Car insurance rates are influenced by a multitude of factors, some of which are within the policyholder's control, such as their driving record, age, and ZIP code, while others are beyond their control, such as state laws and the number of accidents and violations in their area. It is common for insurance rates to increase, especially after auto accidents or traffic violations. Additionally, life changes, such as moving or changes in marital status, can also contribute to rising insurance rates.

| Characteristics | Values |

|---|---|

| Accidents | Both at-fault and not-at-fault accidents can cause an increase in insurance rates. |

| Traffic violations | Speeding tickets and other moving violations can lead to higher insurance rates. |

| Comprehensive claims | Damage-related incidents, such as car theft, vandalism, or weather-related damage, can result in an increase. |

| Address change | Moving to a new location, especially an area with higher rates of accidents or violations, can increase insurance rates. |

| Vehicle or driver addition | Adding a new vehicle or driver, especially a teen driver, can drive up insurance costs. |

| Claims in your area | An increase in claims or crime rates in your ZIP code or neighborhood can lead to higher insurance rates. |

| Age | Insurance rates can increase for older adults, particularly those in their 70s and beyond. |

| Marital status | Marital status changes can impact insurance rates, with married individuals often paying less. |

| Credit score | A decline in credit score can result in higher insurance premiums. |

| Inflation | Inflationary pressures, including rising labor and repair costs, contribute to higher insurance rates. |

| Repair costs | An increase in the cost of vehicle repairs can lead to higher insurance rates. |

| Supply chain issues | Supply chain disruptions can make vehicle repairs more expensive and time-consuming. |

| Environmental events | Severe weather or natural disasters in your state can lead to an increase in insurance rates. |

What You'll Learn

Accidents and violations

At-fault accidents on your driving record indicate a higher risk of future accidents, and insurance companies will price you accordingly. The national average rate increase is 45% for drivers who cause an accident with property damage, and 47% for causing an accident that results in injuries. If you cause a car accident, your car insurance rates will go up by an average of $80 per month for full coverage.

However, even accidents you didn't cause can increase your rate in states that allow it, as insurers have data showing that some drivers have a propensity for not-at-fault accidents. If you live in a state that allows it, your insurance company may raise your rates after an accident that wasn't your fault.

The overall severity of the car accident and the resulting cost of an insurance claim can also affect a rate increase. A minor parking lot fender bender typically won't have the same impact as a major accident. In certain states, your insurer can't raise rates if the claim is under a certain dollar amount. For example, in New York, you can't get a surcharge if there were no injuries and the total damage caused by the accident is less than $2,000.

Your rates are also likely to go up if you've filed multiple claims over the past few years, as your insurance company may consider you a risky driver.

Farmers Insurance: Auto and Home Coverage Explored

You may want to see also

Life changes

Moving or Changing Address

Moving to a new location, especially to an area with a high rate of theft, accident, or weather-related claims, can lead to an increase in your insurance rates. Insurance companies consider the collective risk in an area, so if your new neighbourhood has higher claims or accident rates, your premiums are likely to go up.

Marital Status Changes

Marital status can also impact your insurance rates. Married people often pay lower insurance premiums than their single counterparts. So, if you get divorced or separated, your insurance rates may increase. On the other hand, if you get married, you may be able to benefit from lower rates by bundling your homeowners and auto insurance policies.

Adding a Teen Driver

Adding a teen driver to your policy will almost certainly result in an increase in your insurance rates. Teen drivers have a much higher accident rate than older drivers and are therefore considered riskier to insure. However, some insurance companies offer young driver discounts, so be sure to ask your agent about these.

Ageing

Age is a significant factor in determining insurance premiums. As people age, their insurance rates may increase, especially once they reach their 70s and beyond. Insurance companies often view older drivers as riskier, similar to teen drivers, due to potential changes in health and driving ability.

Income Changes

If you've received a raise or entered retirement, you may want to revisit your insurance policies. Increasing your coverage for things like bodily injury and property damage can provide greater financial protection in the event of an accident. While this will result in higher premiums, it could save you money in the long run.

Vehicle Changes

Purchasing a new or more expensive vehicle will likely lead to an increase in your insurance rates. This is because more costly cars are more likely to be stolen and are generally more expensive to repair or replace. Additionally, certain makes and models of vehicles are considered riskier to insure due to factors like rare parts or high performance.

Daughters of Veterans: USAA Auto Insurance Eligibility

You may want to see also

Inflation

During the early stages of the pandemic, when many cars were off the road, insurance premiums decreased. However, when drivers returned to the roads, there was a notable increase in risky driving behaviours, resulting in more frequent and severe accidents. This contributed to a rise in insurance claims and costs, which has led to higher premiums.

The cost of repairing or replacing a vehicle has increased due to supply chain disruptions and parts shortages, as well as rising wages for auto mechanics. This has made even minor accidents expensive, as plastic or steel bumpers are often replaced with more costly technology like cameras and proximity sensors.

In addition to accident claims, insurance companies have also experienced losses due to natural disasters, some of which may be linked to climate change. As a result, insurance companies have had to increase premiums to cover these additional costs.

While inflation is a significant factor in the rising cost of auto insurance, it is important to note that other factors, such as driving record, age, location, and vehicle type, also play a role in determining insurance rates.

Switching Auto Insurance: Mid-Year Changes

You may want to see also

Repair costs

There are several reasons why the cost of repairing vehicles has been rising. Firstly, the price of car parts has increased, and these parts are becoming harder to find due to disruptions in the supply chain. Secondly, labour costs have risen as garages have had to increase wages to attract workers in an era marked by labour shortages. Thirdly, the increasing sophistication of vehicle technology, such as advanced safety features, has made vehicles more expensive to fix. Finally, inflation has also contributed to the rising cost of repairs, as it has to all areas of the economy.

In addition to the rising cost of repairs, insurance companies also consider the likelihood of a vehicle needing repairs when setting their rates. This is influenced by factors such as the make and model of the vehicle, the age and driving record of the driver, and the location where the vehicle is typically kept. For example, insurance companies may charge higher rates for vehicles that are more expensive to repair or for drivers who have a history of accidents or traffic violations.

When it comes to repairing a vehicle after an accident, there are a few options to consider. If the damage is minor and the repair costs are less than a certain threshold (often around $1,800), the insurance company may not increase the policyholder's premiums. In this case, it may be more cost-effective to pay for the repairs out of pocket to avoid losing any discounts or having a claim on your record. However, if the damage is more extensive and the repair costs are higher, it is generally recommended to file a claim with the insurance company, as the increased premiums will likely be lower than the cost of repairs, medical bills, and property damage.

Self-Insuring Your Auto: Legally Protecting Your Assets

You may want to see also

Location

Traffic

The more time you spend in your car, the higher the likelihood of being in a collision. A longer commute could mean paying more for coverage, even if you relocate to an area with better driving conditions or a safer environment. Moving from a rural area to an urban area can cause premiums to increase by up to 40%. This is because urban areas have more cars and busier highways, increasing the chances of accidents.

Crime

Insurance companies look at an area's vehicle-related crime statistics, such as theft or vandalism. If your vehicle is statistically more likely to be damaged or stolen, companies will charge a higher rate to insure it. Moving to an area with a high likelihood of theft and vandalism can increase the cost of coverage.

Weather

Regions that experience severe natural disasters, such as tornadoes, hurricanes, and wildfires, handle more claims. Moving to one of these regions could result in an increase in your rates. Weather conditions like hail, flooding, and strong winds can leave your vehicle vulnerable to damage.

State Laws

State laws regarding auto insurance vary. If you move to a new state, you might need to purchase a new policy or additional coverage to comply with a new set of rules. For example, no-fault states require drivers to carry personal injury protection, which results in higher insurance rates.

Other Location Factors

Even moving within the same ZIP code can affect your insurance rates. Factors such as changes in parking arrangements, proximity to work, or adjustments in population density can impact your insurance costs.

Unveiling the Mystery: Navigating Credit Score's Impact on Auto Insurance

You may want to see also

Frequently asked questions

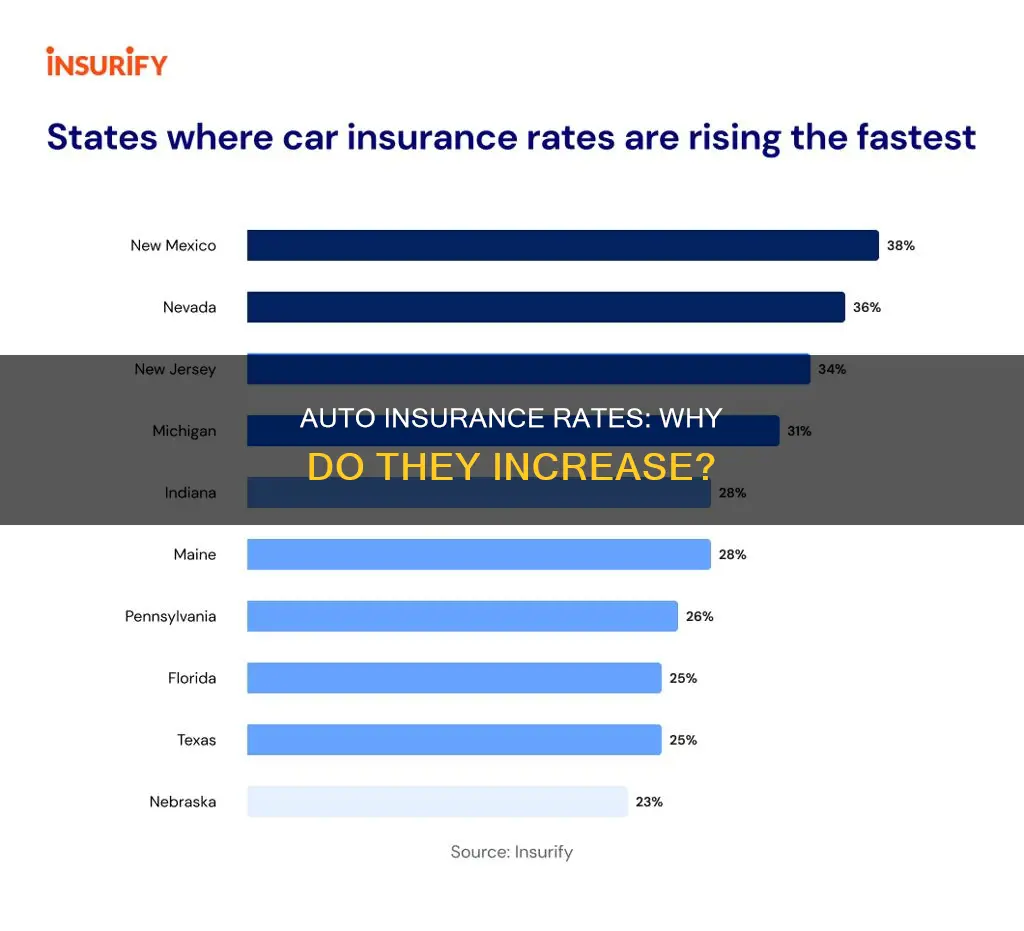

There are several factors outside of your control that can cause your insurance rates to increase, such as the number of crashes and the cost of repairs in your area. For example, if you live in a large metropolitan area, you are likely to pay more because there are more cars on the road, which increases the number of crashes.

Unfortunately, it is normal for auto insurance rates to increase most years. However, insurance companies do sometimes cut rates, and some companies offer loyalty discounts, so your rate may decrease after several years with the same provider.

Your auto insurance can increase if the cost of repairs, labour, or healthcare services increases, as insurance companies raise rates to account for higher costs in these areas. Additionally, a major environmental event that damages many cars in your area can increase rates for all drivers in that state.