Auto-Owners Insurance Group is a Lansing, Michigan-based insurance company that has been in business for over 100 years. It is among the nation's largest insurers, providing insurance to nearly 3 million policyholders. The company offers a wide range of insurance products, including auto, home, life, and business insurance, and is known for its exceptional financial strength and stability. Auto-Owners works exclusively through independent agents, ensuring that customers receive skilled and personalized expertise when choosing the right coverage for their needs.

| Characteristics | Values |

|---|---|

| Year Established | 1916 |

| Headquarters | Lansing, Michigan |

| Number of Policyholders | Nearly 3 million |

| Number of Licensed Agents | 48,000 |

| Number of States Covered | 26 |

| Types of Insurance | Life, Home, Auto, Business |

| Financial Stability Rating | A++ (Superior) |

| Company Type | Mutual Insurance Company |

| Number of Agencies | More than 6,300 |

| Number of Life Insurance Applications in 2019 | 45,000+ |

| Life Insurance in Force in 2019 | $42 billion |

What You'll Learn

Auto insurance coverages

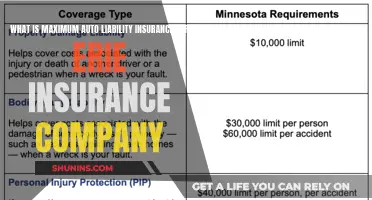

Liability Coverage: This type of coverage pays for injuries or damages you cause to other people or their property in an accident, up to the limits of your policy. It covers the initial medical treatment for your passengers and the costs associated with repairing or replacing another person's property if you are found legally responsible for a car accident.

Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are in an accident with a driver who has little or no insurance. It covers injuries and property damage caused by the uninsured or underinsured driver, up to your policy's limits.

Medical Payments Coverage: This coverage pays for medical and funeral expenses for you, your family members, or your passengers, regardless of who is at fault in the accident. It covers initial medical expenses and can provide additional benefits in some states.

Personal Injury Protection (PIP): PIP coverage is similar to medical payments coverage but may offer additional benefits. It protects you and your passengers from potential medical expenses resulting from an accident.

Comprehensive Coverage: Comprehensive coverage protects your vehicle from events other than collisions, such as fire, theft, vandalism, and more. It provides financial protection for damages not caused by a collision with another vehicle or object.

Collision Coverage: This coverage pays to repair or replace your vehicle if it is damaged in a collision with another vehicle or object, such as a tree or guardrail. Collision coverage ensures you can get your vehicle back on the road after an accident.

These are just a few examples of common auto insurance coverages. There are also additional coverages and specialized options available, such as rental car reimbursement, roadside assistance, and coverage for custom parts and equipment. It is important to work with an insurance provider to determine the right combination of coverages that fit your unique needs and provide you with the necessary financial protection.

Static Pool Reports: Analyzing Auto Insurance Trends and Insights

You may want to see also

Homeowners insurance

Auto-Owners Insurance Group is a Lansing, Michigan-based company that has been in operation since 1916. The company provides insurance to nearly 3 million policyholders and is represented by 48,000 licensed agents in 26 states. Auto-Owners offers a range of insurance products, including life, home, auto, and business insurance.

There are several components to homeowners insurance:

- Property Damage coverage protects against damage to the home and permanent structures on the property, including damage from fire, smoke, wind, falling trees, hail, and theft.

- Personal Property coverage protects belongings that are damaged or stolen, such as furniture, appliances, clothing, and electronics.

- Personal Liability coverage protects against damage or injury caused by the policyholder or members of their household, including pets. This can include medical expenses and property damage, as well as legal expenses in the case of a lawsuit.

- Additional living expenses may be covered if the home becomes uninhabitable due to a covered loss. This could include the cost of temporary accommodation.

Insurance Fronting: Deceiving Vehicle Coverage

You may want to see also

Business insurance

Auto-Owners Insurance Group, headquartered in Lansing, Michigan, has been offering insurance policies for over 100 years. It is one of the nation's largest insurers, providing insurance to nearly 3 million policyholders. The company offers multiple lines of insurance, including business insurance, and is represented by a vast network of licensed agents across 26 states.

There are several common types of business insurance:

- General Liability Insurance: This type of insurance protects businesses from financial losses due to bodily injury, property damage, medical expenses, libel, slander, and legal costs. It is relevant to businesses that work directly with customers or their property and those that advertise.

- Workers' Compensation Insurance: This insurance is legally required in most states and helps compensate employees for expenses related to work-related injuries or illnesses, covering medical bills, rehabilitation, and lost wages. Any business with part-time or full-time employees should carry this insurance.

- Professional Liability Insurance: This type of insurance is designed for businesses providing professional services or advice to clients. It offers financial protection if the business is found negligent, even if no mistake was made.

- Business Property Insurance: Also known as commercial property insurance, this covers losses or damages to company property, including buildings, tools, and equipment. It is relevant to businesses with significant physical assets.

- Commercial Auto Insurance: This insurance covers the costs of auto accidents if a company vehicle or a personal vehicle used for business reasons is involved.

- Data Breach Insurance: Also referred to as cyber insurance, this type of insurance covers expenses arising from data breaches or cyberattacks. It is essential for businesses that handle sensitive customer data.

Additionally, businesses may benefit from a Business Owner's Policy (BOP), which combines essential coverages into one convenient and cost-effective bundle. A BOP typically includes general liability insurance, commercial property insurance, and business income insurance.

Canceling Liberty Mutual Auto Insurance: A Guide

You may want to see also

Life insurance

Auto-Owners Insurance Group, headquartered in Lansing, Michigan, offers multiple lines of insurance, including life insurance. The company has been in business for over 100 years and is represented by 48,000 licensed agents in 26 states.

When considering life insurance, it is important to evaluate your financial goals and needs. Life insurance can provide financial security for your loved ones, ensuring they are taken care of in the event of your death. It can also help with specific financial obligations, such as mortgage payments or funding your children's education.

Auto-Owners Life Insurance Company offers a range of life insurance products to meet the diverse needs of its customers. With a strong financial rating and a commitment to customer service, the company provides personalized expertise and works with independent agents to determine the right coverage for each individual. By choosing Auto-Owners Life Insurance, customers can have peace of mind knowing that their families will be protected and provided for in the future.

Volcanic Eruptions and Auto Insurance: What's Covered?

You may want to see also

Independent agents

Auto-Owners Insurance has been dedicated to the independent agency system for over 100 years. The company offers its insurance products through a network of 48,000 licensed independent agents in 26 states.

Auto-Owners Insurance chooses to work with independent agents to ensure that their clients receive the right protection from skilled professionals. By partnering with independent agents, the company can provide a more personalised and consultative approach to insurance, helping clients navigate the complex world of insurance with ease and confidence.

Progressive Auto Insurance: Everything You Need to Know

You may want to see also

Frequently asked questions

Auto-Owners Insurance is an insurance company that offers a range of insurance policies, including auto, home, life, and business insurance. The company has been in operation for over 100 years and is headquartered in Lansing, Michigan.

Auto-Owners Insurance offers a variety of auto insurance coverages, including protection for your car, Road Trouble Service, Purchase Price Guarantee, rental car coverage, and classic car insurance. They also provide coverage for modified or converted cars, including vehicles with driver control modifications and wheelchair lifts.

Auto-Owners Insurance works exclusively through independent agents to ensure customers receive personalized expertise and skilled professional protection. These agents work with customers to determine the coverages that are right for their specific needs.

Auto-Owners Insurance is rated A++ (Superior) by the AM Best Company, a nationally recognized independent insurance rating authority. This rating indicates that the company has exceptional financial strength and stability.

To obtain a quote, you can use the Agency Locator on the Auto-Owners Insurance website to find an independent insurance agent near you. You can then contact the agent to discuss your specific needs and determine the appropriate coverages.