, make, model, and vehicle identification number (VIN). It is also crucial to decide on the desired level of coverage, as minimum coverage policies tend to be cheaper but may not provide sufficient protection.

By comparing quotes from multiple insurance companies, either directly or through comparison websites or agents, individuals can find the best value for their needs. This process should be repeated periodically, especially when significant life changes occur, to ensure that insurance coverage remains adequate and competitively priced.

Auto Insurance: Tax Return Claims

You may want to see also

Frequently asked questions

You can use an insurance comparison site, such as The Zebra, to compare car insurance rates from multiple companies at once. Alternatively, you can go directly to insurer websites or work with an independent agent to get quotes.

To compare car insurance rates, you will typically need to provide personal information such as your age, address, occupation, driver's license, and marital status. You will also need to provide vehicle information, including the make, model, vehicle identification number (VIN), and mileage. Information about your driving history, current insurance status, and insurance history will also be required.

It is recommended to compare car insurance rates from a minimum of three insurers at least once a year. Shopping around and comparing rates from multiple insurers can help you find the best price and ensure you are getting the most competitive rate.