If you have a pre-existing medical condition, you can still get health insurance. Since 2014, the Affordable Care Act (ACA) has required health insurers to cover pre-existing conditions without raising prices, limiting coverage, or denying coverage. Before the ACA, insurance companies could charge higher prices or even deny coverage altogether to people with pre-existing conditions. Now, it is illegal for health insurance companies to deny coverage or charge higher rates due to a pre-existing condition. However, it's important to note that some health insurance plans purchased before March 23, 2010, are grandfathered and may not include the same protections for pre-existing conditions as plans purchased after this date.

| Characteristics | Values |

|---|---|

| Can insurance companies deny coverage based on pre-existing conditions? | No, insurance companies cannot deny coverage or charge more money for coverage |

| What is a pre-existing condition? | Any health condition or injury before enrolling in a health insurance plan |

| Examples of pre-existing conditions | Cancer, asthma, diabetes, pregnancy, acne, tonsillitis, high blood pressure, menstrual irregularities, depression, dementia, Alzheimer's, heart disease, coronary artery, bypass surgery, etc. |

| When can insurance companies deny coverage for pre-existing conditions? | For health plans that started on or before March 23, 2010 ("grandfathered plans") |

| What is the impact of the Affordable Care Act (ACA) on pre-existing conditions? | ACA requires health insurers to cover pre-existing conditions without raising prices, limiting coverage, or turning away customers. This applies to plans that began on or after January 1, 2014 |

What You'll Learn

The Affordable Care Act (ACA)

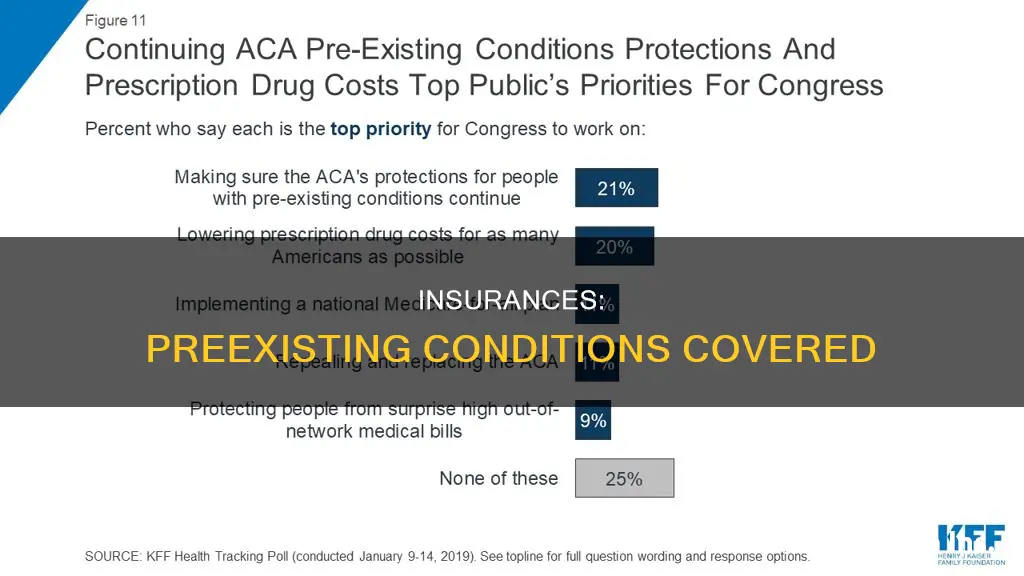

The ACA, enacted in 2010, introduced a range of protections to address these issues. Firstly, it prohibits insurance companies from refusing coverage or charging higher premiums based on an individual's pre-existing health condition. This means that insurers cannot discriminate against people with health problems and must offer them the same rates as those without pre-existing conditions. Additionally, the ACA ensures that insurers cannot impose waiting periods or benefit restrictions for those with pre-existing conditions. This provision is crucial in ensuring timely access to necessary healthcare services.

The ACA also complements the Genetic Information Nondiscrimination Act (GINA). Under GINA, most health insurance plans and employers are prohibited from discriminating based on genetic information, such as an inherited mutation associated with an increased risk of cancer. This provision further safeguards individuals who may be predisposed to developing certain health conditions.

The impact of the ACA is far-reaching. It is estimated that between 50 and 129 million non-elderly Americans have at least one pre-existing health condition. The ACA ensures that these individuals cannot be denied coverage or charged significantly higher premiums. It also provides peace of mind for those who are currently healthy, as approximately 15 to 30% of healthy individuals are predicted to develop a pre-existing condition within the next eight years.

The protections offered by the ACA are particularly critical for older Americans, as their likelihood of having a pre-existing condition increases with age. Up to 86% of individuals aged 55 to 64 have some type of pre-existing health issue. The ACA ensures that this age group cannot be denied coverage or charged exorbitant rates due to their health status.

In summary, the Affordable Care Act (ACA) is a vital piece of legislation that safeguards individuals with pre-existing health conditions from discrimination and unaffordable healthcare costs. By prohibiting insurers from denying coverage, charging higher premiums, or imposing waiting periods, the ACA ensures that all Americans, regardless of their health status, have access to the healthcare services they need.

Understanding Confidentiality: STD Testing and Insurance Claims

You may want to see also

Grandfathered plans

Grandfathered health plans refer to individual health insurance policies purchased on or before March 23, 2010. These plans were sold by insurance companies, agents, or brokers, rather than through the Marketplace. They may not include some rights and protections provided under the Affordable Care Act. Insurers are required to notify customers if they have a grandfathered plan.

If a grandfathered plan is cancelled, customers may qualify for an exemption from the penalty for not having health insurance for the period they were uncovered. They can also switch to a Marketplace plan during the yearly Open Enrollment Period or buy a Marketplace plan outside of Open Enrollment when their grandfathered plan year ends.

The Comprehensive Guide to Navigating Insurance Billing as a Dietitian

You may want to see also

Non-traditional health plans

In the United States, the Affordable Care Act (ACA) of 2014 ensures that health insurance companies cannot refuse coverage or charge more to those with pre-existing conditions. This includes conditions like asthma, diabetes, cancer, and pregnancy. However, there are some exceptions to the ACA's rules, including "grandfathered" policies and non-traditional health plans.

- Short-term health insurance: These policies have an initial term of 364 days or fewer and cannot be renewed for a total duration of more than three years. They are not intended to be a long-term solution and may not provide comprehensive coverage.

- Travel insurance with international medical coverage: While travel insurance can provide peace of mind when travelling abroad, it may not offer the same level of coverage for pre-existing conditions as a traditional health insurance plan.

- Fixed indemnity plans: These plans offer set payouts for specific conditions, which means coverage for pre-existing conditions may be limited or excluded.

It is important to carefully review the terms of any non-traditional health plan and speak with the insurer about coverage for pre-existing conditions before purchasing. These plans may offer more limited benefits and may not be subject to the same regulations as traditional health insurance plans under the ACA.

In addition to non-traditional health plans, "grandfathered" health plans purchased on or before March 23, 2010, are also exempt from covering pre-existing conditions. These plans may not include all the rights and protections provided under the ACA. If you have a "grandfathered" plan and want pre-existing conditions covered, you can switch to a Marketplace plan during Open Enrollment or buy a new Marketplace plan outside of Open Enrollment and qualify for a Special Enrollment Period.

Nature's Fury: Understanding Tornadoes and Their Impact on Home Insurance Policies

You may want to see also

Pregnancy and childbirth

Before the Affordable Care Act (ACA), most plans on the individual market did not cover pregnancy and it was considered a pre-existing condition. This meant that insurers could either deny coverage to pregnant women or charge them more. However, since the ACA, it has been illegal for insurers to deny coverage or increase rates due to pre-existing conditions, including pregnancy.

While pregnancy itself does not qualify you to sign up for health coverage or make changes outside of the Open Enrollment Period, there may be other ways to get coverage when you are pregnant. For example, you can explore options such as Medicaid, the Children's Health Insurance Program (CHIP), community health centres, Planned Parenthood, Hill-Burton facilities, and charity organisations.

It is important for pregnant women to have health coverage to ensure their body and the unborn child have the necessary support. The costs of pregnancy, childbirth, and postpartum care can be significant, and insurance can help cover these expenses. Marketplace plans should cover all medical care related to pregnancy, childbirth, and after the baby is born, including labour and delivery care, C-sections, outpatient services, screenings, tobacco intervention, inpatient services, lactation counselling, and breastfeeding equipment.

Obese Patients: Higher Insurance Charges?

You may want to see also

Children's Health Insurance Program (CHIP)

The Children's Health Insurance Program (CHIP) is a government-funded program that provides low-cost health coverage to children in families with incomes too high to qualify for Medicaid but too low to afford private coverage. CHIP is managed by states according to federal requirements and is funded by both state and federal governments. Each state offers CHIP coverage and works closely with its state Medicaid program.

CHIP covers nearly eight million children and, in some states, pregnant women. To be eligible for CHIP, you must be a resident of the state in which you are applying and meet the following requirements:

- Be 18 years of age or under, or a primary caregiver with a child/children 18 years of age or under.

- Be a U.S. Citizen, National, or a Non-Citizen legally admitted to the U.S.

- Be uninsured and ineligible for Medicaid.

- Have an annual household income (before taxes) below a certain threshold.

The specific income threshold varies by state and household size. For example, in Arizona, the maximum income level for a household of eight people is $105,930, with an additional $8,070 for each additional person.

CHIP benefits differ in each state, but all states provide comprehensive coverage, including dental and vision care, inpatient and outpatient hospital care, and laboratory and X-ray services. Some states may provide additional benefits under CHIP. Routine "well child" doctor and dental visits are free under CHIP, but there may be a fixed amount you pay for covered health care services after paying your deductible.

You can apply for CHIP at any time during the year by calling 1-800-318-2596 or filling out an application through the Health Insurance Marketplace. If you apply for Medicaid coverage through your state agency, they will also inform you if your children qualify for CHIP. If your children are eligible for CHIP, they will not be eligible for any savings on Marketplace insurance plans.

Switching Pediatricians: Insurance and You

You may want to see also

Frequently asked questions

A pre-existing condition is a health problem that exists before you apply for a health insurance policy or enroll in a new health plan. This can be something as common as high blood pressure or allergies, or as serious as cancer, diabetes, or asthma.

Since 2014, the Affordable Care Act (ACA) has required health insurers to cover pre-existing conditions without raising prices, limiting coverage, or turning you away. All Marketplace plans must cover treatment for pre-existing medical conditions. Medicaid and the Children's Health Insurance Program (CHIP) also cover pre-existing conditions.

"Grandfathered" health plans purchased on or before March 23, 2010, are not required to cover pre-existing conditions. In addition, the following non-traditional health plans may not be subject to ACA regulations and might not cover pre-existing conditions:

- Short-term health insurance with an initial term of 364 days or fewer

- Travel insurance with international medical coverage

- Fixed indemnity plans that have set payouts for specific conditions