If you're looking to cancel your auto insurance in Delaware, there are a few things you need to know. Firstly, it's important to understand the state's insurance requirements. All vehicles registered in Delaware must have a minimum liability insurance coverage of $25,000 for bodily injury or death of one person and $50,000 for two or more people, as well as $10,000 for property damage. Additionally, you are required by law to have a valid insurance identification card with you at all times while driving. When cancelling your auto insurance, you must surrender your license plates to the Delaware Division of Motor Vehicles and provide proof of valid insurance from the date of cancellation. You may also be subject to cancellation fees, depending on your insurance company and state laws. It's recommended to have a new insurance policy in place before cancelling your current one to avoid a lapse in coverage and ensure you are still meeting the legal requirements for driving in Delaware.

| Characteristics | Values |

|---|---|

| Minimum liability insurance coverage | $25,000/$50,000/$10,000 |

| Minimum PIP (Personal Injury Protection) | $15,000 for any 1 person and $30,000 for all persons injured in any 1 accident |

| Fine for driving without insurance | $1500 for the first offense and $3000 for each subsequent offense occurring within 3 years of a former offense |

| Penalty for driving without insurance | Fine and suspension of driving license and/or privileges for 6 months |

| Surrender license plates when cancelling insurance | Yes |

| Notice period for cancellation | 30 days |

| Cancellation fee | $20-$50 |

| Cancellation methods | Phone, mail, in-person |

What You'll Learn

Cancelling without a new policy

If you are cancelling your auto insurance in Delaware without taking out a new policy, it is important to be aware of the legal requirements and potential consequences.

Firstly, it is essential to understand that auto insurance is mandatory in Delaware. The state requires all drivers to have a minimum level of liability insurance. This covers $25,000 for bodily injury or death of one person, $50,000 for two or more people, and $10,000 for property damage. If you are caught driving without insurance, you will face a fine of at least $1500 for a first offence and $3000 for subsequent offences within three years. Your driving privileges will also be suspended for six months.

Therefore, if you are cancelling your auto insurance without a new policy, you must also stop driving. You will need to surrender your license plates to the Delaware Division of Motor Vehicles (DMV) before cancelling your insurance. Keep in mind that the DMV will be notified of your insurance cancellation by your insurance company, and you may be audited to provide proof of valid insurance from the date of cancellation. If it is found that you were uninsured, you will face additional penalties.

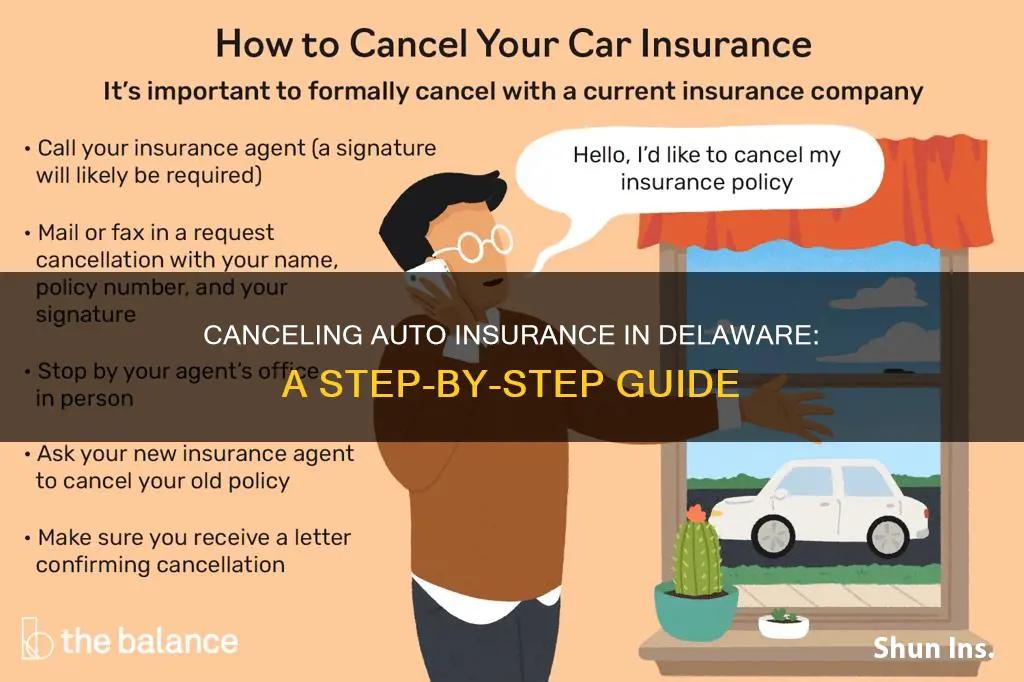

To cancel your auto insurance in Delaware, you should contact your insurance company directly. Most companies allow you to cancel at any time, but some may charge a cancellation fee of $20-$50 or 10% of your remaining policy payments. You may also be required to give a 30-day notice, sign a cancellation letter, and receive a confirmation of cancellation.

It is important to note that cancelling your auto insurance without a new policy can result in a lapse in coverage, which can lead to higher insurance rates in the future. It is recommended that you shop around for new coverage before cancelling your current policy.

Auto Insurance Investigations: Who's Really in the Driver's Seat?

You may want to see also

Cancelling without selling your car

Cancelling your car insurance in Delaware is a simple process, but there are a few things to keep in mind. Firstly, it is essential to understand that you can cancel your car insurance at any time, but you need to make sure you do it the right way. Here is a step-by-step guide on how to cancel your car insurance in Delaware without selling your car:

Step 1: Contact your insurance company

Call your insurance company directly to initiate the cancellation process. You can find their contact information on your insurance card, in your policy, or online. It is important to note that some insurance companies may require a 30-day notice before cancellation. Therefore, be sure to ask about their specific cancellation process and any notice period they require.

Step 2: Understand the cancellation fees and requirements

Some insurance companies in Delaware charge a cancellation fee, which can range from $20 to $50. Additionally, some companies may charge a "short-rate" fee, which is 10% of the remaining premium you agreed to pay for the policy period. Ask your insurance provider about any applicable fees and if they require a signed cancellation letter.

Step 3: Sign and send the cancellation letter

If your insurance company requires a cancellation letter, be sure to obtain the correct format and address or fax number to send it to. Remember to sign the letter, as this is an essential step in officially ending your coverage.

Step 4: Receive confirmation of cancellation

Once your insurance company processes your cancellation, they will send you a confirmation letter or email. This confirmation serves as official notice that your policy has been cancelled.

Step 5: Request a refund

If you have prepaid your auto insurance premiums, you may be entitled to a refund of any unused portion. However, keep in mind that any applicable cancellation fees will be deducted from the refund amount.

It is important to note that you should not cancel your car insurance without having another policy in place, as this can result in a lapse of coverage. Additionally, driving without proper insurance in Delaware can result in fines and the suspension of your driving license and privileges. Therefore, if you are not selling your car, be sure to have a new insurance policy in place before cancelling your current one.

IID Devices: How Auto Insurance Rates are Impacted

You may want to see also

Cancelling online

Cancelling your auto insurance online is a straightforward process, but there are a few things you should know before you begin. Firstly, it's important to have a new insurance policy in place before cancelling your current one, as driving without insurance in Delaware can result in fines and the suspension of your driving license and privileges.

To cancel your auto insurance online, start by gathering the necessary information. This includes your name, address, phone number, Social Security number, driver's license number, car insurance policy number, and chosen date for cancellation. Having this information ready will make the process smoother.

Next, visit your insurer's website. Some insurers may allow you to start the cancellation process online, but you will likely need to speak with an agent via chat or phone to finalise the cancellation. Be prepared for your insurer to try to convince you to stay by offering discounted rates or additional benefits. You can use this opportunity to negotiate for cheaper coverage if you wish.

After speaking with an agent, you will need to sign a cancellation letter to formally end your coverage. Some insurers may allow you to sign this document online, while others may require an in-person signature. The cancellation letter will outline the terms of your cancellation, including any fees you may need to pay. Speaking of which, some insurers charge a fee for cancelling your policy early, so be sure to ask your insurer about this.

Once your cancellation has been processed, your insurer should send you a confirmation letter or email. If you don't receive this confirmation, be sure to follow up with your insurer to ensure that your policy has been cancelled as agreed.

Finally, if you have paid your auto insurance rates in full, you may be entitled to a refund. Be sure to ask your insurer about this before finalising the cancellation.

No-Fault Auto Insurance: How Many States Have It?

You may want to see also

Cancelling by phone

Cancelling your auto insurance policy in Delaware by phone is a straightforward process. Here is a detailed guide to help you through the steps:

Step 1: Gather Necessary Information

Before initiating the cancellation process, ensure you have the following details readily available. This information may be requested by the insurance company to verify your identity and policy:

- Name, address, and phone number

- Social Security number

- Driver's license number

- Car insurance policy number

- Chosen date for cancellation

Step 2: Determine When the Policy Should End

If you are switching to a new insurance provider, it is advisable to have some overlap between your current and new policies to avoid any lapse in insurance coverage. You can achieve this by requesting that your current policy ends a few days after your new policy takes effect.

On the other hand, if you are not immediately switching to a new insurer and will not require insurance coverage for a while, you can request that your current policy ends on the date you intend to stop driving. Remember to clarify the exact cancellation date with your insurer, as some companies require a 30-day notice before cancellation.

Step 3: Contact Your Insurer by Phone

Call your insurance company's customer service line and inform them of your intention to cancel your auto insurance policy. Be prepared for them to attempt to retain you as a customer by offering alternative rates or additional benefits. If you have already decided to cancel and have purchased a new policy, politely decline these offers and proceed with the cancellation process.

Step 4: Provide Necessary Information

During the phone call, the insurance company representative will likely ask you for the information gathered in Step 1 to process your cancellation request. They may also inquire about the reason for cancellation, such as switching to a different insurer or selling your insured vehicle.

Step 5: Pay Any Cancellation Fees

Some insurance companies charge fees for cancelling policies before the end of the policy term. These fees vary by state and company but are often either a flat fee (typically around $50) or a percentage (around 10%) of your remaining premiums. Ask your insurer directly about any applicable cancellation fees, and be prepared to pay them upfront.

Step 6: Confirm Cancellation

Once your policy has been cancelled, you should receive confirmation from the insurer that the policy will end on the agreed-upon date. If you do not receive this confirmation, promptly contact the insurance company again to ensure that the cancellation was processed correctly and that you will not be liable for any continued premiums.

Remember, it is essential to have a new insurance policy in place or to have sold your vehicle before cancelling your current auto insurance to avoid penalties for driving without insurance in Delaware.

Charging Insurance Companies for Auto Glass: What's a Fair Price?

You may want to see also

Cancelling by mail

To cancel your auto insurance by mail in Delaware, you'll need to send a letter to your insurance company. Here's a step-by-step guide on how to do it:

Step 1: Finalize Your New Policy

Before cancelling your current auto insurance policy, it's important to have another policy in place to avoid any lapse in coverage. This will ensure that you don't face higher rates or issues with claims in the future.

Step 2: Gather Information

Make sure you have the following information on hand:

- Your personal details, including your full name and address.

- Contact information, such as your phone number and email address.

- The policy numbers for both your current and new insurance policies.

- The effective date of your new auto insurance coverage.

- The policy cancellation date for your current policy.

Ensure that there is no gap in coverage by making the cancellation date the same day or after your new policy starts.

Step 3: Contact Your Current Insurer

Different insurance companies have different preferences for cancellation requests. While some prefer a phone call, others may ask you to submit your request in writing. Contact your insurer to understand their specific cancellation process and meet your policy obligations.

Step 4: Write and Mail Your Cancellation Letter

Once you have the necessary information and your insurer's instructions, it's time to write your cancellation letter. Here's a basic template you can use:

[Date]

To Whom It May Concern,

I am requesting the cancellation of my auto insurance policy, [policy number], effective [date new policy begins]. As of that date, I will be covered by [new insurance company name], policy number [new policy number]. Please stop all automatic payments or debits from my account as of that date.

I also request written confirmation of the cancellation and the timely refund of any unused premiums. You can send both to me at the following address:

[Your name]

[Your address]

[City, State, ZIP]

If you have any questions, please don't hesitate to contact me at [phone number] or [email address].

Sincerely,

[Your signature]

[Your full name]

Step 5: Tips for Sending Your Cancellation Letter

- Verify the mailing address: Double-check that you have the correct mailing address for your insurance company to avoid delays in processing your cancellation request.

- Be polite: Maintain a courteous and professional tone in your letter to ensure a smooth cancellation process.

- Confirm the preferred delivery method: Ask your insurer if they require a certified letter or if an email is acceptable. This can help you save on postage costs.

- Ask for confirmation: Request confirmation of your cancellation to have proof of your request if any issues arise.

- Keep a copy for your records: Always keep a copy of your cancellation letter for future reference.

Remember to allow some time for processing, and if you don't hear back from your insurer, follow up to ensure your cancellation request has been received and processed.

Gap Insurance: Expensive or Affordable?

You may want to see also

Frequently asked questions

You can cancel your auto insurance by calling your insurance company or by sending a signed cancellation letter if the company requires written notice. You may also be able to cancel online or in person with a local agent.

Some insurance companies charge fees for cancelling policies. The fees vary by state and company but are often either 10% of your remaining premiums or a flat fee of around $50.

Before contacting your insurance company about cancelling your car insurance policy, you should have the following details ready:

- Name, address, and phone number

- Social Security number

- Driver's license number

- Car insurance policy number

- Chosen date for cancellation

The DMV receives notices from insurance companies when insurance is cancelled. As a result, you may be audited to provide proof of valid liability insurance from the date of cancellation. If it is determined that you were uninsured, the penalties are $100 per vehicle for being uninsured from 1-30 days, plus an additional $5 per vehicle for each day after 30 days.