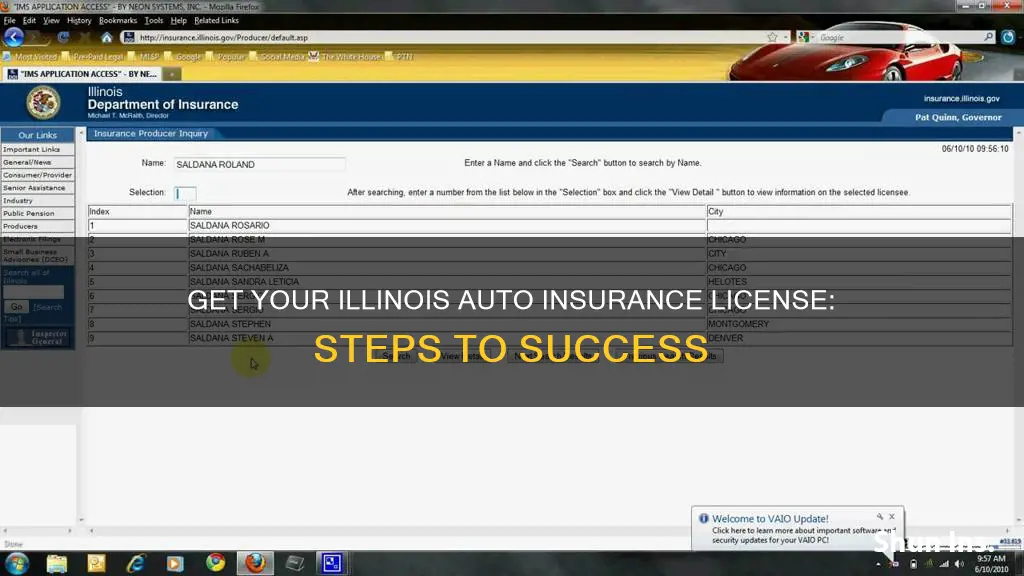

If you're thinking about becoming an insurance agent in Illinois, the first step is to obtain an Illinois insurance license. To do this, you'll need to complete a pre-licensing education course, pass the relevant Illinois Insurance License Exam, submit your insurance license application, and fulfill the Bond Requirement. The Illinois Insurance Licensing Candidate Handbook is a great resource for learning about the specifics of insurance licensure in Illinois, including education requirements, costs, and exam procedures. It's also important to note that Illinois law requires drivers to have insurance before driving and proof of insurance must be kept in the vehicle.

| Characteristics | Values |

|---|---|

| First Step | Figure Out Which Insurance License You Need |

| Second Step | Complete a Pre-Licensing Education Course |

| Third Step | Pass the Relevant Illinois Insurance License Exam(s) |

| Fourth Step | Submit Your Insurance License Application |

| Fifth Step | Fulfill the Bond Requirement |

What You'll Learn

Familiarize yourself with the Licensing Candidate Handbook

The Illinois Insurance Licensing Candidate Handbook is an essential resource for anyone seeking to obtain an insurance license in the state. It is a comprehensive guide that covers all the crucial aspects of insurance licensure in Illinois, serving as a valuable tool for aspiring insurance professionals.

The handbook provides detailed information on the education requirements necessary to pursue a career in insurance in Illinois. It clarifies the educational background needed, addressing questions such as the necessity of a college degree and the potential for other coursework to count toward the requirements. This section is particularly valuable for those who are considering a career change or have prior industry experience in another state.

Additionally, the handbook offers insights into the costs associated with obtaining an insurance license. It outlines the fees for the pre-licensing education courses, the licensing examinations, and the license application process. This financial information is crucial for prospective candidates as it enables them to plan their budgets effectively.

Moreover, the handbook serves as a step-by-step guide to the procedures for taking the licensing examinations. It provides information on scheduling the exams, including registration processes and deadlines. Candidates can also find valuable advice on preparation strategies, such as obtaining practice tests for the different types of insurance. Understanding the examination procedures and having access to preparation resources are key factors in boosting one's confidence and chances of success.

The handbook also includes essential information on the application process for the insurance license itself. It clarifies the timeline, outlining the waiting period between passing the exam and submitting the license application. This ensures that candidates are well-informed about the overall timeline of obtaining their license.

Lastly, the handbook provides an overview of the continuing education requirements to maintain an active insurance license in Illinois. This includes information on renewal periods, credit hours, and any specific courses that may be mandatory, such as ethics training. Staying up to date with these requirements is vital for insurance professionals to keep their licenses valid and remain compliant with state regulations.

Mental Health Records: Can Insurers Access?

You may want to see also

Complete prelicensing education requirements

To get an auto insurance license in Illinois, you must complete a prelicensing course. This is the first step in the process and will prepare you to pass the state licensing exam.

Illinois requires potential insurance agents to complete 20 hours of prelicensing education for each line of authority. For auto insurance, this will be the Property and Casualty Insurance line. For other types of insurance, such as health insurance or life insurance, you would need to complete the relevant prelicensing education course.

Out of the 20 hours of prelicensing education, 7.5 hours must be completed in a classroom or web class. The remaining 12.5 hours can be completed through self-study or online courses.

To satisfy the requirements for your course, you will need to complete the required classroom education and pass a Certification Exam. The Certification Exam is not monitored, and you will need to score 70% or higher to pass.

After passing the Certification Exam, you will receive a Certificate of Completion, which you will need to bring to the state licensing exam. Your prelicensing education is valid for one year from the date of completion, and you will need to take and pass the state exam within this timeframe.

Gap Insurance: PCP Peace of Mind?

You may want to see also

Schedule your exam, pay the fee, and prepare

Scheduling Your Exam

To schedule your exam, you will need to create an account on the Pearson Vue website and follow the step-by-step instructions to make your exam reservation. The exam can be carried out online or in person. The fastest way to schedule your exam is to do so online or by calling (800) 274-0402.

Paying the Fee

The fees are $102 for an individual exam, including a $50 state administration fee. However, you can schedule two exams back-to-back and still pay just $102. You will need to pay the fees when you register.

Preparing for the Exam

To prepare for the exam, you should study and practice. The Illinois Insurance Licensing Candidate Handbook has information on how to pay for the exams and how to obtain practice tests for the different types of insurance. The exam will include both general and state-specific material. The general questions will test your federal insurance product and agent knowledge, while the state-specific questions will cover Illinois insurance regulations and laws.

Each exam normally costs $92, but you can save money by scheduling both the general and state-specific exams at the same time for a total of $92. The Illinois Department of Insurance requires a minimum passing score of 70 for all insurance examinations.

It is recommended that you study for one exam at a time, averaging between two to six weeks of study time per exam, depending on whether you are studying full-time or part-time, and your comfort level with taking proctored exams.

There is no limit to how many times you can attempt an insurance exam throughout the year. However, once you pass one exam (either the general or the state exam), you will be required to pass the other within 90 days.

Additional Tips for Preparation

- Get a pre-license course: This can help you get accustomed to the amount of content you will need to memorize.

- Make enough time to study: Not leaving enough time to prepare is an easy way to ensure that you do not pass your exam on your first attempt.

- Control test anxiety: Establish a consistent pre-test routine and get plenty of sleep in the week leading up to your exam.

Retirement Planners: Auto Insurance Allies?

You may want to see also

Take the exam and pass

Taking and passing the Illinois insurance license exam is a pivotal part of becoming a licensed insurance agent in the state of Illinois. The exam is administered by Pearson VUE, and you can register and book your licensing examinations through their website. The exam can be carried out online or in person.

Each major insurance line examination includes both general and state-specific material. The general questions test your federal insurance product and agent knowledge, whereas the state-specific questions test your knowledge of Illinois insurance regulations and laws that you need to know to operate as an insurance agent.

Each licensing examination has multiple versions, known as forms, which are made up of different questions. This means that your exam can be easier or more difficult than someone else's, even if you're being tested on the same line, on the same day. A statistical procedure called equating is used to ensure that any differences in form difficulty are accounted for.

A scaled score of 70 or above is required to pass your insurance license exam in Illinois. The Illinois insurance license exam cost depends on the number of examinations you take. Each exam normally costs $92, but you can save money by scheduling both at the same time and paying $92 for both.

On the day of the exam, report to the exam center 30 minutes before the scheduled start time. Be sure to have two forms of current ID with a signature, such as a driver's license, passport, military ID, or state-issued ID card. You should also bring your certificate or certificates of completion for your prelicensing education. You'll also be asked to sign a Candidate Rules Agreement form. If you're nervous, you can take a tutorial that won't cut into your exam time.

Umbrella vs. Gap Insurance: What's the Difference?

You may want to see also

Apply for your license

Once you have passed your exam, you will need to wait five days before applying for your license. This waiting period is to ensure that your exam results are verified and processed. After this time, you can submit your application online through the National Insurance Producer Registry (NIPR). The NIPR website has detailed, step-by-step guidance to help you through the application process. The application comes with a $215 processing fee, and you will receive an email confirmation once it has been submitted.

After submitting your application, you will need to fulfill the Bond Requirement. Insurance producers in Illinois must maintain a bond if they place insurance directly or indirectly with an insurer and do not have an agency agreement with them. This bond must be in favor of the people of Illinois, executed by a surety company, and payable to any injured party under the terms of the bond. The bond must be continuous and amount to either $2,500 or 5% of the premiums brokered in the previous calendar year, whichever is greater. The total aggregate liability of the bond cannot exceed $50,000. You must keep this bond at your place of business and make sure that information about the bond is provided to any inquiring party within three working days of their request.

Once you have fulfilled the Bond Requirement, your application will be reviewed. If everything has been filled out correctly, your license should be issued within two to five weeks. This is the amount of time it usually takes for a license application and background check to be reviewed. It is important to note that the issuance of your insurance license can take longer if there are any items from your background check that need to be looked over. The state will likely contact you to provide some context if they run into any issues. Once the review is complete, the state will send you an email regarding the status of your license.

Florida Auto Insurance: Can I Cancel Anytime?

You may want to see also