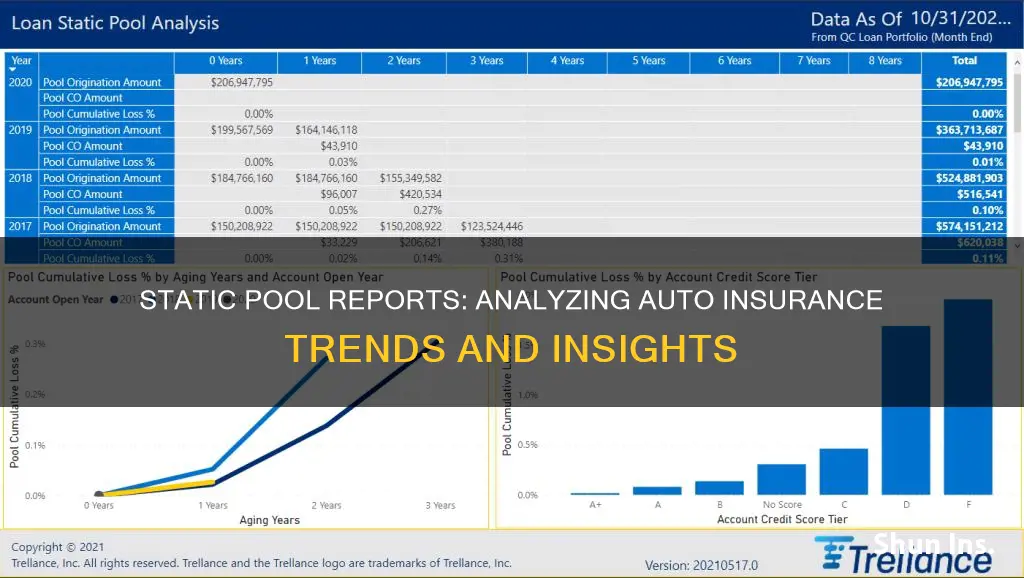

Static Pool Analysis is a risk analysis of a pool of risks linked to a specific time period. It is used to manage risk in loan portfolios and predict future losses. A static pool of loans is a grouping of loans with similar credit risk characteristics that were originated during a specific time period. Static Pool Analysis can be used to track the long-term performance of groups of accounts entered in a given month, quarter, or year. This analysis can help lending companies manage risk and predict and prevent losses.

| Characteristics | Values |

|---|---|

| Definition | Static Pool Analysis is a risk analysis of a pool of risks linked to a specific time period. |

| Type of Analysis | Cohort or Vintage Analysis |

| Indicators | Delinquency rates, defaults, prepayments, etc. |

| Methodology | Tracking performance/risk factors of the pool as a function of time from origination |

| Differentiating Factor | Differentiated from a running portfolio analysis where attributes refer to the current population of risks, irrespective of origination time. |

| Benefits | Helps isolate factors with absolute time characteristics; effective in exposing "Ponzi"-like phenomena. |

| Use Case | Used by credit unions to manage risk in the loan portfolio and predict future losses. |

| Data Measurements | Number of accounts funded, current balance, and various loss statistics. |

| Reports | Static Loss, Loss Summary by Dealer, Raw Data Report |

What You'll Learn

Static Loss by month, quarter, or year

Key data measurements for the Static Loss feature include the number of accounts funded, current balance, and various loss statistics. Users can filter results by branch, class, dealer, and portfolio.

The static pool analysis is particularly useful for managing risk in loan portfolios and preventing and predicting future losses. A static pool of loans is a grouping of loans with similar credit risk characteristics that were originated during a specific time period. The static nature of the pool is important because adding new loans to an existing pool can dilute the performance of the loan pool and provide inaccurate data.

By using static pool analysis, credit unions can increase the accuracy of predicting losses, repayment speeds, and rates of return. It provides a more precise picture of a loan pool's performance compared to other methods such as the annualized loss ratio.

Coyote Collisions: Are You Covered by Auto Insurance?

You may want to see also

Loss summary by dealer

A loss summary by dealer in a static pool report for auto insurance is a record of insurance claims and losses associated with a car. It is a type of loss history report, which is used by insurers when underwriting or quoting policies. The report assists insurers in calculating the risk of writing a new policy, with the claims history factoring into the premium the customer will pay. The more claims made, the higher the premium will be.

A loss summary by dealer in a static pool report for auto insurance will include the following information:

- The date of the reported loss

- The total cost of the loss paid by the insurance company

- Vehicle-identifying information

- The current status of the claim (open or closed)

- A description of the reason for the claim

- The type of claim (insurance policy)

- The name of the dealer

A loss summary by dealer can be used to assess the safety of a vehicle make and model. For example, a dealer may sell a particular model of car that is prone to collisions or property damage liability. This information can be used to predict the experience of the current version of the same vehicle model. However, when automakers substantially redesign their vehicles, the experience of an earlier model may not be indicative of the newer design.

A loss summary by dealer can also be used by prospective car buyers to review the history of a vehicle they are interested in purchasing. This can help identify any past damage to the vehicle that can be inspected before making a purchase.

Auto Insurance in Albany, NY: How Much Do You Need?

You may want to see also

Raw data including all data points

Static Pool Analysis Reports are used by lending companies to manage risk and predict and prevent losses. One of the three built-in reports included in the Static Pool Analysis Reports is the Raw Data Report. This report includes all data points in all periods and shows loss statistics by pool, including values as of the run date and each month-end.

The raw data report is essential for gaining a comprehensive understanding of the static pool's performance and identifying any underlying trends or patterns. It provides a detailed breakdown of the data, allowing for a granular analysis of the information. This level of detail enables lending companies to make informed decisions and adjust their strategies as needed.

The raw data report includes various data points, such as the number of accounts funded, current balance, and loss statistics. It covers different time periods, such as monthly, quarterly, or annual data. This flexibility enables companies to analyze performance over various intervals and identify any fluctuations or patterns that may impact their risk management strategies.

Additionally, the raw data report can be customized to meet specific needs. For example, it can be filtered by branch, class, dealer, and portfolio, allowing for a more targeted analysis. This customization ensures that companies can focus on the specific areas of interest and gain insights relevant to their unique contexts.

By utilizing the raw data report, lending companies can gain valuable insights into the static pool's performance and make data-driven decisions. This report empowers companies to identify trends, compare performance across different periods, and make strategic adjustments to optimize their risk management strategies and overall financial performance.

Uninsured and Unfortunate: How an Accident Can Change Your Fate

You may want to see also

Delinquency rates

A static pool of loans is a group of loans with similar credit risk characteristics that were originated during a specific time period. Once the pool is established, no loans are added or removed. This is important because adding new loans to a static pool can dilute the performance of the loan pool and provide inaccurate data. For example, if you have $1 million in loans from February 2014 and $10,000 of these loans are more than 30 days past due, your 30-day delinquency rate would be 1%. However, if you included an additional $1 million in loans from March 2014, your 30-day delinquency rate would fall to 0.5%, even though the March loans have not matured 30 days.

Static pool analysis can be used to manage risk in a loan portfolio and predict future losses. It provides a more accurate picture of a loan pool's performance than traditional methods used by credit unions. By tracking delinquency rates and other indicators over time, static pool analysis can help lenders identify possible factors that have absolute time characteristics, such as internal and external environmental factors that were present when the portfolio was constructed.

Overall, delinquency rates are an important metric in static pool analysis, helping lenders understand the performance of their loan portfolios and make more informed decisions about risk management and loss prediction.

PA Auto Insurance: No-Fault State?

You may want to see also

Repossessions and charge-offs

Static Pool Analysis is a valuable tool for analysing a portfolio and negotiating contract terms with new customers. It is also useful for determining when to concentrate more resources or effort into collections.

A static pool in the BHPH industry is a stationary (static) group (pool) of loans. The standard pool used in the industry is individual months. So, a static pool of loans is a grouping of loans with similar credit risk characteristics that were originated during a specific time period. Once the pool has been established, no loans are added or removed.

A static pool analysis is conducted by looking at each month of a static pool of loans, to see how many accounts were charged off or repossessed (by month) and what the total dollar amount of losses caused by those charge-offs/repossessions (by month).

A car loan charge-off occurs when a lender moves an auto loan during accounting from the asset category to the liability category. Lenders charge off an auto loan when the borrower stops making payments for a certain period, usually 120 days. This usually occurs after the lender has already attempted to collect the unpaid debt. Moving the debt to liability means they believe they won't be able to collect it.

The process of taking a car back is called repossession. When a borrower defaults on their loan, the lender can repossess the financed vehicle, sell it, and apply the proceeds to pay down the borrower's loan. The lender could even sue the borrower for the balance or "deficiency" remaining after the sale.

Before a bank will provide capital to a dealership, they will most likely need to analyse the dealership's portfolio to understand the amount and frequency of losses caused by repossessions and charge-offs.

The Rising Cost of Auto Insurance: What's Driving the Increase?

You may want to see also

Frequently asked questions

A static pool is a stationary group of loans with similar credit risk characteristics that were originated during a specific time period.

Static pool analysis is a risk analysis of a pool of risks linked to a specific time period, typically when these risks first entered the portfolio or started being tracked.

Key data measurements include the number of accounts funded, current balance, and various loss statistics.

Static pool analysis can help manage risk in a loan portfolio and prevent and predict future losses. It provides a more accurate picture of a loan pool's performance compared to other methods such as the annualized loss ratio.

Static pool analysis focuses on risks linked to a specific time period, typically when they first entered the portfolio. In contrast, running portfolio analysis examines the current population of risks, irrespective of their origination date.