Does your auto insurance go down when you turn 25?

Auto insurance rates are typically lower for 25-year-olds than younger drivers, but this isn't always the case. While age is a significant factor in determining insurance rates, other variables, such as driving experience, coverage lapses, and driving history, can also influence premiums.

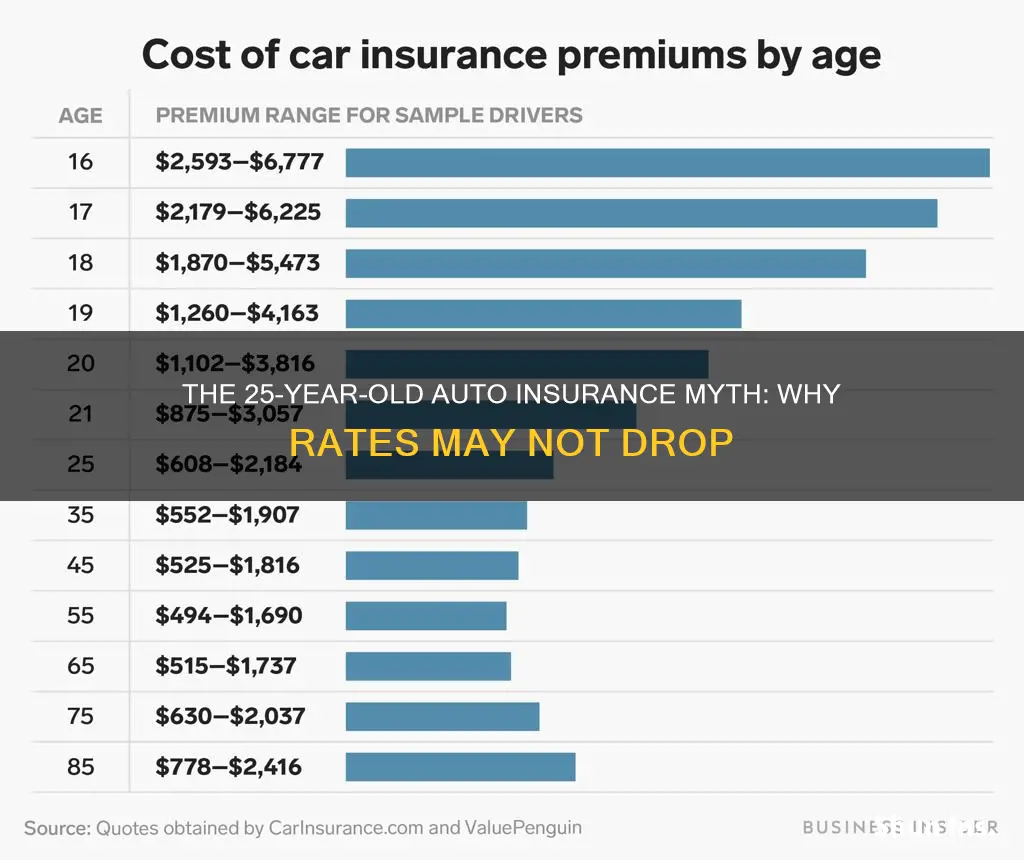

According to experts, auto insurance rates decrease each year for drivers between 16 and 24, with the most significant drops occurring at ages 19 and 21. Once drivers reach 25, their premiums tend to stabilise, and insurance companies no longer consider them youthful drivers. Rates generally continue to lower until drivers turn 30 and only begin to increase again when they reach their senior years.

It's worth noting that insurance rates are influenced by various factors, including gender, driving record, marital status, vehicle type, and location. Additionally, rates can vary significantly between insurance providers, so it's advisable to shop around and compare quotes to find the best deal.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance for 25-year-olds | $3,207 |

| Average annual cost of car insurance for 18-year-olds | $7,179 |

| Average annual cost of car insurance for 21-year-olds | $4,453 |

| Average annual cost of car insurance for 24-year-olds | $3,597 |

| Average annual cost of car insurance for 30-year-olds | N/A |

| Average annual cost of car insurance for 35-55-year-olds | Levelled off |

| Average annual cost of car insurance for 60-75-year-olds | Increased |

| Average annual cost of car insurance for males at 25 | $766 less than at 21 |

| Average annual cost of car insurance for females at 25 | N/A |

| Average annual cost of car insurance for males at 16 | $422 more than for females |

| Average annual cost of car insurance for males at 30 | N/A |

| Average annual cost of car insurance for females at 30 | N/A |

What You'll Learn

- Auto insurance rates decrease as you get older, until around age 75

- Drivers under 25 are statistically more likely to cause accidents and file insurance claims

- Insurance companies consider several factors when determining rates, including marital status, location, vehicle type, driving record, and credit history

- Ways to lower auto insurance costs include shopping around for rates, adjusting coverage and deductibles, and taking a defensive driving course

- Car insurance rates for males and females converge at age 25 and become nearly identical by age 32

Auto insurance rates decrease as you get older, until around age 75

Auto insurance rates are typically highest for young and inexperienced drivers. As drivers get older, their insurance rates tend to decrease. This is because older drivers have more experience behind the wheel and are less likely to cause accidents.

According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers. This is reflected in insurance rates, with 16-year-olds paying around $613 per month for full coverage insurance, on average. Rates gradually decrease as drivers gain more experience, with 19-year-olds paying 24% less than 18-year-olds, and rates dropping by 17% between ages 20 and 21.

By the time drivers reach their mid-20s, their insurance rates become much more affordable. On average, 25-year-olds pay $3,207 for an annual policy, which is 11% cheaper than the average rate for 24-year-olds. Progressive reports that rates on new policies drop by 9% when a driver turns 25. This decrease in rates continues as drivers age, levelling off between the age groups of 35 and 55.

However, it's important to note that age is just one of many factors that insurance companies consider when setting rates. Other factors include marital status, location, vehicle type, driving record, annual mileage, and credit history. Additionally, rates may vary depending on the insurance company, so it's a good idea to shop around and compare quotes from different providers.

After drivers turn 60, insurance rates begin to slowly increase again as age and slower reflexes start to impact driving ability. Rates for 75-year-olds are 19% higher than those for 60-year-olds, and motorists over the age of 70 are considered riskier to insure due to increased physical vulnerability and higher crash death rates.

Does AARP Offer Home and Auto Insurance Bundling?

You may want to see also

Drivers under 25 are statistically more likely to cause accidents and file insurance claims

Drivers under 25 are considered to be high-risk by insurance companies due to their lack of driving experience and proven record. They are more likely to be involved in accidents and file insurance claims, which makes them a financial risk for insurance providers.

Inexperience and Distracted Driving

Young drivers are more prone to making mistakes due to their inexperience. Common errors include failing to check blind spots and driving too fast, which can lead to accidents and insurance claims. Additionally, young drivers are more likely to engage in distracted driving behaviours, such as texting while driving, which further increases the risk of accidents.

Recklessness and Higher-Risk Behaviours

Teen drivers tend to be more reckless and engage in risk-taking behaviours, such as street racing, driving under the influence, or other reckless behaviours. As a result, they are more likely to be involved in accidents and file insurance claims. However, as young drivers enter their twenties, they are less likely to engage in these risk-taking behaviours, which leads to a reduction in insurance rates.

Lower Credit Scores

Young drivers under 25 are less likely to have established credit histories, which can impact their insurance rates. Insurance companies may view drivers with low credit scores or no credit history as high-risk, as they are considered more likely to file insurance claims.

Higher Fatality Rates

According to statistics, young people under 25 have the second-highest fatality rate among all drivers. In 2019, over 5,600 individuals under 25 died in car accidents, compared to 4,958 drivers between the ages of 45 and 54. This data is considered by insurance companies when setting annual rates, resulting in higher premiums for young drivers.

Lower Rates with Experience and Age

As young drivers gain more experience and age into their late twenties, insurance rates typically decrease. This is because the risk associated with younger drivers reduces, and they are seen as less likely to engage in risky behaviours or make inexperienced driving mistakes.

While age is a significant factor in determining insurance rates, it is important to note that other factors, such as driving record, credit score, and location, also play a role in the cost of insurance premiums.

Kids and Auto Insurance: Who's Covered?

You may want to see also

Insurance companies consider several factors when determining rates, including marital status, location, vehicle type, driving record, and credit history

Insurance companies consider several factors when determining rates, and age is just one of them. While auto insurance premiums tend to decrease as you get older, there are other elements that can influence the cost of your insurance. Here are some key factors that insurance companies take into account:

Marital Status

Marital status can impact insurance rates, with married policyholders often paying lower premiums than single individuals. Insurance companies perceive married couples as more financially stable and less likely to file claims, resulting in reduced rates.

Location

Your location, including the city and state where you live, plays a significant role in insurance rates. Urban areas tend to have higher rates due to increased accident risks, theft, and vandalism. Additionally, states with harsh weather conditions or higher population densities may contribute to elevated insurance costs.

Vehicle Type

The type of vehicle you drive is another crucial factor. Luxury or expensive vehicles with advanced technology and safety features typically cost more to insure. Insurance companies consider repair and replacement costs, theft rates, safety records, and the potential damage a vehicle can cause in a collision.

Driving Record

A clean driving record can lead to lower insurance rates. Conversely, accidents, speeding tickets, reckless driving, and DUI/DWI incidents can increase your premiums. Insurance companies view these factors as indicators of high-risk driving behaviour.

Credit History

In most states, credit history is also taken into account when determining insurance rates. A higher credit score generally leads to lower premiums, as insurance companies associate better credit with reduced financial risk. However, some states, such as California, Hawaii, Michigan, and Massachusetts, restrict the use of credit history in setting insurance rates.

CPI and Gap Insurance: What's the Difference?

You may want to see also

Ways to lower auto insurance costs include shopping around for rates, adjusting coverage and deductibles, and taking a defensive driving course

While auto insurance rates are typically lower for 25-year-olds than younger drivers, there are other factors that determine the cost of insurance. These include marital status, location, vehicle type, driving record, and credit history. Here are some ways to lower your auto insurance costs:

Shop Around for Rates

It is important to compare rates from multiple insurance companies, as rates for the same coverage can vary significantly. Getting quotes from at least three insurers will help you find the best deal. Remember to compare identical policy coverage and limits for an accurate price comparison.

Adjust Coverage and Deductibles

Consider dropping collision and comprehensive coverage on older cars. If the cost of insurance is close to 10% of the car's value, the coverage may not be worth it. Increasing your deductible can also lower your costs. Just make sure you have enough savings to cover the higher deductible in case of an accident.

Take a Defensive Driving Course

Completing a defensive driving course approved by your insurer can result in significant savings on your insurance. For example, some companies offer discounts of up to 10% for three years after completing a course.

Other Ways to Lower Costs

- Bundle your insurance policies: Combining your auto insurance with other types of insurance, such as homeowners or renters insurance, can often lead to discounts.

- Improve your credit score: In many states, insurance companies use credit-based insurance scores to determine rates. Improving your credit score can lead to lower insurance premiums.

- Reduce mileage: Driving fewer miles per year may qualify you for low-mileage discounts.

- Group insurance: You may be able to get a group insurance discount through your employer or certain associations you are a part of.

Texassure: Legit Vehicle Insurance Verification

You may want to see also

Car insurance rates for males and females converge at age 25 and become nearly identical by age 32

Car insurance rates are influenced by a variety of factors, including age, gender, driving experience, location, vehicle type, driving record, credit score, and marital status. While age is a significant factor, it is important to note that insurance companies consider multiple criteria to assess an individual's risk profile and calculate their premium.

In general, car insurance rates decrease as individuals get older and gain more driving experience. Specifically, regarding the convergence of rates for males and females at age 25, it is important to understand the broader context.

On average, car insurance rates for 25-year-olds are cheaper than for younger drivers. This is because younger drivers, especially those under 25, are statistically more likely to cause accidents and file insurance claims. The decrease in rates after age 25 is gradual and continues throughout adulthood, provided that drivers maintain a clean driving record.

When it comes to the difference in rates between males and females, there is a notable change at age 25. Car insurance rates for men at this age go down by 12%, while they decrease by 9% for women. This is because younger male drivers are considered riskier to insure due to their higher propensity for aggressive driving and a higher likelihood of being involved in fatal car crashes.

By the time men and women reach their 30s, their insurance rates become comparable, and the gap narrows significantly. This convergence is influenced by various factors, including driving experience, accident history, and the potential impact of marriage on financial stability and risk aversion.

It is important to note that insurance rates are highly personalized and can vary based on individual circumstances and the specific criteria considered by insurance providers. Additionally, state regulations can also impact the use of age and gender as rating factors, with some states prohibiting their use in determining insurance rates.

Progressive Auto Insurance: Understanding Glass Coverage

You may want to see also

Frequently asked questions

Yes, auto insurance rates typically go down when you turn 25. This is because drivers under 25 are statistically more likely to cause accidents and file insurance claims. However, the decrease in rates may not be immediate and is contingent on other factors such as driving experience, coverage lapses, driving history or record, gender, and location or ZIP code.

On average, car insurance rates decrease by about 9% to 11% when you turn 25. However, this can vary depending on the insurance company and other factors.

Yes, in Hawaii and Massachusetts, auto insurance companies are not allowed to consider age when determining rates. In Massachusetts, however, they can consider the number of years a person has been a licensed driver.

Other factors that can affect car insurance rates include gender, driving experience, driving history or record, marital status, vehicle type, credit history, location or ZIP code, and annual mileage.