A carrier ID is a unique identifier for an insurance company. In the past, carrier IDs were more commonly used, but now member IDs are more frequently used to identify patients and policyholders. Insurance companies, hospitals, doctors and third-party administrators can use carrier IDs to access centralised insurance policy information.

| Characteristics | Values |

|---|---|

| Definition | Insurance company |

| Synonyms | Insurer, insurance company, insurance provider |

| Use | Identifying a patient or policyholder |

| Alternative | Member ID |

What You'll Learn

Carrier ID vs Member ID

A carrier ID is an insurance policy number. It is used to access centralised information about an insurance policy. This can be useful for claims resolution, uncovering potential fraud, and finding subrogation opportunities.

In the past, carrier IDs were used to identify patients and policyholders. However, this was when Blue Cross Blue Shield was the only insurance company that required a number other than a Social Security Number. Now, many insurance companies identify patients and policyholders by a number other than their Social Security Number. This is known as a member ID.

A member ID is a unique ID number assigned to each person covered by a health insurance plan. Healthcare providers use this number to verify coverage and arrange payment for services. It is also used by health insurers to look up specific members and answer questions about claims and benefits. This number is always on the front of the insurance card.

When adding insurance information for a client, it is important to verify the payer ID to ensure the correct insurance payer is selected. A payer ID is a unique ID assigned to each insurance company and is used to submit claims electronically.

Red Cross: Workers' Comp Covered?

You may want to see also

Carrier ID and fraud detection

A Carrier ID is an insurance carrier identification number. In the past, the Carrier ID was more commonly used when Blue Cross Blue Shield was the only insurance company that required a number other than the Social Security Number. Now, the Member ID is used more frequently, as many insurance companies are identifying patients by a number other than their Social Security Number.

Carrier ID provides insurance policy information in a centralized and easy-to-access format. This allows Third-Party Administrators and self-insured individuals to identify critical insurance carrier information on claimants and other parties involved in an accident.

Carrier ID can be used to detect fraudulent activity by assessing the legitimacy of a claim. For example, a vehicle appearing on policies from multiple carriers may be a fraud indicator. This can help to streamline claims resolution by providing quick access to critical policy information on private passenger and commercial vehicles.

Fraud and identity theft can also occur when entities use another motor carrier's assigned USDOT number without authorization or when someone acts as a broker without registering with the FMCSA. To prevent this, phone numbers of brokers and carriers can be confirmed using SAFER. If the number provided by the carrier/broker does not match the posted number, it is recommended to call the posted number to discuss the load.

Additionally, when using a search engine to confirm numbers, emails, and websites, it is important to be cautious of fake profiles created by scammers. It is advised to not trust the information unless it can be confirmed on multiple sites.

Accent's Insurance Carrier

You may want to see also

Carrier ID and claim resolution

A carrier ID is a unique identifier for an insurance carrier. It is used to access centralised insurance policy information, including critical policy information on private passenger and commercial vehicles. This allows for faster and more effective claims resolution.

Carrier IDs are an essential tool in the claims resolution process. They allow third-party administrators and self-insured individuals to identify critical insurance carrier information on claimants and other parties involved in an accident. This helps to streamline the claims resolution process by providing easy access to relevant policy information.

For example, in the context of shipping, carrier claims are a standard part of the shipping process. Shippers, recipients, and carriers have contract terms laid out in a bill of lading (BOL), which includes the expectations of the shipment. When something goes wrong, such as shortages, damages, or partial non-deliveries, a carrier claim can be filed to seek reparations.

Carrier IDs can help in this process by providing quick access to insurance policy information. This allows for faster and more efficient resolution of claims, reducing the time and effort required to manage them. Additionally, carrier IDs can help detect fraudulent activity by addressing certain fraud indicators, such as a vehicle appearing on policies from multiple carriers.

Overall, carrier IDs play a crucial role in streamlining the claims resolution process, improving efficiency, and helping to uncover potential fraud. By providing centralised access to insurance policy information, carrier IDs contribute to faster and more effective claims handling, ultimately enhancing the customer experience.

Choosing the Right Concealed Carry Insurance

You may want to see also

Carrier ID and subrogation opportunities

Carrier ID provides insurance policy information in an easy-to-access, centralised format. This allows Third-Party Administrators and self-insured entities to identify critical insurance carrier information on claimants and other parties involved in an accident.

Carrier ID is a useful tool for insurance companies to streamline claims resolution, uncover potential fraud, and find subrogation opportunities. Subrogation is the insurer's legal right to pursue damages after paying a claim. However, insurance companies often neglect to pursue their subrogation right, or they do so with faulty practices, which results in lost money for the insurer.

Carrier ID can help insurance companies identify subrogation opportunities by determining the current policy coverage of an at-fault party in an accident. This is especially useful in situations that may have originated as an uninsured motorist claim. By using Carrier ID, insurance companies can improve their subrogation processes and reduce costs associated with subrogation.

To further optimise their subrogation efforts, insurance companies can implement a combination of process optimisation and technology. This includes solutions such as process reengineering, light-touch technology, business intelligence dashboards, electronic collaboration, and smart shore solutions. By improving their subrogation processes, insurance companies can increase their recovery through subrogation, contain their loss ratio, improve customer satisfaction, and remain competitive in the market.

Additionally, insurance companies should also focus on fraud prevention and abuse mitigation in carrier-to-carrier subrogation. Fraudulent activities can harm stability and reputation, and even one fraudulent claim can impact premiums, coverage, and industry trust. Expert subrogation analysis can help identify and address potential fraud and abuse before they affect the integrity of the claims process. Data analytics plays a crucial role in detecting anomalies and discrepancies, ensuring the integrity of the subrogation process.

Federated Insurance: Admitted Carrier Status

You may want to see also

Carrier ID and insurance company name

A carrier ID is a unique identifier for an insurance company. The terms "insurer," "carrier,"" and "insurance company" are interchangeable. The phrase "provider," on the other hand, usually refers to the hospitals and doctors who deliver health-care services. If you must refer to the insurance company as the "provider," be sure to say "insurance provider" to avoid misunderstanding.

Carrier IDs are used to find critical insurance carrier information on claimants and other parties involved in an accident. This helps third-party administrators and self-insured individuals identify the insurance company associated with a claim. It also helps to assess the legitimacy of a claim by addressing certain fraud indicators, such as one vehicle appearing on policies from multiple carriers.

In the past, carrier IDs were used more frequently when Blue Cross Blue Shield was the only insurance company that required a number other than the Social Security Number. Nowadays, member IDs are more commonly used, as many insurance companies now identify patients by a number other than their Social Security Number.

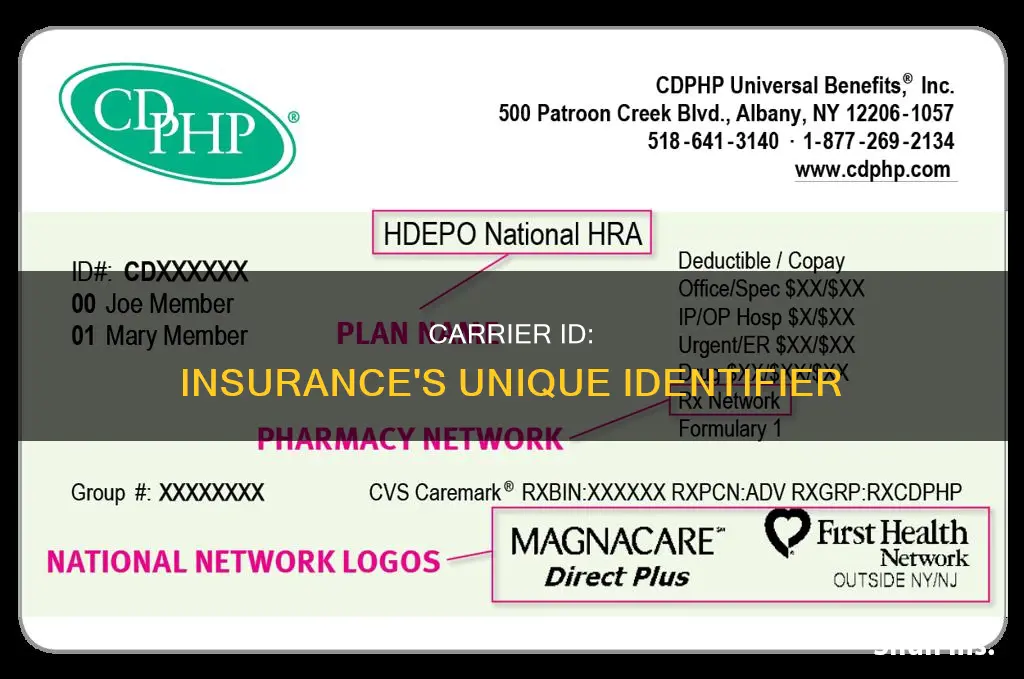

The carrier ID can usually be found on your health insurance ID card, along with other important pieces of information. This includes the names of covered individuals, the member ID/policy number, and contact information for the insurance company.

Multiplan: Insurance Carrier or Not?

You may want to see also

Frequently asked questions

A carrier ID is another name for an insurance company. The terms insurer, carrier, and insurance company are generally used interchangeably.

A carrier ID was used more in the past when Blue Cross Blue Shield was the only insurance company that required a number other than the Social Security Number. A member ID is a more updated option, as many insurance companies now identify the patient by a number other than the Social Security Number.

A carrier ID provides insurance policy information in a centralized, easy-to-access format. It includes critical insurance carrier information on claimants and other parties involved in an accident.