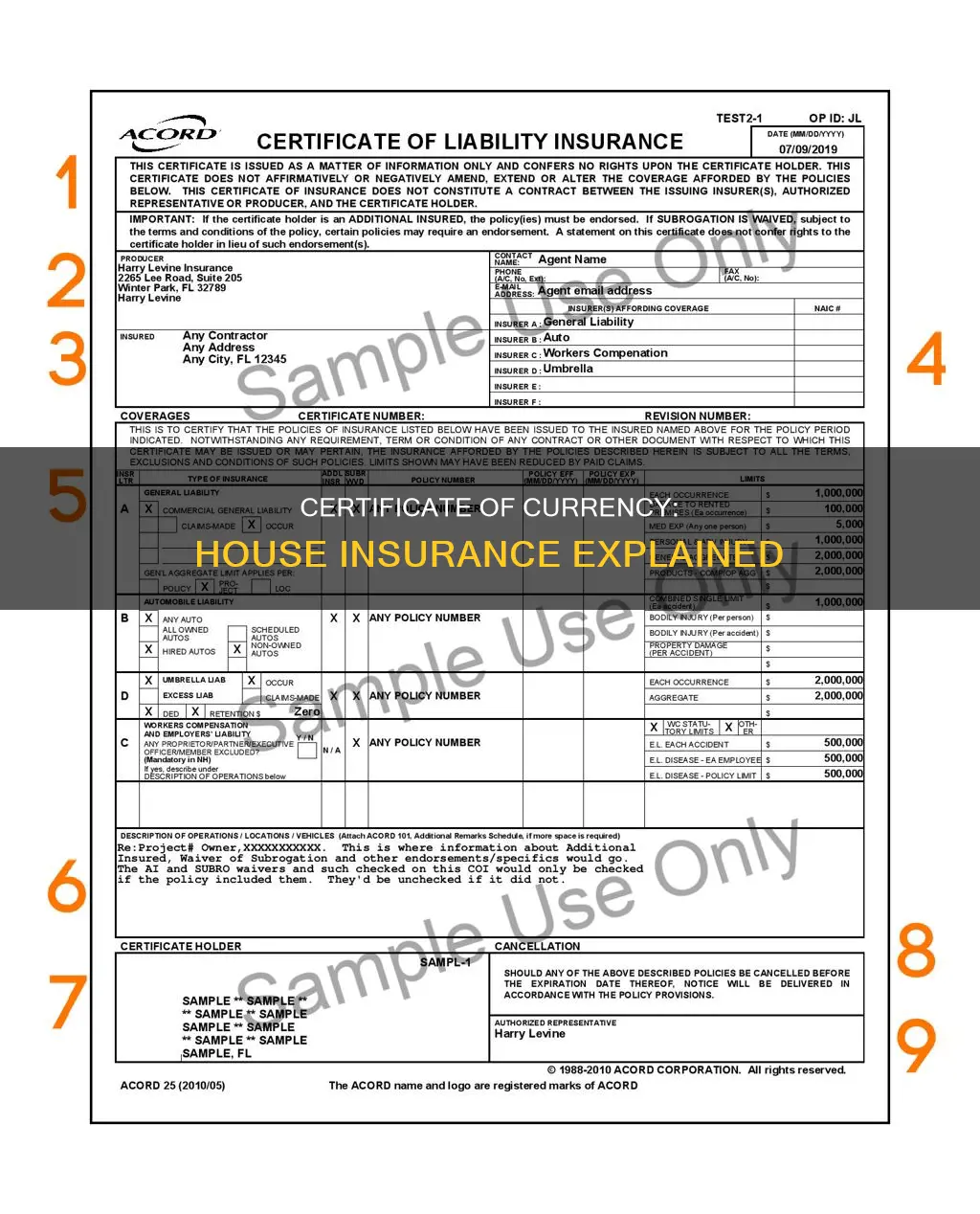

A certificate of currency is a document issued by your insurance provider that confirms your property is insured. It is typically required when applying for a home loan and needs to be provided to your bank or lender. The certificate includes details such as the insured party's name and address, policy number and expiry date, the maximum amount covered by the policy, and premium payment information. This document is important as it protects the lender in the event of unexpected damage or loss to the property.

| Characteristics | Values |

|---|---|

| Purpose | To prove to the bank or lender that your property is insured |

| Who issues it? | Your insurance provider |

| When do you need it? | When applying for a home loan, refinancing your home loan, or purchasing an existing property |

| What does it confirm? | That your insurance policy is effective and valid |

| What is covered? | Insured party details, policy details, limit to protection, and premium payment details |

| Insured party details | Name(s) and residential or investment property address(es) of the insured party |

| Policy details | Policy number, policy type, and policy expiration date |

| Limit to protection | The maximum amount that the policy covers |

| Premium payment details | Amount of premium paid, date paid, and method of payment |

What You'll Learn

Certificate of Currency confirms insurance policy

A certificate of currency is a document issued by an insurance provider that confirms your insurance policy is effective and valid. It is particularly relevant when applying for a home loan, as it proves to the bank or lender that your property is insured.

The certificate of currency includes the insured party's details, such as their name(s) and residential or investment property address. It also includes the policy number, type, and expiration date, as well as the commencement and expiration dates of the insurance contract. The lender's name is listed as an interested party, along with the maximum amount covered by the policy and the premium payment details.

This certificate is necessary to protect the lender from any unexpected damage or loss to the property. It is usually required before the loan settlement and can be obtained from the insurance company free of charge. It is important to ensure that the property is insured for at least the minimum period and amount required by the lender, and that the policy starts before the settlement date.

By providing a certificate of currency, you can confirm that your property is adequately insured, which is a crucial step in the process of obtaining a home loan.

The Perks of Accident Forgiveness with Farmers Insurance

You may want to see also

Required for home loan

A certificate of currency is a document issued by your insurance provider that confirms your property is insured. It is required for a home loan because it protects the lender in the event that your property is damaged by an unexpected event, such as theft or fire.

When you apply for a home loan, your bank or lender will ask for a certificate of currency. This document can make or break your home loan application. It is important and highly beneficial to have one.

A certificate of currency for a home loan will include:

- Your details: name(s) and residential address of the insured party.

- Policy details: insurance policy number and its expiry date.

- Limit to protection: the maximum monetary amount covered by the policy.

- Premium payment details: the amount of the premium that has been paid, as well as the date and method of payment.

You can request a certificate of currency from your insurance company free of charge by calling them or logging in to your online account. Your insurance broker can also request the certificate on your behalf.

Make sure that your property is insured for the minimum period required by your lender and that the policy starts before the settlement date.

Insuring Your Home: The Ultimate Guide

You may want to see also

Details included in the certificate

A certificate of currency is a document issued by your insurance provider that confirms your property is insured. It contains the following details:

Insured Party Details

This includes the name(s) and residential or investment property address(es) of the insured party, i.e. the owner(s) of the property.

Policy Details

The insurance policy number, its type, and its expiry date. It also includes the time and date of the commencement and expiration of the insurance contract.

Interested Party or Mortgagee Details

The lender's name is mentioned as the interested party or mortgagee.

Limit to Protection

The maximum amount that the insurance policy covers is indicated. The applicants can nominate their own amount as long as it is at least the amount required by the lender, which is fixed after the valuation report.

Premium Paid

This includes the amount of the premium that has been paid, the date, and the method of payment. Some certificates of currency also declare the monthly repayments and the method, while others might not mention it in the contract.

Untangling the Web: Navigating the Termination of Sub-Producer Contracts with Farmers Insurance

You may want to see also

When to provide a Certificate of Currency

A certificate of currency is a document issued by your insurance provider that confirms your property is insured. It is usually requested by your bank or lender during the application process when purchasing an existing property or refinancing your home loan.

- When purchasing an existing property: If you are buying a previously owned home, your bank or lender will typically request a certificate of currency during the application process. This is to ensure that the property is adequately insured before they approve your loan.

- When refinancing your home loan: When you are refinancing your existing home loan, the lender will want to verify that your property is still insured. This protects them in case your property is damaged by an unexpected event, such as a fire or theft.

- When your property is not covered by strata or body corporate: If your property is not part of a strata or body corporate, such as a standalone house, you will need to provide a certificate of currency. This is because, in the case of apartments or townhouses covered by strata, the strata corporation typically insures the building, so individual owners don't need to provide separate proof.

- When there is a change in policy: If you are updating your insurance policy, make sure to include the name of the interested party, such as the Commonwealth Bank of Australia, so that they are specified on the certificate of currency.

- When the lender specifically requests it: Even if you are purchasing vacant land or building a new home (where builder's insurance usually applies), your lender may still request a certificate of currency. This is to ensure that their investment is protected and that you meet the terms of your loan agreement.

It is important to note that a certificate of currency is not always required when purchasing vacant land or building a new home. However, it is a crucial document when it comes to finalising your home loan, as the sale may not be legally allowed to proceed without proof of insurance.

Exploring Pet Insurance Options for Farmers: Tailored Coverage for Unique Needs

You may want to see also

How to request a Certificate of Currency

A Certificate of Currency is a document that proves you have a valid insurance policy. It is often requested by lenders before a loan settles to ensure that the property is insured. It is also used to prove to third parties that you have an appropriate level of insurance cover for the work you are about to undertake.

- Ensure that your property is insured for at least the minimum period required by the lender. You can find this information in the loan offer document or by contacting your mortgage broker.

- Make sure that your insurance policy starts before the proposed settlement date.

- Contact your insurance company to request the certificate. You can do this by calling them or by logging into your online account, if they offer this service.

- Ask your insurer to note your bank on the policy as the mortgagee.

- Specify how you would like to receive the certificate (fax, email, or mail). Keep in mind that receiving the certificate by mail may cause delays with your loan being advanced.

- Return the certificate to the bank along with your loan offer to ensure they don't lose it.

It is important to note that you may not need a Certificate of Currency while building a home, as this is typically covered by the builder's insurance, or when purchasing a unit or apartment with strata insurance.

Farmers Insurance Refund Policy: What You Need to Know

You may want to see also

Frequently asked questions

A certificate of currency is a document issued by your home insurance company that confirms that you’re insured.

A certificate of currency includes the insured party's details, such as their name and residential address, the policy details, the limit to protection, and the premium payment details.

You need to provide a certificate of currency when applying for a home loan. You also need one when purchasing an existing property or refinancing your home loan.

You can request a certificate of currency from your insurance company, usually by calling or emailing them. Some companies may also allow you to download it directly from their website.

No, you only need to provide a certificate of currency when taking out a new home loan or refinancing an existing one. The bank assumes that you renew your insurance each year and will not require proof of renewal.