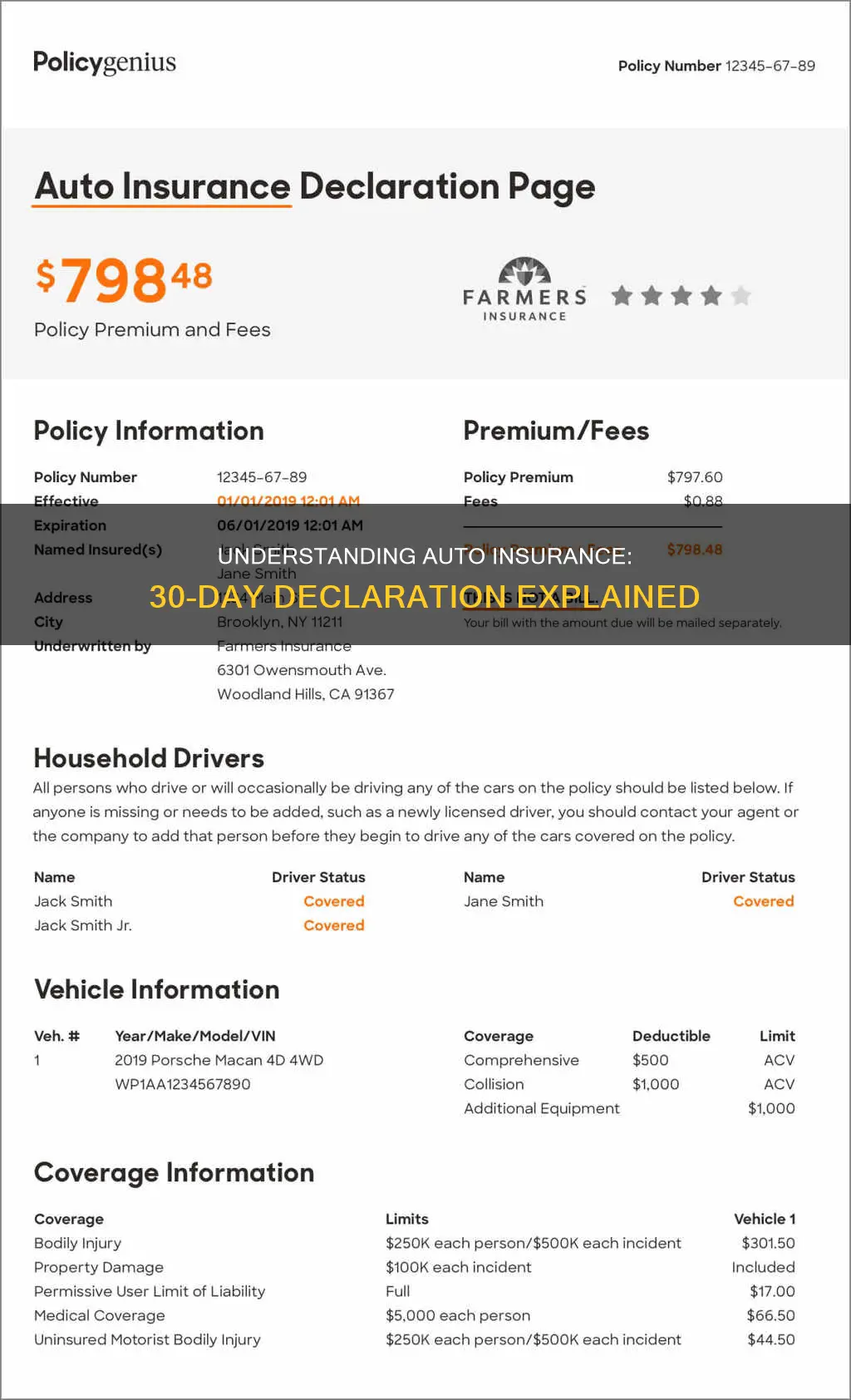

A 30-day car insurance policy is a type of temporary car insurance. While most companies don't offer 30-day insurance, they do provide six-month policies, which are the shortest policy term available from car insurance providers. A car insurance declaration page is a summary of your auto policy, including policy numbers, insured parties, vehicles, coverage limits, and more. This document is not proof of insurance but is useful when reviewing policy details, filing a claim, or renewing or changing your policy.

| Characteristics | Values |

|---|---|

| Purpose | To provide a summary of your auto policy |

| Policy Details | Policy number, term, vehicle details, coverage limits, premiums and discounts, deductibles, additional insureds or <co: 2,4>excluded drivers, endorsements |

| Coverage Types | Liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection/medical payments |

| Coverage Limits | Maximum amounts your insurer will pay for different types of claims |

| Premium | Cost of your insurance policy for the given policy period |

| Deductible | Amount you will pay out of pocket before your insurance coverage kicks in |

| Additional Insureds | Additional drivers covered under the policy |

| Excluded Drivers | Individuals not covered by the policy |

| Endorsements | Optional coverages like roadside assistance or rental reimbursement |

What You'll Learn

What is included in a 30-day declaration of auto insurance

A 30-day declaration of auto insurance is a summary of your auto insurance policy, providing a concise overview of essential policy information. This document is typically issued when you purchase or renew your policy, and it contains details such as:

- The named insured (main policyholder) and any additional insured individuals.

- Excluded drivers, if any.

- Effective dates and the length of the policy term.

- Details of the insured vehicle(s), including year, make, model, and Vehicle Identification Number (VIN).

- Policy limits and deductibles.

- Coverages purchased for each vehicle, which may vary depending on factors such as the presence of a lienholder.

- Premium costs, including a breakdown of the individual costs of each coverage type and vehicle.

- Discounts applied to the policy.

- Information about the loss payee or lienholder, if applicable.

The 30-day declaration page is a handy reference document that outlines the most important aspects of your auto insurance policy. It is not intended to be an exhaustive explanation, and for more detailed information, you may need to refer to the full policy documents or contact your insurance carrier.

Get Your Illinois Auto Insurance License: Steps to Success

You may want to see also

When to use a 30-day declaration of auto insurance

A 30-day declaration of auto insurance is a summary of your auto insurance policy, which is typically sent to you by your insurance company via email, fax, or regular mail when you buy your policy. It contains essential information about your policy, such as the policy number, the date coverage starts and ends, the insured drivers, the covered vehicles, and the types of coverage you have. It also includes personal information, such as the address of the insured, and the names of any additional drivers listed on the policy.

Now, let's take a look at when you should use a 30-day declaration of auto insurance:

When Buying a New Policy

When you purchase a new auto insurance policy, you will receive a 30-day declaration page that outlines the details of your coverage. This is a great time to review the document to ensure that all the information is accurate and that you understand the specifics of your policy.

When Comparing Insurance Rates

The 30-day declaration page contains crucial information about your current policy, including coverage types, limits, and costs. When shopping around for a new policy or comparing rates, having this document handy allows you to provide accurate details to potential insurers, ensuring you receive precise quotes.

When Adding a New Vehicle to Your Policy

If you're adding a new vehicle to your existing policy, you'll receive an updated 30-day declaration page. This document will reflect the changes, including the new vehicle's details and any adjustments to your coverage and costs. Reviewing this updated declaration page ensures that the new vehicle is correctly listed and covered under your policy.

When Verifying Coverage Details

Throughout your policy term, you may need to refer to your 30-day declaration page to remind yourself of the specific coverage you have. This document outlines the types of coverage, their limits, and any applicable deductibles. It's a quick reference guide to understanding what your insurance policy covers and what it doesn't.

When Filing an Insurance Claim

In the event that you need to file an insurance claim, having your 30-day declaration page readily available ensures that you have the necessary policy information. This document provides details such as your policy number, coverage types, and limits, which may be required when submitting a claim.

It's important to note that the 30-day declaration of auto insurance is not proof of insurance for law enforcement or the DMV. For that, you'll need to keep your auto insurance ID card with you, either physically or digitally.

Finding the Right Auto Insurance Policy for You

You may want to see also

When not to use a 30-day declaration of auto insurance

A 30-day declaration of auto insurance is a summary of your auto policy, which includes important information such as the policy number, the date coverage starts and ends, what cars are covered, the types of coverage, and the cost. It is typically located at the front of your policy documents and provided by your insurer via email, fax, or regular mail.

Now, here are some scenarios when it is not advisable to use a 30-day declaration of auto insurance:

When You Need to Provide Proof of Insurance

Whether it is for law enforcement, the DMV, or a lender, a 30-day declaration of auto insurance is not sufficient as proof of insurance. In these cases, you will need to provide a certificate of insurance or your auto insurance ID card, which can usually be found in your glove compartment or on your phone.

When You Need an Exhaustive Explanation of Your Policy

The 30-day declaration page is meant to provide a concise summary of your auto policy. If you require a detailed explanation of your policy, including policy exclusions or definitions, you will need to refer to the full auto policy document or contact your insurance carrier directly.

When You Need to Understand Specific Coverage Types

The declaration page may list the types of coverage you have, but it does not provide an explanation of how these coverages work. For a comprehensive understanding of the different types of coverage, such as liability, collision, or comprehensive insurance, it is advisable to refer to additional resources or consult with your insurance agent.

When Your Policy Has Recently Changed

If you have recently made changes to your policy, such as adding or removing vehicles or drivers, your 30-day declaration page may not reflect these updates. In such cases, it is important to wait for an updated declaration page from your insurer, which should be issued once the changes take effect.

When You Need to Verify Specific Details

While the 30-day declaration page includes essential information, it may not cover all the specific details of your policy. For instance, optional policies like rental reimbursement coverage or identity theft insurance may not be listed. If you need to verify coverage for a specific scenario, it is best to refer to your full policy document or contact your insurance agent.

Florida Auto Insurance: Why So Expensive?

You may want to see also

How to get a 30-day declaration of auto insurance

A 30-day declaration of auto insurance is a document that outlines the key details of your insurance policy, providing a summary of your coverage over a 30-day period. It is important to note that this is not the same as proof of insurance, which is typically provided through a separate insurance ID card. Here is a step-by-step guide on how to obtain a 30-day declaration of auto insurance:

Step 1: Understand the Information Contained in a 30-Day Declaration

The declaration page provides a concise summary of vital policy information. This includes policy periods, numbers, insured drivers, covered vehicles, and elected coverages. Additionally, it contains personal information, such as your name and address, as well as details about your vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

Step 2: Contact Your Insurance Provider

When you purchase an auto insurance policy or make changes to an existing one, your insurance company will provide you with a copy of the declaration page. If you have misplaced or not received this document, you can contact your insurance provider to request a copy. Most insurance companies offer multiple ways to get in touch, including email, phone, fax, or online chat.

Step 3: Request a 30-Day Declaration

When contacting your insurance provider, specify that you require a 30-day declaration of auto insurance. Provide them with all the necessary information, including your policy number, vehicle details, and personal information. They will be able to generate this document for you, outlining the coverage provided during the specified 30-day period.

Step 4: Review the 30-Day Declaration

Once you receive the 30-day declaration, carefully review all the information to ensure its accuracy. Check for any errors or discrepancies, such as misspellings of names or addresses, and verify that the coverage details match your expectations. It is important to confirm that the declaration includes all the relevant vehicles and drivers and that the coverage limits and types are as agreed upon.

Step 5: Keep the 30-Day Declaration Accessible

After confirming the accuracy of the 30-day declaration, keep it in a safe and easily accessible place. Consider storing it in your vehicle's glove compartment or saving a digital copy on your phone or device. This ensures that you can quickly refer to it in case of an accident or insurance-related query during the covered 30-day period.

Vehicle Insurance: Rising Costs Explained

You may want to see also

How to read a 30-day declaration of auto insurance

A 30-day declaration of auto insurance is a summary of your auto insurance policy. It is usually the first page or the beginning of your entire auto insurance policy document. It is a very important document as it contains most of the information you would need when asking questions or reporting a claim to your insurance company. It is also a quick cheat sheet if you have any questions about the specific terms of your policy.

Name and Address

The first item on the declaration page should be the name and address of the insured and the primary driver of the insured vehicle. This is usually you.

Agent

The name and contact information of the insurance agent and/or company that issued the policy should be listed.

Policy Number

Each policy number is unique and will be needed whenever a claim is initiated.

Policy Period

The declaration page will state the time period that the policy is active if premiums are paid. This is usually for 6 or 12 months. It will also state the date coverage goes into effect and the expiration date. Note that policies normally expire at 12:01 am on the date listed (i.e. coverage is in force until the midnight hour on the expiration day).

Drivers Listed and Excluded

All licensed drivers in the household should be listed under Additional Drivers. People in your household who have a driver's license but are not covered are listed as Excluded Drivers. As a policyholder, you may choose to exclude drivers who no longer drive, have their own separate coverage, or who represent a high risk, such as teenagers or anyone with a bad driving record.

Insured Vehicle Information

This section includes the Vehicle Information Number (VIN), year, make, model, odometer reading, annual mileage, and safety features in the vehicle. Make certain all details are correct. If you have a lienholder, it should be listed here along with the value of the car.

Coverages and Premiums

This section lists what the policy covers. It is important to note that if a coverage has no premium next to it, there is no coverage—premium and coverage go hand in hand.

Forms/Endorsements

Some policy selections require special forms (e.g. proof of homeownership). Any such forms along with a record of any changes to your original policy are found in this section.

Miscellaneous Notes

If notes on the policy or car are needed, they will be in this section.

Although each company organizes its declaration page differently, all the items listed above should be on it.

Safe Auto Insurance: Exploring Homeowner Coverage Options

You may want to see also

Frequently asked questions

A 30-day declaration of insurance auto insurance is a summary of your auto insurance policy, valid for 30 days. It includes essential details such as insured parties, vehicles, coverage limits, cost, and policy duration.

A 30-day declaration of insurance auto insurance typically includes the policyholder's name, policy number, policy term, vehicle details, coverage limits, premiums and discounts, deductibles, and additional insureds or excluded drivers.

You should use a 30-day declaration of insurance auto insurance when reviewing your policy details, filing a claim, or renewing or changing your policy. It is also useful as additional proof of insurance in certain situations, such as when you are involved in an accident.