PL Promise Term is a life insurance product offered by the Pacific Life Insurance Company. It is designed to provide financial protection through a death benefit. PL Promise Term offers flexible term durations of up to 30 years, with competitive pricing and aggressive underwriting guidelines. The product is available to individuals aged 18-80, depending on the chosen term duration. PL Promise Term allows policyholders to convert all or part of their death benefit to a new permanent life insurance policy at any time during their level premium period, without additional underwriting approval. Pacific Life Insurance Company is a reputable insurer with a strong financial standing, known for its commitment to providing affordable coverage options for individuals from diverse backgrounds.

| Characteristics | Values |

|---|---|

| Company | Pacific Life Insurance Company |

| Product | PL Promise Term Life Insurance |

| Target Market | Broad market consumer (household incomes of $50K to $200K) |

| Age Limit | 18-80 years (varies by term duration) |

| Term Durations | 10, 15, 20, 25, or 30 years |

| Premium Periods | 10, 15, 20, 25, or 30 years |

| Premium Payments | Annual, semi-annual, quarterly, or monthly |

| Face Amounts | $50,000 and above |

| Conversion Privileges | Partial or complete conversion allowed until age 70 |

| Underwriting | Aggressive underwriting guidelines |

| Customer Service | Award-winning |

What You'll Learn

PL Promise Term offers a range of term options from 10 to 30 years

PL Promise Term is a life insurance product offered by the Pacific Life Insurance Company. Life insurance is a promise to provide financial protection through a death benefit. PL Promise Term offers competitively priced death benefit protection with level premium periods of 10, 15, 20, or 30 years.

The product is designed to serve the death benefit protection needs of the broad market consumer, specifically those with household incomes of $50K to $200K. PL Promise Term offers some of the industry's cheapest term insurance, with face amounts starting at $50,000, which is lower than many competitors. The premiums stay at the same rate for the selected term, with longer-duration plans costing more than shorter-term lengths.

PL Promise Term provides flexibility in premium payments, allowing customers to choose from annual, semi-annual, quarterly, or monthly payments to fit their budgets. The product also offers partial or complete conversion privileges during the level term or until the age of 70. This means that customers can convert their term policy into a permanent or cash value life insurance policy without additional underwriting approval.

The availability of PL Promise Term varies by state, and there is an age cut-off for each term length representing the maximum age to purchase each policy. For example, the age limit for the 10-year term is 80 years old, while the 30-year term has an age limit of 55 years old.

Understanding the Fine Print: Navigating Insurance Policies and Their Terms and Conditions

You may want to see also

PL Promise Term has an age cutoff for each term length

PL Promise Term life insurance is offered by the Pacific Life Insurance Company, which provides a range of life insurance policies, including term and universal life insurance. PL Promise Term offers affordable coverage with flexible payment options, no medical exam, and access to various policy riders.

- PL Promise Term 10-year: Age limit is 80 years old

- PL Promise Term 15-year: Age limit is 75 years old

- PL Promise Term 20-year: Age limit is 65 years old

- PL Promise Term 25-year: Age limit is 60 years old

- PL Promise Term 30-year: Age limit is 55 years old

These age restrictions represent the maximum age an individual can be to purchase each policy. For instance, to buy the PL Promise Term 10-year policy, one must not be older than 80 years old.

In addition to the age cutoff, PL Promise Term life insurance also has issue ages ranging from 18 to 80 years, depending on the chosen term duration. This specifies the age range within which an individual is eligible to apply for the policy.

The Pacific Life Insurance Company, with its PL Promise Term product, offers competitive rates and flexible options to meet the specific needs of its customers. The age cutoff for each term length ensures that individuals can find suitable coverage based on their current age and desired policy duration.

The Risky Business of Lying on Short-Term Insurance Policies

You may want to see also

Premiums can be tailored to your budget

PL Promise Term is a life insurance product from Pacific Life Insurance Company. It is designed to provide financial protection through a death benefit. PL Promise Term offers flexible payment options, allowing you to tailor your premiums to your budget. You can choose from annual, semi-annual, quarterly, or monthly payments to ensure that your insurance payments fit comfortably within your financial means. This flexibility ensures that you can obtain the necessary coverage without straining your finances.

The PL Promise Term product provides a range of term durations, from 10 to 30 years, allowing you to select the period that best suits your needs and budget. The premiums remain fixed for the chosen term, providing predictability and stability in your financial planning. Additionally, the longer-duration plans, while more expensive than shorter-term lengths, offer extended coverage for a reasonable increase in cost.

One of the standout features of PL Promise Term is its competitive pricing. With face amounts starting at $50,000, it is one of the industry's most affordable options, often lower than many competitors. This accessibility makes life insurance more attainable for individuals from a wide range of financial backgrounds. The company's commitment to providing affordable coverage is evident through its rate reductions, ensuring that individuals can find a plan that aligns with their budget without compromising on the essential protection that life insurance offers.

In addition to its affordability, PL Promise Term offers a seamless conversion option. You can convert all or part of the death benefit to a new permanent life insurance policy (also known as cash value) at any time during your level premium period, up to the age of 70. This flexibility allows you to adjust your coverage as your needs and circumstances change without undergoing additional underwriting approval. The automatic approval process simplifies the transition and ensures that you can adapt your insurance plan as your budget and requirements evolve over time.

PL Promise Term also stands out for its fast, convenient process and award-winning customer service. The application and approval process is streamlined, making it easier for individuals to obtain the coverage they need without unnecessary delays. The company's commitment to providing excellent customer service further enhances the overall experience, ensuring that clients feel supported and valued throughout their journey with PL Promise Term.

The Transferability Myth: Understanding the Non-Negotiable Nature of Term Insurance Policies

You may want to see also

PL Promise Term allows partial or complete conversion privileges

PL Promise Term life insurance is offered by the Pacific Life Insurance Company. It is a form of term life insurance, which means it offers life insurance coverage for a specific period, after which the policy expires or can be renewed for another term.

PL Promise Term offers partial or complete conversion privileges. This means that policyholders can switch to a different type of policy, such as permanent life insurance, without submitting to a physical examination. This is known as a conversion privilege, which is commonly offered by term life insurance policies.

With PL Promise Term, policyholders can choose to convert all or just a portion of their death benefit coverage to a new permanent or cash value life insurance policy offered by Pacific Life. This can be done at any time during the level premium period, up to the age of 70, without requiring additional underwriting approval.

Conversion privileges provide policyholders with the flexibility to adapt their life insurance coverage to changing needs and circumstances. It guarantees coverage and set premium payments for a certain period, regardless of the insured's health status. This means that even if an individual is diagnosed with a serious illness, they can still switch to a permanent policy without undergoing another physical exam.

Overall, the partial or complete conversion privileges offered by PL Promise Term life insurance provide policyholders with options to modify their coverage as needed, ensuring they have the financial protection they require.

Understanding the Intersection of Short-Term Health Plans and Obamacare

You may want to see also

PL Promise Term is competitively priced

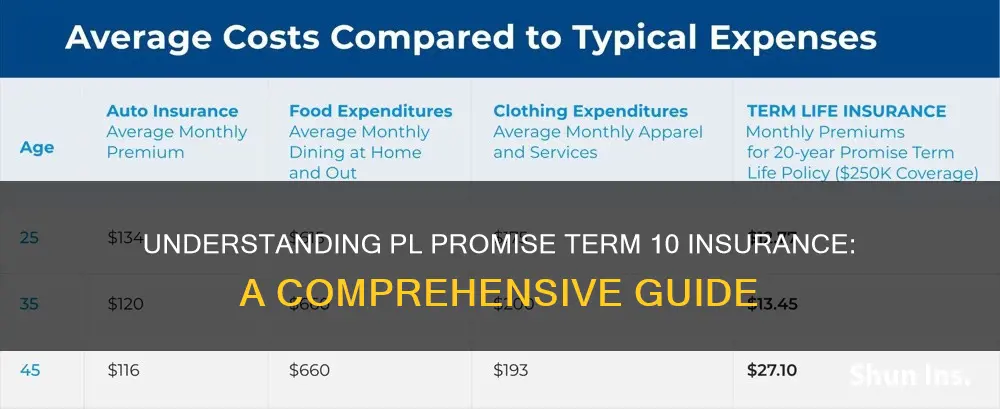

PL Promise Term life insurance is competitively priced, offering affordable coverage for consumers. Pacific Life has committed to providing cost-effective life insurance, reflected in its rate reductions for PL Promise Term. The product is designed to cater to the death benefit protection needs of a broad market consumer, typically households with incomes ranging from $50,000 to $200,000 or $250,000.

The PL Promise Term life insurance plan offers a range of term durations, from 10 to 30 years, with face amounts starting at $50,000, which is lower than many competitors. The premiums remain fixed for the chosen term, with longer-term plans costing more. The premiums can be tailored to suit an individual's budget, with annual, semi-annual, quarterly, or monthly payment options.

Pacific Life's PL Promise Term product is competitively priced compared to other insurance providers, often ranking within the top three for pricing. The company has improved its PL Promise pricing to enhance its competitiveness, particularly for 20-, 25-, and 30-year durations and face amounts exceeding $250,000.

The PL Promise Term life insurance product offers a fast, convenient process and award-winning customer service. It provides flexible conversion options, allowing partial or complete conversion privileges during the level term or until the age of 70. The product also includes a terminal illness benefit at no additional charge.

In summary, PL Promise Term life insurance from Pacific Life is competitively priced, offering affordable coverage with flexible payment options and attractive conversion features. The company has demonstrated its commitment to serving a broad market of consumers by lowering rates and ensuring its product remains accessible and competitively priced.

Securing Short-Term Rental Insurance: Navigating the Path to Comprehensive Coverage

You may want to see also

Frequently asked questions

PL Promise Term 10 Insurance is a life insurance policy offered by the Pacific Life Insurance Company. It provides death benefit protection for a period of 10 years.

The age limit for PL Promise Term 10 Insurance is 80 years old. This is the maximum age for buying this policy.

The insurer determines the premium based on the elected term duration and death benefit. Premiums stay at the same rate for the selected term, and you can choose from annual, semi-annual, quarterly, or monthly payments.

PL Promise Term 10 Insurance offers competitive pricing, fast and convenient processes, award-winning customer service, and flexible conversion options. It also provides partial or complete conversion privileges during the level term or until the age of 70.