When it comes to insurance, bundling your home and auto coverage can save you money and simplify your policy management. The best insurance company for a home and auto package is State Farm, which offers the biggest home and insurance bundling discount with an average saving of 23% per year. State Farm is followed by Erie and Nationwide, which also offer good bundling discounts. Other insurance companies that offer bundling discounts include Allstate, Farmers, and Travelers.

| Characteristics | Values |

|---|---|

| Best overall | State Farm |

| Cheapest | Erie Insurance |

| Best add-ons | Nationwide |

| Best specialty | Allstate |

| Best for military | USAA |

| Best for seniors | Nationwide |

What You'll Learn

Pros and cons of bundling home and auto insurance

Bundling home and auto insurance can be a great way to save money and simplify your insurance management. However, there are also some potential drawbacks to consider. Here are the pros and cons of bundling your home and auto insurance:

Pros of Bundling Home and Auto Insurance:

- Cost Savings: Most insurance companies offer bundling discounts, which can lead to significant savings on your premiums. The amount you save will depend on the company, but it could be as much as 25% in some cases.

- Simplified Account Management: By choosing one insurance company for both your home and auto insurance, you only need to manage one account, use one app, and make payments to a single provider. This simplifies your record-keeping and reduces the risk of missing a payment.

- Convenience: Dealing with just one insurer can be more convenient, especially if you need to file a claim that involves both your home and your car. With bundled insurance, you only have to deal with one company and one agent to get everything resolved.

- Single Deductible: In some cases, if a covered event damages both your home and your car, bundling can mean you only have to pay one deductible instead of two separate ones.

Cons of Bundling Home and Auto Insurance:

- Limited Plan Options: Bundling may not always be the best choice if you have specialized insurance needs. For example, if you have a record of unsafe driving, your best option for car insurance might be a company that specializes in high-risk drivers but doesn't offer home insurance.

- Separate Policies May Be Cheaper: While bundling often reduces premiums, it doesn't always result in the biggest savings. In some cases, it might be cheaper to get separate policies from different insurers, even after accounting for the bundling discount. It's important to compare prices and coverage options before deciding.

- Discourages Shopping Around: Once you have multiple policies with one insurer, you may be less likely to shop around for better rates in the future. This could lead to gradually increasing premiums over time.

- Quality of Coverage: In some cases, an insurer may be great at handling certain types of claims but not others. For example, a company might have an excellent reputation for home insurance claims but poor handling of boat insurance claims. Bundling these types of coverage with that insurer may not be the best choice.

Gap Insurance: Protecting Your Car Finance

You may want to see also

How to bundle home and auto insurance

Bundling home and auto insurance can be a great way to save money and simplify your policy management. Here's a step-by-step guide on how to bundle your home and auto insurance:

Step 1: Understand Insurance Bundling

First, let's understand what insurance bundling is. Insurance bundling, also known as a multi-policy or multiple-line discount, refers to purchasing more than one type of insurance policy from the same provider. By combining your home and auto insurance under one company, you can often benefit from discounted rates and more convenient management of your policies.

Step 2: Decide on Your Priorities

Before starting to request quotes, it's essential to determine what you value most in an insurance provider. Are you primarily looking for the lowest premiums? Do you prefer a company with a strong digital presence and user-friendly apps? Are you interested in specific coverage options or endorsements? Knowing your priorities will help you evaluate the quotes effectively.

Step 3: Get Home and Auto Insurance Quotes

Now it's time to get quotes for home and auto insurance bundles. Contact several insurance companies that offer bundling discounts and provide them with the necessary information to receive a quote. Make sure to use the same coverage types and amounts for each policy to simplify the comparison process.

Step 4: Review the Quotes Carefully

When reviewing the quotes, pay attention to the premium price, the amount of the bundling discount, and any additional perks or special features offered by the insurance company. Consider using a comparison spreadsheet or a similar tool to make the evaluation process more organized and structured.

Step 5: Choose a Company and Start Your Policies

Once you've identified the insurer that best meets your needs and preferences, it's time to make your decision. Contact the chosen insurance company and work with one of their agents to finalize the details and start your new bundled policies. They will guide you through the process and ensure that all the necessary steps are completed.

Step 6: Cancel Your Previous Insurance Policies

If you already had separate home and auto insurance policies with other carriers, remember to cancel them to avoid duplicate coverage. It's generally recommended to wait until you know the effective date of the new policies before canceling the old ones to prevent any lapse in coverage. Don't forget to communicate the change to your mortgage lender if your home insurance is paid through an escrow account.

Full Coverage Auto Insurance: Farm Bureau's Cost?

You may want to see also

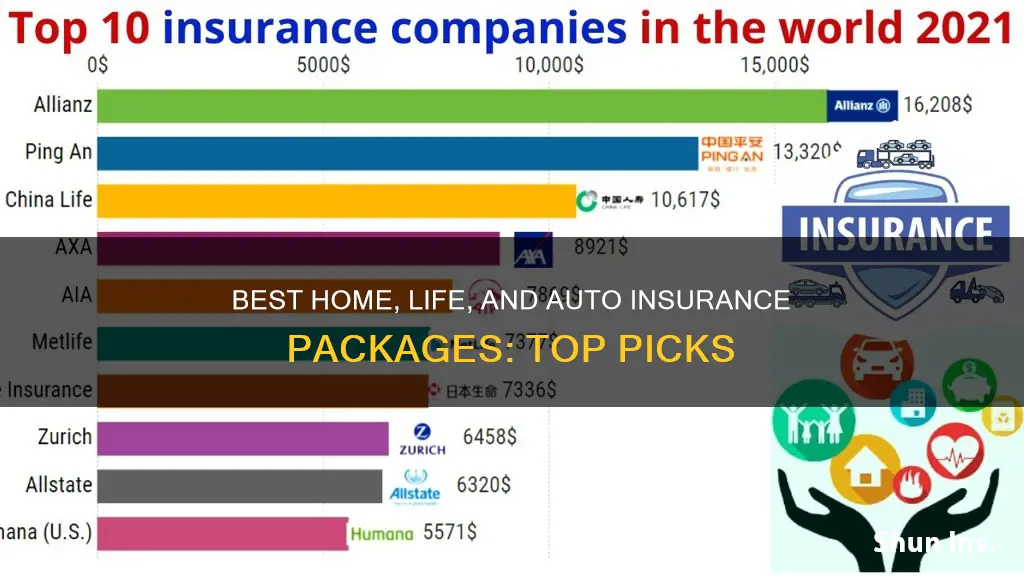

Best companies for bundling home and auto insurance

Bundling home and auto insurance can save you money and make your insurance management easier. Here are some of the best companies for bundling home and auto insurance:

State Farm

State Farm is one of the largest property and casualty insurers by market share and offers insurance products in all 50 states and Washington, D.C., except in Massachusetts and Rhode Island. The company provides a bundling discount of up to $1,273 annually, which is one of the highest in the industry. State Farm also has a low level of complaints and offers competitive pricing.

Erie Insurance

Erie Insurance offers home and auto insurance in 12 states and Washington, D.C. The company provides excellent coverage options, including accident forgiveness, gap insurance, new car replacement coverage, and vanishing deductibles for auto insurance. For home insurance, Erie offers extended water coverage for natural disaster floods and add-on coverage for misplaced jewellery and identity theft.

Nationwide

Nationwide offers insurance products in all states and Washington, D.C., except in Alaska, Florida, Hawaii, Louisiana, Massachusetts, New Jersey, and New Mexico. The company provides a bundling discount of up to 20% and has a good range of coverage options, including accident forgiveness, new car replacement, and vanishing deductible for auto insurance. For homeowners, Nationwide offers "dwelling replacement cost plus" coverage, which provides extended coverage under the home insurance policy.

Auto-Owners

Auto-Owners offers insurance in 26 states and has a low level of complaints for both auto and home insurance. The company provides competitive rates and optional coverage for water backup, extended or guaranteed replacement cost for home insurance. For auto insurance, Auto-Owners offers accident forgiveness, diminishing deductible, gap insurance, and new car replacement.

USAA

USAA offers insurance exclusively to military members, veterans, and their immediate families. The company provides cheap auto and home insurance rates for this community and has a low level of complaints. USAA also offers extended replacement cost coverage for dwellings and accident forgiveness for auto insurance.

These companies provide excellent options for bundling home and auto insurance, offering good coverage, competitive rates, and valuable discounts.

Undocumented Immigrants: Auto Insurance Options

You may want to see also

Discounts available when bundling home and auto insurance

Bundling home and auto insurance is a popular option for those who own both a car and a home, as it can result in significant savings. The best insurance company to bundle with will depend on your individual needs and circumstances.

Discounts

Bundling insurance is when you buy different types of insurance policies from the same company. Most insurance companies provide bundling discounts when policyholders purchase more than one policy type with the same carrier. The discount is typically one of the largest offered by insurance companies, so you might see significant savings.

The average bundling discount is 14%, which saves you around $466 a year. However, this varies from company to company. State Farm offers the biggest home and insurance bundling discount with an average savings of 23% per year. Allstate offers savings of up to 25% when you bundle home and auto insurance. Amica advertises discounts of up to 20% when you combine homeowners insurance with auto insurance, and up to 30% for combining home with auto, condo, life, or umbrella policies. USAA offers a 10% bundling discount.

Other Benefits

As well as saving money, bundling home and auto insurance can simplify your record-keeping and bill payments. You will only have to deal with one insurance company, one app or website, and one agent. You might also benefit from having a single deductible, meaning that if your vehicle and home are damaged in the same event, you will only pay one deductible rather than two.

Disadvantages

Bundling insurance does not always save you money. It is worth comparing quotes for separate policies as well as for bundles to find the best deal. You might find a cheaper price for auto coverage without bundling. Also, some companies serve as affiliates, selling certain policies on behalf of other insurers, so you might end up dealing with multiple insurers even if you bundle.

How to Bundle

If you already have a car insurance policy, you could consider adding a homeowners policy with the same company. However, it is worth shopping around to see if you can find a better deal. Get quotes from several different insurers and compare rates. Remember to consider all your insurance needs and any changes or updates you want to make to your policies. The more types of insurance you bundle, the more money you may be able to save.

Does Your Auto Insurance Cover a U-Haul Rental?

You may want to see also

How to save money when bundling home and auto insurance

Bundling your home and auto insurance can be a great way to save money, but it's not always the best option. Here are some tips to help you save money when bundling your home and auto insurance:

- Shop around for quotes: Compare quotes from multiple insurance companies, both for bundled and separate policies. This will help you find the best overall price. Remember to get quotes for the same coverage types and amounts to ensure you're comparing apples to apples.

- Take advantage of other discounts: In addition to bundling discounts, insurance companies offer a variety of other discounts that you may be eligible for. For example, you might qualify for a safe driver discount, loyalty discount, or low-mileage driving discount.

- Review your policies regularly: Staying with the same insurer can earn you loyalty discounts, but it's also important to shop around and compare rates from time to time. Review your coverage choices and get new quotes after significant life events, such as getting married, having a baby, or moving to a new home.

- Improve your credit score: If your insurance provider uses your credit score to determine your rates, work on improving your credit. This can include paying down debt, making payments on time, and increasing your credit limits.

- Choose the right insurance company: Not all insurance companies offer the same bundling discounts or coverage options. Look for a company that provides a good bundling discount, as well as the coverage and endorsements you need. You may also want to consider factors such as customer satisfaction scores, digital tools, and financial strength ratings.

- Bundle other policies: In addition to home and auto insurance, you may be able to bundle other types of policies, such as renters, condo, life, RV, or boat insurance. Bundling multiple policies can often lead to even greater savings.

- Compare the total cost: Don't just look at the bundling discount; compare the total cost of the bundled policies with the cost of separate policies. Even if a company offers a large bundling discount, their base premiums may be higher than those of other insurers.

Louisiana Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

According to Forbes, State Farm, Erie and Nationwide are the best companies for home and auto insurance bundles. However, other sources suggest that Allstate, Farmers, and USAA are also good options.

Bundling your car and home insurance saves you an average of 17%. State Farm has the cheapest rates, costing $266 per month for a home and auto insurance bundle after a 24% discount.

You can get a bundle discount for a wide range of policies, including home, auto, motorcycle, life and renters insurance. However, the most common bundle offered by insurers includes home and auto insurance.

You should bundle your insurance if the bundling discount helps you pay less than if you used two companies. Bundling also lets you streamline your bills, and you may only have to pay one deductible if there's an incident that damages both your home and car.