Life insurance is a financial safety net that provides a sum of money to select beneficiaries following the death of the policyholder. When applying for life insurance, the insurance company evaluates your risk of death and assigns a cost to the policy accordingly. The older you are when you purchase a policy, the more expensive the premiums will be as the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The younger and healthier you are, the lower the premiums will be. In addition to age and health status, other factors that can influence your life insurance premium rate include lifestyle characteristics such as smoking, drinking, exercise, and driving record. It is important to regularly review your coverage and increase your life insurance protection when you undergo significant changes in your life, such as getting married, having children, or buying a house.

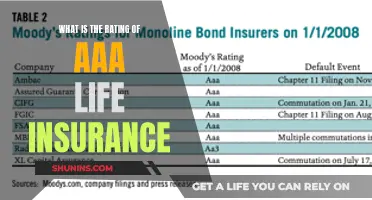

| Characteristics | Values |

|---|---|

| Premium | Increases with age and risk factors |

| Eligibility | Depends on age, health, lifestyle, and income |

| Coverage | Depends on the number of dependents and financial situation |

What You'll Learn

You're taking on more debt

Life insurance is designed to pay out a sum of money to your beneficiaries after your death. The amount of coverage you will need depends on several factors, including any outstanding debt you have.

If you're taking on more debt, you may want to consider increasing your life insurance coverage to ensure that your beneficiaries will have the financial means to pay it off. This is especially important if you have people who are financially dependent on you, such as a spouse or children.

When applying for additional life insurance coverage, the insurance company will evaluate your risk of death and set the cost of the policy accordingly. The younger and healthier you are, the lower your premiums will be. The insurance company will likely require you to answer medical questions and submit to a medical exam. They may also ask about your lifestyle habits, such as smoking, drinking, and exercise, as these can impact your health and life expectancy.

It's important to be honest during the application process, as lying about your health or lifestyle could result in your beneficiaries being denied the death benefit. Additionally, your age will significantly impact the cost of your life insurance premiums. The older you are, the more expensive the premiums will be, as the likelihood of becoming ill or dying while under coverage increases.

If you're taking on more debt, it's crucial to consider the financial burden this may place on your loved ones in the event of your death. Increasing your life insurance coverage can help ensure that they have the necessary funds to pay off any outstanding debts and maintain their financial stability.

Business Owners: Life Insurance Through Your Company?

You may want to see also

Your salary increases

When it comes to life insurance, eligibility requirements and premium rates are influenced by various factors, including age, health, lifestyle, and financial situation. While a salary increase may not directly impact eligibility, it can play a role in determining the coverage amount and policy type that best suits your needs. Here's how a higher salary may affect your life insurance journey:

- Income Replacement: The primary purpose of life insurance is to provide financial protection for your loved ones in the event of your death. A higher salary means your income contributes significantly to your household's financial stability. Therefore, when calculating the coverage amount, it's essential to consider income replacement. Financial experts often recommend having enough coverage to replace at least 10 years of your salary, ensuring your dependents can maintain their standard of living even if you're no longer around.

- Debt Coverage: If you have accumulated debts, such as a mortgage, student loans, or credit card balances, your life insurance policy should include sufficient coverage to pay them off. A higher salary may mean you have taken on more significant debts, so adjusting your coverage accordingly is crucial.

- Standard of Living Maintenance: Life insurance can help maintain the standard of living for your dependents after you're gone. If your salary has increased, it's likely that your family has become accustomed to a certain lifestyle. By increasing your coverage, you can ensure they have the financial resources to continue their current way of life.

- Policy Options: When selecting a life insurance policy, you have the choice between term life insurance and permanent life insurance. Term life insurance covers a set period, making it ideal if you want coverage for a specific duration, such as until your children become financially independent. Permanent life insurance, on the other hand, provides coverage for your entire life and often includes an investment component. A higher salary may give you more flexibility in choosing a policy type, as permanent life insurance tends to be more expensive but offers additional benefits, such as cash value accumulation.

- Affordability: With a higher salary, you may find it more affordable to purchase a life insurance policy with a higher coverage amount and additional riders or benefits. While life insurance is important at any income level, having a higher salary can make it easier to budget for more comprehensive coverage.

It's important to remember that while salary is a factor in determining your life insurance needs, it's not the only consideration. Age, health status, number of dependents, and other financial obligations also play a significant role in choosing the right policy for your situation. Consulting with a licensed insurance advisor or financial planner can help you navigate these factors and select the coverage that best aligns with your circumstances, including any changes in your salary.

Life Insurance After Retirement: What You Need to Know

You may want to see also

You're taking on additional financial responsibilities

Taking on additional financial responsibilities can be a significant factor when considering an increase in eligibility requirements for life insurance. Here are four to six paragraphs elaborating on this topic:

When taking on more financial responsibilities, such as a mortgage, starting a family, or caring for ageing parents, it's crucial to ensure that your loved ones are financially protected in the event of your untimely death. Life insurance serves as a safety net, providing financial support to your dependents when they need it most. By increasing your life insurance coverage, you can rest assured that your family will have the necessary funds to maintain their standard of living, pay off any outstanding debts, and cover future expenses like college tuition.

The amount of life insurance coverage you need will depend on various factors, including your income, the number of dependents, and their future needs. It's recommended to get coverage worth five to ten times your annual salary to ensure your loved ones can maintain their lifestyle and meet essential expenses. Additionally, consider any large future expenditures, such as your children's education, to ensure they have the financial support needed to achieve their goals.

When taking on additional financial responsibilities, it's essential to review and update your life insurance policy. Contact your insurance provider to discuss increasing your coverage. They will work with you to assess your current situation, future goals, and budget to determine the appropriate level of coverage. Remember, the younger and healthier you are, the lower your insurance premiums are likely to be, so don't delay in increasing your coverage.

Life insurance is designed to provide financial security for your loved ones, and it's important to ensure your policy aligns with your current financial responsibilities and future goals. By regularly reviewing and adjusting your coverage, you can have peace of mind knowing that your family will be taken care of, even in your absence. This proactive approach to financial planning demonstrates your commitment to their well-being and ensures they won't be burdened with financial struggles during an already difficult time.

Furthermore, when taking on additional financial responsibilities, it's worth considering different types of life insurance policies to find the best fit for your needs. Term life insurance provides coverage for a specific period, making it ideal if you want protection during the years you're most likely to have financial dependents. In contrast, permanent life insurance offers lifelong coverage and often includes a savings component, providing additional flexibility to meet future financial goals.

By increasing your eligibility requirements for life insurance when taking on more financial responsibilities, you're not just protecting your loved ones; you're also investing in their future. It's a way to ensure that your family can maintain their standard of living, pursue their dreams, and achieve financial security, even when you're no longer there to provide for them directly. This proactive approach to financial planning demonstrates your commitment to their long-term well-being.

Haven Life: Insurance Without the Medical Exam Hassle

You may want to see also

You're planning for future expenses

Life insurance is a crucial aspect of financial planning, providing a safety net for your loved ones in the event of your death. When planning for future expenses, it's essential to consider the eligibility requirements and how they might impact your ability to obtain adequate coverage. Here are some key points to keep in mind:

Understanding Life Insurance:

Life insurance offers financial protection for your family or beneficiaries after your death. It ensures that they can maintain their standard of living and cover expenses such as mortgage payments, college tuition, or other financial responsibilities.

Types of Life Insurance:

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often 10, 15, or 20 years, and is generally more affordable. Permanent life insurance, on the other hand, offers coverage for your entire life and often includes a savings component.

Eligibility Requirements:

When applying for life insurance, you'll typically need to fill out paperwork, undergo a medical exam, and provide health histories for yourself and your immediate family. The insurance company will evaluate your risk of death and set the policy cost accordingly. Age, health, lifestyle choices (smoking, drinking, exercise), and family medical history are all factors that influence your eligibility and premium rates.

Impact of Increasing Eligibility Requirements:

As eligibility requirements increase, it may become more challenging to obtain life insurance, especially for older individuals or those with pre-existing health conditions. Insurers may introduce stricter medical exams and increase premium rates for those who meet the eligibility criteria. This can make it more difficult for individuals with health issues or on lower incomes to obtain adequate coverage.

Planning for Future Expenses:

When planning for future expenses, consider the following:

- Review your coverage regularly: Life insurance should align with your life stage and financial situation. Review your coverage periodically, especially after significant life events like marriage, having children, or purchasing a home.

- Ensure sufficient coverage: Evaluate whether your current coverage is enough to maintain your family's standard of living and cover future expenses, such as education costs or long-term debt.

- Consider increasing your coverage: If your work policy is basic or your income has increased, consider raising your coverage. This is especially important if your salary supports higher living standards or if you've taken on additional financial responsibilities.

- Plan for long-term debt: If you have long-term debt, such as student loans or a mortgage, consider increasing your coverage to ensure that your beneficiaries aren't burdened with these financial obligations.

- Account for changes in your partner's employment status: If your spouse or partner stops working, consider increasing your coverage to maintain adequate protection.

- Prepare for unexpected financial responsibilities: If you're taking care of someone unexpectedly or supporting someone financially, evaluate whether you need to increase your coverage to cover these additional expenses.

- Choose the right type of policy: Opt for term life insurance if you're on a budget or only need coverage for a specific period. Choose permanent life insurance if you want coverage for your entire life and are interested in the savings component.

- Shop around for the best policy: Research different insurance companies and compare quotes to find the most suitable coverage for your needs.

By carefully considering your future expenses and planning accordingly, you can ensure that you have adequate life insurance coverage to protect your loved ones financially. It's essential to review your coverage regularly and make adjustments as your life circumstances change.

Time Life Insurance: What You Need to Know

You may want to see also

You're expecting more children

If you're expecting more children, it's important to review your life insurance coverage to ensure that your family is protected financially. Here are some key considerations:

Calculate Expenses and Determine Your Goals:

Consider the costs associated with raising multiple children, including daily expenses, childcare, education, and future expenses such as college tuition. Determine your financial goals for your growing family and calculate the coverage amount needed to achieve those goals.

Choose the Right Type of Life Insurance:

There are two main types of life insurance: permanent life insurance and term life insurance. Permanent life insurance provides coverage for your entire life, as long as premiums are paid, and includes additional benefits like a cash value. However, it tends to be more expensive. Term life insurance, on the other hand, offers coverage for a specific number of years and is more affordable, making it a popular choice for young families.

Review Your Current Coverage:

If you already have life insurance, evaluate whether it is sufficient for your growing family's needs. Consider the coverage range of your current policy and assess if it needs to be supplemented with an additional individual policy.

Sign Up at the Right Time:

The cost of life insurance is influenced by age and health. The younger and healthier you are when applying for a policy, the more affordable it will be. Therefore, consider signing up for life insurance or increasing your coverage before or early in your pregnancy to avoid higher rates due to health issues associated with pregnancy.

Compare Insurance Providers:

Shop around and compare different insurance providers to find the best coverage for your budget. Consider consulting an independent insurance agent who works with multiple companies to help you find the most suitable option for your family's needs.

Be Mindful of Other Insurance Policies:

In addition to life insurance, review your home, auto, and health insurance policies to ensure they meet the needs of your growing family. For example, you may need to increase your auto insurance coverage or add personal injury protection or a roadside assistance plan for added peace of mind.

By carefully considering these factors, you can ensure that you have adequate life insurance coverage to protect your growing family and provide financial security for their future.

Who Gets the Payout? Contesting Life Insurance Beneficiary Designation

You may want to see also

Frequently asked questions

You need to be able to show insurable interest, which means proving that you would experience financial or other kinds of hardships due to the death of that person.

This depends on your location. In most states in the US, the minimum age is 18, but in Washington state, those aged 15 and older must sign any life insurance application taken out on them. Parents and legal guardians can take out life insurance on children below the legal age limit.

The primary factors are age and health. The older you are, the more expensive the premiums will be as you are likely to become ill or die while under coverage. Other factors include gender, family medical history, lifestyle characteristics such as smoking, drinking, exercise, and risky hobbies.

There are two main categories: permanent life insurance, which provides coverage for your entire life, and term life insurance, which only covers a set period.

You could lower your insurance premium by quitting smoking, losing weight, reducing your alcohol intake, and improving your driving record by incurring fewer moving violations.