Guaranteed cash value life insurance is a feature of some whole life insurance policies that ensures a minimum accumulation of cash value over time. This cash value is separate from the death benefit and can be used by the policyholder while they are still alive. The guaranteed cash value grows at a set rate until it is equal to the face value of the policy at a specified age, typically 100 or 121. The death benefit amount is also called the 'face value' of the policy and will be paid out to beneficiaries if the premiums are up to date and no money has been withdrawn.

What You'll Learn

- Guaranteed cash value is a feature of whole life insurance policies

- It grows over the lifetime of the policy provided the premiums are paid on time

- The guaranteed cash value provides policyholders with a sense of financial security

- Policyholders can use the cash value as needed (within bounds)

- Guaranteed cash value policies are usually referred to as participating policies

Guaranteed cash value is a feature of whole life insurance policies

The death benefit amount of a whole life insurance policy is also called the "face value" of the policy. If the premiums are timely paid and up to date, and no money has been withdrawn in the form of a loan, the death benefit will be the same as the face value or full amount of the policy for beneficiaries. The guaranteed cash value provides policyholders with a sense of financial security and reassurance that their policy will retain a certain minimum value over time.

In the case of traditional life insurance policies, the guaranteed cash value is typically equal to the policy's maturity value. The maturity value is the total amount that the policy will pay out when it reaches its specified maturity date. Policyholders can choose to receive the maturity value as a lump sum or as periodic payments.

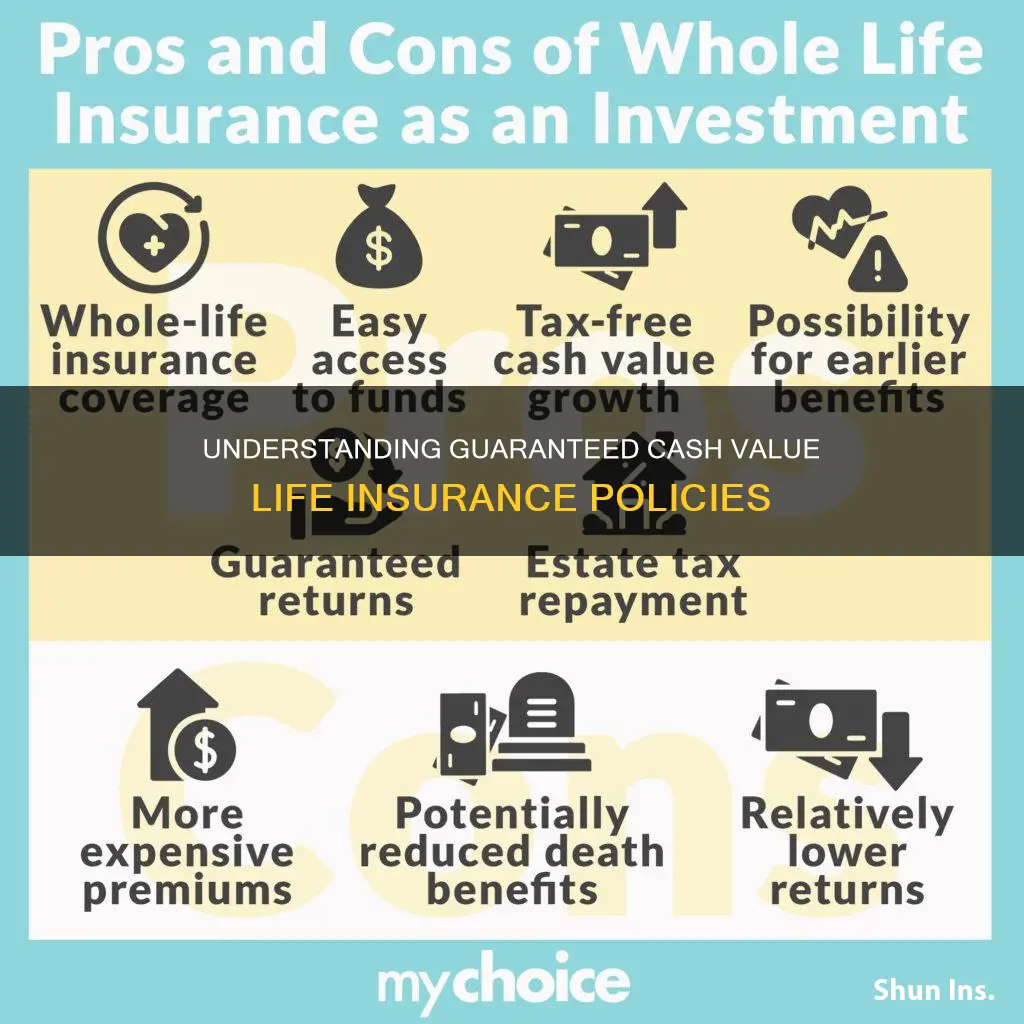

It is important to review the policy contract and understand the specific features, terms, and conditions of the policy to determine if a guaranteed cash value is included. Not every cash value is guaranteed, so it is important to read through the policy carefully. For a whole life insurance policy with a guaranteed cash value, the premiums may be higher than a term life insurance policy with no cash value.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

It grows over the lifetime of the policy provided the premiums are paid on time

Guaranteed cash value is a feature of some life insurance policies, including whole life insurance policies, that ensures a minimum accumulation of cash value over time. This cash value grows over the lifetime of the policy provided the premiums are paid on time. The guaranteed cash value provides policyholders with a sense of financial security and reassurance that their policy will retain a certain minimum value over time. This can be particularly important if they need to surrender or cancel the policy due to unforeseen circumstances. The guaranteed cash value offers stability and predictability in terms of the policy's cash accumulation.

The guaranteed cash value of a whole life policy is the amount that a policyholder can benefit from while still alive. The cash value is separate from the death benefit for the most part, and policyholders can use it as needed (within bounds). The death benefit amount of a whole life insurance policy is also called the “face value” of the policy. If the premiums are timely paid and up to date, and no money has been withdrawn in the form of a loan, the death benefit will be the same as the face value or full amount of the policy for beneficiaries.

The guaranteed cash value grows at a set rate until it is equal to the face value of the policy at a specified age, typically age 100 or 121. The cash value amount can increase over the life of the policy. Cash values normally increase at a fixed rate as opposed to variable life insurance policies. For a whole life insurance policy with a guaranteed cash value, the premiums may be higher than a term life insurance policy with no cash value. One portion of the premium goes toward the policy’s death benefit, while another portion is allotted to the policy’s cash value.

Life Insurance: Eligibility Requirements and Their Impact

You may want to see also

The guaranteed cash value provides policyholders with a sense of financial security

A guaranteed cash value is a feature of a whole life insurance policy. It grows over the lifetime of the policy provided the premiums are paid on time. A guaranteed cash value grows at a set rate until it is equal to the face value of the policy at a specified age, typically age 100 or 121. The face value of the policy is also known as the death benefit amount.

Policyholders can choose to receive the maturity value as a lump sum or as periodic payments. The guaranteed cash value of a whole life policy is the amount that a policyholder can benefit from while still alive. The cash value is separate from the death benefit for the most part, and policyholders can use it as needed (within bounds).

Not every cash value is guaranteed, so it is important to take the time to read through a policy to make sure the cash value is guaranteed. It is also important to review the policy contract and understand the specific features, terms, and conditions of the policy to determine if a guaranteed cash value is included.

Cashing Out Partial Life Insurance: Is It Possible?

You may want to see also

Policyholders can use the cash value as needed (within bounds)

Guaranteed cash value is a feature of a whole life insurance policy. It grows over the lifetime of the policy provided the premiums are paid on time. The guaranteed cash value of a whole life policy is the amount that a policyholder can benefit from while still alive. The cash value is separate from the death benefit for the most part, and policyholders can use it as needed (within bounds).

The guaranteed cash value provides policyholders with a sense of financial security and reassurance that their policy will retain a certain minimum value over time. This can be particularly important if they need to surrender or cancel the policy due to unforeseen circumstances. The guaranteed cash value offers stability and predictability in terms of the policy's cash accumulation.

It is important to review the policy contract and understand the specific features, terms, and conditions of the policy to determine if a guaranteed cash value is included. In some cases, the guaranteed cash value may be equal to the policy's maturity value, which is the total amount that the policy will pay out when it reaches its specified maturity date. Policyholders can choose to receive the maturity value as a lump sum or as periodic payments.

The guaranteed cash value of a whole life policy can provide financial flexibility and peace of mind for policyholders. By having access to the cash value while still alive, policyholders can use the funds as needed to cover unexpected costs, supplement retirement income, or achieve other financial goals. However, it is important to weigh the benefits of accessing the cash value against the potential impact on the death benefit and the overall value of the policy.

Get Licensed: Life & Accident Insurance in California

You may want to see also

Guaranteed cash value policies are usually referred to as participating policies

The guaranteed cash value of a whole life policy is the amount that a policyholder can benefit from while still alive. The cash value is separate from the death benefit for the most part, and policyholders can use it as needed (within bounds). The cash value amount can increase over the life of the policy, growing at a set rate until it is equal to the face value of the policy at a specified age, typically age 100 or 121. In the case of traditional life insurance policies, the guaranteed cash value is typically equal to the policy's maturity value. The maturity value is the total amount that the policy will pay out when it reaches its specified maturity date.

Policyholders can choose to receive the maturity value as a lump sum or as periodic payments. Guaranteed cash value policies provide stability and predictability in terms of the policy's cash accumulation. It is important to review the policy contract and understand the specific features, terms, and conditions of the policy to determine if a guaranteed cash value is included. For a whole life insurance policy with a guaranteed cash value, the premiums may be higher than a term life insurance policy with no cash value. One portion of the premium goes toward the policy’s death benefit, while another portion is allotted to the policy’s cash value.

Zurich Life Insurance: Is It Worth the Hype?

You may want to see also

Frequently asked questions

Guaranteed cash value life insurance is a feature of some life insurance policies that ensures a minimum accumulation of cash value over time. The cash value is separate from the death benefit and can be used by the policyholder during their lifetime.

The guaranteed cash value grows over the lifetime of the policy provided the premiums are paid on time. The cash value amount can increase over the life of the policy at a set or fixed rate until it is equal to the face value of the policy at a specified age, typically age 100 or 121.

The guaranteed cash value provides policyholders with a sense of financial security and reassurance that their policy will retain a certain minimum value over time. This can be particularly important if they need to surrender or cancel the policy due to unforeseen circumstances.

For a whole life insurance policy with a guaranteed cash value, the premiums may be higher than a term life insurance policy with no cash value. One portion of the premium goes toward the policy’s death benefit, while another portion is allotted to the policy’s cash value.