Car insurance in Pennsylvania is considered moderately expensive, with drivers paying around the national average. The average cost of car insurance in Pennsylvania is $155 per month for full coverage and $50 per month for a minimum coverage policy. The average cost of car insurance in Pennsylvania is influenced by various factors, including age, gender, driving record, credit score, vehicle type, and location within the state. Pennsylvania is a no-fault state with a high population density, which contributes to the cost of car insurance. The cost of providing insurance has been steadily increasing, leading to higher premiums for insured drivers. Additionally, factors such as an increase in accidents, claims, and payouts, rising healthcare costs, and severe weather events have impacted the cost of car insurance in Pennsylvania.

| Characteristics | Values |

|---|---|

| Average annual cost of full coverage car insurance | $1,280 |

| Average annual cost of minimum coverage car insurance | $443 |

| Average monthly cost of full coverage car insurance | $107 |

| Average monthly cost of minimum coverage car insurance | $37 |

| Average annual cost of car insurance for teens | $2,589 |

| Average annual cost of car insurance for 22-year-olds | $533-$1,576 |

| Average annual cost of car insurance for 60+-year-olds | $1,156 |

| Average annual cost of car insurance after a DUI | $2,139 |

| Average annual cost of car insurance after a speeding ticket | $1,557 |

| Average annual cost of car insurance after an accident | $1,809 |

| Average annual cost of car insurance for drivers with poor credit | $1,543 |

What You'll Learn

Pennsylvania is a no-fault state with a high population density

The high population density in Pennsylvania leads to a higher number of insured drivers on the roads, which means a greater number of accidents, claims, and payouts for insurance companies. As a result, insurance providers charge higher premiums to offset the increasing cost of providing coverage. This is reflected in the average annual cost of full coverage car insurance in Pennsylvania, which is $1,280, and the state minimum coverage, which is $443.

The no-fault system in Pennsylvania also contributes to the high cost of auto insurance. In a no-fault state, drivers are required to carry personal injury protection (PIP) or medical payments coverage, which provides compensation for their own injuries and losses regardless of who is at fault in an accident. This additional coverage increases the overall cost of auto insurance for Pennsylvania residents.

Furthermore, the cost of auto insurance in Pennsylvania is influenced by factors such as age, driving record, credit score, vehicle type, and location within the state. For example, drivers under 25 and over 65 tend to pay more for auto coverage due to a higher risk of accidents. Additionally, urban areas like Philadelphia, Bensalem, and Levittown typically have higher insurance premiums than rural areas due to higher population density and a greater likelihood of accidents and property crime.

In summary, Pennsylvania's status as a no-fault state and its high population density are significant factors contributing to the high cost of auto insurance in the state. The combination of a large number of insured drivers in a relatively small area, along with the mandatory personal injury protection, leads to increased claims and payouts for insurance companies, resulting in higher premiums for residents.

Maryland Auto Insurance: Unraveling the MD Requirement for PIP Coverage

You may want to see also

People in Pennsylvania are driving more

One of the reasons why auto insurance is so expensive in Pennsylvania is that people in the state are driving more. As a result, the number of accidents, claims, and payouts is also rising. For example, in 2020, there were approximately 1060 fatal crashes in Pennsylvania, compared to 1083 fatal crashes in 2017.

The increase in driving can be attributed to several factors. Firstly, Pennsylvania has a relatively low unemployment rate, which means more people are commuting to work. According to the 2014 Census Bureau American Community Survey, commutes in Pennsylvania are relatively long, with an average travel time of nearly 26 minutes each way. Additionally, the state has a high population density, particularly in cities like Philadelphia, Bensalem, and Levittown, which are among the most expensive locations for insurance in the state. More people living and working in these areas can lead to increased traffic congestion and a higher risk of accidents.

Furthermore, Pennsylvania's strict laws against driving without insurance can also contribute to more people driving insured vehicles. Motorists caught without insurance face a minimum fine of $300, a suspension of their driver's license and registration, and impoundment of their vehicle. As a result, there are relatively fewer uninsured drivers in Pennsylvania compared to other states, with only 7.6% of motorists uninsured as of 2018.

The cost of car maintenance in Pennsylvania may also play a role in encouraging people to drive more. While the average American driver can expect to pay around $3,504 per year in car maintenance, the average Pennsylvanian driver pays slightly less, at $3,233 annually. This is due to Pennsylvania drivers travelling fewer miles than the national average, as well as the state's relatively high gas prices, which can influence driving habits and reduce the overall number of miles driven.

Overall, the combination of these factors leads to more people driving in Pennsylvania, resulting in higher insurance premiums as the number of accidents and claims increases.

Adding Teen Drivers: Auto Insurance Cost Impact

You may want to see also

Auto repairs are getting more expensive

The cost of parts has also increased. In 2022, the cost of parts sourced from automakers rose by 10%, while aftermarket parts rose by 17%, far exceeding the usual annual inflation rate of 0% to 4%. This has been exacerbated by shipping disruptions and supply shortages caused by the COVID-19 pandemic.

Another factor contributing to higher repair costs is the talent shortage in the auto repair industry. The average labour rate for repairs has increased significantly, with technicians demanding higher wages. The pandemic exacerbated this shortage as people drove less, causing a decline in repair demand and leading technicians to leave the industry for other work.

Furthermore, the increasing number of sensors and technology in modern vehicles has made repairs more complex. Even minor accidents can result in the need to replace entire bumpers due to safety sensors being affected. Electric vehicles, in particular, have unique parts and repair requirements, and many mechanics are not trained to work on them, driving up costs further.

The combination of these factors has resulted in auto repairs becoming significantly more expensive, impacting both consumers and insurance companies, who are facing higher claim payouts.

Auto Insurance: Driver or Car Protection?

You may want to see also

People in Pennsylvania drive uninsured

Auto insurance in Pennsylvania is expensive due to a variety of factors, including the fact that it is a no-fault state with a high population density. The cost of insurance is also affected by the increasing number of accidents, claims, and payouts, as well as the rising cost of auto repairs and healthcare. One of the main factors contributing to the high cost of auto insurance in Pennsylvania is the number of uninsured drivers on the road.

In 2019, 6% of drivers in Pennsylvania did not have even the minimum liability insurance, and this number has likely increased as the cost of insurance continues to rise. Driving without insurance in Pennsylvania is a risky decision, as it can result in severe penalties and challenges. The state requires drivers to purchase two types of car insurance: medical benefits or no-fault coverage, and vehicle liability insurance. Failure to provide proof of insurance coverage can result in a suspended driver's license and registration, as well as fines.

The consequences of driving without insurance in Pennsylvania include the loss of driving privileges, suspension of vehicle registration, fines, and the requirement to pay restoration fees. Additionally, no one can drive the vehicle during the suspension period, and it may even be impounded. If caught driving without insurance, individuals will have to surrender their driver's license and possibly their vehicle registration. The cost of restoring a vehicle's registration after a suspension can be significant, with fees ranging from $94 to $112.

To avoid these penalties and risks, it is crucial to maintain current car insurance and purchase adequate coverage. By driving without insurance, individuals not only risk legal consequences but also put themselves in a financially vulnerable position if they are involved in an accident.

Tipping Truck Drivers: The Auto Insurance Conundrum

You may want to see also

Healthcare in Pennsylvania is getting more expensive

A survey of more than 960 Pennsylvania adults conducted in 2018 found that 1 in 2 experienced healthcare affordability burdens in the past year, including 1 in 3 who struggled to pay medical bills. 4 in 5 were worried about affording healthcare in the future. 74% of uninsured adults said that being uninsured was due to high premium costs. Two out of five Pennsylvania adults who needed healthcare encountered cost-related barriers. 29% delayed going to the doctor or having a procedure done, 25% avoided going altogether, and 24% skipped a recommended medical test or treatment.

Another survey, conducted in late 2020, showed that 1 in 2 Pennsylvania adults struggled to afford healthcare in the past year, and 3 in 4 were worried about affording healthcare in the future. When they did receive care, 1 in 4 struggled to pay the resulting bills.

Healthcare spending in Pennsylvania increases by an average of 5.3% every year, and this is a significant factor in the rising cost of auto insurance in the state.

Auto Insurance for the Homeless: Getting Covered

You may want to see also

Frequently asked questions

Car insurance in Pennsylvania is not expensive compared to the rest of the country. Minimum coverage in Pennsylvania is 22% cheaper than the national average, and full coverage costs 6% less than average. One reason car insurance is cheap is that Pennsylvania has a low percentage of uninsured drivers.

Pennsylvania law requires drivers to have both bodily injury and property damage liability coverage, sometimes written as 15/30/5. As a Pennsylvania driver, you also need medical benefits coverage, which pays for your own injuries.

Full coverage is the best option for most people because it pays for damage to your car.

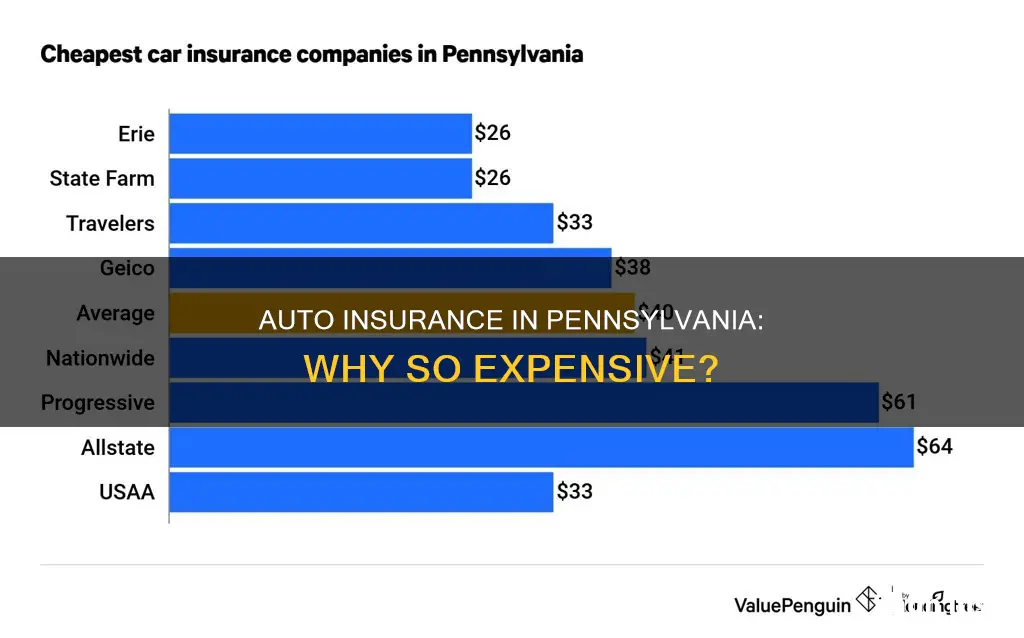

Erie has the cheapest car insurance in Pennsylvania, at $28 per month for a minimum coverage policy. It also has the cheapest full coverage insurance, at $97 per month.