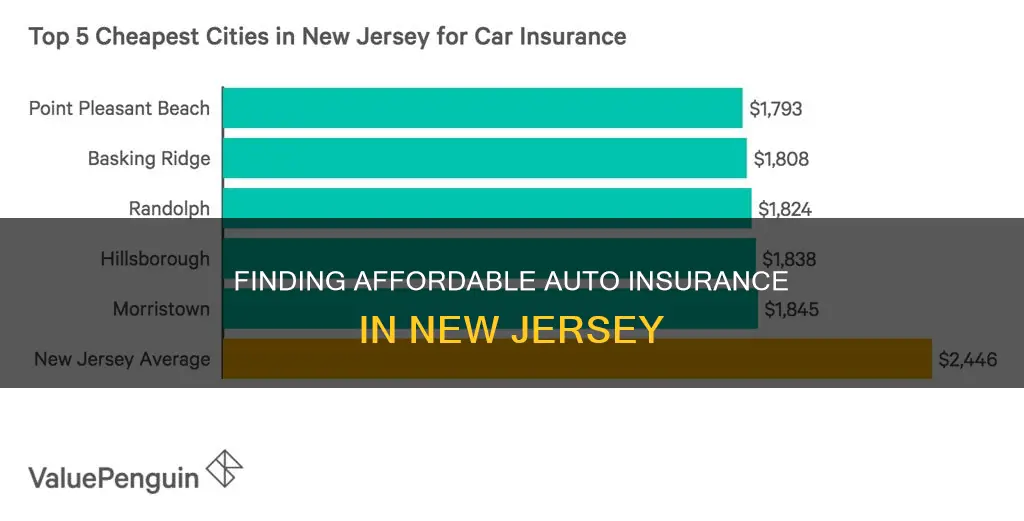

Finding cheap car insurance in New Jersey can be challenging, but it is possible to find affordable coverage that meets the state's minimum requirements. The average cost of car insurance in New Jersey is around $1,700 per year, which is higher than the national average. However, the cheapest car insurance company in the state, according to various sources, is Geico, with an average annual premium of around $1,100. Other cheap options include Selective, NJM, and Plymouth Rock. It's important to note that insurance rates can vary based on factors such as age, driving record, and location, so it's recommended to shop around and compare quotes from multiple companies to find the best rate for your specific needs.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in New Jersey | Geico |

| Average car insurance cost in New Jersey | $1,706 per year |

| Average cost of full-coverage car insurance in New Jersey | $2,412 per year |

| Average cost of minimum-coverage car insurance in New Jersey | $984 per year |

| Cheapest car insurance in New Jersey for minimum coverage | Selective |

| Cheapest car insurance in New Jersey for full coverage | Travelers |

| Cheapest car insurance in New Jersey for drivers with prior incidents | Selective |

| Cheapest car insurance for young drivers in New Jersey | Geico |

What You'll Learn

Cheapest car insurance for young drivers in New Jersey

Car insurance premiums for young adults tend to be pricey. Data shows that young drivers are more likely to be involved in fatal accidents than older age groups. Due to their lack of driving experience, car insurance companies usually charge young drivers the highest premiums.

When it comes to cheap car insurance in New Jersey for young drivers, Geico is the cheapest option for 16, 17, 18, 19, 21, 25, 30, 40, 50, 60, and 70-year-olds. For 20-year-olds, Geico is the cheapest option for minimum coverage, while Travelers offers the lowest rate for full coverage.

How to Get the Cheapest Car Insurance Rates

- Keep a clean driving record.

- Mind your credit score.

- Review your coverage.

- Consider your car choice.

- Select higher deductibles.

- Check out usage-based insurance.

- Ask about discounts.

- Shop around.

Vehicle Symbols: Insurance Decoded

You may want to see also

Cheapest car insurance for drivers with a ticket

For drivers with a ticket, Selective Insurance is the cheapest option in New Jersey. The average annual rate for minimum coverage is $984, and the average annual rate for full coverage is $2,412. Selective Insurance offers rates that are lower than these averages.

Selective Insurance is headquartered in New Jersey and offers a wide range of coverage options, including accident forgiveness, agreed value coverage, and original equipment manufacturer parts coverage. They also have a variety of discounts available, such as multi-policy, anti-theft and safety features, and good student discounts.

It is important to note that insurance rates can vary based on individual factors such as age, driving record, and credit history. Therefore, it is recommended to compare quotes from multiple insurance providers to find the best rate for your specific needs.

Cheapest car insurance for drivers with an at-fault accident

If you are a driver with an at-fault accident in New Jersey, you may be wondering how to find the cheapest car insurance. Here is some information to help you:

According to recent studies, the cheapest car insurance for drivers with an at-fault accident in New Jersey is offered by Selective Insurance. Their average rates for minimum coverage are around $90 per month, while their full coverage rates are approximately $192 per month. This makes them a more affordable option than other popular insurance companies in the state.

Factors Affecting Car Insurance Rates in New Jersey:

Several factors can influence your car insurance rates in New Jersey, including your driving record, age, gender, location, vehicle type, and credit score. Insurance companies consider these factors when assessing the risk of insuring a driver and set their rates accordingly.

Tips for Lowering Your Car Insurance Rates:

To lower your car insurance rates in New Jersey, consider the following strategies:

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Improve your credit score, as insurance companies view drivers with good credit as more responsible.

- Review your coverage regularly and adjust it as needed, especially after major life changes.

- Choose a vehicle with good safety ratings and lower repair costs, as these factors can impact your insurance rates.

- Consider usage-based insurance programs that track your driving habits and offer discounts for safe driving.

- Shop around and compare quotes from multiple insurance companies to find the best rates and coverage options.

By considering these factors and exploring different insurance providers, you can find the cheapest car insurance options in New Jersey, even if you have an at-fault accident on your record.

State Auto Insurance: A Smart Financial Move?

You may want to see also

Cheapest car insurance for high-risk drivers

High-risk drivers in New Jersey can expect to pay more for their car insurance than other drivers. This is because insurance companies consider high-risk drivers more likely to file a claim. Factors that can lead to a driver being considered high-risk include a history of driving violations, a DUI conviction, or a lack of driving experience.

According to Bankrate, the average cost of car insurance in New Jersey for a high-risk driver is around $2,906 per year, which is about $1,111 more than a driver with a clean record. MoneyGeek reports that the cheapest car insurance for high-risk drivers in New Jersey is offered by GEICO, with an average annual cost of $1,553. Progressive is another good option for high-risk drivers, with an average annual cost of $2,149.

For teen drivers, who are considered high-risk due to their lack of experience, GEICO again offers the cheapest average rates in New Jersey, at $2,912 per year. For drivers with a DUI on their record, Progressive is the cheapest option, with an average annual cost of $1,789.

Auto Insurance Rates: Why Do They Increase?

You may want to see also

Cheapest car insurance for drivers with poor credit

If you're a driver with poor credit in New Jersey, you'll be pleased to know that there are a few insurance companies that offer competitive rates.

According to Bankrate, Selective Insurance offers the cheapest rates for drivers with poor credit, with an average annual premium of $2,161.

Other insurance companies that offer affordable rates for drivers with poor credit in New Jersey include:

- Geico

- NJM

- State Farm

- Travelers

It's worth noting that insurance rates are highly personalized and depend on various factors, such as age, gender, location, vehicle type, and driving history. Therefore, it's always a good idea to compare quotes from multiple insurance providers to find the best rate for your specific needs.

Canceling Auto Insurance in Florida: What You Need to Know

You may want to see also

Frequently asked questions

According to a few sources, Geico offers the cheapest auto insurance in New Jersey.

The average cost of auto insurance in New Jersey is $1,706 per year, according to US News. However, Bankrate states that the average cost is $2,412 per year.

New Jersey is unique in that it has two minimum coverage options for its drivers. The basic policy includes $10,000 in optional bodily injury liability per accident, $5,000 property damage liability per accident, and $15,000 personal injury protection. The standard policy includes $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, $25,000 property damage liability per accident, and $15,000 personal injury protection.

In addition to Geico, some of the cheapest auto insurance companies in New Jersey are Selective, NJM, and Travelers.