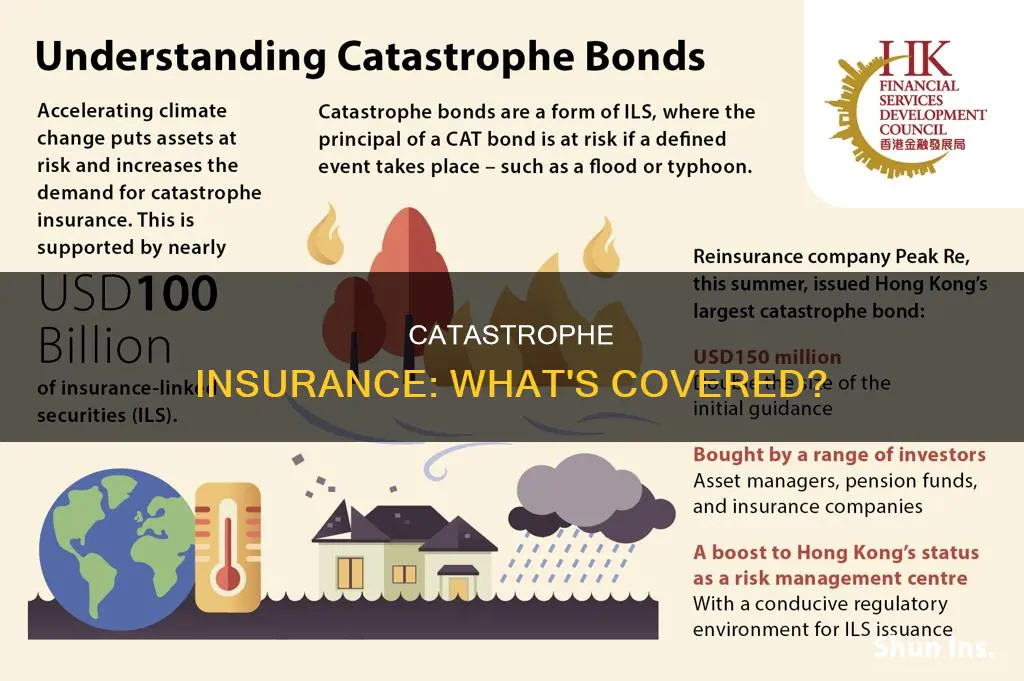

Catastrophe insurance is a type of insurance that covers damage caused by natural disasters and human-made disasters. It is designed to protect businesses and residences from financial losses resulting from events such as earthquakes, floods, hurricanes, riots, and terrorist attacks. These events are typically excluded from standard homeowners insurance policies due to their low probability but high cost.

The definition of a catastrophe in the insurance industry is an event that results in potential insurance claims exceeding $25 million. The types of disasters covered by catastrophe insurance can vary, and some may be included in homeowners, renters, or auto policies, while others require separate coverage. For example, flood insurance is usually a separate policy for homes located in flood-prone areas, and earthquake insurance is typically needed in high-risk areas along fault lines.

The cost of catastrophe insurance depends on various factors, including the type of structure insured, the geographical location, and the level of coverage desired. It is important for individuals to understand their insurance policies and the exclusions to ensure they have adequate protection in the event of a catastrophe.

| Characteristics | Values |

|---|---|

| Definition | An unusually severe natural or man-made disaster |

| Dollar threshold | $25 million |

| Number of policyholders and insurance companies affected | More than a certain number |

| Examples | Earthquakes, hurricanes, floods, riots, terrorist attacks |

| Special catastrophe insurance policies | Flood insurance, storm insurance, earthquake insurance, volcano insurance |

| Typical homeowners insurance policy coverage | Fire, windstorms, hail, riots, explosions, theft, living expenses |

What You'll Learn

- Natural disasters, such as earthquakes, floods and hurricanes, are considered catastrophes

- Human-made disasters, like riots or terrorist attacks, are also included

- Catastrophe insurance is separate from standard homeowners insurance

- Special catastrophe insurance is available for specific disasters

- Catastrophe insurance is challenging for issuers to manage risk effectively

Natural disasters, such as earthquakes, floods and hurricanes, are considered catastrophes

Earthquakes, floods and hurricanes are among the most destructive natural catastrophes. Earthquake insurance is typically excluded from standard homeowners insurance policies, and individuals living in high-risk areas, such as those along fault lines, are advised to purchase separate coverage. Earthquakes can cause extensive damage to dwellings and personal property, and insurance policies may have specific limits or exclusions for certain types of losses related to earth movement.

Floods are another significant catastrophe, and flood insurance is usually offered separately from homeowners insurance. Floods can occur in various forms, including overflowing rivers, tidal waters, and flash floods. While some regions are more prone to flooding than others, it is important to note that flooding can occur in both high-risk and moderate-to-low-risk areas.

Hurricanes, tropical storms, and related flooding account for a significant proportion of catastrophe losses. These storms can cause extensive wind and water damage, and in some cases, separate hurricane insurance or a comprehensive hurricane policy may be required. It is important to carefully review insurance policies to understand the coverage provided for hurricane-related damage, as standard policies may have exclusions or limitations.

In addition to these natural disasters, other events such as tornadoes, wildfires, and acts of terrorism can also be considered catastrophes. The impact of these events varies based on geographical location and the vulnerability of the affected areas. Obtaining adequate insurance coverage for these catastrophes is crucial to protect against financial losses and ensure peace of mind.

Address Change: Insurance Woes

You may want to see also

Human-made disasters, like riots or terrorist attacks, are also included

Terrorism insurance, for example, is often excluded from homeowners policies and must be purchased separately. Acts of terrorism are typically not spelled out in a homeowners policy, and coverage depends on whether you have a “named perils” or “all perils” policy. If you have a "named perils" policy, you will only be covered for acts of terrorism if that peril is specifically named. If you have an "all perils" policy, terrorism is usually covered unless it is listed under the policy exclusions.

Riots are another type of human-made disaster that may be covered by homeowners insurance. The typical homeowners insurance policy covers damage from fire, windstorms, hail, riots, and explosions, as well as other types of loss such as theft and the cost of living elsewhere while the structure is being repaired or rebuilt. However, it's important to carefully review your policy to understand what is and isn't covered.

In addition to terrorism and riots, other human-made disasters that may be covered by catastrophe insurance include civil disorders, vandalism, and malicious mischief. These events can cause significant financial losses, and having the appropriate insurance coverage can provide important protection.

When considering catastrophe insurance for human-made disasters, it's important to assess the risks in your area and the specific coverage offered by the policy. Working with an independent insurance agent can help you find the right coverage for your needs and ensure that you're properly protected in the event of a disaster.

FQHCs: Insurance-Covered Facilities?

You may want to see also

Catastrophe insurance is separate from standard homeowners insurance

Catastrophe insurance is a separate type of coverage from standard homeowners insurance. While homeowners insurance may cover some catastrophes, it typically excludes coverage for natural catastrophes like floods and earthquakes, as well as man-made disasters such as terrorist attacks or nuclear destruction.

Catastrophe insurance, on the other hand, provides protection against severe disasters that inflict major financial losses, including both natural and human-made disasters. It covers low-probability, high-cost events that are generally excluded from standard homeowners insurance policies. These events can include earthquakes, floods, hurricanes, riots, and terrorist attacks.

The distinction between catastrophe insurance and standard homeowners insurance is particularly important for homeowners and small-business owners who live in high-risk zones. They may need to purchase catastrophe insurance separately to ensure adequate protection for their assets.

For example, flood insurance is typically a separate policy for homes, especially for those located on flood plains. Similarly, earthquake insurance is usually a separate coverage for high-risk areas along fault lines, such as California, Alaska, and Hawaii.

The need for catastrophe insurance depends on the specific geographic area and the risks associated with it. Certain geographical areas are at higher risk for events like hurricanes, tornadoes, windstorms, wildfires, or floods.

In summary, catastrophe insurance fills the coverage gaps in standard homeowners insurance policies by providing protection against severe disasters, both natural and human-made, that are typically excluded from standard coverage.

Navigating the Insurance Billing Maze: Unraveling the 'Which Insurance to Bill' Conundrum

You may want to see also

Special catastrophe insurance is available for specific disasters

Catastrophes are defined as unusually severe natural or man-made disasters that result in potential insurance claims in excess of $25 million. Catastrophe insurance is designed to protect businesses and residences against these disasters. While some disasters are covered by homeowners, renters, or auto policies, others require separate coverage.

Special catastrophe insurance is available for specific natural disasters, including:

- Floods: Flood insurance is typically a separate policy for homes located on flood plains. It is available through the federal government's National Flood Insurance Program (NFIP). Flood insurance covers flooding from overflowing rivers, creeks, tidal waters, and flash floods. It is important to note that there is usually a 30-day waiting period for flood insurance policies to take effect.

- Hurricanes and Tropical Storms: Coverage for these storms often requires a separate policy or a rider on homeowners insurance, especially in high-risk areas. Hurricane insurance covers wind and water damage but generally excludes flooding.

- Earthquakes: Earthquake insurance is separate coverage in high-risk areas along fault lines, typically in California, Alaska, and Hawaii. It covers damage caused by earthquakes, as well as other forms of earth movements such as mudslides, mudflows, and sinkholes.

- Tornadoes and Windstorms: Windstorm insurance is designed for regions prone to gale-force winds and minimal rain. Tornado and windstorm coverage is typically part of a homeowners policy, but additional coverage may be needed in areas like "Tornado Alley."

- Volcanoes: Volcano insurance is available as a separate endorsement, though fire coverage in home insurance may cover a portion of the loss.

- Tsunamis: Coverage for tsunamis and related flooding is typically separate from homeowners insurance and only available in high-risk areas along coastlines or on islands like Hawaii.

- Acts of Terrorism: Damage from terrorism may be included in homeowners insurance, but some policies exclude these events and require separate coverage.

The availability and cost of special catastrophe insurance depend on the geographical area and the specific disaster being covered. It is important to consult with an independent insurance agent to determine the appropriate coverage for your needs and risks.

Data Analytics Revolutionizes Insurance: Unlocking New Insights and Opportunities

You may want to see also

Catastrophe insurance is challenging for issuers to manage risk effectively

The challenges of catastrophe risk management are compounded by the fact that catastrophic events often result in extremely large numbers of claims being filed at once. This can overwhelm issuers and lead to delays in claims processing and payment. To manage this risk, insurers use reinsurance and retrocession, which help spread the risk and financial burden of catastrophic events.

Additionally, catastrophe insurance covers a wide range of events, including natural disasters such as earthquakes, floods, hurricanes, and human-made disasters like riots or terrorist attacks. The varied nature of these events can make it difficult for issuers to accurately assess and price the risk.

Furthermore, the cost of catastrophe insurance can vary significantly depending on several factors, such as the type of structure insured, the location's risk level, and the coverage amount desired. This complexity in pricing can make it challenging for issuers to manage their exposure and ensure they are charging premiums that adequately reflect the risk.

Another challenge for issuers is that catastrophe insurance policies often have time constraints. For example, there may be a waiting period before a policy takes effect, such as the 30-day waiting period for flood insurance policies. This can lead to situations where policyholders are not covered for a catastrophe that occurs soon after purchasing a policy.

Overall, the unpredictable and infrequent nature of catastrophes, the high volume of claims, the varied events covered, the complex pricing structure, and the time constraints associated with catastrophe insurance policies all contribute to the challenge of managing risk effectively for issuers.

The Hidden Costs of a Heart Attack: Unraveling the Financial Toll Without Insurance

You may want to see also

Frequently asked questions

Catastrophe insurance covers businesses and residences against human-made and natural disasters like earthquakes and floods. Standard homeowners insurance may exclude covering losses due to landslides, earthquakes, power failures, war, government action, faulty zoning, inadequate maintenance, poor workmanship, and certain types of water damage.

Catastrophe insurance covers natural disasters such as earthquakes, floods, hurricanes, and tornadoes, as well as human-made disasters like riots or terrorist attacks.

The cost of catastrophe insurance varies depending on the types of risks covered, the type of structure insured, and the amount of coverage desired. The cost is typically higher for those living in high-risk areas.