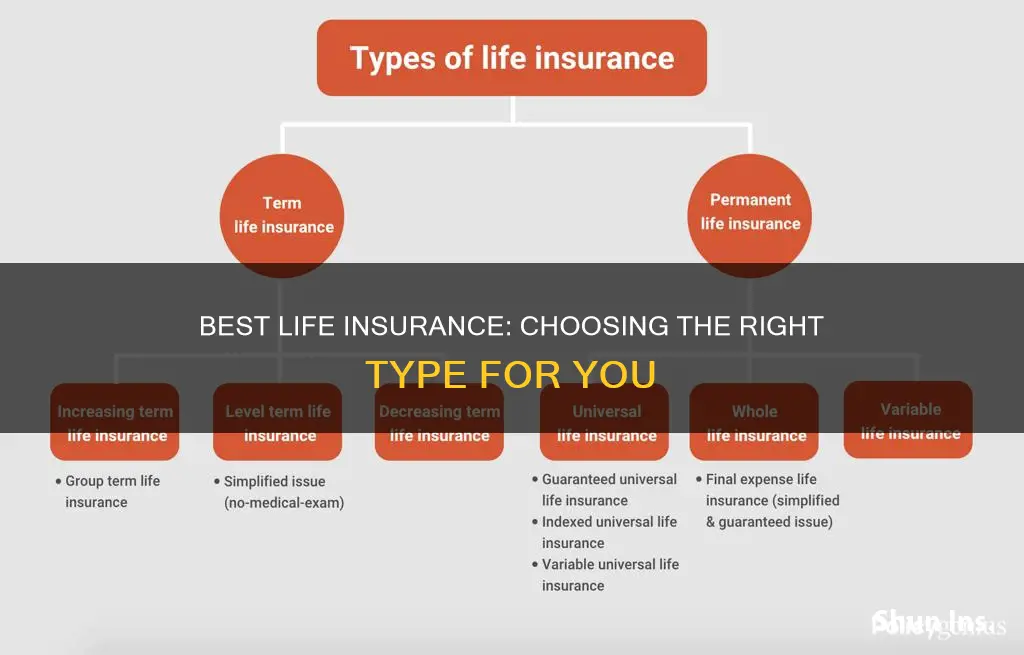

There are two main types of life insurance: term and permanent. Term life insurance covers you for a limited period, while permanent life insurance can cover you for the rest of your life. However, there are several other types of life insurance, including whole life, universal life, variable life, and final expense/burial insurance.

The best type of life insurance for you will depend on factors such as your budget, age, health, preferences, and risk tolerance. Term life insurance is typically the most affordable option, while whole life insurance offers a predictable and low-maintenance way to provide coverage for your entire life. Universal life insurance provides more flexibility, as you can adjust your premiums and death benefit over time. Variable universal life insurance allows you to invest your cash value into assets like mutual funds, giving you more control over your investments. Final expense/burial insurance is designed to cover end-of-life expenses and is often a good choice for those who are elderly or have pre-existing medical conditions.

| Characteristics | Values |

|---|---|

| Type | Term, Permanent |

| Duration | Temporary (10, 15, 20, 30 years), Permanent |

| Cost | Affordable, High |

| Flexibility | Fixed, Flexible |

| Cash Value | Yes, No |

| Premium | Level, Variable |

| Death Benefit | Fixed, Variable |

| Risk | Low, High |

What You'll Learn

Term life insurance

There are a few types of term life insurance to choose from:

- Fixed Term: The most popular choice. It is the most basic version and lasts 10, 20, or 30 years. The premiums remain static.

- Increasing Term: Allows you to scale up the value of your death benefit throughout the term. Your premiums will slightly increase over time, and these types of policies tend to cost more but usually deliver a larger payout.

- Decreasing Term: Reduces the premium payments over time, which can result in a smaller death benefit. This type of insurance makes sense for those who predict they will have fewer financial obligations as they age.

- Annual Renewable: Provides coverage on a yearly basis and must be renewed by the policy end date to continue coverage. The premiums usually increase each time the plan is renewed. This option is best for those in need of short-term coverage but can be more expensive.

Haven Life Insurance: MyVisaJobs' Comprehensive Guide

You may want to see also

Whole life insurance

Life insurance premiums are based on factors including age and health. The younger and healthier you are when you sign up, the lower the rate you can lock in for life. In addition to a fixed death benefit, whole life policies come with a cash value savings component. Every time you make a premium payment, part of the payment goes toward your cash value. Interest then accrues on that money according to a fixed rate.

You can withdraw from or borrow against your cash value account during your life. However, that amount will be deducted from the death benefit your beneficiary receives. You could choose to pay back a cash value loan to return to the original death benefit.

Who Gets the Payout? Contesting Life Insurance Beneficiaries

You may want to see also

Universal life insurance

One of the key advantages of universal life insurance is its flexibility. Policyholders can adjust their premiums and death benefits to suit their budget and needs. This flexibility can be especially useful for those with variable income or those who want to change their coverage as their life circumstances change. However, it is important to carefully monitor the cash value and ensure that premiums are sufficient to cover the cost of insurance, as a failure to do so may result in large payment requirements or policy lapse.

When choosing universal life insurance, it is essential to consider the potential risks. The cash value growth and death benefit are not guaranteed, and if the investments underperform or you underpay for too long, it could affect the death benefit or cause the policy to lapse. Additionally, some withdrawals from the policy may be subject to taxation.

Overall, universal life insurance is a good option for those who want permanent coverage with the flexibility to adjust their premiums and death benefit over time. It is important to carefully consider your needs, budget, and risk tolerance when deciding if universal life insurance is the best type of life insurance for you.

Teamsters Life Insurance: Interest Included or Excluded?

You may want to see also

Variable universal life insurance

The cash value of a VUL can be invested in subaccounts chosen by the account holder, which operate like mutual funds. This gives you control over how to invest your cash value, allowing you to pick the subaccounts that best fit your risk tolerance and investment objectives. The growth of the policy's cash value is tax-deferred, and policyholders may access their cash value by taking a withdrawal or borrowing funds.

However, it's important to carefully assess the risks before purchasing a VUL policy. The return on the cash component is not guaranteed year after year, and you can even lose money. If your cash value balance is too low, you may need to pay higher premiums to keep your policy active. VULs can also charge high fees because you're paying for both life insurance and investments.

Understanding Excess Group Life Insurance and PA Tax Laws

You may want to see also

Final expense life insurance

Final expense insurance policies generally have fixed premiums that do not change over time and do not expire as long as the premiums are paid. They also include a cash value component, which means that the insured may be able to take out a policy loan. Additionally, these policies usually do not require a medical exam for approval, making them more accessible to seniors with pre-existing health conditions. The application process is typically quick and easy, with coverage often issued within days or even on the same day.

When choosing a final expense insurance policy, it is important to consider the coverage amount needed to cover various end-of-life expenses, including funeral arrangements, burial costs, medical bills, and other outstanding expenses. The cost of final expense insurance depends on factors such as age, sex, health, coverage amount, and the chosen insurance company. It is a good option for those who need money to cover final expenses and funeral costs, especially seniors looking for an affordable way to ensure their end-of-life expenses are covered.

Whole Life Insurance: SEC Registration Requirements

You may want to see also

Frequently asked questions

Term life insurance covers you for a limited period, often 10, 15, 20, or 30 years. It is typically the most affordable option and is best for those who need coverage during a period of large financial responsibilities, such as paying off a mortgage or supporting a family.

Whole life insurance is a permanent policy that covers you for your entire life, as long as you pay the premiums. It offers a fixed death benefit and premium, as well as a cash value savings component. While it is initially more expensive than term life insurance, the premiums remain the same throughout your life.

Universal life insurance is another type of permanent policy that offers a flexible premium and death benefit. It also has a cash value component, but unlike whole life, the interest accrues based on market interest rates. This option is suitable for those who want permanent coverage but desire more flexibility in their payments.