A deductible is the amount of money you pay out of pocket for certain covered health care services before your health plan starts to pay. It is a predetermined amount that you must pay each year before your insurance coverage starts sharing the costs. Insurance companies charge deductibles in part as a cost-saving measure.

| Characteristics | Values |

|---|---|

| What is it? | A health insurance deductible is a set amount you pay for your healthcare before your insurance starts to pay. |

| How does it work? | You can think of your deductible as adding up throughout the year. As you start the plan year, you pay the full amount for your covered health care costs — until you meet you annual deductible. |

| Why is it used? | Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium. |

| Average yearly deductible | The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families had an average deductible of $10,310. |

| Average deductible for marketplace plans | In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans. |

What You'll Learn

Deductible amount varies by insurance plan

A deductible is the amount of money you pay out of pocket for certain covered health care services before your health plan starts to pay. The deductible amount varies by insurance plan. Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium.

The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Americans buying health insurance plans in the ACA marketplace typically pay between 10% and 40% of their total annual healthcare costs, depending on the plan's coverage and premiums. Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

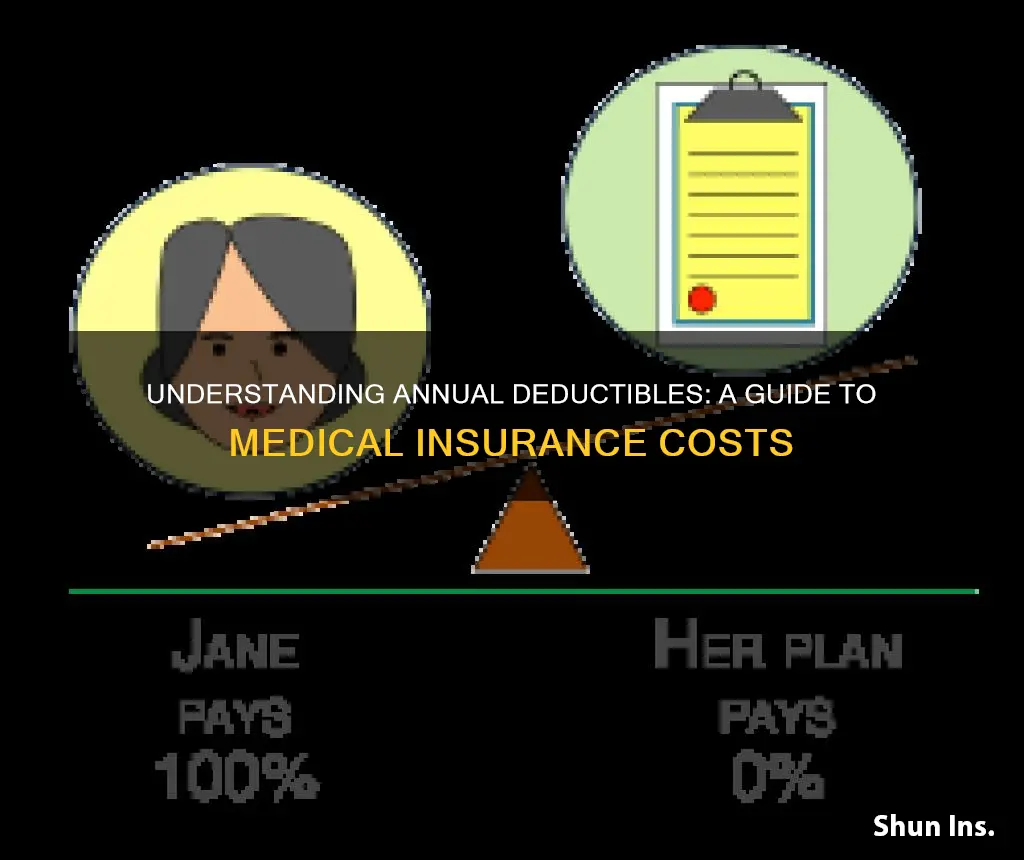

You can think of your deductible as adding up throughout the year. As you start the plan year, you pay the full amount for your covered health care costs — until you meet your annual deductible. Each time you pay costs that count toward your deductible, it adds to the total amount you have to pay that year.

The higher the deductible, the lower your premium, and vice-versa. Some companies offer first dollar coverage, which carries no deductible. These policies often have high premiums and limits to payout amounts.

Navigating Your Deductible: Strategies to Meet Your Medical Insurance Goal

You may want to see also

Deductibles encourage cost-saving and prevent unnecessary visits

A health insurance deductible is a set amount you pay for your healthcare before your insurance starts to pay. Once you max out your deductible, you pay a copayment or coinsurance for services covered by your healthcare policy, and the insurance company pays for the rest. As a general rule, the higher the deductible, the lower your premium, and vice-versa. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310.

Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium. Some companies offer first dollar coverage, which carries no deductible. These policies often have high premiums and limits to payout amounts.

Americans buying health insurance plans in the ACA marketplace typically pay between 10% and 40% of their total annual healthcare costs, depending on the plan's coverage and premiums. Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

Deductibles also promote cost-saving by encouraging insured individuals to shop around for the best healthcare options at the best prices. This can lead to savings on both the deductible amount and the overall cost of healthcare. Deductibles also encourage insured individuals to take a more proactive approach to their healthcare by seeking preventive care and managing chronic conditions more effectively.

Unraveling the Mystery: Medical Conditions and Life Insurance Disqualifications

You may want to see also

Deductibles add up throughout the year

A deductible is a predetermined amount that you must pay out-of-pocket before your insurance coverage starts sharing the costs.

Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium.

Americans buying health insurance plans in the ACA marketplace typically pay between 10% and 40% of their total annual healthcare costs, depending on the plan's coverage and premiums.

As you start the plan year, you pay the full amount for your covered health care costs — until you meet your annual deductible. Each time you pay costs that count toward your deductible, it adds to the total amount you have to pay that year.

Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

Unraveling Medical Insurance Coverage for Speech Therapy: A Comprehensive Guide

You may want to see also

Once deductible is met, insurance pays

A deductible is a predetermined amount that you must pay out-of-pocket before your insurance coverage starts sharing the costs. Once you meet your annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium.

Each time you pay costs that count toward your deductible, it adds to the total amount you have to pay that year. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310.

Americans buying health insurance plans in the ACA marketplace typically pay between 10% and 40% of their total annual healthcare costs, depending on the plan's coverage and premiums. Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

The higher the deductible, the lower your premium, and vice-versa. The average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Navigating Florida's Medical Insurance Landscape: A Comprehensive Guide for Residents

You may want to see also

High deductibles = lower premiums

A deductible is a predetermined amount that you must pay out-of-pocket before your insurance coverage starts sharing the costs. The higher the deductible, the lower your premium, and vice-versa. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. Americans buying health insurance plans in the ACA marketplace typically pay between 10% and 40% of their total annual healthcare costs, depending on the plan's coverage and premiums.

Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium.

Each time you pay costs that count toward your deductible, it adds to the total amount you have to pay that year. Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.

Some companies offer first dollar coverage, which carries no deductible. These policies often have high premiums and limits to payout amounts.

Medicaid and Insurance: Navigating Dual Coverage

You may want to see also

Frequently asked questions

An annual deductible is a predetermined amount that you must pay out-of-pocket before your insurance coverage starts sharing the costs.

An annual deductible is a set amount you pay for your healthcare before your insurance starts to pay. Once you max out your deductible, you pay a copayment or coinsurance for services covered by your healthcare policy, and the insurance company pays for the rest.

The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310.

Insurance companies charge deductibles in part as a cost-saving measure. The up-front cost of care before the deductible is met encourages the insured to avoid unnecessary provider visits and medical procedures and allows those who expect to remain healthy to choose a high-deductible plan with a lower monthly premium.

Once you pay the annual deductible, your health insurance plan will start picking up your covered medical costs, with a couple of exceptions.