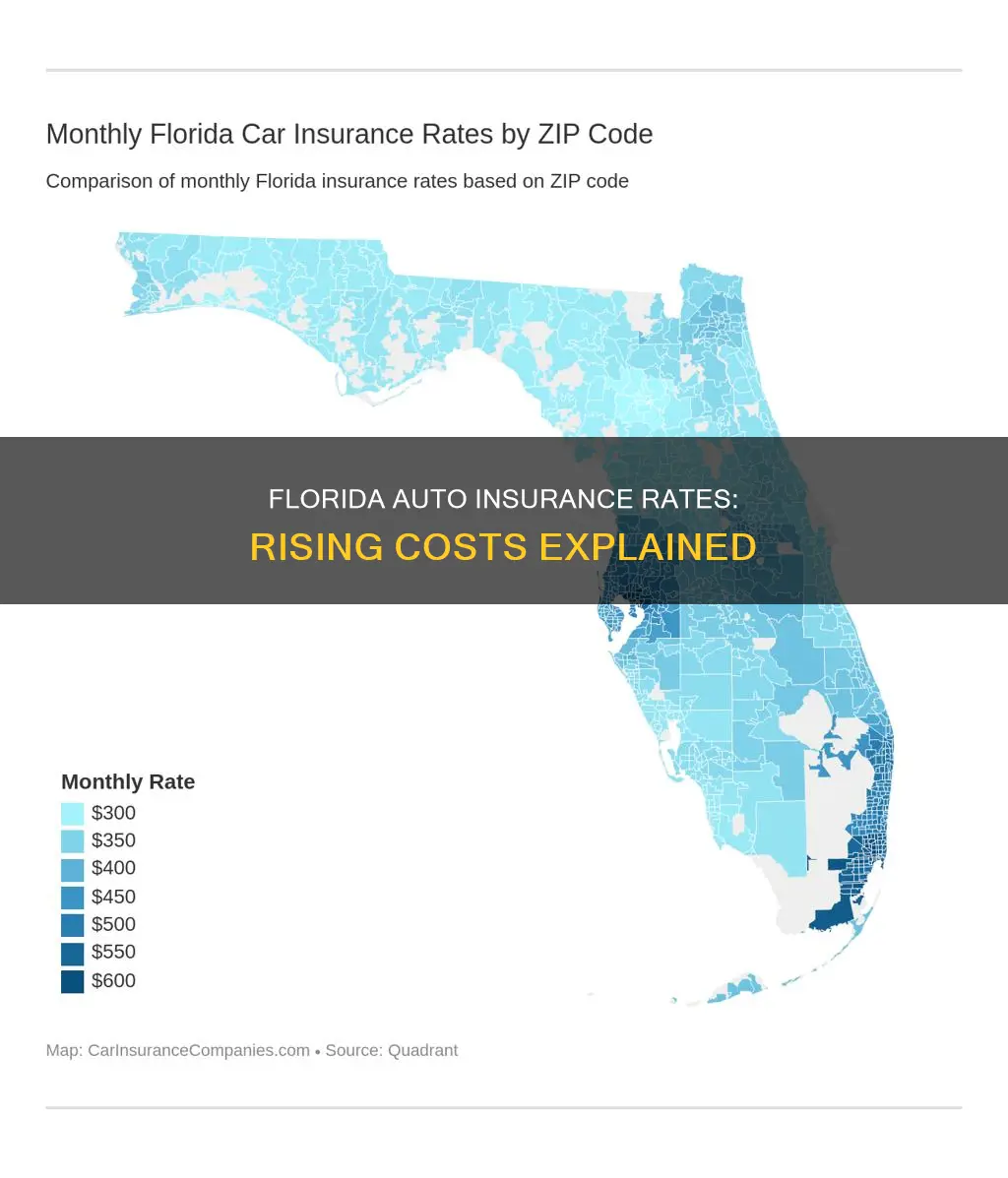

Auto insurance rates in Florida are on the rise, with costs increasing by an average of 23% since 2015—faster than the national increase of 17% in the same period. There are several factors contributing to this surge, including the state's susceptibility to natural disasters, high litigation costs, and the impact of the COVID-19 pandemic. Florida's location on the Gulf Coast makes it more vulnerable to hurricanes and storms, which can cause extensive vehicle damage. The state also has a high proportion of uninsured drivers, with 20% of drivers lacking coverage as of 2019, which drives up the cost of insurance for those who are insured.

Additionally, Florida has experienced an increase in natural disasters, with 21 billion-dollar disasters since 2016, leading to higher insurance costs. Litigation costs are another significant factor, with Florida leading the country in insurance-related litigation. The state's previous one-way attorney fees system, which shielded policyholders from paying attorney fees if they lost a claim, has contributed to this issue.

The COVID-19 pandemic also played a role in rising insurance rates, as driving decreased during the pandemic, leading to a drop in crashes and insurance rates. However, as people returned to the roads in 2021, accident rates increased, resulting in higher claims and insurance charges.

What You'll Learn

Reinsurance costs

Reinsurance, or "insurance for insurance companies", is a crucial factor in Florida's rising auto insurance rates. The state's vulnerability to natural disasters, such as hurricanes and storms, makes reinsurance essential for local insurers to manage risks and pay out claims.

Florida's insurance market is unique due to its heavy reliance on reinsurance. The market consists primarily of small and medium-sized insurers operating exclusively within the state. These local companies depend on reinsurance as a "shock absorber" to protect them from risks beyond their assumed capacity.

The increasing frequency and severity of natural catastrophes, exacerbated by climate change, have driven up reinsurance rates in Florida. Between January and June, reinsurance rates increased by 45% to 100%, with another hike of 20% to 40% in June renewals. These increased costs are inevitably passed on to consumers in the form of higher insurance premiums.

The impact of climate change cannot be overstated. Florida has experienced a growing number of destructive storms and hurricanes, including Hurricane Ian in 2022, which caused $114 billion in inflation-adjusted losses. As a result, reinsurance rates have soared, and insurers have been forced to raise premiums to cover potential claims.

To mitigate the burden on both insurers and policyholders, Florida has enacted two bills: the Reinsurance to Assist Policyholders (RAP) Fund and the Florida Optional Reinsurance Assistance Program (FORA). These programs provide reimbursement for a significant portion of insurers' covered losses and loss adjustment expenses related to hurricanes.

The increasing reinsurance costs in Florida are a significant contributor to the rising auto insurance rates in the state. As climate change continues to intensify natural catastrophes, the role of reinsurance and its impact on insurance premiums will remain crucial factors in Florida's insurance landscape.

Reducing Auto Insurance Costs: Tips for Lowering Your Bill

You may want to see also

Litigation costs

Florida's auto insurance rates are rising due to several factors, one of which is litigation costs. Litigation costs refer to the expenses incurred by insurance companies when dealing with legal proceedings, including attorney fees and settlements. Florida has a unique legal system that has contributed to the increase in litigation-related expenses for insurance companies.

Previously, Florida allowed a "one-way attorney fees" system for property insurance claims. This meant that insurance companies were required to pay the attorney fees of policyholders who successfully sued over claims. At the same time, policyholders were shielded from paying attorney fees if they lost the case. This system created an imbalance, encouraging more policyholders to take legal action without financial risk.

The "one-way attorney fees" system has since been repealed during Florida's late 2022 special session. However, this change is not retroactive, meaning that all policies in force before January 1, 2023, will still fall under the previous regulations. As a result, insurance companies charged higher premiums on these policies to offset the potential costs associated with the "one-way attorney fees" structure.

The high litigation costs in Florida are not limited to property insurance but also extend to auto insurance. Florida's status as a no-fault state means that all parties involved in a car accident must submit claims to their respective insurance companies, increasing the likelihood of attorney involvement. Attorney involvement can result in higher costs, which insurance companies then pass on to policyholders in the form of higher premiums.

The combination of the previous "one-way attorney fees" system for property insurance and the inherent legal complexities of auto insurance in a no-fault state has contributed to the rise in litigation costs for insurance companies in Florida. These increased costs are ultimately reflected in the higher insurance premiums paid by Florida residents.

BMW Leases: GAP Insurance Standard?

You may want to see also

High proportion of uninsured drivers

Florida has a high proportion of uninsured drivers, which is a significant factor in the rising cost of auto insurance in the state. The percentage of uninsured drivers in Florida is estimated to be as high as 26.7%, which is almost double the national average of 13-14%. This means that insured drivers are at a higher risk of being involved in an accident with an uninsured driver, which has an impact on their premiums.

The high rate of uninsured motorists in Florida is due in part to the high cost of car insurance in the state. Florida has some of the most expensive car insurance rates in the country, with an average monthly cost of $115 for minimum liability coverage and $270 for full coverage. This is much higher than the national average of $52 per month for minimum coverage and $167 per month for full coverage. As a result, many Florida drivers are choosing to forgo coverage, despite it being a violation of state law.

The high proportion of uninsured drivers in Florida have a significant impact on insured drivers. The 80% of drivers who do have coverage will ultimately foot the bill for the accidents that the uninsured 20% are responsible for. This can be through uninsured motorist coverage, collision coverage, or out-of-pocket expenses.

The high cost of car insurance in Florida is also due to other factors such as the increased risk of hurricanes, the rising cost of auto parts, and the high volume of vehicle theft and claim fraud. However, the high proportion of uninsured drivers is a significant contributor to the increasing auto insurance rates in the state.

To protect themselves from the financial burden of an accident with an uninsured driver, Florida drivers can purchase "uninsured and underinsured motorist insurance." This added coverage will protect them and their families from the potential heartache and financial strain that can follow a severe car accident in the state.

Auto Insurance Coverage: Are Most Americans Fully Covered?

You may want to see also

Weather-related exposure

Florida's geographic location makes it susceptible to hurricanes and storms, which are among the top causes of vehicle damage. The state's position on the Gulf Coast means it is more vulnerable to natural disasters than most other states. Twenty-three percent of all billion-dollar disasters (adjusted for inflation) in the United States since 1980 have occurred in Florida.

The frequency and severity of these weather-related events have increased in recent years, primarily due to climate change. For example, Hurricane Ian in 2022 caused almost $114 billion in inflation-adjusted losses, making it the third costliest hurricane in the country.

As a result of these destructive storms, auto insurers in Florida are forced to raise premiums to cover potential claims. The increasing frequency and severity of natural catastrophe claims have pushed Florida reinsurance rates up, which will be passed on to consumers.

In addition to hurricanes and storms, Florida also experiences high rates of deadly "hit-and-run" crashes and severe weather events that cause insurers to declare vehicles total losses. More than 100,000 vehicles were destroyed by Hurricane Ian in September 2022.

Understanding Automatic Windshield Insurance Claims and Coverage

You may want to see also

Vehicle repair costs

One key factor is the rise in the cost of auto parts. Supply chain issues have driven up the prices of raw materials and auto parts, making it more expensive to fix cars that have been in accidents or require maintenance. This increase in auto parts prices is not limited to Florida but is a nationwide issue. The higher costs of repairing vehicles mean that insurance companies have to pay out more for claims, which is reflected in the premiums charged to policyholders.

Florida's geographic location and susceptibility to hurricanes and storms also play a role in vehicle repair costs. The state's exposure to extreme weather events can cause vehicle damage, and the frequency and severity of these natural catastrophes are expected to increase due to climate change. As a result, insurers in Florida have to factor in the higher likelihood of weather-related vehicle damage when setting their premiums.

In addition, Florida has a high proportion of uninsured drivers, which drives up the cost of insurance for all drivers in the state. When an accident occurs involving an uninsured driver, the insured driver often has to bear the cost of repairs, leading to higher insurance claims and, consequently, higher premiums.

The combination of these factors has led to a significant increase in vehicle repair costs in Florida, which is a contributing factor to the rising auto insurance rates in the state.

Auto Insurance's Long Memory: Unraveling the Wreck History

You may want to see also

Frequently asked questions

There are several reasons why auto insurance rates in Florida are going up. Firstly, Florida is susceptible to hurricanes and storms, which are among the top causes of vehicle damage. Secondly, Florida has a high rate of uninsured drivers, which increases the financial burden on insured drivers. Thirdly, litigation costs have increased due to a legal system that previously allowed "one-way attorney fees", where insurers had to pay the policyholder's attorney fees if they won a claim but shielded them from these fees if they lost. Other factors include the state's high auto theft rates, claims fraud, and the impact of inflation on repair and parts costs.

Florida's geographic location makes it vulnerable to hurricanes and storms, which can cause extensive vehicle damage. As a result, auto insurance providers have to pay out a significant number of claims, leading to increased costs that are passed on to policyholders in the form of higher premiums.

Florida has one of the highest rates of uninsured drivers in the US, with approximately 20% of drivers lacking insurance as of 2019. This means that insured drivers bear the cost of accidents caused by uninsured drivers, leading to higher premiums.

Florida previously allowed a "one-way attorney fees" system, where insurers were required to pay the attorney fees of policyholders who successfully sued over claims but were shielded from paying these fees if the policyholder lost. This system increased litigation costs for insurance companies, which were then passed on to consumers in the form of higher premiums.