An insurance carrier loss run is a document that records a business's history of insurance claims. It is similar to a credit score for a bank loan, allowing insurance providers to determine whether a business is eligible for coverage and how high or low their rates will be. Loss runs are compiled into a report that includes information such as the type of claim, when it occurred, and how much has been paid out by the carrier. This report can be provided to prospective insurers when shopping for new coverage.

| Characteristics | Values |

|---|---|

| Purpose | To provide an overview of a company's claims history |

| Who creates it | Insurance carrier |

| Who uses it | Insurance providers, businesses |

| When to use it | When applying for a new insurance policy |

| What it includes | Type of claim, when it occurred, how much has been paid out |

| How to obtain it | Contact insurance carrier or agent directly |

What You'll Learn

Loss run reports are used to determine a business's risk level

Loss run reports are an essential tool for businesses to understand their risk profile and insurance needs. They are the insurance equivalent of a credit score for a bank loan, providing a summary of a company's insurance losses and claims history. This report is compiled by the insurance company and sent to the policyholder, containing details such as the date, type, and amount of each loss.

The loss run report is particularly useful when a business is looking for new insurance coverage. It allows potential insurers to evaluate the risk of offering insurance coverage by reviewing the company's past claims and their financial impact. Insurers need to determine whether a business is a satisfactory risk, which will influence the premium charged. A business with no claims history may benefit from lower premiums, similar to a driver with a good record obtaining a discount on car insurance.

The report also helps businesses review their risk exposure and implement strategies to mitigate future losses. For example, frequent claims for water damage due to a leaky roof may indicate poor maintenance, which the business can then address. Loss run reports can also help identify trends and vulnerabilities in specific departments, enabling businesses to improve workplace safety and overall efficiency.

In addition, loss run reports are valuable for insurance renewals. They provide an up-to-date overview of a company's claims history, helping insurance professionals determine eligibility for coverage types, premium amounts, and policy renewals. The report's "valuation date" is crucial for underwriters to assess the most recent claims adjustments and reserve estimates.

Overall, loss run reports are a critical tool for businesses to understand their insurance needs, improve operations, and make informed decisions about their coverage. They provide a comprehensive view of a company's risk profile, guiding both insurers and businesses in their decision-making processes.

Insurance for Kids: A Smart Advantage?

You may want to see also

They are similar to credit scores

Insurance loss runs are similar to credit scores in that they allow insurance providers to assess the risk of insuring a business, much like a bank uses a credit score to determine whether a loan or credit card is suitable for a customer.

A loss run report details a business's claims history, including the type of claims made, the financial impact of the claims, and the frequency of claims. This information is used by insurance providers to evaluate the risk of offering coverage to a business, in the same way that a credit score is used by banks to determine creditworthiness.

The loss run report reflects on the business's operations and management, indicating the business's commitment to minimizing risk. Similarly, a credit score gives banks an idea of how well an individual manages their finances and their ability to repay loans.

Both loss run reports and credit scores are used to make informed decisions about the level of risk involved in providing insurance coverage or financial credit. They provide a clear picture of a business's or individual's history and the potential risks associated with offering a service.

Additionally, just as a clean credit history can result in favourable loan terms, a business with a clean claims history can benefit from lower insurance premiums. Conversely, a high-risk business with an adverse loss history may struggle to obtain insurance coverage, similar to how a low credit score can hinder an individual's ability to secure a loan or credit card.

DUI History: Insurance Impact

You may want to see also

They are used when applying for a new insurance policy

Loss runs are insurance carrier reports that detail a company's claims history. They are used when applying for a new insurance policy to help insurance providers determine whether a business is eligible for coverage and how high or low their rates will be.

When applying for a new insurance policy, a loss run report is provided to the prospective insurance provider. This report allows them to assess the risk of insuring your business. It is similar to a credit score when applying for a loan or credit card. The insurer will be able to review the type of claims made in the past, the financial impact of these claims, and the frequency of claims. This information is used to determine whether the business is a satisfactory risk or a high-risk customer.

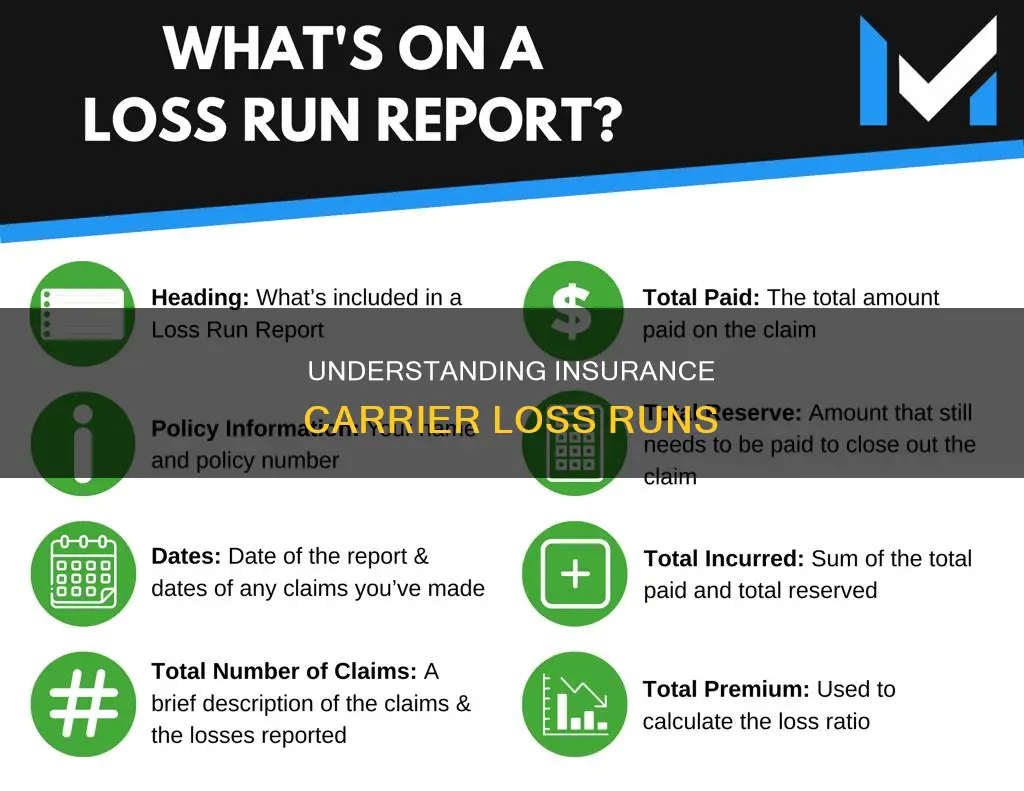

A loss run report will typically include the following information:

- The insured's name

- The dates of any claims and when they were reported

- A description of the claim and the reason for it

- The amount paid to settle the claim

- The status of the claim (open or closed)

- The amount being held in reserves for the claim

When applying for a new insurance policy, the prospective insurance provider will usually request between three to five years of claims history in the form of a loss run report. This allows them to decide whether to insure the business and at what cost. A business with no claims history or a low number of claims may qualify for lower premiums.

Loss run reports are most frequently used when applying for an insurance policy with a new carrier, but they can also be a valuable tool for businesses to monitor and improve their operations and safety practices.

Insurance Coverage: Does It Carry Over?

You may want to see also

They can be used to monitor and improve business operations

Insurance loss runs are reports that detail a business's claims history. They are generated by insurance carriers and include information such as the type of claim, when it occurred, and how much has been paid out by the carrier. Loss runs are most frequently used when a business is applying for an insurance policy with a new carrier.

However, loss runs can also be used to monitor and improve business operations in several ways:

- Identifying weaknesses in operating protocols: Loss runs can help businesses identify weaknesses in their operating protocols by highlighting areas of frequent claim activity. For example, frequent water damage losses from a leaky roof may indicate a poor maintenance policy. By identifying these weaknesses, businesses can take corrective measures to prevent future losses and improve their operations.

- Developing a risk avoidance strategy: By reviewing their loss run report, businesses can gain insights into their risk profile and develop strategies to avoid or mitigate future risks. This can help businesses improve their safety practices and reduce the likelihood of future claims.

- Negotiating premiums: Loss run reports can be used by businesses to negotiate lower premiums with insurance companies. A clean claims history or a low-risk profile may qualify a business for discounted rates on their insurance coverage.

- Evaluating the safety culture: Businesses with a large number of employees in risky jobs can use loss runs to evaluate their safety culture and identify areas where additional safety measures or training may be needed.

- Due diligence in business purchases: When purchasing another business, reviewing its loss runs can provide valuable insights into the risk level of the business. This can help avoid surprises and make more informed decisions about the purchase.

- Improving safety practices: Loss runs can help businesses identify patterns or trends in their claims history, which can inform improvements to their safety practices and operations. For example, if a business has a history of frequent workers' compensation claims due to injuries in a particular department, they can focus their efforts on improving safety measures and training in that area.

Contractor Insurance: What Policies Are Essential?

You may want to see also

They are used to determine eligibility for coverage

Loss runs are used by insurance providers to determine a business's eligibility for coverage. They are a record of a company's insurance claims history, detailing the types of claims made, when they occurred, and how much was paid out by the insurance carrier.

Insurance companies use loss runs to assess the risk of insuring a particular business. By reviewing the types of claims made, the financial impact of those claims, and the frequency with which they occur, insurers can determine whether a business is a satisfactory or high-risk customer. This assessment is a critical component of the insurance underwriting process and helps insurers decide whether to offer coverage and at what rate. A business with multiple losses or high-dollar claims is likely to be considered riskier to insure and may be quoted a higher premium or even be declined for coverage.

Loss runs are typically requested when a business is applying for a new insurance policy or carrier and are used to evaluate the business's risk profile. They are also used by business owners to monitor and improve their operations and safety practices, as well as to negotiate premiums with insurance companies.

In most cases, insurance companies will request loss runs for the last 2 to 5 years of a business's operations to make an informed decision about eligibility and rates. The information contained in loss runs is, therefore, a crucial factor in determining a business's eligibility for insurance coverage and the associated costs.

Concealed Carry Insurance: Protection for Gun Owners

You may want to see also

Frequently asked questions

An insurance carrier loss run is a document that records the history of claims made against a business insurance policy. It is similar to a credit score for taking out a loan.

An insurance carrier loss run includes the insured's name, the dates of all reported claims, a description of the event, the dates the insurer was notified of each loss, the reason for the claim, the amount the insurer paid to settle the claim, and the amount the insurer has set aside in reserves if the claim is still open.

Insurance carrier loss runs are important because they allow insurance providers to determine whether a business is eligible for coverage and how high or low their rates will be. They are also useful for businesses to review their own risk and create a risk avoidance strategy.