Ranking auto insurance companies can be done in several ways, depending on what is most important to you.

US News ranks auto insurance companies based on customer service and claims handling, with USAA and Auto-Owners taking the top two spots.

Bankrate ranks auto insurance companies based on a weighted rank of industry-standard ratings for financial strength and customer experience, in addition to average quoted rates. Using this methodology, Amica and Geico tied for the top spot.

NerdWallet ranks auto insurance companies based on affordability, customer satisfaction, discounts, and financial strength. Using these criteria, Travelers, Auto-Owners, and American Family took the top three spots.

CNBC Select ranks auto insurance companies based on cost, coverage, customer satisfaction, and more. Using these criteria, Geico, Erie, and Nationwide took the top three spots.

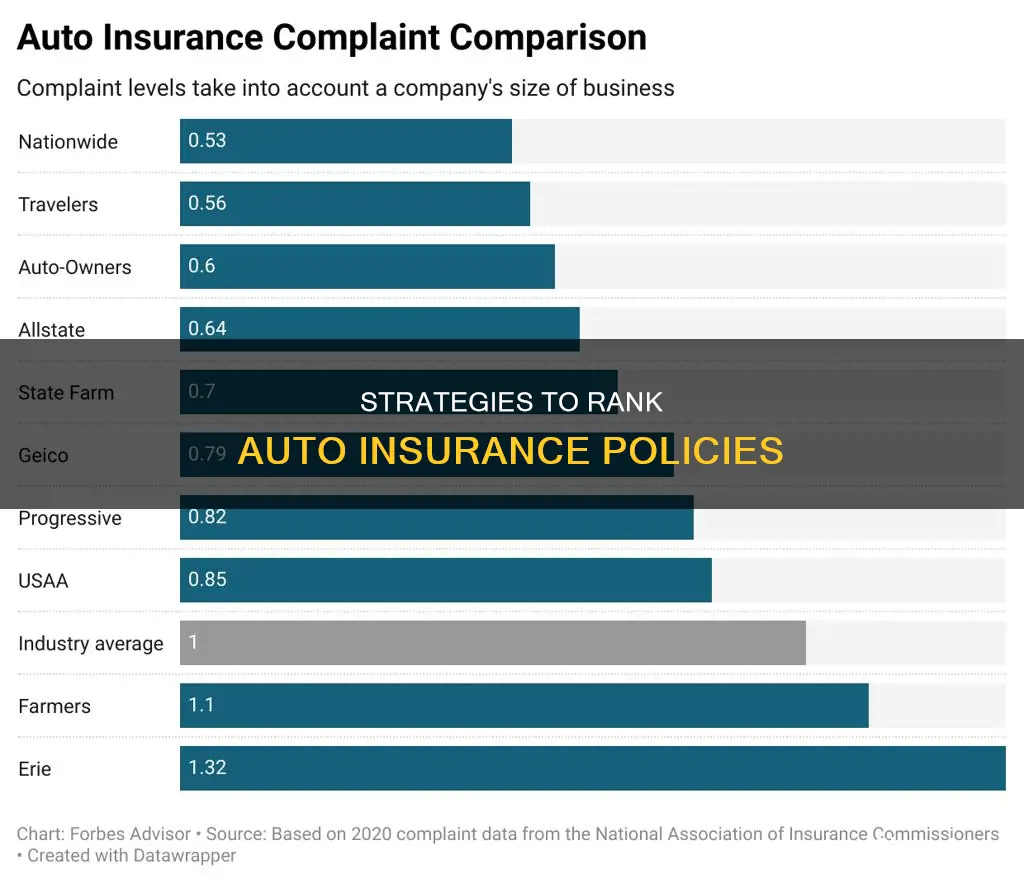

Forbes Advisor ranks auto insurance companies based on costs, coverage options, complaints, and collision repair scores. Using these criteria, Nationwide, USAA, Travelers, and Erie took the top four spots.

When ranking auto insurance companies, it is important to consider what is most important to you as a customer. Do you value low costs, high customer satisfaction, or something else? Different ranking methodologies will weigh these factors differently, so be sure to consider what goes into the ranking when reviewing the results.

| Characteristics | Values |

|---|---|

| Company | USAA |

| Company | Auto-Owners |

| Company | Nationwide |

| Company | State Farm |

| Company | Geico |

| Company | Progressive |

| Company | American Family |

| Company | Erie |

| Company | Travelers |

| Company | Safeco |

| Company | Liberty Mutual |

What You'll Learn

Best for customer satisfaction

USAA

USAA is a highly-ranked auto insurance company in terms of customer satisfaction. It is only available to military members, veterans, and their families. USAA has high customer satisfaction ratings and offers a discount for storing your car on a military base. It also has relatively low insurance rates and provides other financial solutions for qualifying customers, such as banking and investment products.

State Farm

State Farm is the largest personal auto insurance company in the country. It has a large network of exclusive local agents and superior financial strength. State Farm ranked No. 1 among eight large insurers in J.D. Power's 2023 U.S. Insurance Shopping Study. It also ranked No. 5 out of 24 companies in J.D. Power’s U.S. Auto Claims Satisfaction Study the same year. State Farm offers numerous discounts and extras, including travel expense coverage, making it a good choice for most drivers.

Amica

Amica has high marks for customer satisfaction and low consumer complaints. It offers free perks for good drivers, including accident forgiveness and a disappearing deductible. Amica also gives customers the option to buy a dividend-paying policy, which can save money in the long run.

Erie

Erie has low rates and dedication to customer service. It has a combination of reasonable rates and top-of-the-line customer service. Erie only offers auto insurance in 12 states and Washington, D.C. However, it came in first in J.D. Power's 2024 insurance shopping survey and second-highest for claims satisfaction. Erie's Rate Lock® feature ensures that your premiums won't increase as long as you keep your policy the same, even if you file a claim.

Lying to Auto Insurance: Is It Worth It?

You may want to see also

Best for pay-per-mile coverage

If you don't drive much, pay-per-mile car insurance could be a great option for lowering your insurance costs. This type of insurance is best suited for people who generally don't drive often, such as those who take public transportation, work from home, or have a second vehicle that they rarely use.

Nationwide is a standout for its usage-based insurance program, SmartMiles, which can lower your premiums if you don't drive a lot. It also scores highly for availability, with policies in every state except Alaska, Hawaii, Louisiana, and Massachusetts.

Nationwide's pay-per-mile insurance offering is designed for low-mileage drivers who have little or no commute and are looking to save on their insurance costs. A SmartMiles auto insurance policy consists of a base rate and a variable rate that is determined by how much you drive. Some of the features Nationwide offers include a discount for safe driving, a handy mobile app that works as a mileage-tracking odometer, and a road trip exemption in which only the first 250 miles count during a single day. Expect the common coverage types, including liability, comprehensive, and collision coverages. This service is available in most states and is compatible with most cars produced after 1996.

The cost of pay-per-mile car insurance varies by insurer and how much you drive. Your pay-per-mile car insurance cost will depend on your base rate and the number of miles you drive. For example, if you have a $30 monthly rate and your mileage rate is $0.06 per mile, you would pay $57 if you drove 450 miles in a month ($30 monthly rate + 450 miles x $0.06 = $57).

To estimate how much you’ll pay for pay-per-mile insurance, use the following formula:

Monthly base rate + (Per-mile rate x Approximate number of miles you drive per month)

For instance, let’s say your pay-per-mile quote shows a monthly base rate of $34 and a per-mile rate of 5 cents. You generally drive 800 miles a month.

You can calculate your monthly rate as: $34 + (.05 x 800) = ($34 + $40) = $74.

Again, this is only an estimate, and your actual cost per month will vary depending on how many miles you drive.

Deductibles and Accidents: Understanding Auto Insurance Claims

You may want to see also

Best for bundling

Bundling your home and auto insurance can be a great way to save money and simplify your insurance management. You can also bundle other types of insurance, such as renters, condo, life, RV, boat, and more. Here are some of the best insurance companies for bundling:

- State Farm: State Farm is the largest auto insurer in the US and offers bundling discounts of up to $1,273 per year. They have a wide range of insurance products, including auto, home, condo, renters, and life insurance. State Farm has excellent customer satisfaction ratings and a large network of local agents. However, they do not offer gap insurance.

- Allstate: Allstate offers a bundling discount of up to 25%, one of the highest in the industry. They provide a wide range of insurance products and endorsements, including home-sharing coverage and green improvement reimbursement. However, their average premiums are higher than some competitors, and they have a high complaint index.

- Nationwide: Nationwide offers a bundling discount of up to 20%. They have a strong presence across the US, with local independent agents in most states. Nationwide provides a variety of insurance products and endorsements, as well as digital tools for policy management. However, they have below-average customer satisfaction scores from J.D. Power.

- Farmers: Farmers Insurance offers an average bundling discount of 20%. They have local agents and multiple discount opportunities for both home and auto insurance. However, Farmers has a lower-than-average ranking on the J.D. Power home insurance study.

- Travelers: Travelers offers a bundling discount on home and auto insurance. They have a wide network of independent agents and offer various endorsements and discounts. Travelers also has a strong financial strength rating from AM Best. However, they are not available in all states and have below-average auto and property claims satisfaction ratings.

Switching Auto Insurance: Early Termination

You may want to see also

Best for discounts

Auto insurance can be expensive, but there are plenty of ways to save. Here are some of the best auto insurance companies for discounts:

USAA

USAA is available to service members, veterans and their families in all 50 states and Washington, D.C. In addition to low rates, USAA offers discounts if you are deployed or store your vehicle on base. USAA also has high scores from J.D. Power for insurance shopping and claims satisfaction.

American Family

American Family has 18 discounts that can lower your auto premiums, including for having a clean driving record, paying your premium in full, and for volunteering in your community. Safe drivers can save up to 20% if you let the company track your driving habits, while combining American Family auto and home insurance can save you as much as 23%.

State Farm

State Farm offers over a dozen discounts, including for safe driving, bundling, and good students. If you insure two or more vehicles with State Farm, you could save as much as 20%. State Farm is also best-in-class for customer service, landing among the top carriers on the J.D. Power 2024 U.S. Insurance Shopping Study.

Progressive

Progressive is one of the best choices for high-risk drivers, thanks to its lower-than-average rates for customers with speeding tickets, at-fault accidents, and DUI convictions. Progressive also offers SR-22 filing if you need your license reinstated.

Auto-Owners

Auto-Owners offers an impressive menu of more than a dozen discount opportunities. Drivers could save by getting a quote ahead of their current policy’s expiration or by opting for paperless billing and payment options. Auto-Owners also offers three discounts geared toward young drivers.

Geico

Geico offers many discounts, including for good driving, insuring multiple vehicles, and bundling your Geico auto and homeowners policies.

Full Auto Insurance Coverage in Louisiana: How Much?

You may want to see also

Best for high-risk drivers

High-risk drivers are those with at least one speeding ticket, at-fault accident, or DUI conviction on their record, or married couples with a teen driver on their policy. Different insurance companies may define high-risk drivers more broadly.

Progressive is one of the best choices for high-risk drivers, thanks to its lower-than-average rates for customers with speeding tickets, at-fault accidents, and DUI convictions. Progressive also offers SR-22 filing if you need your license reinstated.

Progressive is one of the nation's largest auto insurance providers, offering policies in all 50 states. It has standout features like gap insurance, three different kinds of accident forgiveness, and veterinary expense coverage, which pays vet bills if your pet is injured in a covered accident.

Progressive is also one of the first companies to specialize in insuring high-risk drivers, beginning in the 1950s. While other companies have entered the market since then, Progressive still offers competitive rates on auto insurance for drivers with DUIs and severe speeding tickets.

Progressive's Snapshot safe-driving discount program could result in rates going up, so it's important to understand the terms before signing up.

Other good options for high-risk drivers include State Farm, USAA, Nationwide, Geico, and Travelers.

Electric Vehicle Insurance: Cheaper?

You may want to see also

Frequently asked questions

Shop around and compare quotes from at least three insurers, keeping the limits, coverage and deductible the same.

Compare car insurance quotes from multiple companies.

Understand your state's laws, check customer reviews, customise your coverage and adapt to life events.

Your coverage amount, your personal information, your credit history, your driving history, your car and its features.