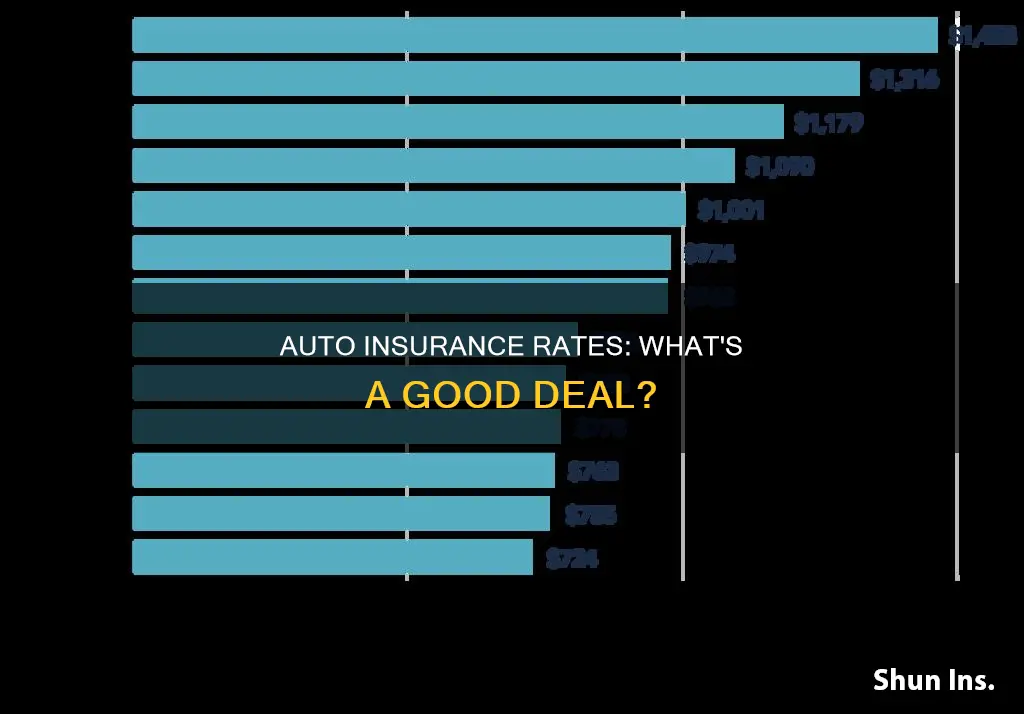

The cost of auto insurance varies depending on a number of factors, including age, location, driving history, and the type of vehicle being insured. The national average rate for full coverage car insurance is $1,895 per year, but rates can range from as low as $1,175 in Maine to as high as $2,883 in Louisiana. The cost of insurance can also vary depending on the insurance company, with some companies offering lower rates for certain driver profiles. When shopping for auto insurance, it is important to compare rates from multiple companies to find the best price and coverage for your needs.

| Characteristics | Values |

|---|---|

| National average rate for full coverage car insurance | $1,895 |

| State with the most expensive car insurance | Louisiana |

| State with the cheapest car insurance | Maine |

| Average car insurance policy for full coverage in the U.S. | $158 a month |

| Average cost of full coverage car insurance | $1,718 per year |

| Average cost of minimum coverage car insurance | $488 per year |

| Average annual rate for good drivers | $1,414 |

| Average annual rate for drivers with a speeding ticket | $1,804 |

| Average annual rate for drivers with a DUI | $2,450 |

| Average annual rate for drivers with poor credit | $2,242 |

| Average annual rate for drivers with an at-fault accident | $2,050 |

What You'll Learn

Average car insurance rates by state

The national average annual cost for full-coverage car insurance in the USA is between $1,895 and $2,278. However, this varies drastically by state. The state you reside in is one of the biggest factors influencing the price of your auto insurance premium.

The most expensive states for car insurance

The most expensive states for car insurance are Louisiana, Florida, California, Colorado, and South Dakota. The average annual cost of full-coverage car insurance in these states is between $2,337 and $2,883.

The cheapest states for car insurance

The cheapest states for car insurance are Ohio, Maine, Idaho, Vermont, and New Hampshire. The average annual cost of full-coverage car insurance in these states is between $1,162 and $1,417.

Factors that affect car insurance costs

There are several factors that affect car insurance costs, including:

- Driving record: Accidents, claims, and violations raise your premiums.

- Gender and age: When calculating insurance rates, the driver’s gender and age matter in most states.

- Location: If you live in a populated city with higher rates of crime and traffic violations, you’ll likely pay more.

- Credit score: Your credit score is used by insurance companies in most states.

- The type of vehicle you drive: The car you drive will impact your insurance premium.

Vintage Cars: Insurance Costs Explained

You may want to see also

Car insurance rates by company

The cost of car insurance varies from company to company. Some of the largest car insurance companies in the US include State Farm, Progressive, Geico, Allstate, USAA, Liberty Mutual, Farmers, American Family, Travelers and Nationwide. Together, they collect 77% of what people spend on car insurance in the US.

The cost of car insurance depends on a variety of factors, including age, gender, location, driving history, credit score, and the type of vehicle. The national average rate for full coverage car insurance is $1,895, but rates vary by state. Louisiana is the most expensive state for car insurance, with an average annual premium of $2,883, while Maine is the cheapest, with an average annual premium of $1,175.

When comparing car insurance rates, it's important to consider the company's financial stability, customer complaint records, and the types of coverage and discounts offered. Some companies may offer lower rates for certain driver profiles, such as young drivers or those with a DUI. It's also worth noting that smaller, local insurance companies may offer more personalized service and competitive rates compared to the larger, national companies.

Erie Auto Insurance: Good or Bad?

You may want to see also

Car insurance rates by age

Age is one of the most important factors that insurance companies consider when determining car insurance rates.

Younger drivers tend to pay the highest car insurance rates. Rates start to decrease once drivers turn 25 and are levelled out by age 40. Rates begin to increase again after age 60.

The average monthly cost of a full-coverage car insurance policy in the US is $158. However, a 16-year-old driver will pay around $613 per month for full coverage, while a 60-year-old driver will pay around $158 per month for the same coverage.

The difference in insurance rates between age groups is because younger drivers have less experience and are more likely to cause accidents. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident than older drivers, and drivers between 15 and 20 were responsible for 7% of all fatal accidents, despite only making up 4% of drivers.

After age 60, rates begin to slowly increase as age and slower reflexes start to impact driving ability. An 80-year-old driver will pay around $209 per month for full coverage, which is $10 more per month than a 25-year-old.

Gender and Car Insurance Rates

Gender also plays a role in car insurance costs. On average, men pay 6% more for full-coverage car insurance than women, although this difference varies by age. Until age 21, men pay 10% more than women, but the gap shrinks after age 30, with men paying 1% less than women until age 50.

Cheapest Car Insurance Companies for Young Drivers

Travelers Insurance has the cheapest rates for drivers under 25, with an average of $273 per month for full coverage. This is 6% cheaper than Geico and 9% cheaper than State Farm.

Cheapest Car Insurance Companies for Senior Drivers

State Farm, Travelers, and USAA offer the cheapest rates for senior drivers. With an average rate of $118 per month, Farm Bureau has the cheapest full-coverage quotes for seniors, but their options vary depending on location, and there is also a membership fee.

Liability Insurance: Auto Claims Explained

You may want to see also

Car insurance rates for drivers with a DUI

The cost of car insurance varies depending on several factors, including location, age, gender, and type of vehicle. The national average rate for full coverage car insurance is $1,895 per year, but this can be higher or lower depending on individual circumstances. For example, the state with the most expensive car insurance is Louisiana, with an average annual premium of $2,883, while the cheapest state for car insurance is Maine, with an average annual premium of $1,175.

When it comes to car insurance rates for drivers with a DUI, the costs can increase significantly. A DUI is considered a severe driving incident, and as a result, car insurance companies view drivers with a DUI as high-risk. The average cost of car insurance with a clean driving record is $2,542 per year, while the average cost for a driver with a DUI is $4,790 per year, an increase of 88%. The increase in insurance rates after a DUI can vary by state and insurance provider, but it typically lasts for three to five years. During this time, it is important to maintain a clean driving record and shop around for the best rates. Some insurance companies may refuse to insure drivers with a DUI, so it is essential to compare rates and find a company that specializes in high-risk drivers.

AAA Auto Insurance: Affordable or Overpriced?

You may want to see also

Car insurance rates for drivers with poor credit

In most states, car insurance companies can use your credit history to set your premiums when writing a new policy. Poor credit is seen as a risk factor for frequent insurance claims. The average annual cost of full-coverage auto insurance for drivers with poor credit is $4,063, while drivers with state minimum coverage pay an average of $1,165 per year. That’s an average increase of nearly 80%.

Geico offers the cheapest rates for drivers with poor credit on average. Progressive is also a good option for drivers with poor credit who prefer a national insurance carrier. Progressive is known for its strong digital tools, including the Name Your Price Tool, which may help shoppers narrow down exactly what they want in their policy and cut needless expenses.

Dairyland and Direct Auto are two other companies that may be good for drivers with poor credit. Dairyland is only available in 38 states but offers non-standard auto policies with potential add-ons like gap insurance, rental reimbursement, and special equipment coverage. Direct Auto may be a solution for drivers with poor credit who don’t qualify for a policy elsewhere, as it offers flexible payment plans. However, Direct Auto has limited add-on coverage options and both Dairyland and Direct Auto have high rates of customer complaints.

In addition to Geico and Progressive, Nationwide, Mercury, American Family, and Travelers are some of the cheapest major providers for drivers with bad credit.

Insurance Law: Fixing Damaged Vehicles

You may want to see also

Frequently asked questions

Many factors affect your auto insurance rate, including your age, gender, driving history, location, and the type of vehicle you drive.

To get a good auto insurance rate, you should shop around and compare rates from multiple insurers. You can also try to improve your credit score and driving record, as these are two factors that insurers use to determine your rate. Additionally, you may be able to get a discount if you bundle your auto insurance with another type of insurance, such as homeowners or renters insurance.

The cost of auto insurance varies depending on the coverage level, your personal characteristics, and your driving history. The national average cost for full coverage auto insurance is $1,718 per year, or about $143 per month. For minimum coverage, the national average cost is $488 per year, or about $41 per month.

You should compare auto insurance rates regularly, especially if your personal circumstances have changed. For example, if you have moved to a new state, bought a new car, or had an accident, you should compare rates to see if you can get a better deal.

Full coverage auto insurance includes liability, collision, and comprehensive insurance, which covers damage to your own vehicle as well as damage to others' vehicles and property. Minimum coverage auto insurance only includes liability insurance, which is the minimum amount of insurance required to drive legally in your state.