Coverage D, also known as Loss of Use Coverage, is a type of auto insurance that covers living expenses incurred if your home becomes uninhabitable due to a covered peril. This includes costs such as temporary housing, excess grocery or restaurant bills, and storage costs for household items. It provides financial assistance and peace of mind for individuals and families who are suddenly displaced from their homes. While it is typically included in homeowner's insurance policies, it is important to review your specific policy to ensure adequate coverage.

| Characteristics | Values |

|---|---|

| Type of insurance | Loss of use insurance, additional living expenses (ALE) insurance, or Coverage D |

| What it covers | Additional costs incurred for reasonable housing and living expenses if a covered event makes your house temporarily uninhabitable while it’s being repaired or rebuilt |

| Examples of covered costs | Cost of temporary housing, such as a hotel or a motel; excess of normal grocery or restaurant bills; storage costs for household items; transportation expenses |

| What it doesn't cover | Expenses that you were already responsible for before the loss, e.g. mortgage, insurance, child care expenses |

| How it works | Included in your homeowner's insurance policy with a limit, typically calculated as a percentage of your dwelling coverage |

What You'll Learn

Part D covers damage to your auto

Part D of the Personal Automobile Policy (PAP) is first-party property insurance. The insurer agrees to pay for direct and accidental loss to your covered auto and to any other nonowned auto used by you or a family member, subject to policy limitations and exclusions. Automobile equipment, generally meaning those items normally used in the auto and attached to or contained in it, is also covered. All of this is subject to a deductible.

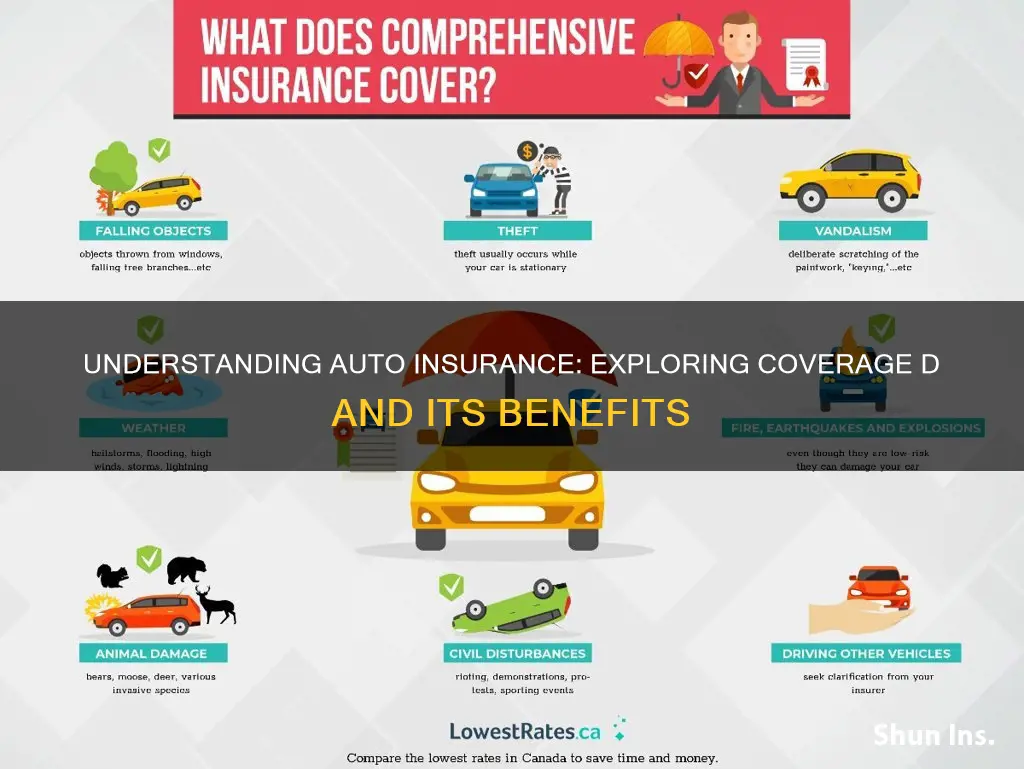

You have the option of buying coverage for your automobile on an open perils basis by purchasing both collision and comprehensive (also called other-than-collision) coverage. Collision means the upset (turning over) of the covered auto or nonowned auto, or striking another object. Every type of nonexcluded loss-causing event other than collision is considered comprehensive (other-than-collision).

To help you identify certain ambiguous perils as either collision or other-than-collision, a list is provided in the policy. You might mistakenly take this list as one of exclusions. Rather, the perils shown in the policy are other-than-collision perils and are therefore covered along with other nonexcluded perils if other-than-collision coverage applies. For example, loss caused by an exploded bomb is neither collision nor among the events listed as examples of other-than-collision. Because breakage of glass may occur in a collision or by other means, the insurer will allow you to consider the glass breakage as part of the collision loss, negating dual deductibles.

In addition to the items listed in the policy, the insurer will pay up to $20 per day (to a maximum of $600) for transportation expenses in the event your covered auto is stolen. Transportation expenses would include car rental or the added cost of public transportation, taxis, and the like. You are entitled to expenses beginning forty-eight hours after the theft and ending when your covered auto is returned to you or its loss is paid. You must notify the police promptly if your covered auto is stolen.

Some insurers offer towing and labor coverage for an additional premium. If your car breaks down, this coverage pays the cost of repairing it at the place where it became disabled or towing it to a garage. The limit of liability is $25 and a typical premium is $4 or $5. Considering the fact that you may be able to get towing service and many other services for about the same cost from automobile associations, adding towing and labor to your policy may not be a bargain. Furthermore, if your car is disabled by collision or other-than-collision loss, the cost of towing it to the garage will be paid under those coverages.

Two of the exclusions found in Part D (the first and third) have already been discussed. The remaining exclusions are dominated by limitations on the coverage for automobile equipment. One important exclusion reflects the high frequency of theft losses to certain equipment. Exclusion 4 omits coverage for electronic equipment, including radios and stereos, tape decks, compact disk systems, navigation systems, internet access systems, personal computers, video entertainment systems, telephones, televisions, and more. These exclusions do not apply to electronic equipment that is permanently installed in the car.

Rideshare Insurance: Las Vegas Auto Insurers Offering Coverage

You may want to see also

Collision and upset coverage

If you lease or finance a vehicle, collision insurance is likely a mandatory requirement. If you own your car, you may decide not to purchase collision insurance, but this could be a risky move. If you are involved in an at-fault accident and don't have collision coverage, you will have to pay out of pocket to repair or replace your vehicle. Collision coverage will cover the cost of repairing or replacing your vehicle, no matter who is at fault in the accident.

There are some exceptions to this. If you are hit by an "unidentified third party" (a hit-and-run), even if you are not at fault, you will not be covered without collision coverage. In some provinces, such as Alberta, Ontario, and Quebec, damage caused by a third party is covered through Direct Compensation Property Damage (DCPD). In Quebec, it is called the Direct Compensation Agreement. DCPD only applies to not-at-fault accidents, and you are only covered up to the percentage that you are not at fault. For example, if you are 60% at fault in an accident, DCPD will pay for 40% of the damage, and your collision coverage will pay for the remaining 60%.

When deciding whether to choose collision coverage, there are a few factors to consider:

- Your personal financial situation and the potential impact of removing collision coverage. Could you afford to pay out of pocket to repair or replace your vehicle if necessary?

- The maximum amount your insurance company will pay out if you are involved in an at-fault accident and your vehicle is written off.

- The cost of collision coverage weighed against the value of your car and your chosen deductible. For example, if your car is only worth $1000 and your deductible is $1000, collision coverage may not be worth the cost.

Drive Safe in Georgia: No Auto Insurance, No Problem

You may want to see also

Comprehensive (other-than-collision) coverage

Comprehensive coverage is typically associated with a lower deductible than collision coverage. The deductible is the amount you have to pay out of pocket when making a claim. For example, if you have a $1,500 comprehensive claim and your policy has a $500 deductible, the insurance company will deduct $500 from your claim amount and pay you the remaining $1,000.

When purchasing comprehensive coverage, it's important to understand the limitations and exclusions. For instance, coverage for electronic equipment like radios, stereos, and navigation systems is usually excluded unless they are permanently installed in the car. Additionally, there may be limitations on coverage for custom furnishings or equipment in pickups and vans.

It's also worth noting that if you still owe money on your car, your lender will typically require you to have both collision and comprehensive coverage to protect their financial interest in the vehicle.

Travelers: Combining Home and Auto Insurance Policies

You may want to see also

Transportation expenses if your covered auto is stolen

Coverage D, also known as loss of use coverage or additional living expenses (ALE) insurance, is a type of homeowners insurance that covers living expenses incurred if a covered peril makes your house temporarily uninhabitable while it's being repaired or rebuilt. While Coverage D is typically associated with homeowners insurance, similar coverage can be purchased for automobiles through comprehensive insurance.

If your covered auto is stolen, you may be reimbursed for temporary transportation expenses like the cost of renting a car, taking a taxi, or using a ride-sharing service. This reimbursement typically ends once the stolen vehicle is recovered, repaired, or replaced.

Comprehensive insurance covers the actual cash value of a stolen car or the cost to recover and repair it if it's found. If your car is stolen, it's important to notify the police as soon as possible, as failing to do so could affect the outcome of your claim.

While comprehensive insurance covers the vehicle itself, it does not cover items stolen from within the car, unless they were permanently or temporarily attached to the vehicle and their operation relies solely on power generated by the car, such as a built-in stereo system or GPS. Items not attached to the vehicle, such as laptops, phones, purses, or suitcases, are typically covered under your homeowners or renters insurance policy if you have personal property coverage.

To protect custom parts or equipment added to your vehicle after purchase, you may need to purchase additional coverage, such as custom parts and equipment (CPE) coverage, which covers aftermarket parts, custom paint jobs, navigation systems, and car stereo upgrades.

Auto Insurance Investigators: What They Scrutinize and Why

You may want to see also

Towing and labour coverage

Coverage D, also known as Loss of Use Coverage or Additional Living Expenses (ALE) insurance, is a type of homeowners insurance that covers living expenses incurred if your home becomes uninhabitable due to a covered peril. This can include costs such as temporary housing, additional food expenses, and storage fees for household items while your home is being repaired or rebuilt.

Now, let's focus on Towing and Labour Coverage in auto insurance:

The labour portion covers the cost of a service technician's time and work to get your vehicle back on the road, including services like jump starts, winching, and locksmith services. However, it typically doesn't include the cost of materials or parts. For example, if you run out of gas, the coverage will pay for someone to bring you fuel, but you'll have to pay for the fuel itself.

Towing coverage reimburses you for towing expenses from the location where your vehicle stopped. Since towing companies usually charge by the mile, this coverage can help avoid unexpected high costs. It's important to note that to add towing coverage, you generally need to have comprehensive coverage on your policy.

When you sign up for towing and labour coverage, you'll receive contact information for an emergency roadside assistance company contracted with your insurance provider. In the event of a breakdown or emergency, you can call them, and they will send someone to help and directly bill your insurance company.

Liability Insurance: How Much Auto Coverage?

You may want to see also

Frequently asked questions

Coverage D, also known as Loss of Use Coverage or Additional Living Expenses (ALE) insurance, is a type of homeowners insurance that covers living expenses incurred if your home becomes uninhabitable due to a covered peril and requires you to live elsewhere temporarily while it's being repaired or rebuilt.

Coverage D typically covers expenses such as the cost of temporary housing (e.g., a hotel or rental apartment), excess grocery or restaurant bills, and storage costs for household items.

Coverage D is often included as part of your homeowner's insurance policy, and it has limits on what and how much your insurance provider will reimburse. It's important to review your policy to ensure you have adequate coverage.