In Florida, drivers are required to have a valid registration to operate on Florida roads. This includes a metal plate, a registration certificate, and a registration decal. For those registering a vehicle for the first time or renewing their registration, car insurance is also required. While a physical copy of your vehicle registration must be kept in the car, Florida law allows you to display your insurance card electronically, as long as it resembles the physical card. Most police officers will accept a copy of your insurance and registration, although there is a chance you could be ticketed.

| Characteristics | Values |

|---|---|

| Are copies of auto insurance and registration valid in Florida? | Yes, copies of auto insurance and registration are valid in Florida. |

| Are digital copies of auto insurance and registration valid in Florida? | Yes, digital copies are valid, but only if the electronic display looks like the insurance card. |

| Are physical copies of auto insurance and registration mandatory in Florida? | Yes, physical copies are mandatory, and must be kept in the car at all times. |

| What are the consequences of not having valid auto insurance in Florida? | A suspended license or registration, and a reinstatement fee of up to $500. |

What You'll Learn

Florida requires proof of insurance to register a car

Florida requires proof of insurance when registering a car. This applies to both first-time registrations and renewals. Before registering a vehicle with at least four wheels in Florida, you must show proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) automobile insurance. PIP covers 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, regardless of who caused the accident. PDL coverage, on the other hand, pays for damage to another person's property caused by you or someone else driving your insured vehicle. The minimum PDL coverage limit is $10,000.

In addition to the insurance requirements, you must also obtain a registration certificate and license plate within 10 days of establishing residency, starting employment, or enrolling your children in a Florida public school. You will also need a Florida certificate of title for your vehicle unless an out-of-state lien holder/lessor holds the title.

It is important to note that you must maintain the required insurance coverage throughout the registration period. Failure to do so may result in the suspension of your driver's license and registration, and you may be required to pay a reinstatement fee of up to $500.

When it comes to providing proof of insurance, Florida allows for some flexibility. While you must have a physical copy of your vehicle registration, you can display your insurance card electronically, as long as the electronic display looks like the insurance card.

Collateral Protection Insurance: Vehicle Safeguards

You may want to see also

Vehicle registration must be shown in physical form

In the state of Florida, vehicle registration must be shown in physical form. This is because, although law enforcement computers can provide this information, technology doesn't always work. Therefore, a hard copy is required.

Florida traffic laws require a driver to have their vehicle registration and insurance in the car. While your vehicle's insurance card can be displayed electronically under Florida law, the electronic display must look like the insurance card. However, vehicle registration must be shown in physical form.

To register a vehicle in Florida, you must have a valid registration to operate on Florida roads. Out-of-state registrations are required by law to be registered within 10 days of the owner either becoming employed, placing children in public school, or establishing residency. A complete registration includes a metal plate, a registration certificate, and a registration decal. The number on the plate must match the number provided on the registration and decal, and the validation decal should be affixed in the square in the upper right-hand corner of the Florida license plate. This complete set serves as evidence of having paid the registration taxes and fees for a motor vehicle.

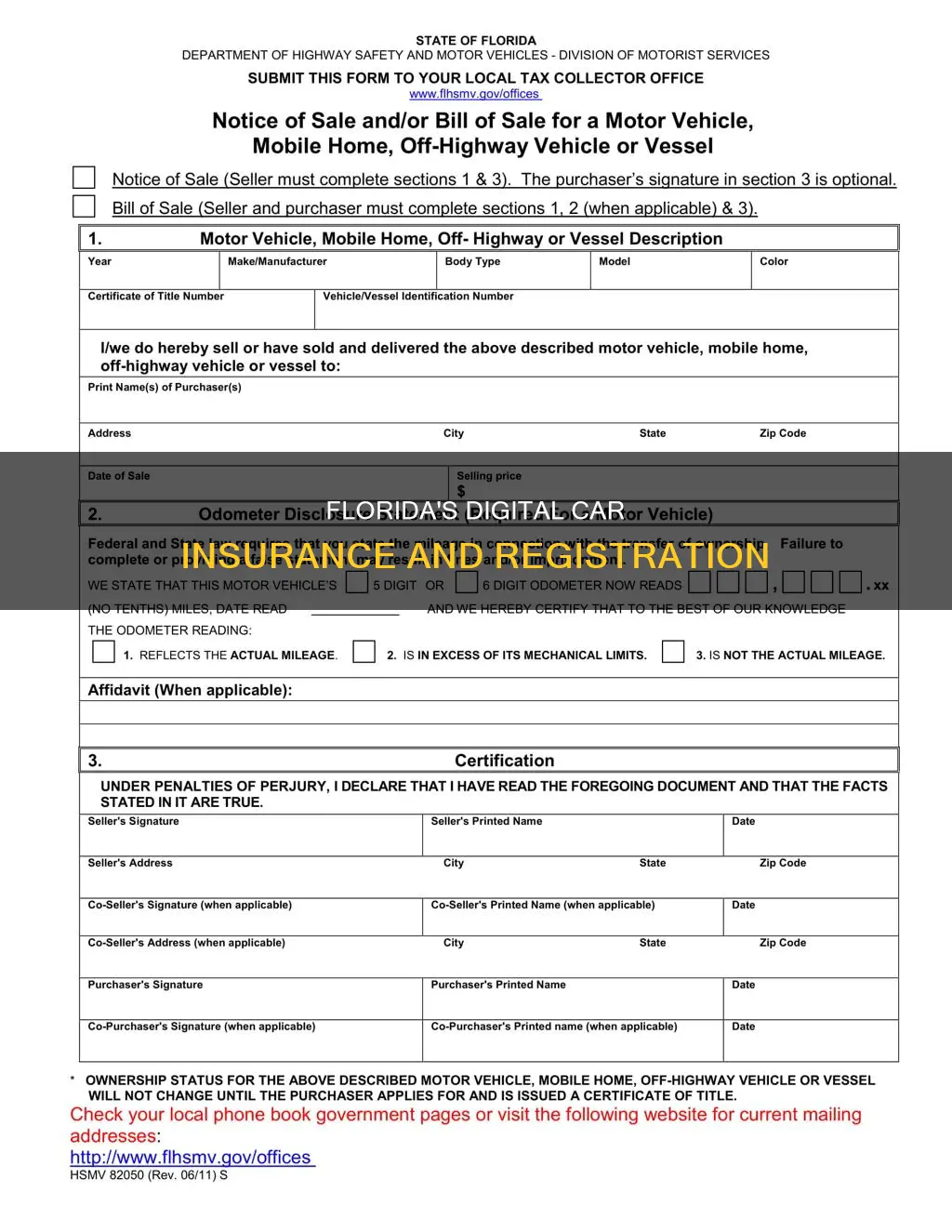

To obtain a Florida registration, you must submit proof of identity, proof of Florida insurance, and a completed Application for Certificate of Title With/Without Registration (HSMV form 82040). The registration certificate must be in the possession of the vehicle operator or carried in the vehicle at all times.

Gap Insurance: Monthly Payment or One-Time Fee?

You may want to see also

Florida is a no-fault state

In Florida, a vehicle must have a valid registration to operate on Florida roads. Out-of-state vehicles must be registered within 10 days of the owner either becoming employed, placing children in public school, or establishing residency. A complete registration consists of a metal plate, a registration certificate, and a registration decal.

Florida's no-fault insurance covers medical expenses, lost wages, and death benefits through PIP coverage and property damage through PDL coverage. Your insurance compensates you for these damages even if you are at fault for an accident.

Florida's no-fault system allows anyone injured in a car accident to more quickly receive access to medical treatment and compensation for their medical expenses and lost wages. This is because their auto insurance policy more immediately pays them for out-of-pocket expenses and a portion of their income if injuries prevent them from working. By contrast, compensation from a lawsuit comes much slower.

Personal injury protection (PIP) coverage is mandatory under Florida's no-fault laws. It includes a mandatory requirement for all Florida drivers to pay for medical expenses and death benefits. Florida drivers must carry PIP coverage in their auto insurance policies. The no-fault system is designed to provide up to 80% compensation for a policyholder's medical expenses, even if they are at fault for an accident. Injured passengers are also covered by PIP, which protects the policyholder from having to pay out of their own pocket.

Auto Insurance Payments: Tax Deductible?

You may want to see also

Non-residents must insure their vehicles with a Florida policy under certain conditions

Florida has specific requirements for vehicle insurance and registration. Before registering a vehicle with at least four wheels in Florida, you must show proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) automobile insurance. This means that non-residents must insure their vehicles with a Florida policy under certain conditions.

The minimum requirements for auto insurance coverage in Florida are $10,000 for PIP and $10,000 for PDL. PIP covers 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, regardless of who caused the crash. PDL coverage, on the other hand, pays for damage to another person's property caused by the insured vehicle.

Non-residents must obtain a Florida registration certificate and license plate within 10 days of starting employment or enrolling their children in a Florida public school. This means that non-residents who accept employment or engage in a trade, profession, or occupation in Florida, or who enroll their children in Florida public schools, must have their vehicles insured with a Florida policy. They must also have a Florida certificate of title for their vehicle unless an out-of-state lien holder/lessor holds the title and will not release it to Florida.

It is important to note that non-residents cannot cancel their Florida insurance until they have registered their vehicles in another state or surrendered all valid plates/registrations. Additionally, they must maintain the required insurance coverage throughout the registration period, or their driving privileges and license plates may be suspended for up to three years.

Criminal Enterprise Vehicles: Insured?

You may want to see also

Florida license plates must be replaced once a decade

In the state of Florida, all license plates must be replaced every 10 years as per section 320.06(1)(b) of the Florida Statutes. This is because, after 10 years, the reflective coating that makes the plates visible wears off.

Florida law requires a driver to have their vehicle registration and insurance in the car. While the vehicle's insurance card can be displayed electronically, the registration must be shown in physical form. This is because, although law enforcement computers can provide this information, technology doesn't always work.

To renew a registration, customers must provide the license plate or vehicle identification number (VIN) of the vehicle. If the department is unable to electronically verify valid insurance on the vehicle, no registration will be issued.

There are a few options for renewing a registration:

- Online at the MyDMV Portal, where a processing fee of $2.00 is charged.

- Via the MyFlorida mobile app, which is available on all mobile devices and allows customers to securely renew a registration. A processing fee of $3.75-$4.00 is applied to each transaction.

- In person at a local service center.

In the state of Florida, a vehicle must have a valid registration to operate on Florida roads. Out-of-state vehicles are required by law to be registered within 10 days of the owner either becoming employed, placing children in public school, or establishing residency.

When it comes to insurance, before registering a vehicle with at least four wheels in Florida, proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) automobile insurance is required. PIP covers 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, regardless of who caused the crash. PDL coverage pays for damage to another person's property caused by the insured vehicle.

It's important to note that license plates belong to the state and must be returned if the decal is unexpired and insurance is not maintained. Failure to surrender a valid license plate when insurance is canceled or expires can result in the suspension of your driver's license.

Best-Rated Auto Insurance Companies

You may want to see also

Frequently asked questions

Yes, you need to have proof of insurance to register a car in Florida.

The minimum auto insurance requirements in Florida are:

- Property Damage Liability: $10,000 minimum limit

- Medical Payments Coverage: $10,000 limits per person and per accident

You need to have a physical copy of your car registration. However, you can display your insurance card electronically as long as it looks like the physical insurance card.

Even if you're not a resident of Florida, you will need to insure your vehicle with a Florida policy if you accept employment or enroll your children in a Florida public school.

If you're caught driving without insurance in Florida, you could face a suspended license or registration, as well as a reinstatement fee of up to $500.