Commercial auto insurance is a type of insurance policy that covers vehicles used for commercial purposes, such as conducting a service, transporting goods or people, or travelling to multiple job sites. The amount of insurance required for a commercial vehicle is typically determined by state or federal law, which considers factors such as the vehicle's weight, number of passengers, and whether it carries hazardous materials. Commercial vehicles can be classified based on their gross vehicle weight (GVW) or gross vehicle weight rating (GVWR), which is the maximum loaded weight specified by the manufacturer. Light trucks, for example, have a GVW of 10,000 pounds or less, while heavy trucks have a GVW of 20,001 to 45,000 pounds. Understanding the weight classification of a commercial vehicle is crucial for ensuring adequate insurance coverage in the event of an accident during work-related tasks.

Commercial Auto Insurance Vehicle Weight Characteristics and Values Table

| Characteristics | Values |

|---|---|

| Gross Vehicle Weight (GVW) | 10,000 pounds or less (Light Truck) |

| 10,001-20,000 pounds (Medium Truck) | |

| 20,001-45,000 pounds (Heavy Truck) | |

| 45,000 pounds or more (Extra Heavy Truck) | |

| Gross Vehicle Weight Rating (GVWR) | Class 1: 0-6,000 pounds |

| Class 2: 6,001-10,000 pounds | |

| Class 3: 10,001-14,000 pounds | |

| Class 4: 14,001-16,000 pounds | |

| Class 5: 16,001-19,500 pounds | |

| Class 6: 19,501-26,000 pounds | |

| Class 7: 26,001-33,000 pounds | |

| Class 8: 33,000 pounds+ | |

| Insurance Requirements | State or federal law defines insurance requirements based on vehicle weight or number of passengers |

What You'll Learn

Commercial vehicle classifications

There are three main business use classifications: service, retail, and commercial. Service vehicles are those that carry people, equipment, and tools to and from work sites but are not involved in doing work. They are typically smaller, lighter trucks, such as pickups or vans, and usually do not weigh more than 4 tons. Retail vehicles are those that transport property to and from individual households. Commercial vehicles are any other type of transportation except service and retail, and typically include larger trucks.

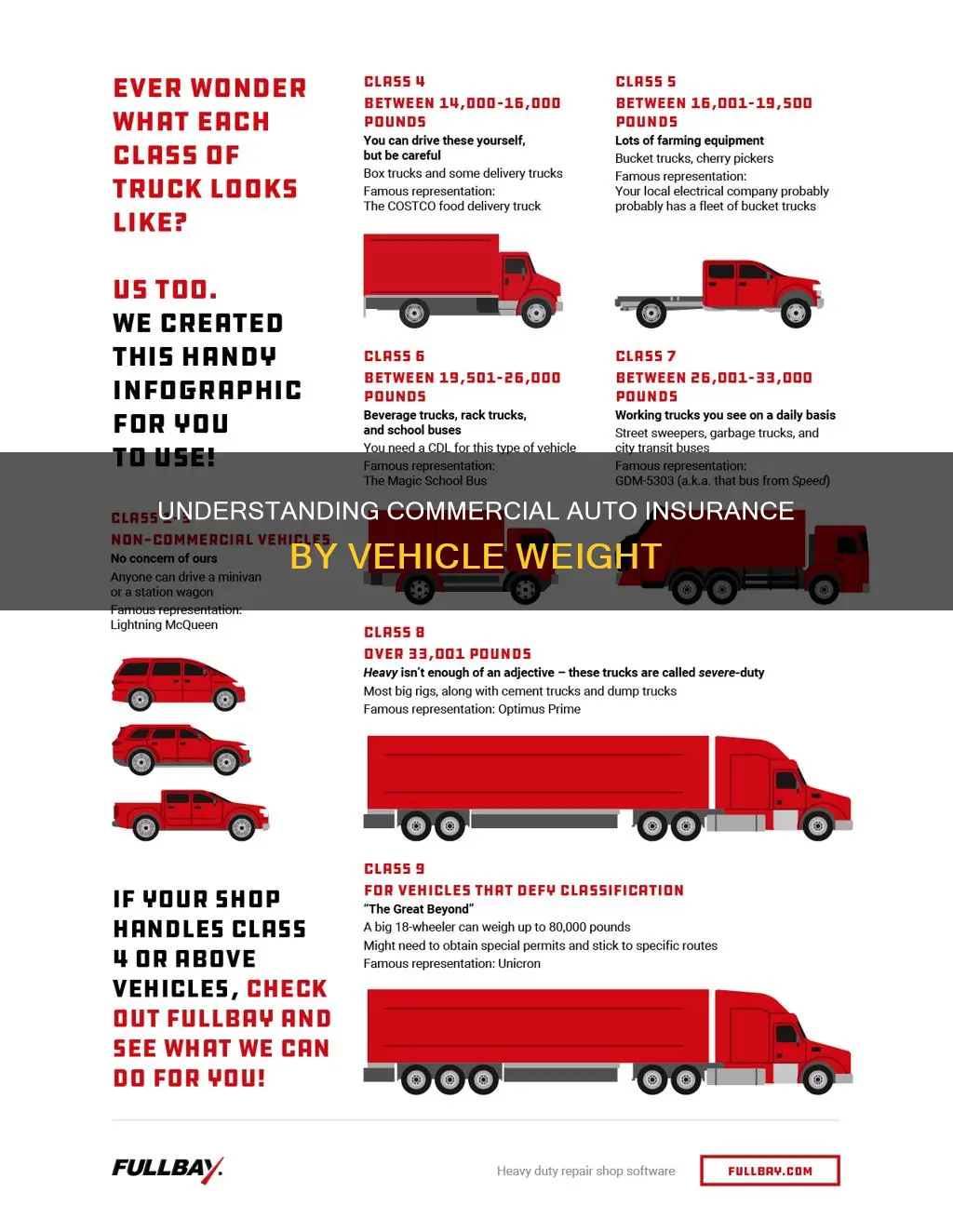

Trucks are ranked according to their gross vehicle weight rating (GVWR), which combines the vehicle's total wet weight and its cargo-carrying capacity. There are eight weight classes for trucks, ranging from Class 1 (0 to 6,000 pounds) to Class 8 (33,000 pounds and above). Classes 1 and 2 are considered light trucks, classes 3 through 6 are medium trucks, and the rest are heavy trucks.

In addition to weight ratings, commercial trucks also vary in configuration. Common types include articulated semi-trucks, vans, coaches, buses, taxis, box trucks, and heavy equipment used in industries such as mining, construction, and farming.

Auto Insurance: How Long Should Your History Be?

You may want to see also

Gross vehicle weight

The GVWR includes the curb weight (the weight of the empty vehicle) plus the weight of passengers, fuel, vehicle accessories, cargo, and the tongue weight of a tow trailer. This rating can be found on the Safety Compliance Certification Label, often located on the driver's door, or in the vehicle's owner's manual.

GVW is an important factor in determining the insurance requirements for a vehicle. In the context of commercial auto insurance, vehicles with a GVW exceeding certain weight classes are typically classified as commercial vehicles and require a commercial auto policy.

Commercial trucks are often classified based on their GVW:

- Light Truck: GVW of 10,000 pounds or less

- Medium Truck: GVW between 10,001 and 20,000 pounds

- Heavy Truck: GVW between 20,001 and 45,000 pounds

- Extra Heavy Truck: GVW of 45,000 pounds or more

Auto Insurance in Florida: Affordable or Not?

You may want to see also

Commercial truck insurance

One of the key factors in determining the type of commercial truck insurance needed is the weight of the vehicle. Trucks are typically classified into several categories based on their gross vehicle weight rating (GVWR) or gross vehicle weight (GVW). These categories include light trucks, medium trucks, heavy trucks, and extra-heavy trucks. Each class has a specific weight range, with light trucks weighing up to 10,000 pounds, medium trucks weighing between 10,001 and 20,000 pounds, heavy trucks weighing between 20,001 and 45,000 pounds, and extra-heavy trucks weighing 45,000 pounds or more.

In addition to weight, the type of cargo being hauled and the nature of the business can also impact the insurance requirements. For example, businesses that transport hazardous materials or those that require their employees to drive to multiple job sites per day may need additional coverage. Commercial truck insurance can also vary depending on whether the truck is owned by the business or leased from a motor carrier.

When it comes to choosing a commercial truck insurance provider, there are several reputable companies in the market. GEICO, for instance, offers competitive rates, outstanding service, and customisable policies to meet the unique needs of the trucking industry. They also provide a user-friendly online platform that allows customers to easily manage their policies. Another option is Progressive Commercial, which has over 50 years of experience and specialises in providing coverage for trucks and trailers of all sizes in California.

Overall, commercial truck insurance is a crucial aspect of running a trucking business. By understanding the weight classifications and specific needs of their operations, business owners can ensure they have the necessary coverage to protect themselves from financial losses and comply with federal and state regulations.

Switching Auto Insurance: Exploring the Potential Pitfalls and Pain Points

You may want to see also

Commercial auto policy

Commercial auto insurance is necessary for vehicles used in tasks related to the operator's occupation, profession, or business. This includes vehicles owned by a business entity, those driven by employees, co-workers, volunteers, or clients, and those that transport goods, people, or provide a service.

The amount of insurance required for a commercial vehicle is determined by state or federal law, which typically defines insurance requirements based on a vehicle's weight or number of passengers. For example, vehicles with a gross vehicle weight (GVW) of over 15,000 pounds typically require a commercial auto policy.

Vehicles are classified into different categories based on their gross vehicle weight rating (GVWR), which is a system designed to prevent the overloading of commercial trucks. The GVWR is determined by the vehicle manufacturer by considering the combined weight of the strongest and weakest weight-bearing components. The GVWR is then used to determine the vehicle's commercial class, with certain regulations applying to each class.

The eight commercial classes are as follows:

- Class 1: Light-Duty Vehicles (GVWR of 0-6,000 pounds)

- Class 2: Light-Duty Vehicles (GVWR of 6,001-10,000 pounds)

- Class 3: Medium-Duty Vehicles (GVWR of 10,001-14,000 pounds)

- Class 4: Medium-Duty Vehicles (GVWR of 14,001-16,000 pounds)

- Class 5: Medium-Duty Vehicles (GVWR of 16,001-19,500 pounds)

- Class 6: Medium-Duty Vehicles (GVWR of 19,501-26,000 pounds)

- Class 7: Heavy-Duty Vehicles (GVWR of 26,001-33,000 pounds)

- Class 8: Heavy-Duty Vehicles (GVWR greater than 33,000 pounds, including all tractor-trailers)

Vehicles in the two heaviest classes require a Class B commercial driving license (CDL) to operate. Commercial vehicles in Class 3 and above are also subject to federal and state safety regulations and must stop at weigh and inspection stations.

Cure Auto Insurance: Rate Hikes and the Reasons Behind Them

You may want to see also

State insurance requirements

Commercial auto insurance requirements vary by state. Each state sets its own minimum coverage requirements for bodily injury liability and property damage liability.

- Alabama: The minimum liability coverage for commercial auto policies is 25/50/25. Semi-trucks and other large vehicles travelling between states require at least $750,000 in CSL coverage.

- Alaska: All commercial auto policies must have a minimum liability limit of 50/100/25. Passenger-carrying vehicles need insurance with bodily injury coverage of $500,000 and property damage coverage of $200,000.

- Arizona: The minimum liability limit for commercial auto policies is set at a 25/50/15 split. For vehicles transporting property or non-hazardous materials, the minimum insurance levels are: 20,001-26,000 pounds: $300,000 CSL; More than 26,000 pounds: $750,000 CSL.

- Arkansas: Arkansas's commercial auto policy minimum liability limit is 25/50/25. Passenger transportation services are required by law to take out insurance with the following minimum liability coverage: 1-12 passengers: 50/80/30; 13-20 passengers: 50/120/30; 21-30 passengers: 50/160/30; 31 or more passengers: 50/200/30.

- California: California has a minimum liability limit of 15/30/5 on commercial auto policies. Vehicles with a USDOT or MC number crossing state lines must have a CSL of no less than $750,000.

- Colorado: The minimum liability coverage is 25/50/15. Vehicles with a USDOT or MC number operating across state lines must have at least $750,000 in CSL coverage under FMCSA rules.

It is important to note that these are just a few examples, and commercial auto insurance requirements can vary significantly from state to state. It is always best to check with your specific state's regulations to ensure you are meeting the necessary requirements.

Insurance Safeguards for Pedestrians Without Vehicle Cover

You may want to see also

Frequently asked questions

Commercial auto insurance is necessary for vehicles used in tasks related to the operator's occupation, profession, or business. This includes vehicles used for conducting a service, transporting goods or people for a fee, or driving to multiple job sites per day.

Vehicle weight is classified by gross vehicle weight (GVW) or gross vehicle weight rating (GVWR). GVW is the maximum loaded weight for which a vehicle is designed by the manufacturer. GVWR is a combination of the vehicle's total wet weight (with fluids and fuel) and its cargo carrying capacity.

There are eight weight classes for commercial vehicles:

- Class 1: 0 to 6,000 pounds (Light-Duty)

- Class 2: 6,001 to 10,000 pounds (Light-Duty)

- Class 3: 10,001 to 14,000 pounds (Medium-Duty)

- Class 4: 14,001 to 16,000 pounds (Medium-Duty)

- Class 5: 16,001 to 19,500 pounds (Medium-Duty)

- Class 6: 19,501 to 26,000 pounds (Medium-Duty)

- Class 7: 26,001 to 33,000 pounds (Heavy-Duty)

- Class 8: 33,000 pounds or more (Heavy-Duty)

Yes, different states have varying insurance requirements based on vehicle weight, the number of passengers, and other factors such as the carriage of hazardous materials. For example, in Arizona, non-hazardous property carriers weighing between 20,001 and 26,000 lbs. require a commercial auto insurance policy with a minimum liability coverage of $750,000.

Larger vehicles like dump trucks, cargo vans, and vehicles weighing over 15,000 pounds typically require a commercial auto policy.