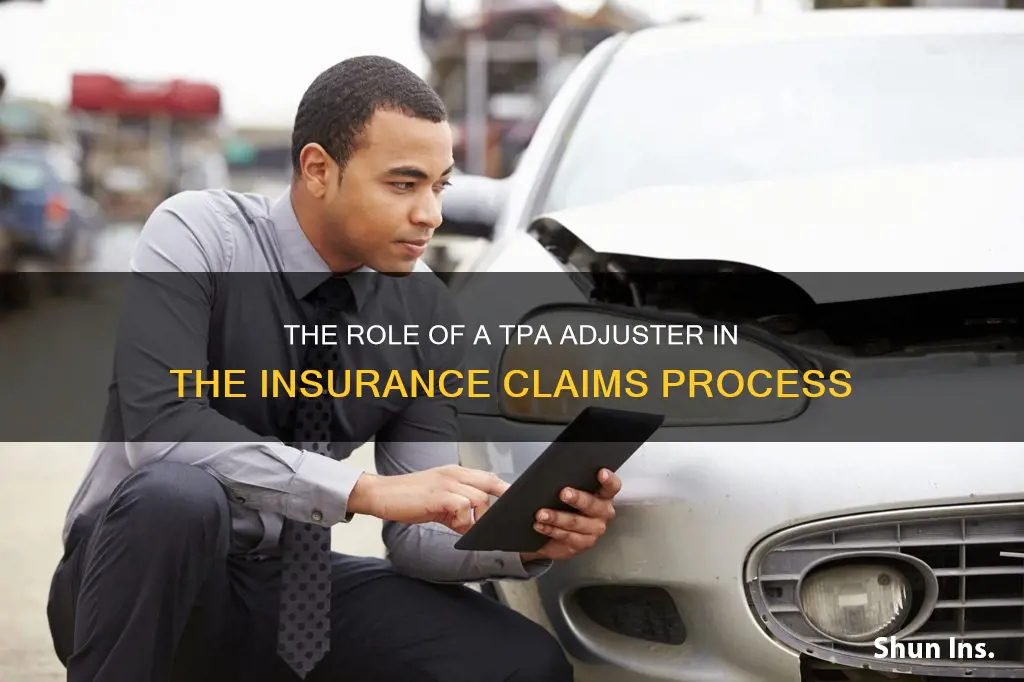

A Third-Party Administrator (TPA) is an independent company that provides operational services such as claims processing and employee benefits management for another company. In the insurance industry, TPAs are often used by insurance companies and self-insured companies to outsource their claims processing. TPAs do not sell policies or bear financial risk, but they provide support by handling administrative tasks and operational duties related to claims management. They can assist with insurance enrollment, premium billing, customer support, and regulatory compliance. TPAs are commonly associated with health insurance but are used in various insurance fields, including commercial liability insurance and investment company operations.

| Characteristics | Values |

|---|---|

| Definition | Third-Party Administrator (TPA) |

| Type of Entity | An independent company that is separate from the insurance company |

| Role | Assists insurance carriers and adjusters in managing claims |

| Function | Provides operational services such as claims processing, employee benefits management, customer support, provider networks, utilisation review, and membership functions |

| Specialty | Various, including specific insurance claims, industries, or niches |

| Skills/Offerings | Operational administration, coordination with service providers, data analytics and reporting |

| Relationship with Insurers | Insurers can outsource claims to TPAs to improve efficiency and focus on core operations |

| Relationship with Adjusters | Collaborates with adjusters to improve claims management capabilities and customer service |

| Licensing | Licensing requirements vary by state; some states require TPAs to obtain an independent adjuster's license to operate |

What You'll Learn

Third-party administrators (TPAs) are independent companies

In the insurance industry, third-party administrators (TPAs) are independent companies that provide operational services such as claims processing and employee benefits management. They are separate entities that contract with insurance companies or self-insured companies to handle various administrative tasks and operational duties related to claims management. TPAs do not sell policies or bear financial risk but instead provide support to insurance carriers and adjusters by managing claims. This allows insurance companies to focus on their core operations, resulting in improved efficiency and better outcomes.

The use of TPAs is becoming common in the insurance industry, and they play a crucial role in health insurance, commercial liability insurance, and investment company operations. They are often associated with health insurance, but they are utilised in various insurance fields. TPAs may work with multiple insurers and can be large multinational corporations or independent contractors. Their specific roles vary depending on the plan they administer, but they generally offer common services such as benefit plan design, insurance enrollment assistance, claims processing, customer support, and compliance with federal regulations.

One of the key advantages of TPAs is their ability to improve efficiency and reduce costs. They can expedite claim settlements, negotiate cost-effective solutions, and reduce expenses for insurers. TPAs also possess expertise in specialised claim areas, including fraud detection and prevention, data analytics, and industry-specific knowledge. This ensures accurate assessments and fair claim settlements. Additionally, TPAs prioritise regulatory compliance, quickly adapting their processes to meet updated standards and legal requirements, which gives insurers peace of mind.

In the context of commercial general liability (CGL) policies, TPAs act as claims adjusters for the insurance company. They may work in conjunction with internal claims adjusters, outside claims investigators, and defence counsel. The TPA sometimes has the authority to select the defence counsel. The larger the self-insured retention (SIR), the more responsibility the TPA has in controlling the handling and resolution of the claim.

Overall, TPAs play an essential role in the insurance industry by providing efficient claims management and administrative services, allowing insurance carriers and adjusters to focus on their core operations and improve customer satisfaction.

Insurance Adjusters: To Speak or Not to Speak?

You may want to see also

They help insurance carriers and adjusters manage claims

A third-party administrator (TPA) is an independent company that helps insurance carriers and adjusters manage claims. When an insurer receives a claim, they can choose to outsource it to a TPA. This allows insurance companies to focus on their core operations, improving efficiency and outcomes for all involved.

TPAs are not insurance companies; they do not sell policies or bear financial risk. Instead, they support insurance companies by handling administrative tasks and operational duties related to claims management. For example, a homeowner files a claim for wind damage. The insurance company assigns the claim to a TPA, which processes the claim, investigates the damage, and confirms whether the policy covers the loss.

TPAs offer various services, including operational administration, coordination with service providers, and data analytics and reporting. By partnering with a TPA, insurance providers and adjusters can enhance their claims management capabilities and improve customer service. TPAs can expedite claim settlements, reduce expenses, and provide flexibility during high-volume events, ultimately lightening the workload for insurers.

The use of TPAs is becoming common in the insurance industry, particularly in health insurance, commercial liability insurance, and investment company operations. They are often large, multinational corporations, but there are also independent contractors with TPA certification. TPAs must have a deep understanding of the rules and regulations governing the services they administer.

The Distinct Roles of Insurance Adjusters and Lawyers: Unraveling the Similarities and Differences

You may want to see also

TPAs don't sell policies or bear financial risk

A third-party administrator (TPA) is an independent company that provides operational services such as claims processing and employee benefits management under contract to another company. They are not insurance companies and do not sell policies or bear any financial risk. Instead, they support insurance carriers and adjusters by handling administrative tasks and operational duties related to claims management.

When an insurer receives a claim, they have the option to outsource it to a TPA. By leveraging the expertise and resources of a TPA, insurance companies can focus on their core operations, leading to improved efficiency and better outcomes for all parties involved. TPAs can expedite claim settlements, improve customer service, and negotiate cost-effective solutions, resulting in cost savings for insurers.

While TPAs provide valuable support to insurance companies, they do not assume any financial risk for policyholder claims. The risk of loss remains with the employer, and not with the TPA. TPAs act as a connector between businesses with self-funded health plans and insurance providers, facilitating the claims process and providing administrative expertise.

The use of TPAs is becoming common in the insurance industry, particularly in health insurance, commercial liability insurance, and investment company operations. They are also increasingly handling other day-to-day operational services, such as underwriting and customer service. TPAs may work with multiple insurers and are often associated with self-funded insurance group health plans, where they help manage and administer the plan for employees.

Crafting a Comprehensive Letter to Your Insurance Adjuster

You may want to see also

They provide operational and administrative services

A third-party administrator (TPA) is an independent company that provides operational and administrative services to insurance carriers and adjusters, helping them manage claims more efficiently. They do not sell policies or bear any financial risk but instead provide support by handling administrative tasks and operational duties related to claims management. This allows insurance companies to focus on their core operations, ultimately improving efficiency and achieving better outcomes.

TPAs are commonly associated with health insurance, but they are utilised across various insurance sectors. They are often engaged by commercial liability insurers and retirement plan administrators to act as claims adjusters or customer support staff. In the context of health insurance, TPAs handle tasks such as processing medical claims, ensuring compliance with regulations, and providing customer support to employees covered by group health plans.

The operational and administrative services provided by TPAs can include:

- Claims Processing: TPAs handle the administrative burden of processing insurance claims, including investigating and assessing damage, determining coverage, and recommending claim values. They expedite claim settlements, improve customer service, and negotiate cost-effective solutions.

- Data Analytics and Reporting: TPAs leverage data analytics to assess claims data, identify trends, and generate reports for insurers and adjusters. This helps them make informed decisions and improve their claims management processes.

- Coordination with Service Providers: TPAs coordinate with various service providers involved in the claims process, including outside investigators and defence counsel. They work collaboratively to resolve claims efficiently and effectively.

- Regulatory Compliance: TPAs ensure compliance with federal, state, and local regulations related to insurance claims. They stay up-to-date with changing insurance regulations and adapt their processes to meet updated standards and legal requirements.

- Customer Support: TPAs often provide customer support to policyholders, answering questions, addressing concerns, and facilitating smooth communication throughout the claims process.

- Benefits Plan Design: In the context of group health plans, TPAs may assist in designing benefit plans tailored to the specific health needs of a company's employees, ensuring that the plan meets the unique requirements of the covered individuals.

By outsourcing these operational and administrative tasks to TPAs, insurance providers and adjusters can focus on their core competencies, improve efficiency, and enhance the overall customer experience.

Adjusting Unexpired Insurance: A Guide to Making Amendments to Your Policy

You may want to see also

TPAs are commonly associated with health insurance

A third-party administrator (TPA) is an independent company that provides operational services such as claims processing and employee benefits management under contract to another company. While TPAs are used in a variety of insurance fields, they are commonly associated with health insurance.

Health insurance companies often outsource their claims operations and other administrative functions to third-party administrators. TPAs play a vital role in the health insurance industry by performing tasks such as claims processing, policy administration, and customer service on behalf of insurance companies. They act as intermediaries between insurance companies and healthcare providers or patients.

When an individual is admitted to the hospital, an intimation of the same is given to the TPA. The TPA then processes the claim, investigates the damage, and confirms whether the individual's policy covers the loss. TPAs also coordinate with service providers and provide data analytics and reporting.

TPAs offer many benefits to insurance companies and policyholders. They can improve efficiency and reduce costs by expediting claim settlements and negotiating cost-effective solutions. TPAs also have expertise in specialized claim areas, such as fraud detection and prevention, and can access claims data and analytics. Additionally, TPAs can ensure regulatory compliance by quickly adapting to updated standards and legal requirements.

For policyholders, TPAs simplify the claim procedure under health insurance plans and provide constant support during hospitalization. They issue health cards to policyholders, guide them through the documentation process, and ensure efficient cashless claims settlement. TPAs also provide 24/7 customer support and help strengthen hospital networks by building strong relationships with healthcare providers.

Navigating the Path to Becoming a Farm Bureau Insurance Adjuster

You may want to see also

Frequently asked questions

TPA stands for Third-Party Administrator. It is an independent company that provides operational services such as claims processing and employee benefits management for another company.

An insurance TPA processes insurance claims and handles other administrative tasks for insurance companies. They do not set policies but help ensure that policies are followed.

Insurance companies can outsource their claims processing to TPAs, allowing them to focus on their core operations. TPAs can also provide expertise in specialized areas such as fraud detection and regulatory compliance, improving the efficiency and effectiveness of the claims-handling process.

Yes, in certain jurisdictions, such as New York, TPAs are required to obtain a license to adjust insurance claims. Each state or region may have its own regulations and licensing requirements for TPAs.