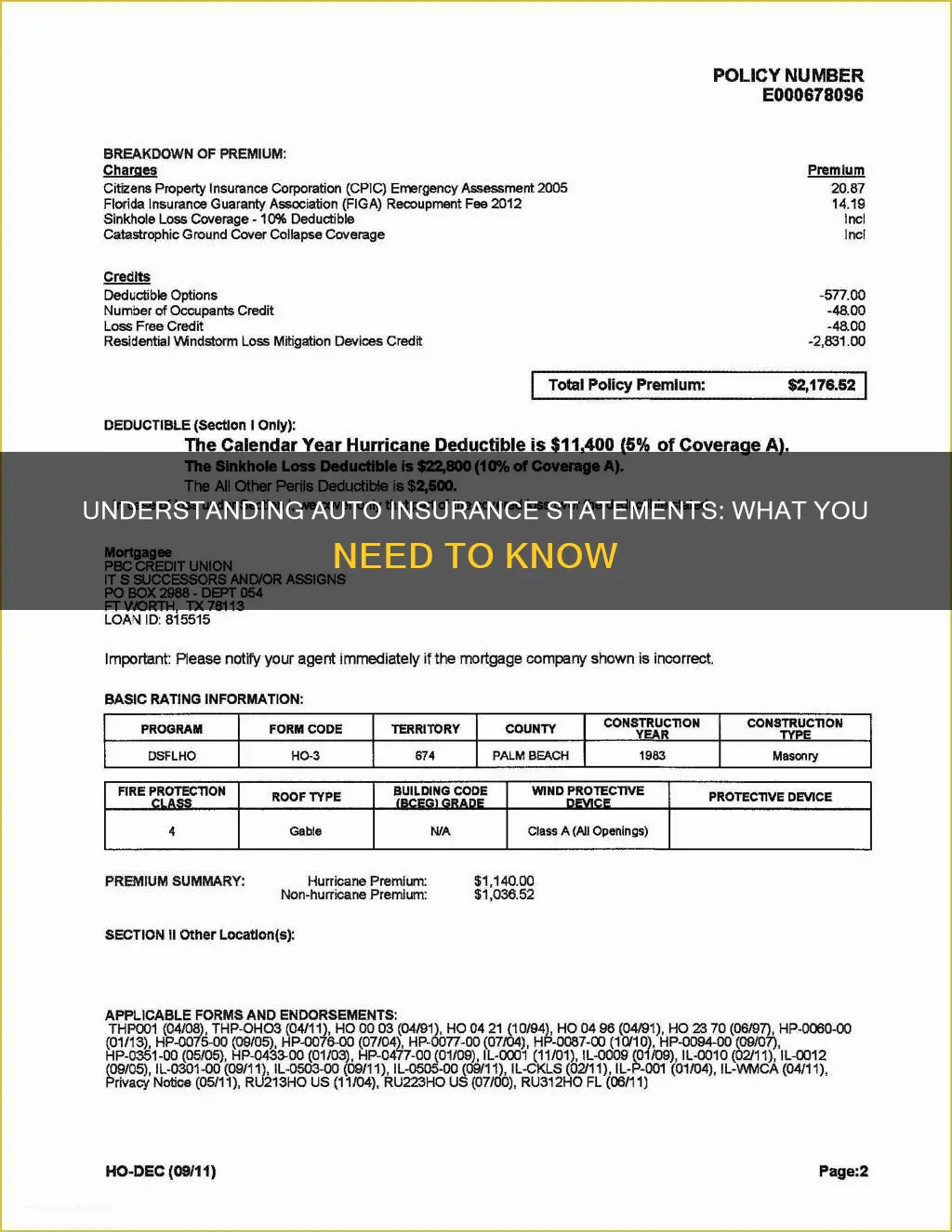

An auto insurance statement, or a dec page, is a summary of your auto insurance policy. It includes the policy number, effective dates, types of coverage, policy limits, and personal information about the insured individuals. The statement also contains details about the insured vehicles, such as the year, make, model, mileage, and Vehicle Identification Number (VIN). It is important to review the auto insurance statement to ensure all the information is accurate and to understand the coverage provided by the policy.

| Characteristics | Values |

|---|---|

| Purpose | To summarise your auto insurance policy |

| Information Included | Policy number, effective dates, types of coverage, policy limits, personal information about the insured, vehicle information, driving history, etc. |

| Format | Usually the first page of your policy documents |

| Access | Sent by the insurance company via email, fax, or regular mail; may also be available online |

What You'll Learn

What is a declaration page?

A declaration page, also known as a "dec page", is a summary of your auto insurance policy. It is typically attached to the front of your policy and includes basic details such as how much your car insurance costs, the type of coverage your policy contains, and the term period. It also includes information about your premiums, deductibles, the make and model of your car, and more.

The declaration page will list your policy number, which is needed when filing a claim. It will also include the policy term, including the effective date and end date. The page will also list the names of all insured drivers, including the policyholder and any additional drivers covered under the policy.

The declaration page will also include vehicle details such as the year, make, model, vehicle identification number (VIN), and average mileage. It will also list the types of coverage included in the policy, coverage limits, deductibles, premiums, and policy add-ons such as accident forgiveness.

The declaration page is a useful reference if you have questions about your policy or need to file a claim. It can also be used to compare your current policy with quotes from other insurers.

Auto Insurance in Mississippi: What's the Law?

You may want to see also

What is a recorded statement?

A recorded statement is a statement given by a claimant to an insurance adjuster, which is recorded for legal purposes. It is used to gather information about the accident and determine fault and how much compensation should be paid. While it may seem harmless, it is important to remember that the insurance company is not on your side. The adjuster is trained to ask specific questions in specific ways to elicit responses that can be used to undermine your claim. For example, they may ask vague or specific questions that you don't have definitive answers to, to make you sound uncertain and cast doubt on your claim. They may also ask about your medical history or medications, which you are not required to answer.

The adjuster will use your recorded statement, along with driver statements, witness statements, and the police report, to build a picture of the events leading to your injuries. Everything you say will be transcribed and put into a document, which becomes part of your claim file. This means that you need to be careful about what you say, as it can be used against you. For example, if you downplay the severity of your injuries or say that you felt fine after the accident, the insurance company may use this to justify limiting your compensation.

You are not legally required to give a recorded statement to a third-party liability insurer and should never do so without legal counsel. If the request comes from your own insurance company, you may be contractually obligated to provide a statement, but you still have the right to postpone it until you have consulted with a lawyer.

Switching Auto Insurance: Unraveling the Impact on Dependent Coverage

You may want to see also

What to do if the insurance company asks for a recorded statement?

An auto insurance statement is a record of what happened in a car accident, which is used by the insurance company to determine how much coverage needs to be applied. If an insurance company asks for a recorded statement, it is important to proceed with caution. Here are some steps to follow:

Understand the Risks

The insurance company is not on your side. Their goal is to pay out as little as possible, and they will try to get you to say something that can be used against you to limit your compensation. They may ask vague or specific questions designed to make you sound uncertain or inconsistent. They may also inquire about your medical history or medications, which you are not required to answer.

Consult an Attorney

Before giving any recorded statement, it is highly recommended to consult an experienced attorney or personal injury lawyer. They can guide you through the claims process and help you protect your rights. An attorney can also be present or on the phone with you during the recorded statement.

Postpone the Statement

If the insurance adjuster insists on a recorded statement before proceeding, politely decline and explain that you would like to get legal advice first. Reschedule the statement for a later date and use this time to prepare with your attorney.

Provide Basic Information Only

When speaking to the insurance adjuster, stick to providing only basic biographical information. Avoid answering questions about the accident or your injuries, as these may be used against you. For example, saying "I felt fine" after the crash could be used as evidence that you were not injured, even if you experience delayed symptoms.

Have an Attorney Present

If you must give a recorded statement, it is advisable to have an attorney present or on the phone with you. They can help you prepare your statement in advance, ensuring that you only provide relevant and accurate information while avoiding any potential traps.

Review and Sign Documents

Do not sign any documents provided by the insurance company without having an attorney review them first. Insurance companies aim to settle cases quickly and cheaply, and signing documents may waive your right to pursue additional damages, even if your injuries are more severe than originally thought.

Financed Vehicle: Essential Insurance Coverage

You may want to see also

What to do when talking to your insurance agent?

Talking to an insurance agent can be a tricky process, and it's important to know what to do to ensure you don't accidentally say something that could be used against you. Here are some detailed instructions on what to do when talking to your insurance agent:

Before the Conversation

Before you speak to an insurance agent, it's important to be prepared. Have your insurance information ready, so you don't have to scramble to find it if the adjuster needs it. It's also a good idea to take some time to breathe and collect your thoughts, especially if you're still recovering from the accident. You are not legally required to speak with the other driver's insurance company, and you can always reschedule the call if you don't feel up to it.

During the Conversation

When speaking with the insurance agent, it's crucial to remain calm and polite, even if you're angry or upset about the accident. Provide basic information to confirm your identity, such as your name and address, but avoid offering any unnecessary personal information. Be cautious about what you say, as anything you share can potentially be used against you. Do not admit fault or provide reasons for the accident, and refrain from discussing your injuries in detail.

Only answer the specific questions asked and avoid elaborating or providing extraneous information. If you don't know the answer to a question, simply say, "I don't know." It's also important to confirm the identity of the adjuster and the company they represent. Get their name, position, phone number, and company name.

Decline any requests for a recorded statement or to sign any documents. You are not obligated to provide a recorded statement, and doing so may create a permanent record that could be used against you later. Similarly, do not sign any papers or agree to a settlement without first seeking legal advice.

After the Conversation

It's a good idea to document the conversation by taking notes or writing down the key details discussed. Create a paper trail by sending a follow-up email or letter to confirm any representations or promises made during the conversation. Be proactive and provide your insurer with proof of your losses, and don't be afraid to ask for the compensation you believe you are entitled to. Remember that the insurance company is not your friend, and their primary goal is to minimise their payouts.

Seeking Legal Advice

If you're unsure about how to handle the situation, consider consulting a lawyer. An experienced car accident attorney can deal with the insurance companies on your behalf and ensure that your interests are accurately and professionally represented. They can guide you through the process and help protect your rights.

Gap Insurance: Maryland's Cost and Benefits

You may want to see also

What to do when talking to the at-fault party's insurance company?

Talking to the at-fault party's insurance company is a tricky situation. While you are not legally required to speak with them, there are times when doing so will benefit you.

If you choose to speak with the at-fault party's insurance company, there are several things you should keep in mind. Firstly, remember that their primary goal is to pay out as little money as possible. They will attempt to collect information to prove that you were negligent or that your injuries are not as severe as claimed. Avoid discussing how you are feeling or elaborating on the details of the accident. Only provide factual answers to their specific questions and do not speculate. If possible, have a representative from your insurance company present during the conversation.

It is also important to understand that anything you say can be used against you. The insurance company may try to get you to accept a quick settlement before you fully understand the extent of your injuries or the cost of repairs. Therefore, it is advisable to refrain from accepting any money or signing anything until you have a clear understanding of the situation.

In some cases, the at-fault party's insurance company may deny your claim or refuse to pay. If this happens, you can ask for their detailed reasoning in writing and then file a claim with your own insurance company. If necessary, seek legal assistance to help you navigate the process and protect your rights.

To summarise, while speaking with the at-fault party's insurance company is not always necessary, if you choose to do so, be cautious, provide only the necessary information, and seek support from your insurance company or a legal professional if needed.

Challenging the Verdict: Navigating the Appeals Process for Auto Insurance Claims

You may want to see also

Frequently asked questions

An auto insurance statement, or "dec" page, is a summary of your auto insurance policy. It includes details such as the policy number, effective dates, types of coverage, policy limits, and personal information about the insured individuals.

An auto insurance statement typically includes the following information:

- Policy number, period, and expiration date

- Name and contact information of the insurance agent

- Names of all insured drivers

- Details of all insured vehicles, including make, model, year, and Vehicle Identification Number (VIN)

- Types and limits of coverage

- Deductibles and premiums

An auto insurance statement is important because it provides a concise summary of your auto insurance policy. It serves as a quick reference guide to answer any questions you may have about the specific terms of your policy. It is also useful for verifying your coverage information and can be used as temporary proof of insurance in certain situations.