The average cost of car insurance varies depending on factors such as location, age, gender, driving history, and the type of insurance coverage. In the United States, the average monthly cost of car insurance is $196 for full coverage and $53 for minimum coverage. However, these costs can differ significantly based on individual circumstances. For example, the average cost of car insurance for a 20-year-old driver is $3,653 for full coverage and $1,046 for minimum coverage. Additionally, location plays a significant role, with states like Florida, Louisiana, and Texas having higher average insurance costs than states like Idaho, Vermont, and Ohio.

| Characteristics | Values |

|---|---|

| Average cost of car insurance in the US | $1,766 per year for full coverage |

| Average cost of car insurance in the US | $497 per year for minimum coverage |

| Average monthly cost of car insurance in the US | $196 for full coverage |

| Average monthly cost of car insurance in the US | $53 for minimum coverage |

| Average cost of car insurance in Ontario | $1,927 per year |

| Average monthly cost of car insurance in Ontario | $161 |

What You'll Learn

Average car insurance costs by state

The cost of car insurance varies depending on the state in which you live. The average cost of car insurance ranges from $29 per month in South Dakota to $154 per month in Michigan for minimum coverage. The national average for full coverage is $2,681 per year or $223 per month, while minimum liability coverage costs an average of $869 per year or $72 per month.

Factors Affecting Car Insurance Costs by State

Several factors affect the cost of car insurance in each state. These include:

- State regulations: Each state has different insurance requirements, such as personal injury protection or medical payment coverage, which can impact the cost.

- Weather conditions: States with severe weather events, such as hurricanes or tornadoes, may have higher insurance costs due to the increased risk of damage to cars.

- Population density: Urban areas with higher population densities tend to have higher insurance rates due to increased accident risks.

- Number of uninsured drivers: States with a high percentage of uninsured drivers may have higher insurance costs.

- Cost of car repairs and medical care: The cost of car repairs and medical treatment varies by state, impacting insurance costs.

- Frequency of lawsuits: States with a higher number of lawsuits related to car accidents may have higher insurance rates.

Most Expensive States for Car Insurance

The following states have the highest average car insurance rates:

- New York: $8,232 per year for full coverage.

- Louisiana: $4,357 per year for full coverage.

- Michigan: $4,067 per year for full coverage.

- Pennsylvania: $3,909 per year for full coverage.

- Nevada: $3,870 per year for full coverage.

Cheapest States for Car Insurance

On the other hand, these states have the lowest average car insurance rates:

- Maine: $1,460 per year for full coverage.

- Vermont: $1,539 per year for full coverage.

- Hawaii: $1,581 per year for full coverage.

- Idaho: $1,588 per year for full coverage.

- Ohio: $1,660 per year for full coverage.

Unlicensed and Underinsured: Exploring the Auto Insurance Conundrum

You may want to see also

Average car insurance costs by provider

The average cost of car insurance varies depending on the provider chosen. National providers tend to have the most expensive car insurance on average, while local providers sport the most affordable rates.

USAA

USAA is only available to military, veterans, and their families. It has an average annual cost of $1,335 for full coverage and $722 for minimum coverage.

Erie Insurance

Erie has an average annual cost of $1,532 for full coverage and $497 for minimum coverage.

Auto-Owners Insurance

Auto-Owners has an average annual cost of $1,619 for full coverage and $767 for minimum coverage.

Geico

Geico has an average annual cost of $1,766 for full coverage and $497 for minimum coverage.

Nationwide

Nationwide has an average annual cost of $1,829 for full coverage and $638 for minimum coverage.

State Farm

State Farm has an average annual cost of $2,068 for full coverage and $1,997 for minimum coverage.

Progressive

Progressive has an average annual cost of $2,300 for full coverage and $1,000 for minimum coverage.

Allstate

Allstate has an average annual cost of $3,374 for full coverage.

Auto Insurance Reimbursement for Totaled Vehicles: What's Covered?

You may want to see also

Average car insurance costs by age

The cost of car insurance is dependent on several factors, with age being one of the most critical. Teen drivers are considered to be high-risk due to their lack of driving experience and are therefore more likely to be involved in accidents, making their insurance rates the highest. The cost of insurance starts to drop as drivers enter their early 20s and continues to decrease until the age of 60 or 65, with middle-aged drivers considered the least expensive to insure due to their low accident and claims rates. After age 60 or 65, insurance rates begin to rise again as insurers associate advanced age with a higher risk of accidents due to factors such as slower reaction times and impaired vision.

Average Car Insurance Rates for Teens

For a 16-year-old driver, the average cost of full coverage insurance ranges from $3,192 to $7,149 per year, while the average monthly cost is around $613. Sixteen-year-olds are considered the most expensive drivers to insure due to their high risk of accidents.

Average Car Insurance Rates for Early 20s

For 20-year-olds, the average annual cost of full coverage insurance ranges from $3,537 to $3,943, while the average cost of a liability-only policy is around $1,192 to $1,275.

For 21-year-olds, the average annual cost of full coverage insurance is around $2,958 to $3,231, while the average cost of a liability-only policy is around $985 to $1,034.

For 22-year-olds, the average annual cost of full coverage insurance is around $2,750 to $2,965, while the average cost of a liability-only policy is around $918 to $950.

For 23-year-olds, the average annual cost of full coverage insurance is around $2,584 to $2,756, while the average cost of a liability-only policy is around $856 to $877.

For 24-year-olds, the average annual cost of full coverage insurance is around $2,594, while the average cost of a liability-only policy is around $812 to $823.

Average Car Insurance Rates for Age 25

At age 25, the cost of car insurance between males and females becomes almost equal, with males paying around $737 and females paying around $743 for a liability-only policy. For a full-coverage policy, 25-year-old males pay around $2,295, while 25-year-old females pay around $2,224.

Average Car Insurance Rates for Middle Age

Car insurance rates are cheapest for drivers in their 40s, 50s, and 60s. For example, the average annual cost of full coverage insurance for a 50-year-old is around $1,580.

Average Car Insurance Rates for Seniors

After age 60 or 65, car insurance rates start to increase again. For a 75-year-old driver, the average annual cost of full coverage insurance is around $2,492, while the average monthly cost is around $209. Seniors are considered higher-risk due to age-related factors such as impaired vision and slower reaction times.

Auto Insurance: Understanding Coverages for Financed Vehicles

You may want to see also

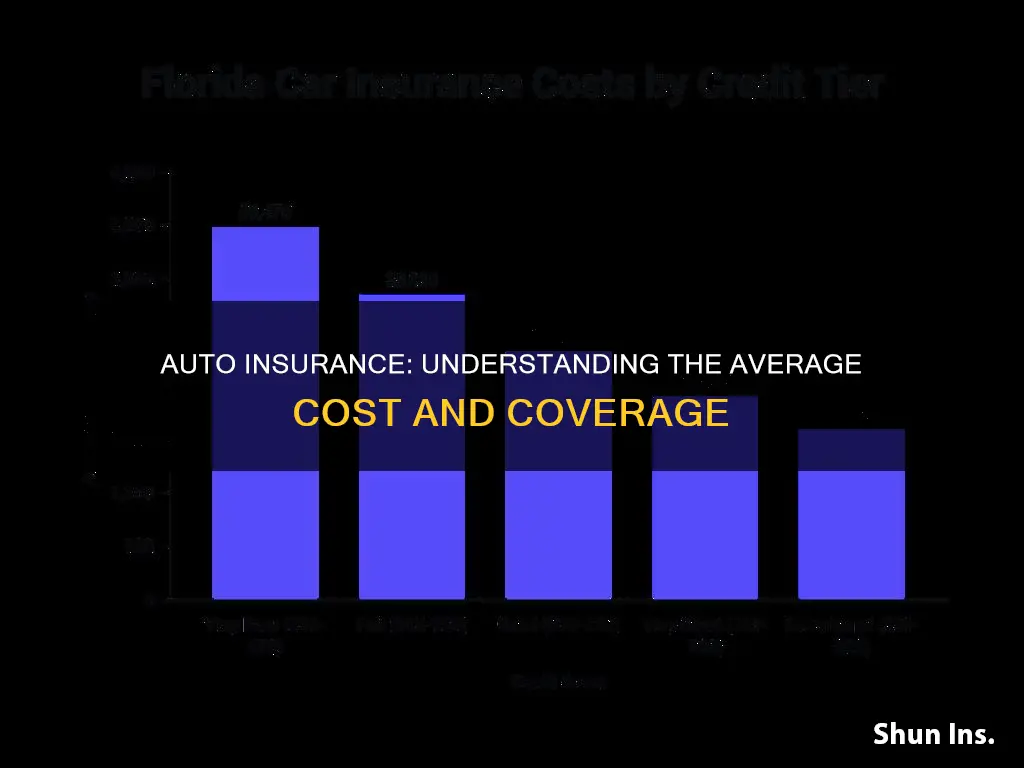

Average car insurance costs by credit score

Credit scores can have a significant impact on car insurance costs, with drivers with poor credit often facing substantially higher premiums than those with good or excellent credit. This is because insurers believe that those with lower credit scores are more likely to file insurance claims.

In the United States, the average annual cost of car insurance for drivers with excellent credit scores (above 800) is around $2,031, while those with poor credit scores (below 580) can expect to pay approximately $4,366 or more. This disparity is also reflected in the average monthly rates, with excellent credit score holders paying around $169 per month and poor credit score holders paying roughly $364 or more.

The impact of credit scores on car insurance rates varies across different states. For example, in Arizona, New Hampshire, New York, and New Jersey, drivers with poor credit tend to pay more than double the rates of those with excellent credit. On the other hand, states like Oklahoma, Nevada, North Carolina, Florida, and New Mexico have a smaller gap between the average rates for excellent and poor credit score holders.

It's important to note that some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit or limit the use of credit scores in determining car insurance rates. In these states, insurance companies rely on other factors to set their premiums.

Improving your credit score can be beneficial if you want to reduce your car insurance costs. Paying your bills on time, maintaining a low credit utilization ratio, and minimizing hard credit inquiries are some effective strategies to enhance your credit score.

Auto Insurance: Am I Covered?

You may want to see also

Average car insurance costs by driving record

The cost of car insurance varies depending on a driver's record. A driver with a clean record will pay less than a driver with a history of accidents, speeding tickets, or DUIs.

Drivers with a clean record and good credit can expect to pay $1,766 per year for full coverage and $497 per year for minimum coverage, according to NerdWallet. However, these rates will vary depending on other factors such as age, location, and vehicle type. For example, a 20-year-old driver with good credit and a clean record will pay around $3,653 for full coverage and $1,046 for minimum coverage.

The cost of car insurance also varies by state. For example, the average cost of full coverage in Wyoming is $970 per year, while in Florida, it is $3,090.

Drivers with a history of accidents will pay more for car insurance. On average, car insurance costs increase by about 48% for a driver who has caused a wreck. A DUI on a driver's record will also result in significantly higher rates, with costs going up by about 83% on average.

Speeding tickets can also impact car insurance costs, with drivers paying around 27% more on average if they have a recent speeding ticket.

Insuring Your Car Without a Bank Account

You may want to see also

Frequently asked questions

The average cost of auto insurance in the US varies depending on the source and the type of coverage. According to Bankrate, the monthly average cost of auto insurance is $196 for full coverage and $53 for minimum coverage. Meanwhile, NerdWallet reports that the national average annual cost of auto insurance is $1,766 for full coverage and $497 for minimum coverage. Forbes Advisor, on the other hand, states that the national average cost for car insurance is $2,118 per year.

Location is one of the most significant factors influencing auto insurance rates. Rates can vary by hundreds or even thousands of dollars from state to state and city to city. For example, in the US, Louisiana has the highest average car insurance costs, while Idaho has the lowest. Similarly, in Ontario, Canada, auto insurance rates in Brampton are approximately $2,900 annually, while rates in Kingston average about $1,700 per year.

Age is a crucial factor in determining auto insurance rates. Generally, younger and less experienced drivers pay higher premiums since they are considered higher-risk. Auto insurance rates tend to decrease as drivers get older and gain more experience. However, rates may increase again for elderly drivers due to factors such as decreased reaction time and poorer eyesight.

In most states, gender is a factor in auto insurance rates, with men typically paying higher premiums than women. This is because men are statistically more likely to engage in riskier driving behaviors and are involved in more accidents. However, the difference in rates between men and women tends to decrease as they age, becoming negligible after 25. It's important to note that some states, such as California, Hawaii, and Pennsylvania, prohibit the use of gender as a factor in auto insurance rates.

In addition to location, age, and gender, several other factors can impact auto insurance rates. These include driving record, credit score, vehicle type, marital status, coverage limits, and deductibles. A good driving record with no accidents or violations can result in lower premiums, while a poor credit score can lead to higher rates. The type of vehicle, its repair costs, and theft rates can also influence rates, with sports cars and luxury vehicles typically costing more to insure. Marital status can also play a role, with married individuals often receiving lower rates.