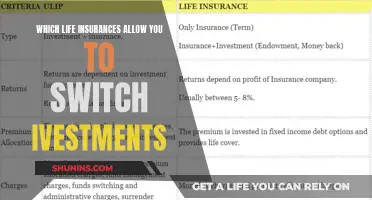

Variable life insurance is a permanent life insurance policy with a fixed death benefit, meaning it pays out a sum of money to beneficiaries upon the policyholder's death. It also includes an investment component, with a cash-value account that is typically invested in mutual funds. This means that, unlike other life insurance policies, variable life insurance carries more risk as the cash value component may rise or fall in value.

When considering variable life insurance, it is important to understand the associated risks and policy structures. While it offers more control over investments and higher potential returns, it also combines investment and insurance policies, and the federal government requires sellers of variable policies to be registered to sell securities. This highlights the market risks that come with these policies, and the potential for poor performance in the market to leave policyholders with no value in their cash account.

What You'll Learn

How is the expected midpoint calculated?

An expected midpoint ledger for variable life insurance is a document that estimates how an insurance policy will perform over the course of its coverage. It is a hypothetical ledger that shows how a life insurance policy might perform under different circumstances and outcomes. The ledger will contain columns for the year, age, premium, dividend, cash value, increase in cash value, death benefit, loan balance, and taxable distribution or tax liability.

The expected midpoint is calculated by taking into account the current dividend scale of the life insurance company and reducing it to a point between the current and guaranteed dividend scale of the policy. The midpoint projection is meant to serve as a buffer to help manage expectations in case dividend rates decrease from unusually high levels. While the guaranteed column assumes the worst-case scenario, and the current column assumes the best-case scenario, the midpoint column assumes a likely scenario.

The expected midpoint ledger will show how the policy would perform assuming current policy fees and an interest or dividend rate that is between the current and guaranteed rates. The assumed rate of return is usually shown at the top of the ledger column. It is important to note that the midpoint is not the most likely scenario for interest credits but rather a random point halfway between the interest rate projections.

The expected midpoint ledger is part of the Tabular Detail of the Proposed Insurance Policy, which contains a numerical breakdown of premiums, dividends, cash value, and death benefit of the proposed life insurance policy. This section provides significant data to the proposed buyer about the policy and can help explain the functionality of various features.

Life and Insurance: Global Companies, Similar Names

You may want to see also

What is the purpose of an expected midpoint ledger?

The purpose of an expected midpoint ledger is to provide a detailed projection of a variable life insurance policy's performance over its duration. It is part of a life insurance illustration, a document that outlines the workings and features of a prospective insurance policy.

The midpoint ledger is one of the hypothetical ledgers within the illustration, showing how the policy might perform under different circumstances and outcomes. It is often labelled as "midpoint", "current", or "illustrated", and it reflects the policy's performance assuming current policy fees and an interest rate that falls between the current and guaranteed rates. This rate is usually displayed at the top of the ledger column.

The expected midpoint ledger is considered the most likely scenario for the policy's performance. It is calculated by taking into account various variables, such as the policyholder's age, health rating, family medical history, payment methods, and the assumed rate of return. These variables are plugged into a software program developed by the insurer to generate the ledger.

The midpoint ledger is particularly useful for prospective policyholders as it provides a realistic estimate of the policy's performance. It helps them understand the potential costs and benefits associated with the policy and make informed decisions about their insurance choices.

By reviewing the expected midpoint ledger, individuals can gain insights into how their policy might perform over time, taking into account both guaranteed and non-guaranteed elements. This information can help them assess the policy's suitability for their needs and financial goals.

Life Insurance: Pre-Death Benefits and Payouts Explained

You may want to see also

How does the expected midpoint ledger differ from the guaranteed and current columns?

A life insurance illustration is a document that estimates how a prospective insurance policy will perform over its coverage period. It is a complex hypothetical ledger that shows how a life insurance policy might perform under different circumstances and outcomes.

The illustration will include a ledger or table, usually on or near a page that requires a signature. These ledgers are labelled "guaranteed" and "nonguaranteed" and illustrate, in five-year increments, how the policy could perform under different scenarios.

The guaranteed column illustrates a worst-case scenario, assuming the insurer charges maximum fees and pays the minimum interest or dividend crediting rate. The policy would likely lapse before the insured person's expected mortality, and to keep it in force, a significantly higher premium would be required.

The nonguaranteed column may include two ledgers: "current" or "illustrated", and "midpoint". The current ledger shows the death benefit and how much cash value the policy could build, assuming the current policy fees and a high assumed interest or dividend crediting rate.

The expected midpoint ledger, also known as the "intermediate" ledger, differs from the guaranteed and current columns in that it represents a most likely scenario. It assumes the current policy fees but with an interest or dividend rate that falls between the current and guaranteed rates. In other words, it assumes a more moderate level of returns and charges. This ledger is not meant to represent the most likely scenario but rather serves as a midpoint between the best- and worst-case scenarios.

The midpoint projection was introduced when dividend rates were at extraordinarily high levels, and it acted as a buffer to manage expectations in case dividend rates decreased. While dividend rates are no longer at those high levels, the midpoint projection remains a standard part of life insurance illustrations.

It is important to note that the mortality charges do not change between the guaranteed and nonguaranteed illustrations. Additionally, the nonguaranteed columns are only guaranteed for the first year of the policy. The actual financial results will differ from those shown in either the guaranteed or nonguaranteed columns.

Life Insurance: A Safety Net for Premature Death

You may want to see also

What are the benefits of variable life insurance?

Variable life insurance is a permanent life insurance policy with an investment component. It offers several benefits, including:

Higher growth potential

Variable life insurance lets you grow your cash value (and sometimes the value of the policy's death benefit) by investing it into underlying investment options, including equity, bond, and money market portfolios. While there is a risk of loss as the cash value can either increase or decrease, a well-managed policy could gain value as the market grows over the years.

Guaranteed and flexible death benefit

Variable life insurance can guarantee a death benefit, though this may vary depending on the insurer and the policy's terms. The death benefit can usually be structured in one of two ways: a level death benefit equal to the face value when purchased, or the face amount plus the cash value. A variable universal policy also lets you increase or reduce your death benefit and premiums to suit your circumstances.

Flexible premium payments

Variable life insurance offers more flexibility in how you pay your premiums compared to term life insurance. You can pay more of your premiums upfront, pay premiums from the policy's cash value, or pay a monthly minimum premium without building cash value. Paying the minimum keeps the policy active and the death benefit in place, while anything beyond the minimum goes toward the cash value.

Tax advantages

The investment portion of variable life insurance receives favorable tax treatment – growth is tax-deferred and not taxable as ordinary income. You can also take out loans using the account as collateral instead of making direct withdrawals, and receive tax-free income.

Customisable policies

Variable life insurance policies can be designed and customised for a wide range of financial situations and personal goals. They can offer various risk-based investment strategies, the ability to cover two people, and living benefits such as extra disability coverage or the ability to borrow from your cash value.

No-Lapse Guarantee

Variable life insurance policies sometimes offer a No-Lapse Guarantee, which means that as long as you keep paying your premium at a minimum agreed-upon amount, your life insurance policy will stay active.

Long-term growth potential

Variable life insurance can be a good option for those seeking long-term growth potential and are willing to manage their premiums and choose investments to suit their financial goals.

HSBC OBC Life Insurance: Exploring NAV and Benefits

You may want to see also

What are the drawbacks of variable life insurance?

Variable life insurance is a unique kind of permanent life insurance that combines lifelong insurance coverage with an investment element. While it offers a guaranteed minimum death benefit for beneficiaries, it also allows you to grow the policy's cash value by investing part of your premium in various funds, such as stock or bond portfolios. However, there are several drawbacks to this type of insurance:

Investment Risk:

The cash value of a variable life insurance policy is directly tied to the performance of the chosen investments. If the market performs poorly, the cash value can decrease. This means that, unlike other life insurance policies with guaranteed growth, variable life insurance carries the risk of losing money. It is important to closely monitor the investments and be comfortable with this level of risk.

Complexity and Fees:

Variable life insurance is more complex than most other forms of life insurance. It requires careful and regular monitoring to ensure the policy doesn't lapse or lose significant value due to poor investment performance. Additionally, the fees associated with variable life insurance may be higher than those of a universal life insurance policy.

Surrender Charges:

Variable life insurance policies are typically subject to surrender charges, which can be very high, especially during the early years of the policy. These charges apply if you decide to surrender or cancel your policy and withdraw your accumulated cash value.

Reduced Investment Returns:

The returns on investments within a variable life insurance policy are often reduced by sales loads, mortality charges, and surrender fees, especially in the early years of the policy. This means that the actual returns may be lower than what you would achieve with a standalone investment account.

Limited Investment Selection:

While variable life insurance offers some investment options, they are typically limited to specific funds managed by the insurer. These funds may not align fully with your broader financial goals and investment preferences.

Time to Build Cash Value:

Building cash value in a variable life insurance policy can take a significant amount of time. Most of the growth occurs after holding the policy for 20 or more years. Surrendering the policy early may result in no benefits, as the cash value earned may be less than the premiums paid.

Cashing Out Lasso Whole Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Variable life insurance is a permanent life insurance policy with a fixed death benefit. It has a cash-value account where money is invested, typically in mutual funds.

An in-force illustration is a projection of a life insurance policy's future performance. It uses current policy values and projects future values based on current earnings, mortality, and expense charges.

A guaranteed illustration outlines the worst-case scenario of policy performance, while a current illustration represents the insurer's best-case scenario of policy performance.

A whole life insurance policy illustration includes details such as the insurance coverage amount, the annual premium requirement, the guaranteed cash value, current dividend payment, and the year-over-year increase in cash value.

The purpose of a life insurance illustration is to help potential policyholders understand the terms and features of the policy. It is a hypothetical ledger that shows how a policy might perform under different circumstances and outcomes.