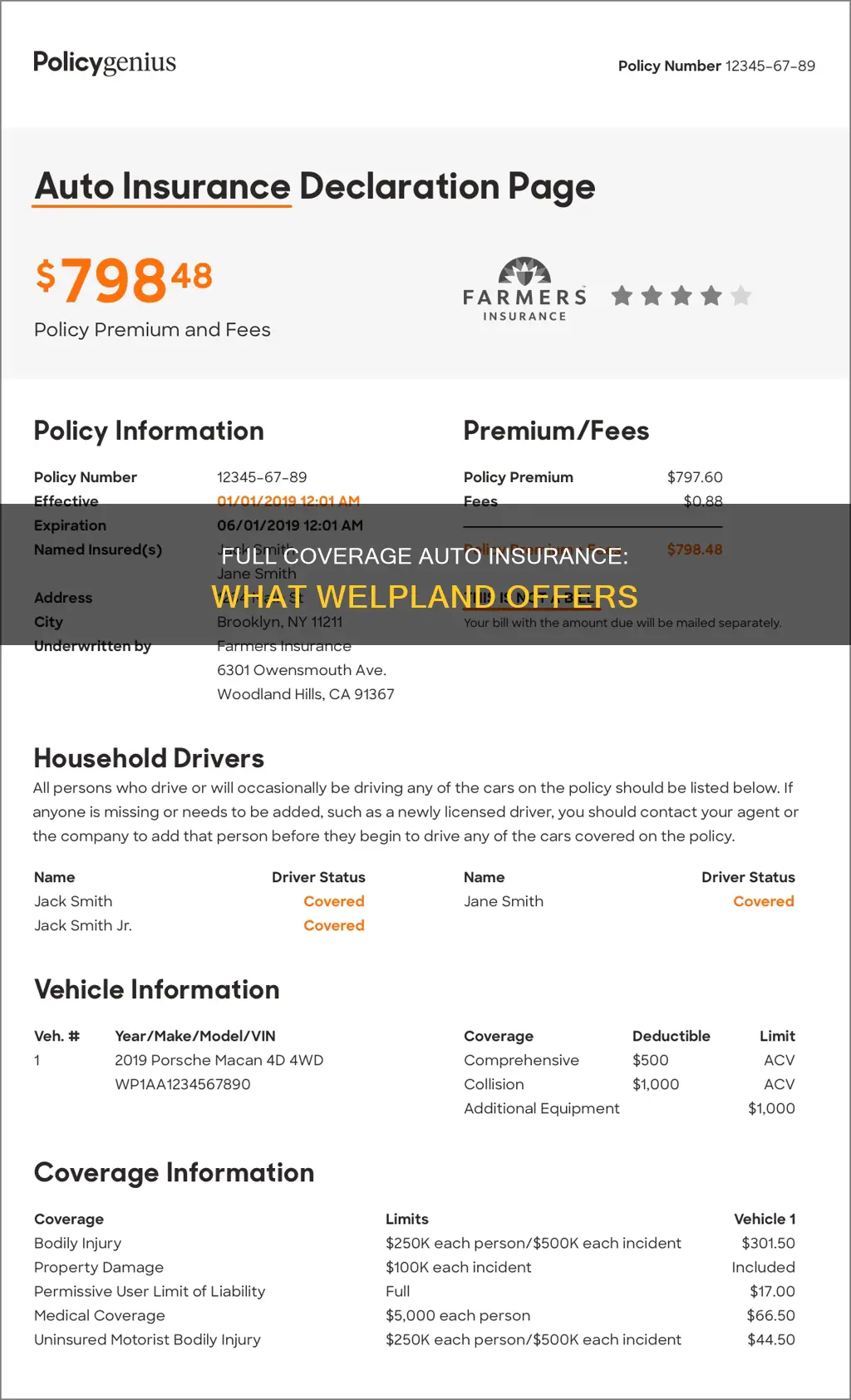

Full coverage auto insurance is a general term used by insurance agents, lenders, and dealerships to describe a policy that includes certain coverages. Despite its popularity, there is no actual policy called full coverage auto insurance. In other words, insurance providers do not offer a policy that covers everything. However, what is often considered full coverage auto insurance includes liability insurance, collision insurance, and comprehensive insurance. This combination provides protection against a wide range of circumstances, including accidents, vandalism, weather damage, and theft. The specific coverages and limits may vary by state, and it is important to customize your policy to fit your individual needs and requirements.

What You'll Learn

Liability insurance

The amount of coverage provided by liability insurance varies depending on the state and the specific policy. For example, in California, the minimum liability insurance requirements include $15,000 for injury or death to one person, $30,000 for injury or death to more than one person, and $5,000 for property damage. These requirements will increase as of January 1, 2025, to $30,000 for injury or death to one person, $60,000 for injury or death to more than one person, and $15,000 for property damage.

While liability insurance is a crucial aspect of full coverage auto insurance, it is important to remember that it does not cover damage to your own vehicle or injuries to yourself. To protect yourself in these situations, you would need to add comprehensive and collision insurance to your policy. Comprehensive insurance covers damage to your vehicle from events such as weather, theft, or fire, while collision insurance covers damage to your vehicle if you are at fault in an accident.

By combining liability, comprehensive, and collision insurance, you can create a robust full coverage auto insurance policy that protects you, your vehicle, and others in the event of an accident. It is important to review your policy details, coverage limits, and deductibles to ensure that you have adequate protection.

Launching Your Auto Insurance Agency in California

You may want to see also

Collision insurance

While there is no policy called "full coverage auto insurance", collision insurance is often considered a component of full coverage.

Best Auto Insurance Companies for Vehicle Maintenance

You may want to see also

Comprehensive insurance

While there is no policy called "full coverage auto insurance", what is considered full coverage by some is a combination of comprehensive insurance, collision insurance, and liability insurance. Comprehensive insurance is defined as an optional coverage that protects against damage to your vehicle caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, and weather- or nature-related incidents.

Auto Insurance: AARP's Benefits and Coverage

You may want to see also

Personal injury protection

While there is no single policy that delivers 100% coverage, full coverage auto insurance is typically understood to be a combination of comprehensive insurance, collision insurance, and liability insurance. However, drivers may also choose to add additional coverages to their policy, such as personal injury protection (PIP).

- Rehabilitation therapy

- Lost income resulting from the accident

- Replacement of necessary services, such as family care or household maintenance, if the injured person is not an income producer

- Funeral, burial, or cremation expenses

PIP is also known as no-fault insurance, meaning it helps cover expenses after a car accident regardless of who is at fault. It's important to note that PIP doesn't cover everything, and requirements for this coverage vary from state to state. For example, in Texas, PIP insurance is not mandatory, but you must sign a waiver if you want to decline the coverage.

Navigating Auto Insurance Law Changes: Your Essential Guide

You may want to see also

Uninsured motorist coverage

Underinsured motorist coverage is often offered alongside uninsured motorist coverage. This type of coverage protects you if you are hit by a driver whose insurance is insufficient to cover the damages or injuries they caused. If you are involved in an accident with an underinsured driver, underinsured motorist coverage can pay for medical expenses and vehicle repairs, ensuring you are not left with large out-of-pocket expenses.

In addition to providing financial protection in the event of an accident, uninsured and underinsured motorist coverage also offer peace of mind. Knowing that you are protected in the event of an accident with an uninsured or underinsured driver can reduce stress and worry. This type of coverage is particularly important if you frequently drive in areas with a high percentage of uninsured drivers or if you have passengers who rely on your insurance coverage.

While not all states mandate uninsured and underinsured motorist coverage, it is a valuable addition to any auto insurance policy. By including this coverage, you can ensure that you and your passengers are protected in the event of an accident, regardless of the other driver's insurance status.

Auto Loan: Liability Insurance Needed?

You may want to see also

Frequently asked questions

Full-coverage auto insurance is a combination of comprehensive, collision, and liability insurance. It covers damage to your car and injuries or damage you cause to others.

Full-coverage auto insurance can apply in most situations, including damage to your car from a storm, an at-fault accident, hitting an animal, or vandalism. It also covers medical costs due to injuries or deaths from an accident you caused.

The cost of full-coverage auto insurance depends on various factors, including age, location, driving record, and insurance score. The national average for a 35-year-old good driver with good credit is $1,766 per year or about $147 per month.

Full-coverage auto insurance is typically not required by law, but it may be required under certain circumstances, such as when you have an auto loan or lease. It is recommended if you can afford it and want extra financial protection.

To save on full-coverage auto insurance, you can shop around and compare rates from multiple companies, look for discounts, increase your deductible, improve your credit score, and avoid traffic infractions.