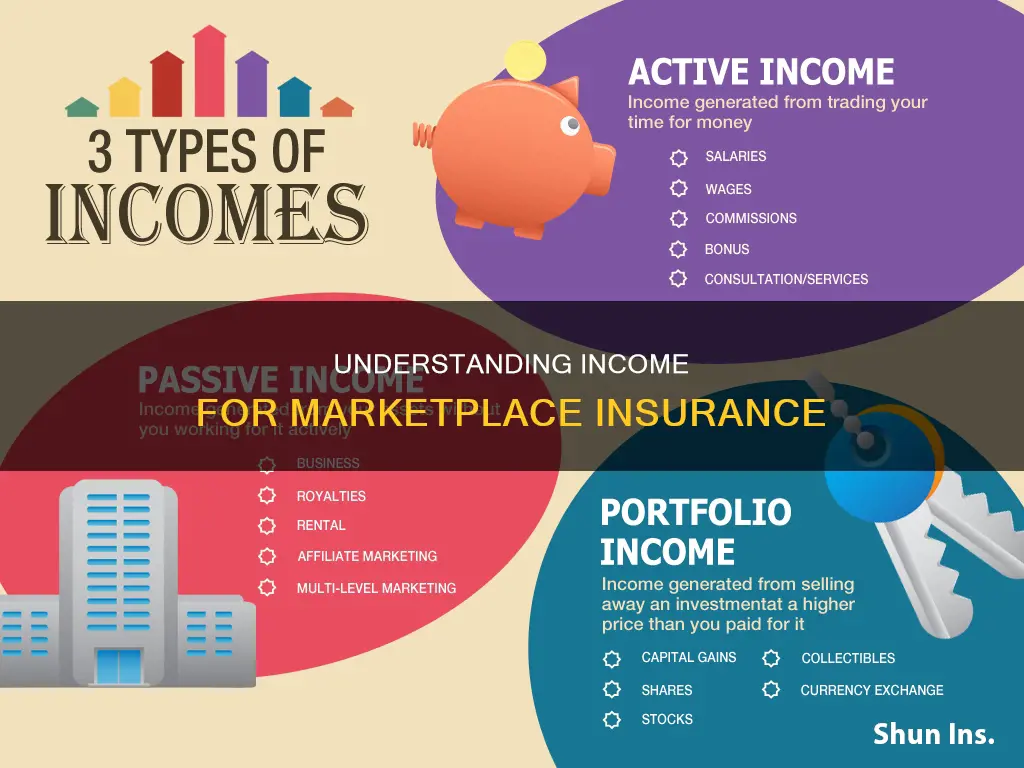

When applying for Marketplace insurance, you will need to estimate your expected household income for the year you want coverage. This includes the income of the tax filer, their spouse, and anyone they claim as a tax dependent. The Marketplace uses a figure called modified adjusted gross income (MAGI) to determine eligibility for savings. MAGI includes your total gross income for the tax year, minus certain adjustments, as well as tax-exempt foreign income, non-taxable Social Security benefits, and tax-exempt interest. It's important to note that Marketplace savings are based on your expected income for the year you want coverage and not your income from the previous year.

| Characteristics | Values |

|---|---|

| Modified Adjusted Gross Income (MAGI) | Adjusted Gross Income (AGI) plus untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest |

| Adjusted Gross Income (AGI) | Total (or "gross") income for the tax year, minus certain adjustments |

| Federal Taxable Wages | "Federal taxable wages" on pay stub, or "gross income" minus amounts taken out for child care, health coverage, and retirement plans |

| Self-employment income | Net self-employment income (business income minus business expenses) |

| Unemployment compensation | Include all unemployment compensation received from the state |

| Social Security Income | Include all Social Security Income, taxable and non-taxable |

| Retirement or pension income | Include most IRA and 401k withdrawals, but not qualified distributions from a designated Roth account |

| Interest and dividends | Include expected interest and dividends earned on investments, including tax-exempt interest |

| Rental and royalty income | Net rental and royalty income |

| Veterans' disability payments | Include veterans' disability payments |

| Worker's Compensation | Include worker's compensation |

| Child Tax Credit | Include Child Tax Credit checks or deposits |

What You'll Learn

Modified adjusted gross income (MAGI)

MAGI is calculated by adjusting one's gross income or adjusted gross income (AGI) for certain tax deductions and credits. Gross income includes money earned from all sources, including wages, tips, investment income, pension, and rents. AGI is one's gross income minus certain tax-deductible expenses. MAGI is then calculated by taking one's AGI and adding back certain deductions which may include:

- Student loan interest

- Qualified tuition expenses

- Tuition and fees deduction

- Passive income or loss

- Non-taxable Social Security payments

- Exclusion for income from U.S. savings bonds

- Foreign earned income exclusion

- Foreign housing exclusion or deduction

- Exclusion for adoption expenses

- Overall loss from a publicly traded partnership

MAGI is used to determine eligibility for:

- Deducting traditional IRA contributions

- Contributing to a Roth IRA

- Taking the premium tax credit

Unlocking the Accelerated Death Benefit in Term Insurance: A Guide to Early Payouts

You may want to see also

Adjusted gross income (AGI)

AGI is calculated by subtracting certain adjustments to income from your total income for the year (your gross income). Adjustments to income are specific deductions that directly reduce your total income to arrive at your AGI. The types of adjustments that you can deduct are subject to change each year, but a number of them consistently show up on tax returns year after year. Some of these adjustments include:

- Half of the self-employment taxes you pay

- Self-employed health insurance premiums

- Alimony payments made to a former spouse (for agreements prior to 2019)

- Contributions to certain retirement accounts (such as a traditional IRA)

- Student loan interest paid

- Educator expenses

- Moving expenses for military members

- Deductible HSA contributions

- Deductible IRA contributions

- Deductible self-employment taxes

- Penalties on early withdrawals of savings

Your AGI can directly impact the deductions and credits you are eligible for, which can wind up reducing the amount of taxable income you report on your tax return. For example, your AGI has to be below certain levels to claim the Lifetime Learning Credit.

The Internal Revenue Service (IRS) uses AGI to determine your income tax liability for the year. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act (ACA).

OHP Insurance: Changing Health Needs

You may want to see also

Tax-exempt foreign income

If you are a US citizen or resident alien, you are taxed on your worldwide income. This means that you must report all sources of income to the US government, including foreign income. However, there are certain circumstances in which you may be exempt from paying taxes on your foreign-earned income.

Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion (FEIE) allows you to exclude a limited amount of your foreign-earned income from your US income taxes. For the tax year 2023, you may be able to exclude up to $120,000 of foreign-earned income from your US income taxes. This amount is adjusted annually for inflation and has increased to $126,500 for the tax year 2024.

To be eligible for the FEIE, you must meet certain requirements:

- You must have foreign-earned income.

- You must be a US citizen who is a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

- You must be a US resident alien who is a citizen or national of a country with which the US has an income tax treaty in effect and who is a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

- You must be a US citizen or US resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

- Your tax home must be in a foreign country.

Your tax home is defined as the general area of your main place of employment, where you are permanently or indefinitely engaged to work, regardless of where you maintain your family home. It is important to note that your place of residence can be different from your tax home.

The FEIE can help you avoid double taxation on income earned overseas. However, it is not automatic, and you must spend a certain number of days outside the US per year and prove your ties to your new country. Additionally, you must file a US tax return and claim the exclusion by filing IRS Form 2555 with your return.

Foreign Tax Credit

The Foreign Tax Credit (FTC) is a non-refundable tax credit for income taxes paid to a foreign government due to foreign income tax withholdings. It allows you to receive a credit for every dollar you owe, so you don't pay taxes on the same income again on your US tax filing. The FTC is available to anyone who works in a foreign country or has investment income from a foreign source.

To claim the FTC, you must file Form 1116.

Other Considerations

It is important to note that the FEIE and FTC do not apply to passive income such as interest and dividends. Additionally, business owners may be subject to self-employment tax inside the US, which is not considered part of the FEIE. However, you may still be able to exclude your earnings after paying the self-employment tax.

If you are a US government employee or are paid by the US government, you will not be able to use the FEIE to minimise your US expat taxes.

It is always advisable to consult a tax expert or advisor to determine your specific situation and eligibility for tax exemptions on foreign income.

Maximizing Reimbursement: Navigating Medical Insurance Billing for Drug Deliveries

You may want to see also

Taxable wages

The amount of wages to be taxed is based on the total income earned minus certain deductions allowed under the Internal Revenue Service (IRS) tax code as outlined in IRS publication 15, the employer's tax guide. Examples of pre-tax deductions include contributions to a 401(k) retirement plan, health insurance, and other payments under a Section 125 cafeteria plan. These deductions reduce the amount of Federal Income Tax (FIT) withheld but do not apply to Social Security and Medicare taxes.

Once the deductions are subtracted, the remaining income is referred to as taxable wages. This amount is used by the federal government to determine the amount of FIT withheld. Additional taxes are also levied based on tax rules at the state and local levels of government.

Gross wages, gross income, or gross pay refer to the amount of income earned before tax deductions. This is not the same as pretax income, which applies to businesses rather than individual workers. After all qualified deductions are subtracted from gross wages, the remainder is the taxable wage amount. If an employee has no deductions, the gross wages are equal to the taxable wage amount.

To calculate taxable wages, start by adding up all payments such as salary, overtime, and reimbursements for items like tuition and business expenses. This total amount needs to be reported to the IRS, even though some amounts will be deducted in the next step.

Next, subtract certain non-taxable employer payments, such as reimbursement for mileage, certain business expense reimbursements, and educational assistance. Many of these payments have a cap on the amount considered non-taxable.

Now, subtract pre-tax deductions from the gross wages. These include employee contributions to qualified retirement programs, flexible spending accounts (FSA), small business health insurance, and other pre-tax contributions.

For many employees, the taxable wages have now been calculated. However, if the employer provides other taxable benefits, add these to the income amount. Examples include payments for moving expenses and the use of a company car.

After all the additions and deductions to gross wages have been calculated, the final amount is used to determine tax liability, which is called the employee's taxable wages. The actual amount of tax taken from an employee's paycheck also depends on their filing status (single or married) and the number of allowances, both of which are reported on the employee's W-4 form.

Gross wages) - (Non-taxable wages) - (Pre-tax deductions) + (Taxable benefits) = Taxable wages

Term Insurance Refund Policies: Unraveling the Mystery of Premium Returns

You may want to see also

Self-employment income

If you're self-employed, you can use the individual Health Insurance Marketplace to enrol in flexible, high-quality health coverage that works well for people who run their own businesses. Self-employed people are defined as those who own a business that brings in income but has no employees. Self-employed people can also include freelancers, independent contractors, and consultants.

When filling out a Marketplace application, you will need to estimate your net self-employment income. This is the total income you expect to make from your business minus your business expenses. It's important to note that Marketplace savings are based on your estimated net income for the year you're getting coverage, not last year's income. This means that you may need to update your Marketplace application during the year if it looks like your yearly net income will be higher or lower than you estimated.

If you're self-employed and your income is hard to predict, you can base your estimate on your past experience, realistic expectations, industry standards, and other information. You can also use an income calculator to make your best estimate. It's important to provide your best estimate, as you may have to pay back some or all of the premium tax credits you received if you wind up making more than you reported. On the other hand, if you make less than expected, you could qualify for additional premium tax credits.

As a self-employed individual, you can purchase qualified health coverage through the Marketplace for individuals and families. With an Individual Marketplace plan, you can find coverage for yourself and your family and access premium tax credits and other savings if you qualify. The Individual Marketplace offers flexible, quality coverage for people who run their own businesses, are self-employed with no employees, or work as freelancers or consultants.

Overall, if you're self-employed, the Health Insurance Marketplace provides a range of coverage options and savings opportunities based on your estimated net self-employment income for the year.

Unraveling the Complexities of Pregnancy Insurance Billing

You may want to see also

Frequently asked questions

MAGI stands for Modified Adjusted Gross Income. It is the income number used by the Marketplace to determine eligibility for savings. It includes your AGI (adjusted gross income) plus any untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Your household income includes the MAGI of the tax filer, their spouse, and any dependents who are required to file a tax return.

All income is taxable unless it is specifically exempted by law. Income can come in the form of money, property, or services. Examples of taxable income include wages, salaries, bonuses, commissions, business income, and self-employment income.

Supplemental Security Income (SSI) is not included in MAGI. Other examples of non-taxable income include child support received, welfare payments, workers' compensation, and veterans' benefits.

Start with your household's adjusted gross income (AGI) from your most recent federal income tax return. Then, add any tax-exempt foreign income, tax-exempt Social Security benefits, and any other relevant income sources. Finally, adjust your estimate for any expected changes, such as new jobs or changes in income from other sources.