Medical insurance carriers, also known as health insurance companies, play a crucial role in the healthcare system by providing financial protection and coverage for individuals and families. These carriers are responsible for underwriting and managing health insurance policies, which offer coverage for medical expenses, including doctor visits, hospital stays, surgeries, and prescription drugs. They assess risks, set premiums, and negotiate rates with healthcare providers to ensure that policyholders receive the necessary medical care while managing costs. Understanding the functions and services of medical insurance carriers is essential for individuals seeking to navigate the complex world of healthcare and make informed decisions about their insurance coverage.

What You'll Learn

- Definition: Medical insurance carriers are companies that provide health coverage to individuals and groups

- Role: They administer policies, manage claims, and negotiate rates with healthcare providers

- Types: Carriers offer various plans, including HMO, PPO, and indemnity

- Network: Carriers have networks of healthcare providers they contract with

- Regulation: Insurance carriers are regulated by state and federal agencies to ensure compliance

Definition: Medical insurance carriers are companies that provide health coverage to individuals and groups

Medical insurance carriers, often referred to as health insurance companies, are essential entities in the healthcare industry. These companies play a pivotal role in facilitating access to medical care for individuals and groups by offering financial protection against the often high costs associated with medical treatment. The primary function of a medical insurance carrier is to provide health coverage, which acts as a safety net for policyholders, ensuring they can afford necessary medical services when needed.

These carriers operate by entering into agreements with policyholders, where they promise to cover a portion or all of the medical expenses incurred by the insured party. This coverage can include a wide range of healthcare services, such as doctor visits, hospital stays, emergency room visits, prescription drugs, and even preventive care. The terms and conditions of these agreements are outlined in insurance policies, which detail the extent of coverage, exclusions, and any limitations.

When an individual or group purchases a health insurance plan from a carrier, they essentially gain a financial safety net. This allows them to seek medical attention without the immediate financial burden of paying for services out-of-pocket. Medical insurance carriers manage the complex task of negotiating rates with healthcare providers, ensuring that policyholders can access a network of approved medical professionals and facilities.

The process typically involves the carrier setting agreed-upon rates with doctors, hospitals, and other healthcare providers, which are then used to calculate the premiums that policyholders pay. This structured system ensures that medical insurance carriers can provide consistent coverage while also managing their financial obligations. As a result, individuals and groups can have peace of mind, knowing that their health needs are protected, and they can focus on their well-being without the added stress of unexpected medical costs.

In summary, medical insurance carriers are the intermediaries that facilitate the relationship between individuals seeking health coverage and the healthcare system. Their role is critical in making healthcare more accessible and affordable, ultimately contributing to the overall health and well-being of the population they serve. Understanding the function and impact of these carriers is essential for anyone seeking to navigate the complex world of health insurance.

Allstate's Medical Insurance: A Comprehensive Guide

You may want to see also

Role: They administer policies, manage claims, and negotiate rates with healthcare providers

A medical insurance carrier, often referred to as an insurance company or insurer, plays a crucial role in the healthcare system by facilitating the management of health risks and providing financial protection to individuals and groups. One of their primary responsibilities is to administer insurance policies, which outline the terms and conditions of coverage, including the benefits, exclusions, and coverage limits. When an individual or group purchases a policy, the carrier becomes responsible for ensuring that the policyholders receive the agreed-upon medical coverage.

The role of a medical insurance carrier is multifaceted and involves several key functions. Firstly, they are tasked with managing claims, which is a complex process. When a policyholder incurs medical expenses, they must submit a claim to the insurance company, providing details of the treatment, costs, and relevant medical documentation. The carrier then reviews the claim to determine its validity, ensuring that the services provided are covered under the policy and that the charges are reasonable and in compliance with the terms of the agreement. This process involves verifying the accuracy of the information, checking the provider's credentials, and assessing the medical necessity of the services.

Another critical aspect of their role is negotiating rates with healthcare providers. Insurance carriers often have a network of preferred healthcare providers, including doctors, hospitals, and specialists. When a policyholder requires medical services, the carrier negotiates rates with these providers to ensure that the costs are reasonable and in line with the terms of the insurance policy. This negotiation process aims to strike a balance between providing affordable healthcare and ensuring that the policyholders receive quality care. By setting these rates, insurance carriers can manage the financial risks associated with medical services and maintain a sustainable healthcare system.

In addition to these core responsibilities, medical insurance carriers also handle customer service, policy administration, and risk management. They provide support to policyholders, answer queries, and assist with any policy-related issues. Policy administration involves maintaining accurate records, updating policies, and ensuring compliance with regulatory requirements. Risk management is a strategic process where carriers assess and mitigate potential risks associated with healthcare services, which helps in setting appropriate premiums and managing the overall financial exposure.

Overall, the role of a medical insurance carrier is vital in facilitating access to healthcare services while managing financial risks. They ensure that policyholders receive the necessary medical coverage, manage the complex process of claims, and negotiate rates to provide affordable healthcare options. By performing these functions, insurance carriers contribute to a well-functioning healthcare system, offering financial protection and peace of mind to individuals and groups who rely on their services.

Understanding Medical Bill Adjustments: A Guide to Insurance Reimbursement

You may want to see also

Types: Carriers offer various plans, including HMO, PPO, and indemnity

Medical insurance carriers, also known as health insurance companies, are entities that provide coverage for healthcare services to individuals and groups. These carriers play a crucial role in the healthcare system by managing the financial risks associated with medical care and facilitating access to medical services for their policyholders. When you purchase health insurance, you essentially enter into a contract with one of these carriers, which outlines the terms and conditions of your coverage.

One of the primary ways medical insurance carriers offer coverage is through different types of health insurance plans. These plans are designed to cater to various needs and preferences, ensuring that individuals can choose the option that best suits their healthcare requirements. Here are some of the common types of plans offered by carriers:

- Health Maintenance Organization (HMO) Plans: HMOs are a popular type of managed care plan. In an HMO, policyholders typically choose a primary care physician (PCP) who acts as the first point of contact for all medical needs. The PCP then coordinates and manages the care, referring patients to specialists within the HMO network. HMOs often have lower out-of-pocket costs but may require patients to stay within the network for comprehensive coverage. This plan encourages preventive care and early intervention, promoting a more cost-effective healthcare approach.

- Preferred Provider Organization (PPO) Plans: PPOs offer more flexibility compared to HMOs. With a PPO, you can choose to receive care from any healthcare provider, both in-network and out-of-network. In-network providers are typically preferred as they usually result in lower out-of-pocket costs. However, out-of-network care is still covered, but at a higher cost-sharing level. PPOs provide a balance between choice and cost control, allowing individuals to access a wide range of healthcare providers while managing expenses.

- Indemnity Plans: Indemnity insurance, also known as traditional health insurance, provides coverage for medical expenses without the need for referrals or a primary care physician. Policyholders can seek treatment from any licensed healthcare provider and file claims directly with the insurance carrier. Indemnity plans often have higher premiums but offer more flexibility in choosing healthcare providers. This type of plan is suitable for individuals who prefer a more straightforward and traditional approach to healthcare coverage.

These plans represent a spectrum of options, catering to different healthcare preferences and needs. Carriers often customize these plans to meet the diverse requirements of their policyholders, ensuring that individuals can access the necessary medical services while managing costs effectively. Understanding these plan types is essential for individuals to make informed decisions when selecting a medical insurance carrier and plan that aligns with their healthcare goals.

Unveiling Insurance Secrets: Why Medical Records Matter

You may want to see also

Network: Carriers have networks of healthcare providers they contract with

Medical insurance carriers, often referred to as health insurance companies or simply "carriers," play a crucial role in the healthcare system by providing financial protection and coverage to individuals and families. One of the key aspects of their operation is the network of healthcare providers they establish and maintain.

Carriers contract with various healthcare providers, including doctors, hospitals, clinics, and specialists, to create a network of approved medical services. This network is designed to ensure that policyholders have access to a wide range of quality healthcare options while also helping the carrier manage costs. When an individual purchases a health insurance plan, they are essentially agreeing to utilize the services within this network.

The network of healthcare providers is carefully curated and managed by the carrier. They negotiate rates and terms with each provider, ensuring that the costs are reasonable and aligned with the carrier's pricing strategy. By doing so, carriers can offer competitive premiums to their customers. This network approach also allows carriers to maintain control over the quality of care, as they can monitor and evaluate the performance of the healthcare providers within their network.

When a policyholder needs medical attention, they typically choose a provider from the carrier's network. This could be a primary care physician, a specialist, or a hospital. The carrier then arranges for the necessary coverage and reimbursement for the services provided. This streamlined process ensures that policyholders can access healthcare services efficiently without incurring excessive out-of-pocket expenses.

In summary, the network of healthcare providers is a fundamental aspect of medical insurance carriers' operations. It enables carriers to offer comprehensive coverage, manage costs, and provide policyholders with a wide range of healthcare options. By contracting with various providers, carriers can ensure that their customers receive the necessary medical care while maintaining financial stability.

Navigating Florida's Medicaid: Unlocking the Best Coverage Options

You may want to see also

Regulation: Insurance carriers are regulated by state and federal agencies to ensure compliance

Insurance carriers, also known as insurance companies, play a crucial role in the healthcare industry by providing financial protection against medical expenses. These carriers are regulated by both state and federal authorities to maintain standards, protect consumers, and ensure fair practices. The regulatory framework is designed to safeguard the interests of policyholders and maintain the integrity of the insurance market.

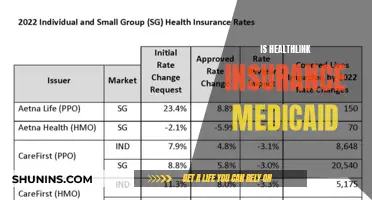

State insurance departments are primarily responsible for overseeing insurance carriers within their jurisdiction. They establish and enforce rules and regulations to govern the business operations of these companies. These regulations cover various aspects, including licensing, financial stability, rate-setting, and consumer protection. For instance, states may require insurance carriers to maintain a certain level of capital or surplus to ensure they can fulfill their financial obligations to policyholders. They also set guidelines for premium rates, ensuring that carriers do not charge excessive or unfair prices.

Federal regulations, on the other hand, provide a nationwide framework for insurance carrier operations. The primary federal agency involved is the Centers for Medicare & Medicaid Services (CMS). CMS sets standards and guidelines for health insurance carriers, particularly those offering Medicare and Medicaid programs. These regulations ensure that carriers provide adequate coverage, adhere to specific guidelines for claims processing, and maintain transparency in their operations. Federal laws also mandate that insurance carriers disclose relevant information to policyholders, such as coverage details, claim procedures, and policy changes.

The regulatory process involves regular examinations and audits of insurance carriers' operations. State insurance departments conduct on-site inspections and reviews to verify compliance with the established regulations. This includes assessing the carrier's financial stability, marketing practices, and customer service standards. Federal agencies also perform oversight, especially for carriers involved in federal healthcare programs, to ensure they meet the required standards and protect the interests of enrollees.

In summary, regulation of insurance carriers is essential to maintain a stable and trustworthy healthcare system. It ensures that carriers operate within legal boundaries, provide fair and transparent services, and offer adequate financial protection to policyholders. By enforcing these regulations, state and federal agencies contribute to a well-functioning insurance market, ultimately benefiting individuals and families seeking medical coverage.

Chen Medical's Insurance Coverage: A Comprehensive Guide

You may want to see also