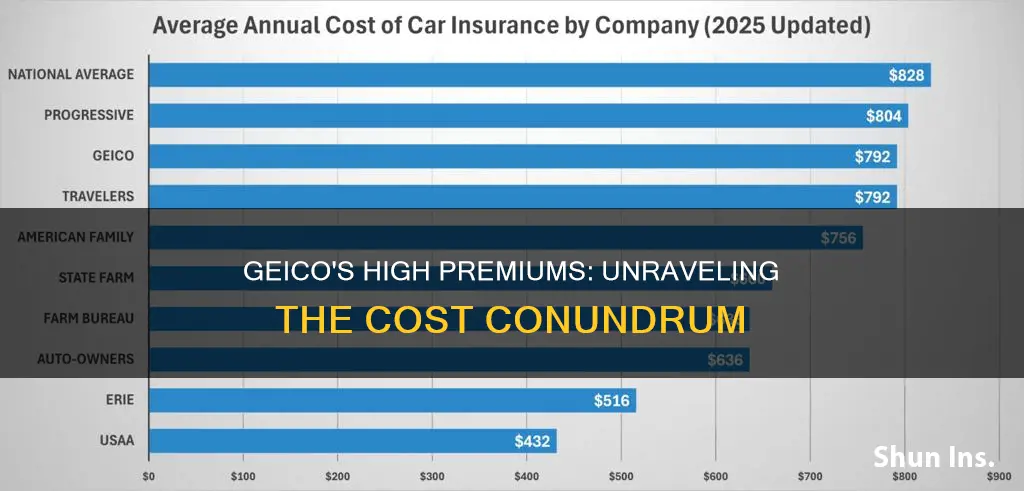

Geico, a well-known insurance company, often faces the question of why its insurance rates can be relatively high compared to other providers. This paragraph aims to shed light on this topic: Geico's insurance premiums may seem higher than some competitors, but there are several factors that contribute to this. Firstly, Geico's extensive advertising and brand recognition have led to higher operational costs. Additionally, the company's focus on customer service and personalized policies can result in more comprehensive coverage options, which may come at a premium. Geico's commitment to financial stability and a strong market presence also influences its pricing strategy. Understanding these aspects can help consumers make informed decisions when choosing an insurance provider.

What You'll Learn

- Competitive Market: Geico's rates are competitive, but high due to market dynamics and customer loyalty

- Comprehensive Coverage: Geico offers extensive coverage, which can lead to higher premiums

- Claims Process: Efficient claims handling may result in increased costs for policyholders

- Safety Features: Emphasis on safety features can drive up insurance prices

- Customer Service: Excellent customer service may contribute to higher premiums

Competitive Market: Geico's rates are competitive, but high due to market dynamics and customer loyalty

The insurance market is highly competitive, and GEICO, a well-known insurance company, often finds itself at the center of discussions regarding its premium rates. While GEICO's prices might seem high to some, it's essential to understand the factors that contribute to these rates and how they stack up in the competitive insurance landscape.

In a competitive market, insurance companies strive to offer competitive rates to attract customers. GEICO, being a prominent player, has successfully established a strong brand and a loyal customer base. This loyalty is a significant factor in maintaining higher premiums. When customers consistently choose GEICO over competitors, it creates a dynamic where the company can set rates that reflect the value they provide. Over time, this customer loyalty has contributed to GEICO's ability to command higher prices.

Market dynamics play a crucial role in determining insurance rates. GEICO's business model and strategies have evolved to cater to specific customer segments. By focusing on specific demographics and offering tailored policies, they have created a unique position in the market. This targeted approach allows GEICO to optimize its rates, ensuring they remain competitive within its niche. As a result, customers who value the specialized services GEICO provides are willing to pay a premium, even if it means slightly higher insurance costs.

Additionally, GEICO's extensive advertising and marketing campaigns have contributed to its brand recognition and customer trust. This brand visibility allows them to attract new customers and retain existing ones, further solidifying their market position. When customers perceive GEICO as a reliable and trusted insurance provider, they are more likely to accept the associated costs, even if they are higher compared to some competitors.

In a competitive insurance environment, GEICO's rates are a reflection of its strategic positioning and customer-centric approach. While it may seem counterintuitive, the company's competitive rates are a result of its ability to cater to specific market needs and build a loyal customer base. Understanding these market dynamics is key to comprehending why GEICO's insurance premiums might be considered high, yet still attract a significant customer following.

Marketplace Insurance: Why Premiums Remain High and What to Do About It

You may want to see also

Comprehensive Coverage: Geico offers extensive coverage, which can lead to higher premiums

Geico, a well-known insurance company, has gained popularity for its competitive rates and extensive coverage options. However, one of the reasons why Geico's insurance premiums can be considered high is the comprehensive nature of their coverage. When comparing insurance policies, it's essential to understand the different types of coverage available and how they impact the overall cost.

Comprehensive coverage, as the name suggests, provides a wide range of protection beyond the basic liability and collision coverage. This type of coverage is designed to safeguard your vehicle and offer financial protection in various scenarios. For instance, comprehensive insurance typically includes protection against theft, vandalism, natural disasters, and even damage caused by falling objects. These additional benefits are meant to ensure that policyholders are financially secure in a multitude of situations.

The extensive coverage offered by Geico means that their policies often include a broader range of perils and incidents. While this provides peace of mind and comprehensive protection, it also results in higher premiums. Insurers calculate the cost of insurance based on the potential risks and the likelihood of certain events occurring. With more comprehensive coverage, the insurance company is taking on a larger risk, which is reflected in the increased cost of the policy. For example, if you live in an area prone to severe storms, comprehensive coverage would include protection against wind damage, which may be a higher-risk scenario compared to a region with fewer extreme weather events.

Furthermore, Geico's comprehensive coverage might also include additional benefits such as rental car reimbursement, emergency road service, and trip interruption coverage. These extra features contribute to the overall cost of the policy but provide valuable assistance in various travel-related situations. The more comprehensive the coverage, the more the insurance company is committed to ensuring financial protection for the policyholder, which can lead to higher premiums.

In summary, Geico's insurance premiums may be perceived as high due to their comprehensive coverage options. While this extensive protection offers peace of mind and financial security, it also reflects the increased risk and cost associated with providing a broader range of benefits. Understanding the details of comprehensive coverage and its impact on premiums can help individuals make informed decisions when choosing an insurance provider.

Liberty Insurance and the 21st Birthday: Unraveling Auto Insurance Adjustments

You may want to see also

Claims Process: Efficient claims handling may result in increased costs for policyholders

The high cost of insurance, particularly from companies like Geico, often sparks curiosity among consumers. One aspect that contributes to these elevated premiums is the claims process and its efficiency. Efficient claims handling, while beneficial for policyholders in terms of timely resolutions, can inadvertently lead to increased costs for them.

In the insurance industry, efficient claims processing is a strategic advantage. It involves streamlining the entire process, from the initial report of a loss to the final settlement. This efficiency is achieved through various means, such as implementing digital claim submission systems, utilizing advanced analytics for faster damage assessments, and employing automated processes for policy verification. While these methods undoubtedly improve the customer experience, they also have financial implications.

The primary reason for the potential increase in costs is the investment required to maintain and improve these efficient systems. Insurance companies must allocate significant resources to develop and maintain advanced technologies, hire specialized staff, and ensure compliance with regulatory standards. These expenses are then reflected in the premiums paid by policyholders. For instance, the development and implementation of a user-friendly online claims portal, which allows customers to report incidents quickly, may require substantial upfront costs. However, this investment can lead to faster claim settlements, reducing the overall operational costs for the insurance company in the long run.

Additionally, efficient claims handling often results in a higher volume of processed claims, which can lead to increased administrative costs. When a company can quickly and accurately process claims, it may also face a higher risk of fraud or errors, requiring additional resources for verification and dispute resolution. These factors contribute to the overall operational expenses, which are ultimately passed on to the policyholders in the form of higher premiums.

In summary, while efficient claims processing is a desirable feature for insurance customers, it is a complex process that requires significant investment. This investment, coupled with the potential for increased administrative costs, can contribute to the higher insurance premiums associated with companies like Geico. Understanding these factors can help consumers make more informed decisions when choosing insurance providers and policies.

Late Payment Consequences for MetLife Auto Insurance Policyholders

You may want to see also

Safety Features: Emphasis on safety features can drive up insurance prices

The cost of insurance, especially from companies like GEICO, can often be a concern for many drivers. One of the primary factors that contribute to higher insurance premiums is the emphasis on safety features in modern vehicles. These safety features are designed to enhance driver and passenger safety, which is undoubtedly a positive aspect, but they also play a significant role in determining insurance rates.

Safety features have evolved significantly over the years, and modern cars are equipped with advanced technologies that were once considered luxury options. These include advanced driver-assistance systems (ADAS), such as lane-keeping assist, adaptive cruise control, automatic emergency braking, and blind-spot monitoring. While these features significantly reduce the risk of accidents and improve overall road safety, they also contribute to higher insurance costs. Insurance companies often view these advanced safety systems as a sign of a more cautious and responsible driver, which can lead to lower claim rates and, consequently, higher premiums for policyholders.

The complexity and sophistication of these safety features also play a part in the pricing. For instance, advanced driver-assistance systems rely on a network of sensors, cameras, and software, which can be expensive to repair or replace if damaged in an accident. Additionally, the algorithms and machine learning capabilities of these systems require regular updates and maintenance, adding to the overall cost of ownership and, subsequently, the insurance premium.

Furthermore, the presence of these safety features can also impact the vehicle's resale value. Cars with advanced safety technologies often retain their value better over time, which can be advantageous for the driver but may also influence insurance rates. Insurance providers might consider the residual value of a vehicle when calculating premiums, especially for those with high-end safety features.

In summary, the emphasis on safety features in modern vehicles is a double-edged sword. While it significantly reduces the risk of accidents and enhances road safety, it also contributes to higher insurance premiums. The advanced technologies and complex systems in today's cars are designed to protect drivers and passengers, but they also drive up the cost of insurance, making it a crucial factor for consumers to consider when choosing a vehicle and an insurance provider.

Is Insurance Higher for Hatchbacks? Unveiling the Truth

You may want to see also

Customer Service: Excellent customer service may contribute to higher premiums

The relationship between customer service and insurance premiums is an intriguing aspect of the insurance industry. While one might assume that better customer service would lead to lower premiums, the opposite can sometimes be true, especially for companies like GEICO. This paradoxical situation can be attributed to several factors.

Firstly, excellent customer service often results in a higher volume of satisfied customers. When clients are happy with the support they receive, they are more likely to remain loyal to the company. This loyalty can lead to a higher retention rate, which, in turn, may encourage the insurance provider to increase premiums. Insurance companies often view long-term customers as lower-risk, as they are less likely to switch providers and potentially take their business elsewhere. As a result, the company might adjust premiums to reflect this reduced risk, especially if they have a large number of such customers.

Secondly, a company with a strong customer service reputation might attract more clients. Positive word-of-mouth and online reviews can significantly impact a company's reputation and its ability to acquire new customers. When more people sign up for insurance, the company's overall risk pool increases, which can lead to a slight premium hike. This strategy is often employed by insurance providers to maintain profitability, especially when they have a high customer satisfaction rate.

Moreover, the nature of customer service interactions can also play a role. In the insurance industry, customer service representatives often deal with a wide range of issues, from policy inquiries to claims processing. When these interactions are efficient, friendly, and effective, customers are more likely to feel valued. This sense of appreciation can lead to increased customer loyalty and, consequently, higher premiums. However, it's important to note that this is not always the case, as some companies might struggle to maintain consistent service quality, which could lead to customer dissatisfaction and churn.

In the context of GEICO, their customer service reputation might be a contributing factor to their relatively higher premiums. GEICO has built a strong brand image, and their customer service is often cited as a key reason for customer satisfaction. While this can attract more clients, it may also lead to a perception of exclusivity, where customers feel they are paying a premium for the superior service they receive. This perception can, in turn, justify higher premiums, especially if GEICO's customer service is consistently ranked as one of the best in the industry.

Navigating Another Person's Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

GEICO's insurance rates can vary depending on several factors, and there's no one-size-fits-all answer. However, one reason could be their extensive use of data-driven underwriting. GEICO analyzes a vast amount of data to set premiums, considering factors like driving record, vehicle type, and coverage options. This personalized approach can result in higher rates for certain drivers, especially those with a history of claims or traffic violations.

GEICO's pricing strategy is designed to be competitive and tailored to individual needs. They offer a wide range of discounts, such as good driver, safe driver, multi-policy, and loyalty discounts, which can significantly reduce premiums. While some may perceive their rates as high, these discounts can make their insurance more affordable for many drivers. It's essential to compare quotes from multiple insurers to ensure you're getting the best value.

There are several ways to potentially reduce your GEICO insurance expenses:

- Shop around and compare quotes from different insurers to find the best rates.

- Increase your deductible, as this can lower your premium.

- Take advantage of GEICO's various discounts, such as those for safe driving, multiple policies, and good student status.

- Review your coverage regularly and adjust it based on your needs; you might be able to save by removing unnecessary coverage.

- Maintain a good driving record and avoid accidents or traffic violations to keep your premiums stable.