When considering life insurance, it's important to understand the investment options available. Some life insurance policies offer the flexibility to switch investments, allowing policyholders to adjust their investment strategy according to their financial goals and market conditions. This feature can be particularly appealing to those who want more control over their insurance premiums and investment returns. In this article, we will explore the different types of life insurance that permit investment switching, the benefits and potential risks associated with this option, and how to choose the right policy for your needs.

What You'll Learn

- Investment Options: Understand the range of investment choices offered by different life insurance policies

- Flexibility: Learn how easily you can adjust your investments within the policy

- Cost Analysis: Compare fees and charges for switching investment options

- Tax Implications: Explore tax consequences of changing investments in life insurance

- Customer Support: Evaluate the assistance provided by insurers during investment switches

Investment Options: Understand the range of investment choices offered by different life insurance policies

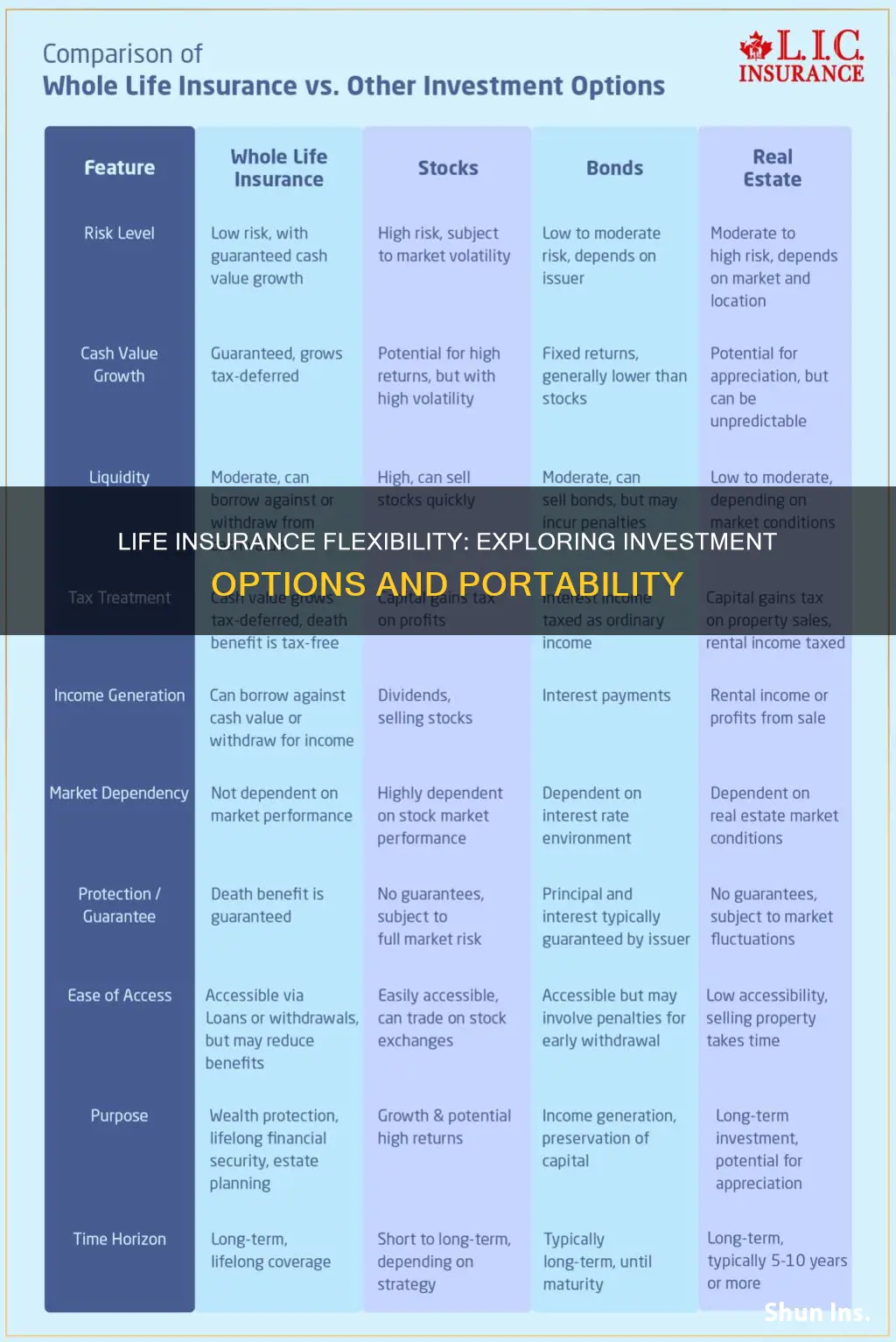

When considering life insurance policies, it's important to understand the investment options available to policyholders. Many life insurance companies offer a range of investment choices within their policies, allowing individuals to potentially grow their money and achieve financial goals. These investment options can vary widely, and understanding the differences can help you make informed decisions about your insurance coverage.

One common type of investment offered by life insurance companies is a guaranteed investment account (GIA). GIAs provide a secure and stable investment option, often with a fixed rate of return. This type of account is typically low-risk and designed to preserve capital while offering a modest return over time. It's an attractive choice for those seeking a conservative investment strategy within their life insurance policy.

In contrast, some life insurance policies offer more aggressive investment options, such as variable universal life (VUL) policies. VULs provide policyholders with a wide range of investment choices, often including stocks, bonds, and mutual funds. These investments can offer higher potential returns but also come with higher risks. Policyholders can customize their investment strategy by allocating a portion of their policy's cash value to different investment options, allowing for a more dynamic approach to growing their money.

Additionally, some life insurance companies offer index-based investment options, which are designed to track specific market indexes or sectors. These investments can provide diversification and potentially higher returns compared to traditional fixed-income investments. Index-based options may include investments in stock indexes, bond indexes, or a combination of both.

It's crucial to carefully review the investment options provided by different life insurance companies. Each policy may have its own set of investment choices, fees, and associated risks. Some policies might offer more flexibility in terms of investment switching, allowing policyholders to adjust their strategy as their financial goals and market conditions evolve. Understanding these investment options can empower you to make the best choices for your long-term financial well-being.

Simplifying Life Insurance: A Beginner's Guide to Easy Coverage

You may want to see also

Flexibility: Learn how easily you can adjust your investments within the policy

When considering life insurance policies that offer investment options, one of the key factors to evaluate is the flexibility provided in managing your investments. This aspect is crucial as it determines how easily you can adapt your investment strategy to changing financial goals and market conditions. Here's a detailed look at why flexibility is essential and how it can benefit you:

Understanding Investment Flexibility:

Flexibility in investment options means having the ability to adjust your investment choices within the life insurance policy. This includes the freedom to move your funds between different investment portfolios or asset classes. For instance, you might want to shift your investments from stocks to bonds or explore alternative investments like real estate or commodities. A flexible policy should allow you to make these changes without incurring significant penalties or fees.

Benefits of Adjustable Investments:

- Market Adaptation: Financial markets are dynamic, and your investment strategy should reflect this. With a flexible policy, you can quickly respond to market trends and adjust your investments accordingly. For example, if the stock market experiences a downturn, you can rebalance your portfolio by moving funds to less volatile assets.

- Risk Management: Flexibility allows you to manage risk more effectively. You can allocate your investments based on your risk tolerance and financial objectives. If you're approaching retirement, you might want to reduce risk by shifting investments to more conservative options.

- Personalized Approach: Every individual's financial situation and goals are unique. A flexible investment policy enables you to tailor your investments to your specific needs. Whether you're saving for a child's education or planning for retirement, you can adjust your strategy to align with your milestones.

How to Assess Flexibility:

When reviewing life insurance policies, pay close attention to the terms and conditions related to investment management. Look for policies that offer:

- Multiple Investment Options: Choose a policy with a diverse range of investment choices, allowing you to diversify your portfolio.

- Regular Reviews: Ensure the policy provides for periodic reviews of your investments, enabling you to make adjustments as needed.

- Low or No Penalties: Opt for policies with minimal or no fees associated with switching investments, ensuring that your financial decisions are not penalized.

- Transparency: A transparent policy will clearly outline the investment performance and any associated risks, helping you make informed choices.

In summary, flexibility in investment options is a critical feature of life insurance policies, especially when considering long-term financial planning. It empowers you to take control of your investments, adapt to market changes, and align your strategy with your life goals. By choosing a policy that offers adjustable investments, you gain the freedom to navigate the ever-changing financial landscape with confidence.

Does Globe Life Insurance Offer Cash Value Benefits?

You may want to see also

Cost Analysis: Compare fees and charges for switching investment options

When considering the cost implications of switching investment options within a life insurance policy, it's crucial to understand the various fees and charges associated with this process. Here's a detailed breakdown of the costs involved:

Understanding the Fees:

Life insurance companies often offer policyholders the flexibility to switch investment options, allowing them to customize their investment strategy. However, this convenience comes with associated costs. The primary fees to consider are the surrender charge, the investment management fee, and any potential transaction costs. The surrender charge is typically a one-time fee levied when an insured individual decides to terminate or switch their investment option. This charge is designed to compensate the insurance company for the potential loss of future premiums and investment returns. The amount of the surrender charge varies depending on the policy type, the time elapsed since the policy's inception, and the specific investment option chosen.

Investment Management Fees:

These fees are charged by the insurance company for managing the investment portfolio. They cover the costs associated with research, portfolio management, and administrative tasks. Investment management fees are usually a percentage of the total investment value and can vary widely between different insurance providers. It's essential to compare these fees to ensure you're getting a competitive rate, especially if you plan to hold the policy for an extended period.

Transaction Costs:

Switching investment options may also incur transaction costs, which can include processing fees, transfer fees, or other administrative charges. These costs are often a one-time payment and can vary depending on the insurance company and the complexity of the switch. It's important to inquire about these fees upfront to avoid any surprises.

Comparing Policies:

To make an informed decision, it's crucial to compare the cost structures of different life insurance policies. Request detailed fee schedules from various providers, ensuring you understand the surrender charges, investment management fees, and transaction costs associated with each policy. This comparison will help you identify the most cost-effective option, especially if you intend to switch investment strategies frequently.

Long-Term Considerations:

While switching investment options may provide flexibility, it's essential to consider the long-term impact on your overall policy costs. Some insurance companies offer lower-cost investment options, but these may come with higher surrender charges or different fee structures. Understanding the trade-offs between short-term flexibility and long-term costs is vital for making a well-informed decision.

AD&D Life Insurance: What You Need to Know

You may want to see also

Tax Implications: Explore tax consequences of changing investments in life insurance

When it comes to life insurance, the ability to switch investment options can be a valuable feature, offering policyholders more control over their financial decisions. However, it's crucial to understand the tax implications that come with making these changes. Life insurance policies often incorporate investment components, allowing policyholders to allocate their premiums into various investment options. This flexibility can be advantageous, but it also introduces considerations regarding taxes.

One of the primary tax implications is the potential impact on capital gains. When you switch investments within a life insurance policy, you may be dealing with taxable events. If the new investment option has a higher value than the previous one, you could trigger a capital gain, which is generally taxable. This is especially relevant if you frequently change investments, as each switch may result in a gain or loss. It's important to review the tax rules in your jurisdiction to understand the specific regulations regarding capital gains and how they apply to life insurance policies.

Additionally, the tax treatment of withdrawals from the investment portion of a life insurance policy is essential to consider. If you take out funds from the policy's investment account, you may be subject to income tax on the amount withdrawn. The tax rate applied will depend on your overall income for the year and the tax laws in your country. It's advisable to consult a tax professional to determine the best strategy for minimizing tax liabilities when accessing funds from the investment side of your life insurance.

Furthermore, the tax consequences can vary depending on the type of life insurance policy. Term life insurance, for instance, typically has a simpler structure, and changes in investment options may have less complex tax implications. On the other hand, whole life or universal life policies often include permanent investment components, which can lead to more intricate tax considerations. Understanding the specific features of your policy is crucial in assessing the tax impact of any investment switches.

In summary, while the ability to switch investments in life insurance provides flexibility, it's essential to be aware of the potential tax implications. Capital gains, withdrawals, and the specific characteristics of your insurance policy all play a role in determining the tax consequences. Seeking professional advice can help you navigate these complexities and make informed decisions regarding your life insurance investments.

Marketing Life Insurance: Strategies for Success

You may want to see also

Customer Support: Evaluate the assistance provided by insurers during investment switches

When considering the support offered by life insurance companies during investment switches, it's important to evaluate the level of assistance and guidance provided to policyholders. Here's an analysis of the key aspects:

Information and Transparency: Insurers should provide comprehensive information about the investment options available and the process of switching. This includes clear explanations of different investment strategies, potential risks, and associated fees. A detailed breakdown of the current investment portfolio and the proposed changes can help customers make informed decisions. For instance, a well-structured report outlining the current and proposed investments, with a comparison of performance and potential outcomes, would be beneficial.

Dedicated Support Team: Efficient customer support is crucial during investment switches. Insurers should assign a dedicated team or representative to assist policyholders throughout the process. This team should be knowledgeable about the investment products and able to answer queries promptly. A single point of contact ensures that customers receive consistent and accurate information, reducing confusion and potential errors.

Personalized Guidance: Each customer's investment journey is unique, so insurers should offer personalized assistance. This involves understanding the customer's financial goals, risk tolerance, and investment preferences. By providing tailored advice, insurers can help individuals make switches that align with their specific needs. For example, a customer with a conservative investment strategy might require a more cautious approach when switching, while someone with a higher risk tolerance may be open to more aggressive investments.

Regular Updates and Communication: Regular communication is essential to ensure customers stay informed. Insurers should provide periodic updates on the progress of the investment switch, including any milestones or changes in the investment strategy. This proactive approach keeps customers engaged and allows them to address any concerns promptly. Additionally, insurers should be responsive to customer inquiries, providing timely responses and clarification on any investment-related matters.

Post-Switch Support: The evaluation of customer support should also consider the post-switch period. Insurers should offer ongoing assistance to address any challenges or questions that arise after the investment switch. This support can include regular reviews of the new investment portfolio, performance analysis, and adjustments to the strategy if needed. By providing long-term support, insurers demonstrate their commitment to customer success.

In summary, evaluating the assistance provided by insurers during investment switches involves assessing the quality and comprehensiveness of the support offered. From transparent information sharing to dedicated customer support and personalized guidance, insurers should strive to ensure a smooth and successful investment transition for their policyholders.

Life Insurance: Accumulating Value Over Time

You may want to see also

Frequently asked questions

The process of switching investment options in a life insurance policy can vary depending on the insurance company and the specific policy. Typically, policyholders can request a change by contacting their insurance provider and providing the necessary information. This may include the desired investment strategy, the amount to be allocated, and any relevant documentation. The insurance company will then update the policy accordingly, allowing the policyholder to switch between different investment options.

Yes, there are usually restrictions and guidelines. Insurance companies often offer a range of investment options, such as stocks, bonds, mutual funds, or a mix of these. The specific investments available may depend on the policy type and the insurance provider. It's important to review the policy's terms and conditions to understand the allowed investment strategies and any associated fees or penalties for changes.

The frequency of investment changes can vary. Some policies may allow for adjustments at any time, providing flexibility to adapt to changing financial goals or market conditions. However, there might be certain periods or conditions under which changes are not permitted. For instance, some policies may restrict changes during specific times of the year or require a minimum holding period for certain investments. It's advisable to check the policy's guidelines and consult with the insurance provider for the most accurate and up-to-date information.

Switching investments can potentially impact your policy's benefits and premiums. Different investment options may have varying levels of risk and potential returns, which can affect the overall value of your policy. If you choose a more aggressive investment strategy, your policy's cash value might grow faster, but it could also be more volatile. Conversely, more conservative investments may provide steadier growth but at a slower pace. Additionally, changing investments might result in different premium payments, as the investment-linked policy's value can influence the cost. It's essential to carefully consider your risk tolerance and financial objectives when making these decisions.