Auto insurance rates are influenced by a variety of factors, including age, gender, driving history, and location. While age is a significant factor, it is not the only one that determines the cost of auto insurance. On average, auto insurance rates tend to decrease as individuals get older, with the lowest rates typically offered to drivers in their 50s. This is because younger and less experienced drivers are considered higher-risk and are more likely to be involved in accidents or engage in risky behaviour. However, rates begin to increase again for drivers over 70 due to age-related factors such as slower response times and vision loss. Additionally, personal circumstances, such as claims history, address, occupation, and vehicle type, can also impact insurance rates.

What You'll Learn

Auto insurance rates are lowest for drivers in their 50s

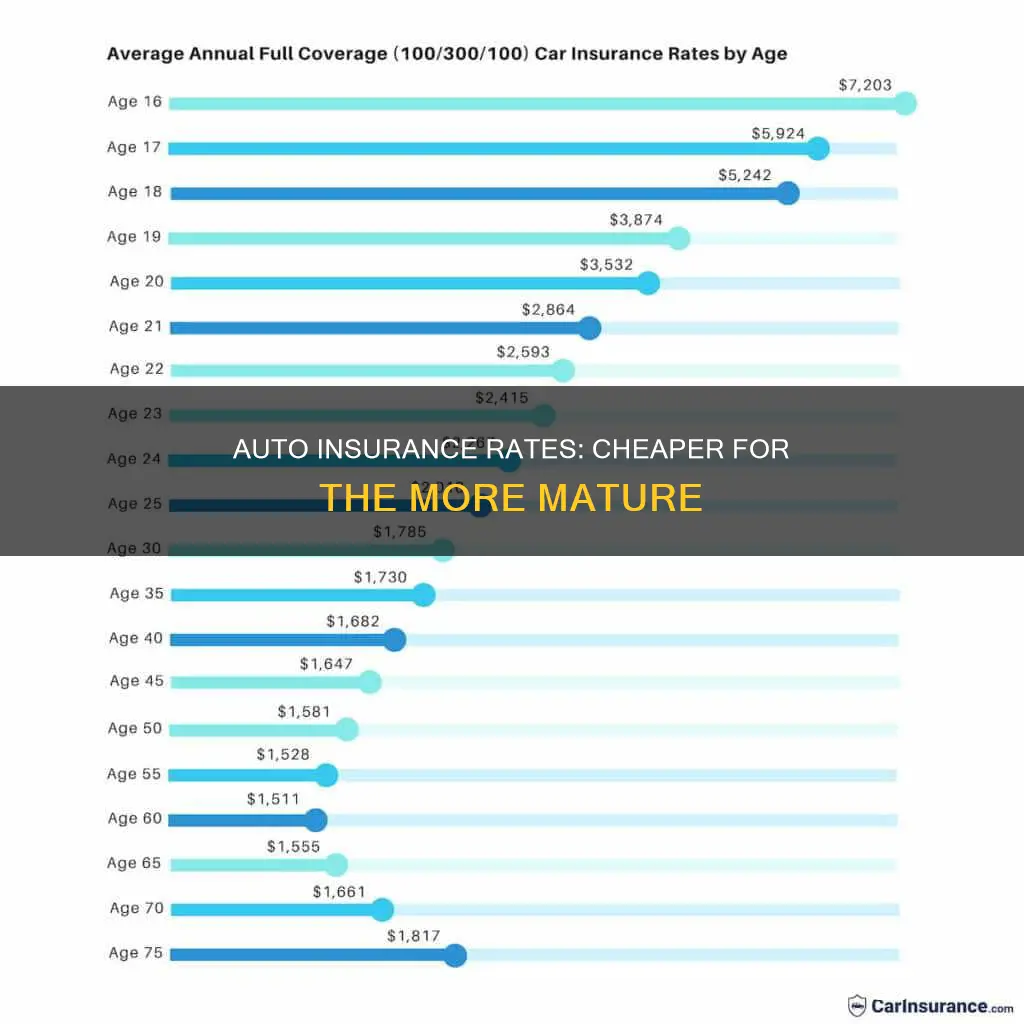

Age is one of the most important factors in determining car insurance rates. Younger drivers are generally more likely to have accidents or take risks on the road, so they are considered higher-risk and charged higher premiums. This is especially true for teenage drivers, who are among the riskiest drivers to insure due to their inexperience. As a result, young drivers can pay thousands of dollars more for car insurance than older, more experienced drivers.

As drivers gain more experience and enter their 20s, insurance rates typically decrease. By the time a driver reaches their mid-20s, they are no longer considered "youthful operators" by insurance carriers and may see a significant reduction in their premiums. Insurance rates continue to decrease or stabilize for drivers in their 30s and 40s, as long as they maintain a clean driving record.

However, as drivers approach their 70s, insurance rates start to increase again. This is because older drivers are considered riskier to insure due to age-related factors such as slower response times and vision loss, which can increase the risk of car accidents. Additionally, older drivers may have a higher risk of complications from injuries, which can increase the cost of medical care.

It's important to note that age is not the only factor that affects car insurance rates. Other factors include marital status, location, vehicle type, driving record, credit history, and coverage level. While age plays a significant role in determining insurance premiums, it is just one of many considerations used by insurance companies.

Auto Insurance for Uber: What You Need to Know

You may want to see also

Rates for male drivers go down by 12% at age 25

Auto insurance rates are influenced by a variety of factors, including age, gender, driving experience, and history. While age is a significant factor, it is important to note that rates may vary depending on other considerations as well.

On average, auto insurance rates for 25-year-olds are more affordable than rates for younger drivers. This is because drivers under the age of 25 are considered to be high-risk due to their lack of driving experience and are statistically more likely to be involved in accidents, leading to higher insurance premiums.

According to statistics, the cost of car insurance for male drivers decreases by 12% when they reach the age of 25. This reduction in rates is attributed to the decrease in risk factors associated with younger male drivers. Research from the American Automobile Association's (AAA) Foundation for Traffic Safety indicates that men tend to drive more aggressively and are more prone to fatal car crashes between the ages of 21 and 25 compared to their female counterparts. As a result, insurance companies charge higher rates to male drivers in this age group to mitigate the increased risk.

However, it is important to note that the reduction in rates at age 25 may not be immediate, and other factors may come into play. For example, if a male driver has a history of accidents or traffic violations, insurance providers may still consider them high-risk, resulting in higher premiums. Additionally, factors such as marital status, driving record, credit history, vehicle type, and location can also influence insurance rates.

While age plays a significant role in determining insurance rates, it is just one of many factors considered by insurance companies. By maintaining a clean driving record, improving credit scores (where applicable), and comparing quotes from different insurance providers, male drivers can work towards obtaining more affordable rates as they approach and surpass the age of 25.

AIAS Gap Insurance: Protection for Your Car Loan

You may want to see also

Rates for female drivers go down by 9% at age 25

Auto insurance rates are determined by several factors, including age, gender, marital status, location, vehicle type, driving record, and credit history. While age is a significant factor, it is just one of many variables that insurers consider when setting rates.

In general, auto insurance premiums tend to decrease as individuals get older, up until about age 75, when they may start increasing again. Younger drivers, particularly those under 25, often face higher insurance rates due to their lack of driving experience and the increased risk of accidents. At this age, individuals are considered “youthful operators” by insurance carriers, and their premiums tend to be higher.

However, it is important to note that age is not the only factor influencing insurance rates. Other factors, such as marital status, location, vehicle type, driving record, and credit history, can also impact insurance premiums. Additionally, insurance rates can vary by state, with some states banning the use of age or gender as rating factors.

According to Progressive, rates for female drivers drop by 9% at age 25 on average. This decrease is because drivers under 25 are statistically more likely to cause accidents and file insurance claims. As drivers gain more experience and enter their late twenties, the risk of accidents decreases, leading to lower insurance premiums.

It is worth noting that insurance rates are highly personalized, and the specific rate change at age 25 may vary depending on other factors and the individual's insurance provider. Additionally, insurance companies use different methods to determine premiums, resulting in varying rates across different companies. Therefore, it is always a good idea to shop around and compare quotes from multiple insurance companies to find the best rates.

Auto Body Repair Shops: Waiving Insurance Deductibles and Ethical Implications

You may want to see also

Rates for 25-year-old drivers vary dramatically across insurers

Age is a significant factor in determining auto insurance rates, with younger drivers generally considered more likely to have accidents or take risks on the road. As a result, drivers under 25 are often charged higher premiums. However, rates for 25-year-olds can vary significantly across different insurance providers. For example, Progressive reports that their rates drop by 9% on average at age 25. This decrease is attributed to the reduced risk of accident claims among more experienced drivers.

While age is a critical factor, it is important to note that insurance rates are influenced by various other factors, including marital status, location, vehicle type, driving record, annual mileage, and credit history. These factors collectively contribute to the overall risk assessment used by insurance providers to determine rates.

It is worth noting that some states, such as California, Hawaii, and Massachusetts, have banned the use of age as a rating factor. In these states, insurance rates may be determined primarily by factors such as driving history and vehicle type, rather than age.

To find the most affordable rates, it is recommended to shop around and compare quotes from multiple insurance companies. Additionally, taking advantage of discounts, such as those for good students or driver training, can further help lower insurance costs for young drivers.

Insurance Valuation of Totaled Cars

You may want to see also

Age is one of the most important factors in determining insurance rates

In general, auto insurance rates decrease as drivers gain more experience, with rates tending to stabilize or decrease slightly from ages 34 to 75. At Progressive, for example, rates drop by an average of 9% when a driver turns 25. However, this decrease is not guaranteed and can vary depending on other factors, such as driving history, credit history, and location.

The cost of car insurance for both male and female drivers tends to decrease with every year of driving experience. Male drivers typically pay more than female drivers due to higher risk factors, but this gap narrows as drivers age. By the age of 32, the cost of insurance for men and women is nearly identical.

While age is a significant factor, it is important to note that insurance companies consider various other details when calculating premiums, including the amount of coverage, location, driving record, and credit-based insurance score. These factors can also impact whether a driver's insurance rates decrease at age 25.

Auto Insurance: Collision Coverage Optional?

You may want to see also

Frequently asked questions

Yes, auto insurance rates tend to decrease as you get older, up until around age 70 when they begin to increase again.

Drivers under 25 are statistically more likely to get into accidents and file insurance claims. After 25, drivers are less likely to have accident claims, so they become cheaper to insure.

The cost of car insurance goes down by about 11% when you turn 25.

In addition to age, auto insurance rates can be influenced by your marital status, location, vehicle type, driving record, annual mileage, and credit history.

Here are some strategies to lower your auto insurance costs:

- Shop around for the best rates and discounts.

- Adjust your coverage and deductibles.

- Bundle your auto insurance with other types of insurance.

- Take a defensive driving course.

- Improve your credit score.