A medical insurance policy number is a unique identifier assigned to an individual's health insurance coverage. It serves as a distinct reference point for the insurance company, allowing them to track and manage the specific health plan associated with a particular policyholder. This number is crucial for various administrative tasks, such as processing claims, managing billing, and ensuring accurate record-keeping. Understanding the significance of this identifier is essential for individuals to navigate their healthcare coverage effectively and for insurance providers to deliver efficient services.

| Characteristics | Values |

|---|---|

| Definition | A unique identifier assigned to a specific health insurance policy. |

| Purpose | To uniquely identify the policy and its associated coverage details. |

| Format | Typically a combination of letters, numbers, and sometimes symbols. |

| Length | Varies, but commonly ranges from 8 to 15 characters. |

| Issuer | Provided by the insurance company or health plan. |

| Importance | Essential for billing, claims processing, and policy management. |

| Privacy | Sensitive information, often required for security and verification purposes. |

| Usage | Used by healthcare providers, insurance companies, and administrative staff. |

| Renewal | May change if the policy is renewed or updated. |

| Portability | Can be transferred between insurance providers if the policy is switched. |

| Online Access | Often accessible through the insurance company's website or portal. |

| Customer Service | Contact the insurance provider for assistance with policy numbers. |

What You'll Learn

- Unique Identifier: A medical insurance policy number is a unique identifier for your insurance plan

- Claim Processing: It's essential for processing medical claims and billing

- Coverage Details: The number links to your specific coverage and benefits

- Policy Administration: It helps administrators manage and track your policy

- Customer Service: Policyholders use it to contact customer service for assistance

Unique Identifier: A medical insurance policy number is a unique identifier for your insurance plan

A medical insurance policy number is a unique identifier assigned to each individual insurance plan. It serves as a distinct code that helps insurance providers, healthcare facilities, and other relevant parties identify and track specific insurance policies. This number is crucial for efficient management of insurance claims, billing processes, and overall administration. When you purchase a medical insurance plan, this unique identifier is typically assigned to your policy, ensuring that all associated information, such as coverage details, premiums, and claims, can be accurately linked to your specific plan.

The primary purpose of this identifier is to streamline the complex world of healthcare and insurance. It enables insurance companies to manage their vast databases effectively, ensuring that each policyholder's information is correctly associated with their plan. For instance, when you visit a healthcare provider, they can quickly access your insurance details by using your policy number, making the billing process smoother and more accurate. This system also facilitates the processing of insurance claims, allowing healthcare providers and insurance companies to verify coverage and expedite the reimbursement process.

In the context of healthcare, this unique number plays a vital role in maintaining privacy and security. It ensures that sensitive medical information is linked to the correct policyholder, protecting patient confidentiality. When you interact with healthcare providers or insurance companies, your policy number acts as a secure key, granting access to your personalized medical records and coverage details while safeguarding your privacy.

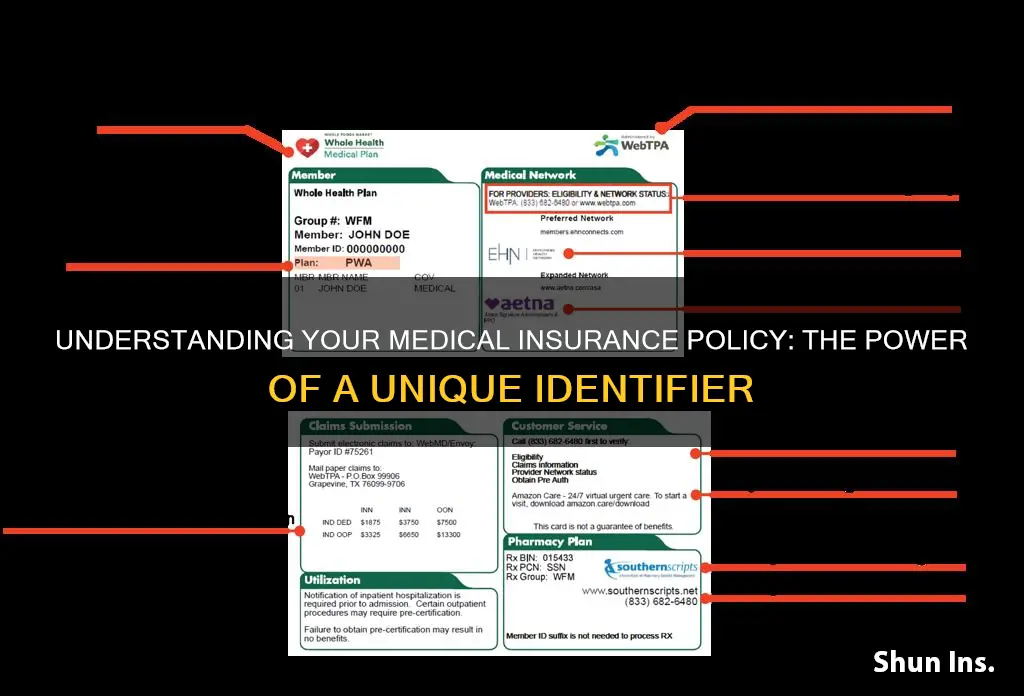

Obtaining your medical insurance policy number is relatively straightforward. It is typically provided to you when you enroll in a new insurance plan or when your existing policy is renewed. The number can usually be found on your insurance card, which is a physical or digital card that serves as a summary of your insurance coverage. Additionally, your insurance provider may also share this information through other documents, such as welcome packets or annual summaries.

Understanding and utilizing your medical insurance policy number can greatly enhance your healthcare experience. It empowers you to take control of your insurance journey, allowing you to quickly access your coverage details, track your insurance information, and efficiently manage any medical expenses. By knowing your unique identifier, you can ensure a seamless and secure healthcare experience, making the most of your insurance benefits.

Chlamydia Treatment: Affordable Options Without Insurance

You may want to see also

Claim Processing: It's essential for processing medical claims and billing

The process of claim processing is a critical component of the healthcare system, ensuring that medical services are reimbursed accurately and efficiently. When a patient receives medical treatment, the healthcare provider must submit a claim to the insurance company to request payment for the services rendered. This is where the medical insurance policy number plays a vital role.

A medical insurance policy number is a unique identifier assigned to each insurance policyholder. It is a crucial piece of information that links the patient's medical services to their insurance coverage. When a claim is submitted, the policy number is essential for several reasons. Firstly, it helps the insurance company quickly identify the specific policy and its associated coverage details. This ensures that the claim is processed accurately, as the insurance provider can access the policy's terms, benefits, and coverage limits. By having this information readily available, the processing time can be significantly reduced, allowing for faster reimbursement to the healthcare provider.

During claim processing, the insurance company verifies the policy number to ensure the claim is legitimate and falls within the policy's coverage. This verification step is crucial to prevent fraud and ensure that only eligible medical expenses are reimbursed. The policy number also enables the insurance company to track the claim's progress, providing transparency and accountability throughout the process.

Moreover, the policy number facilitates the accurate allocation of payments. When a claim is approved, the insurance company uses the policy number to determine the amount to be paid based on the policy's terms. This ensures that the healthcare provider receives the correct reimbursement, covering the actual costs incurred. Efficient claim processing, therefore, relies on the accurate and timely submission of the policy number, which streamlines the entire billing and payment process.

In summary, claim processing is an essential aspect of medical billing, and the medical insurance policy number is a key element in this process. It enables efficient identification of policies, verification of coverage, and accurate payment allocation. Healthcare providers and insurance companies must work together to ensure that policy numbers are accurately recorded and utilized, ultimately leading to smoother claim processing and faster reimbursement for medical services.

Affordable Gonorrhea Treatment: Options for Uninsured Individuals

You may want to see also

Coverage Details: The number links to your specific coverage and benefits

A medical insurance policy number is a unique identifier assigned to your health insurance plan. It serves as a direct link to your specific coverage details and benefits. When you have a claim or need to access your policy information, this number is crucial. It ensures that your insurance provider can quickly locate and retrieve your personal and coverage-related data.

This number is typically found on various documents related to your insurance policy. It might be printed on your insurance card, which you should always carry with you, or it could be included in your policy documents, such as the membership card or welcome kit you receive when enrolling in a plan. Knowing this number is essential for several reasons. Firstly, it allows you to access your policy details, including coverage limits, exclusions, and any specific conditions or restrictions. This information is vital for understanding what your insurance plan covers and what you might need to pay for out-of-pocket.

Moreover, the policy number is used to process claims and ensure that your insurance provider can accurately match your coverage to the services or treatments you receive. When you visit a healthcare provider or hospital, they will use this number to verify your insurance and process the necessary claims. This process ensures that you receive the benefits you're entitled to and that your insurance company can manage the billing efficiently.

In summary, a medical insurance policy number is a critical piece of information that provides access to your specific coverage details. It enables you to understand your benefits, helps healthcare providers verify your insurance, and ensures that your insurance company can efficiently manage your claims. Keeping this number secure and easily accessible is essential for a smooth and hassle-free experience with your health insurance.

Unraveling the Mystery: Medical Insurance and Service Dogs

You may want to see also

Policy Administration: It helps administrators manage and track your policy

A medical insurance policy number is a unique identifier assigned to each individual health insurance policy. It serves as a crucial reference point for both the insurance provider and the policyholder, enabling efficient management and tracking of the policy throughout its lifecycle. This number is typically a combination of letters and numbers, ensuring it is distinct and easily recognizable.

In the context of policy administration, this number plays a pivotal role in various administrative tasks. When an administrator receives a new policy application, they can quickly identify the specific policy by matching the application details with the policy number. This streamlined process ensures that administrators can efficiently manage and track policies, especially in large organizations or insurance companies with numerous clients.

The policy administration system, often a specialized software or platform, utilizes this number to organize and categorize policies. Administrators can input the policy number into the system, allowing them to access and modify policy details, such as coverage information, premium payments, and beneficiary data. This centralized approach simplifies the management of policies, making it easier to identify and update specific policies when necessary.

Moreover, the policy number facilitates communication between the insurance provider and the policyholder. When a policyholder needs to make changes, file a claim, or inquire about their coverage, providing the policy number ensures that the administrator can promptly locate the relevant policy. This efficient tracking system enhances customer service and reduces the time required to resolve inquiries.

In summary, a medical insurance policy number is an essential component of policy administration, enabling administrators to effectively manage and track policies. It streamlines the process of policy management, improves customer service, and ensures that each policy is accurately identified and accessible. Understanding the role of this number is crucial for both insurance providers and policyholders to navigate the complexities of healthcare coverage efficiently.

Understanding Medically Needy and Health Insurance: A Comprehensive Guide

You may want to see also

Customer Service: Policyholders use it to contact customer service for assistance

A medical insurance policy number is a unique identifier assigned to each insurance policyholder. It serves as a crucial reference point for both the insurance company and the policyholder, enabling efficient management and administration of the insurance policy. When you purchase health insurance, the insurance provider generates this number, which is typically a combination of letters and numbers. This identifier is essential for various reasons, ensuring smooth operations and providing a personalized experience for policyholders.

For customer service interactions, the policy number is a vital tool. When a policyholder needs to reach out to the insurance company for any reason, they can provide this number to the customer service representative. It acts as a direct link to their specific policy, allowing the representative to quickly access the policy details, including coverage information, claim history, and personal contact details. This streamlined approach ensures that customer service agents can efficiently address the policyholder's inquiries or concerns.

In the event of a claim, the policy number becomes even more critical. Policyholders can use it to initiate the claims process, providing the necessary documentation and information to the insurance company. By having the policy number readily available, the claims process can be expedited, ensuring that the policyholder receives the benefits they are entitled to in a timely manner. This is particularly important during emergencies or when immediate assistance is required.

Customer service representatives are trained to request the policy number at the beginning of any interaction to ensure a seamless experience. This practice helps in quickly identifying the policyholder and their specific coverage, allowing for a more personalized and efficient service. It also enables the representative to provide accurate and relevant information, ensuring that the policyholder's needs are met effectively.

In summary, a medical insurance policy number is a critical component of the insurance process, facilitating efficient customer service and claims management. It empowers policyholders to easily access their insurance information and ensures that the insurance company can provide prompt and accurate assistance when needed. By utilizing this unique identifier, both parties can maintain a smooth and productive relationship, ultimately leading to a more satisfying insurance experience.

Unraveling Insurance Coverage for Erectile Dysfunction Medication: What You Need to Know

You may want to see also

Frequently asked questions

A medical insurance policy number is a unique identifier assigned to your health insurance policy. It is a series of letters and/or numbers that helps insurance companies and healthcare providers quickly identify and access your specific policy. This number is essential for processing claims, billing, and ensuring that your insurance coverage is applied accurately.

Your policy number can typically be found on various documents related to your insurance coverage. Common places to look include: your insurance card, welcome or enrollment packet, billing statements, or any correspondence from your insurance provider. If you are unable to locate it, contact your insurance company's customer service department, and they should be able to provide or assist in locating your policy number.

The policy number is crucial for several reasons. It ensures that your insurance benefits are applied correctly when you seek medical treatment. Healthcare providers and billing offices use this number to verify your coverage and process claims efficiently. Additionally, it helps in maintaining the confidentiality of your personal and medical information, as it is a unique identifier specific to your policy.

No, using someone else's medical insurance policy number for claims is fraudulent and illegal. Each policyholder is assigned a unique policy number to ensure accurate billing and coverage. Sharing or using another person's policy number can lead to serious consequences, including legal penalties and damage to your credit history. It is essential to use your own policy number for all insurance-related transactions.