Navigating the complexities of healthcare coverage can be challenging, and one of the most pressing questions for many individuals is understanding the financial implications of not having medical insurance. The cost of not having insurance can vary significantly depending on several factors, including your location, age, and overall health status. In this article, we will explore the different factors that influence the fine for not having medical insurance and provide insights into how you can manage these costs effectively. Whether you're considering enrolling in a health plan or simply want to understand your options, this guide will help you make informed decisions about your healthcare coverage.

What You'll Learn

- Cost Variations: Penalties vary based on income and state

- Penalty Structure: Fines are typically a percentage of income or a fixed amount

- Exemptions and Exceptions: Certain groups may be exempt from penalties

- Payment Options: Penalties can be paid in installments or online

- State-Specific Rules: Penalties differ by state, impacting coverage requirements

Cost Variations: Penalties vary based on income and state

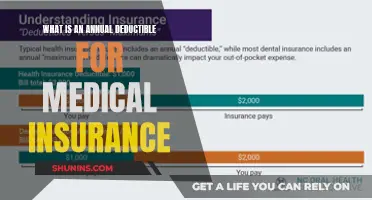

The penalties for not having health insurance can vary significantly depending on several factors, primarily your income and the state you reside in. This variation is a crucial aspect of understanding the financial implications of being uninsured. In the United States, the Affordable Care Act (ACA) introduced a mandate requiring individuals to have health insurance or pay a penalty. However, the amount of this penalty is not a flat fee but rather a percentage of your income or a fixed amount, whichever is greater.

For individuals with lower incomes, the penalty is typically calculated as a percentage of their income. This percentage can range from 2.5% to 4.5% of the federal poverty level (FPL) for the year. For instance, in 2023, the FPL for a single person is approximately $13,590, and the penalty would be 2.5% of this amount, which is $339.75. As income increases, the penalty as a percentage of income decreases, but the absolute amount increases. This means that higher-income earners may face a higher penalty in dollar terms.

The state in which you live also plays a significant role in determining the penalty. Some states have chosen to implement their own health insurance marketplaces and may have different rules and penalties. For example, California's Health Insurance Marketplace has a penalty that is a fixed amount per month, with a maximum annual penalty. In contrast, other states may have no penalty at all, leaving the decision to purchase insurance entirely to the individual.

The complexity of these variations can be overwhelming, and it's essential to understand your specific situation. If you have a low income, the penalty might be a small percentage of your income, but it could still accumulate over time. On the other hand, higher-income individuals may face a higher absolute penalty, which could be a significant financial burden. Additionally, states with no penalty or lower penalties might encourage more people to go without insurance, potentially impacting public health and the overall cost of healthcare.

Understanding these cost variations is crucial for making informed decisions about health insurance. It highlights the importance of considering both your income and the specific regulations in your state when evaluating the financial implications of not having health coverage. Being aware of these factors can help individuals plan and budget accordingly, ensuring they are prepared for any potential penalties.

Understanding Medical Bill Adjustments: A Guide to Insurance Reimbursement

You may want to see also

Penalty Structure: Fines are typically a percentage of income or a fixed amount

The penalty structure for not having medical insurance can vary significantly depending on the country and region. In the United States, for instance, the penalty is structured as a percentage of one's income or a fixed amount, whichever is greater. This means that the fine is calculated based on a percentage of your annual income or a set fee. For the tax year 2022, the penalty for individuals who can afford health insurance but choose not to purchase it is 0.5% of their household income above the tax-filing threshold, up to a maximum of 8.5% of the national average wage index. This penalty is applied to the income of the household, not just the individual.

In some cases, the fine can be a fixed amount, which is a set fee that everyone must pay. For example, in certain European countries, the penalty for not having health insurance is a flat rate, often ranging from €100 to €500, depending on the country and local regulations. These fixed amounts are usually lower than the income-based penalties and are designed to ensure that everyone has access to essential healthcare services.

The percentage-based structure is more common in countries with a progressive tax system, where the tax rate increases as income rises. This approach ensures that those with higher incomes contribute a larger share of the penalty. For instance, in the US, the penalty for individuals is 2.5% of their income above the tax-filing threshold, up to a maximum of 2.7% for the year 2023. This structure encourages compliance by making the penalty more significant for those who can afford to pay for insurance.

It's important to note that these penalties are designed to encourage individuals to obtain health insurance and ensure they have access to necessary medical care. The specific details of the penalty structure, such as the percentage or fixed amount, can vary based on the year and the region's healthcare policies. Therefore, it is essential to stay informed about the latest regulations to avoid any unexpected financial burdens.

Understanding the penalty structure is crucial for individuals to make informed decisions about their healthcare coverage. By knowing the potential financial impact, people can better assess the benefits of having medical insurance and take the necessary steps to protect their health and financial well-being.

Understanding PCP: Your Medical Insurance's Key Player

You may want to see also

Exemptions and Exceptions: Certain groups may be exempt from penalties

The Affordable Care Act (ACA) in the United States introduced a penalty for individuals who do not have health insurance, known as the individual shared responsibility payment or the "individual mandate." However, there are several exemptions and exceptions to this penalty, ensuring that certain groups are not subject to the fine. Understanding these exemptions is crucial for individuals who may fall into these categories.

One of the primary exemptions is for individuals who cannot afford health insurance. The ACA defines "affordability" based on the federal poverty level (FPL). If a person's income is below a certain threshold, they may qualify for an exemption. For instance, in 2023, the FPL for a single individual is $13,590, and for a family of four, it is $27,700. Individuals with income below these levels may be exempt from the penalty, provided they have a hardship exemption or are enrolled in a state-based health insurance marketplace.

Another group exempt from the penalty is those who are members of a health coverage "mini-med" plan. These are limited benefit plans that provide basic coverage but do not meet the requirements of the ACA. Individuals enrolled in such plans are not subject to the individual mandate penalty. However, it's important to note that these plans often have lower coverage limits and may not provide comprehensive benefits.

Individuals who are members of a recognized religious group that objects to health insurance on moral or religious grounds may also be exempt. This exemption is granted under the Religious Freedom Restoration Act and requires a formal application process. The applicant must demonstrate that the health insurance requirement would impose a substantial burden on their religious beliefs.

Additionally, individuals who are members of a health coverage "grandfathered" plan are exempt. Grandfathered plans are those that were in existence before the ACA's implementation and have been maintained with certain modifications. These plans are not subject to the ACA's requirements, including the individual mandate penalty. However, it's important to check the specific rules and regulations regarding grandfathered plans, as they may have different coverage and eligibility criteria.

Furthermore, individuals who are members of a health coverage "catastrophic" plan are also exempt. Catastrophic plans are designed for young adults and provide limited coverage, typically until age 26. These plans are intended for those who cannot afford comprehensive coverage and are not subject to the penalty.

It is essential to understand that exemptions and exceptions to the individual mandate penalty are not automatic and often require specific documentation and applications. Individuals should review their eligibility and provide the necessary information to the relevant authorities to ensure they are not penalized for not having health insurance.

Dental Implants: Unlocking Coverage Secrets with Medical Insurance

You may want to see also

Payment Options: Penalties can be paid in installments or online

When it comes to the penalties for not having medical insurance, it's important to understand the payment options available to those who may be facing these fines. The process can be daunting, but knowing how to pay and when can help alleviate some of the stress. Here's a breakdown of the payment options for penalties related to the lack of health insurance.

One of the most flexible payment methods is the installment plan. This option allows individuals to spread out the cost of the fine over several months, making it more manageable for those who may be facing financial constraints. To take advantage of this, you'll typically need to contact the relevant authorities and request an installment agreement. They will guide you through the process and provide the necessary forms. It's crucial to adhere to the agreed-upon payment schedule to avoid additional fees or legal consequences.

For those who prefer a more immediate and convenient approach, online payment is an option. Many government agencies now offer the ability to pay penalties and fees through their websites. This method often involves a secure online portal where you can input your payment details and complete the transaction. Online payments usually require a valid credit or debit card, and some agencies may also accept electronic bank transfers. It's essential to ensure that the website is secure and legitimate to protect your personal and financial information.

In addition to these structured payment methods, it's worth noting that some regions or countries may offer alternative payment options. These could include payment plans through financial institutions or even payment assistance programs specifically designed to help individuals afford their insurance fines. Exploring these options can provide further relief and ensure that you can meet your financial obligations without incurring additional penalties.

Remember, the key to managing these penalties is to be proactive and informed. Understanding the payment options available and choosing the one that best suits your financial situation can make the process less overwhelming. Always ensure you follow the instructions provided by the relevant authorities to avoid any unnecessary complications.

Understanding the Duration of Individual Medical Expense Insurance

You may want to see also

State-Specific Rules: Penalties differ by state, impacting coverage requirements

The penalties for not having medical insurance vary significantly across different states in the United States, and these variations can greatly impact individuals' coverage requirements and financial obligations. Understanding these state-specific rules is crucial for anyone navigating the complex landscape of healthcare coverage. Each state has its own set of regulations regarding insurance mandates, and these rules can influence the cost of not having insurance.

In some states, the penalty for not having health insurance is a fixed amount, while in others, it is calculated as a percentage of the individual's income. For instance, Massachusetts was one of the first states to implement a penalty-based system, requiring residents to have health insurance or pay a fee. This state's approach set a precedent for others, and many states have since adopted similar models. The Massachusetts Health Connector, the state's health insurance marketplace, enforces this mandate, and the penalty is typically a percentage of the state's average wage, ensuring that the fee is proportional to the individual's ability to pay.

On the other hand, states like New York and California have chosen to impose a fixed penalty amount. In New York, the Health Insurance Marketplace enforces the requirement, and the penalty is a fixed dollar amount, which can vary from year to year. Similarly, California's Health Insurance Exchange has its own penalty structure, and the fee is determined by the state's health insurance regulators. These fixed penalties can be more straightforward for individuals to understand and plan for, but they may also be less flexible in accommodating varying income levels.

The impact of these state-specific rules is significant. For individuals living in states with higher penalties, the financial burden of not having insurance can be substantial. For example, in states with income-based penalties, a person with a moderate income might face a penalty that is a significant portion of their annual earnings, making it challenging to afford insurance. Conversely, states with fixed penalties may provide more predictable costs, but the absolute amount can still be a burden for those with limited financial resources.

Navigating these state-specific rules requires careful consideration of one's circumstances and the specific regulations in their state. Some states offer exemptions or reduced penalties for certain groups, such as low-income individuals or those with specific health conditions. Understanding these nuances is essential to making informed decisions about healthcare coverage and avoiding potential financial penalties. It is always advisable to consult official state resources or seek professional advice to ensure compliance with local laws and to make the most cost-effective choices regarding medical insurance.

Motorcycle Insurance: Medical Bill Coverage Explained

You may want to see also

Frequently asked questions

The penalty for not having health insurance, also known as the individual shared responsibility provision, was eliminated as of January 1, 2019, under the Affordable Care Act (ACA). However, this doesn't mean that not having insurance is without consequences. You may still face financial and health-related impacts.

Yes, there are several ways to avoid the penalty:

- Enroll in a qualified health plan through the Marketplace and qualify for a special enrollment period.

- Have a member of your household enroll in a qualified health plan.

- Be covered under a spouse's or parent's plan.

- Be eligible for a health coverage exemption due to financial hardship, religious beliefs, or membership in a recognized health care sharing ministry.

- Be a full-time student or a member of a recognized health care sharing ministry.

Before the penalty was eliminated, individuals who didn't have health insurance for all of the year and didn't qualify for an exemption were subject to a penalty. The penalty was calculated as a percentage of your income above the federal poverty level, up to a maximum amount. In 2021, the penalty was $695 per adult and $347.50 per child, or 2.5% of your income, whichever is greater.

Not having health insurance can lead to several issues:

- Financial burden: Medical bills and treatments can be costly, and without insurance, you may face significant out-of-pocket expenses.

- Delayed or forgone treatment: Without insurance, you might delay or avoid seeking medical care due to cost, which can lead to more serious health issues.

- Loss of access to preventive care: Regular check-ups and preventive services are essential for maintaining good health, but without insurance, you may skip these.

- Impact on employment: Some employers offer health insurance as a benefit, and not having coverage could affect your job prospects or benefits.