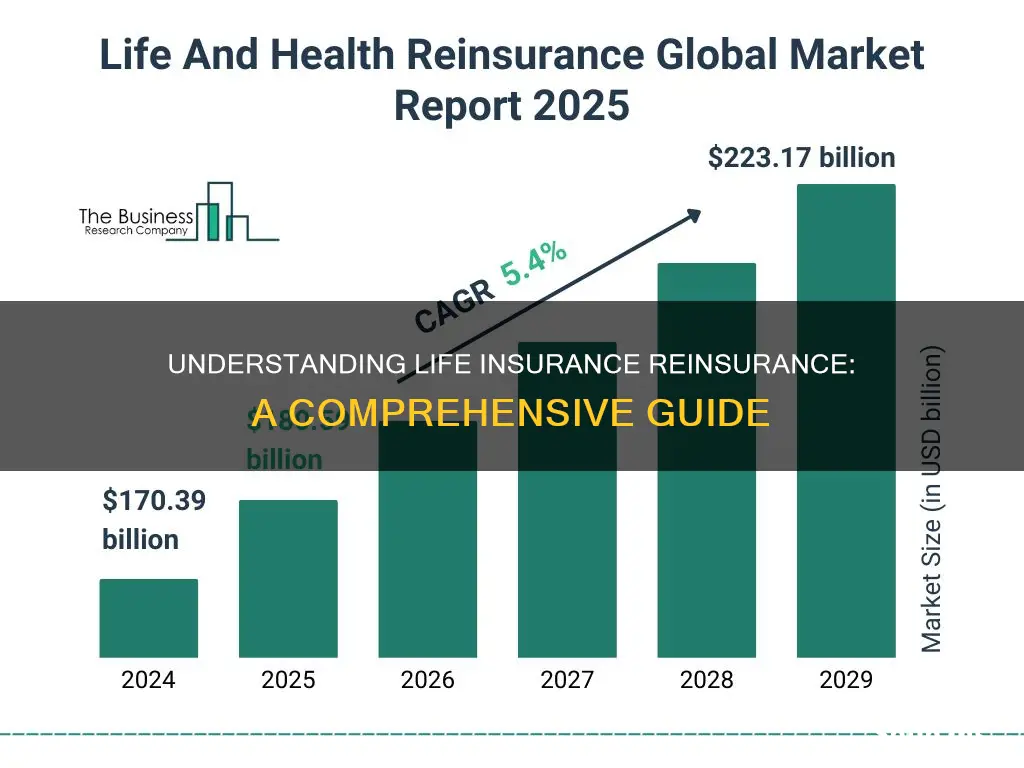

Life insurance reinsurance is a crucial aspect of the insurance industry, acting as a safety net for insurers to manage and mitigate risks associated with life insurance policies. It involves an agreement where one insurer (the reinsurer) provides financial protection to another insurer (the ceding company) against potential losses from life insurance claims. This practice allows insurers to transfer a portion of their risk to another party, ensuring they can fulfill their financial obligations to policyholders even in the event of large-scale claims. Reinsurance is essential for maintaining the stability and solvency of insurance companies, especially in the face of unforeseen events like natural disasters or widespread health crises.

What You'll Learn

- Reinsurance Basics: Transferring risk to another party through a contract

- Life Reinsurance: A contract to provide financial protection for a deceased individual

- Reinsurance Premiums: The cost of reinsurance coverage, often a percentage of the premium

- Reinsurance Pools: Aggregating risks from multiple insurers to manage large-scale events

- Reinsurance Capacity: The ability of a reinsurer to accept and manage risk

Reinsurance Basics: Transferring risk to another party through a contract

Reinsurance is a fundamental concept in the insurance industry, allowing companies to manage and transfer risk to another party through a contractual agreement. This process is particularly crucial in the life insurance sector, where the potential for large-scale financial losses can be significant. By engaging in reinsurance, life insurance companies can mitigate their exposure to risk and ensure their long-term financial stability.

The basic principle of reinsurance involves a contract between two parties, the reinsurer and the ceding company (the original insurance provider). In this contract, the reinsurer agrees to assume a portion of the financial risk associated with the ceding company's insurance policies. This risk transfer is essential as it allows the ceding company to reduce its potential losses and retain more profitable policies. For instance, if a life insurance company has a policy with a high-risk profile, it can reinsure this policy with a reinsurer, thus sharing the financial burden if the policyholder were to pass away.

Reinsurance contracts are typically structured with specific terms and conditions. These include the amount of risk to be transferred, the duration of the agreement, and the premium paid by the ceding company to the reinsurer. The reinsurer, in turn, provides financial protection against potential losses, ensuring that the ceding company can fulfill its obligations to policyholders. This arrangement is especially vital for life insurance, where long-term commitments are common, and the risk of mortality is ever-present.

One of the key advantages of reinsurance is its ability to provide financial stability and risk management. By sharing the risk, reinsurers enable insurance companies to offer more competitive rates, attract a broader customer base, and maintain their financial health. This is particularly important for life insurance providers, as it allows them to continue operating and serving their customers effectively, even in the face of unforeseen events.

In summary, reinsurance is a critical tool for life insurance companies to manage risk and ensure their longevity. Through contractual agreements with reinsurers, these companies can transfer financial burdens, maintain stability, and provide customers with reliable coverage. Understanding the basics of reinsurance is essential for anyone involved in the insurance industry, as it highlights the importance of risk management and the collaborative nature of the business.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

Life Reinsurance: A contract to provide financial protection for a deceased individual

Life reinsurance is a specialized form of reinsurance that provides financial protection for life insurance companies in the event of a policyholder's death. It is a crucial component of the life insurance industry, offering a safety net for insurers to manage their risks effectively. When an individual purchases a life insurance policy, the insurer agrees to pay a specified death benefit to the policyholder's beneficiaries upon the insured's passing. However, the insurer also faces the risk of potential financial loss if the insured dies before the policy's maturity or if the death benefit exceeds the insurer's expectations. This is where life reinsurance comes into play.

In simple terms, life reinsurance is a contract between a life insurance company and a reinsurer (another insurance company or a reinsurance intermediary). The reinsurer agrees to assume a portion of the risk associated with the life insurance policy in exchange for a premium. This premium is typically calculated based on the expected risk and the policy's terms. By doing so, the reinsurer provides financial protection to the original insurer, ensuring that they can fulfill their obligation to pay the death benefit even if the insured individual passes away.

The primary purpose of life reinsurance is to mitigate the financial impact of large payouts, especially in cases of early mortality. It allows life insurance companies to offer policies with higher coverage amounts or more competitive rates, as they can transfer a portion of the risk to the reinsurer. This is particularly important for insurers to maintain profitability and ensure they can meet their financial obligations to policyholders.

When a life insurance company purchases reinsurance, they typically select a reinsurance program that suits their specific needs. This may include term life reinsurance, which covers a specific period, or permanent life reinsurance, providing coverage for the entire policy term. The reinsurer then becomes responsible for paying the death benefit if the insured individual dies during the reinsured period. This arrangement ensures that the original insurer can continue to operate and provide financial security to their customers.

In summary, life reinsurance is a vital mechanism that enables life insurance companies to manage the risks associated with death benefits. It provides a safety net, allowing insurers to offer more comprehensive coverage and competitive pricing. By transferring a portion of the risk, life reinsurance ensures that policyholders' beneficiaries receive the intended financial protection, even in the unfortunate event of the insured's passing. This contract-based approach is essential for the stability and growth of the life insurance industry.

Global Life Insurance: Is It a Smart Choice?

You may want to see also

Reinsurance Premiums: The cost of reinsurance coverage, often a percentage of the premium

Reinsurance premiums are a critical component of the reinsurance market, representing the cost of reinsurance coverage that insurance companies pay to protect themselves against potential financial losses. This financial arrangement allows insurers to transfer a portion of their risk to reinsurers, providing a safety net in the event of large-scale claims or catastrophic events. The premium is essentially a fee paid to the reinsurer, which is typically a percentage of the total premium collected by the original insurer.

When an insurance company writes a policy, it assumes a certain level of risk, and this risk is directly proportional to the premium it charges the policyholder. Reinsurance premiums are calculated based on this risk assessment, ensuring that the reinsurer is compensated for the potential liabilities it is taking on. The percentage of the premium that goes to the reinsurer can vary widely depending on the specific policy, the insurer's risk management strategies, and the reinsurer's terms. For instance, a reinsurer might charge a 10% premium on a life insurance policy, meaning they receive 10% of the total premium collected by the insurer for that policy.

The calculation of reinsurance premiums involves a complex process that considers various factors. These include the insured's age, health, and lifestyle, as well as the type of policy and the geographic location. Older individuals, for example, may be considered higher-risk, leading to higher reinsurance premiums. Similarly, policies with higher potential payouts, such as those with large death benefits, will also incur higher reinsurance costs. Reinsurers use sophisticated models and data to assess these risks and determine the appropriate premium structure.

Understanding reinsurance premiums is essential for both insurance companies and policyholders. For insurers, it represents a necessary expense to ensure they can meet their financial obligations and maintain their solvency. For policyholders, it means that a portion of their premium is directly contributing to the stability and financial health of the insurance industry. This arrangement is particularly crucial in the context of life insurance, where large payouts can be life-changing for beneficiaries and where the industry's stability is vital for long-term sustainability.

In summary, reinsurance premiums are the financial cost associated with reinsurance coverage, a critical aspect of the insurance industry's risk management strategy. These premiums are calculated based on the risk assessment of the insured and the policy's specific details, ensuring that reinsurers are adequately compensated for their role in protecting insurers from potential financial losses. This system allows for the transfer of risk, providing stability and security to the insurance market and its customers.

Irrevocable Life Insurance Trusts: Estate Liquidity and Protection

You may want to see also

Reinsurance Pools: Aggregating risks from multiple insurers to manage large-scale events

Reinsurance pools play a crucial role in the insurance industry by providing a mechanism to aggregate risks from multiple insurers, thereby managing large-scale events and mitigating potential financial losses. These pools are essentially collaborative arrangements where insurers come together to share the burden of risks, especially those that could lead to significant payouts. The primary objective is to ensure that no single insurer is exposed to an excessive amount of risk, which could potentially lead to insolvency in the event of a major catastrophe.

In the context of life insurance, reinsurance pools are particularly important for managing risks associated with large-scale events such as natural disasters, pandemics, or other catastrophic occurrences. For instance, a life insurance company might offer policies to a large number of individuals, and the risk of a significant number of policyholders dying simultaneously in a disaster is a real concern. By participating in a reinsurance pool, the insurer can share this risk with other companies, reducing the potential financial impact on any one entity.

The process typically involves a group of insurers contributing a portion of their premiums to a common fund. This fund is then used to cover a portion of the claims that arise from large-scale events. The key advantage is that it allows insurers to spread the risk, ensuring that they have the financial capacity to honor their commitments even in the aftermath of a major disaster. This is especially critical for life insurance companies, as they deal with long-term commitments and the potential for large, unexpected payouts.

Reinsurance pools are structured in various ways, including facultative and treaty arrangements. In a facultative pool, insurers voluntarily contribute to a fund, which is then used to cover specific, agreed-upon risks. Treaty pools, on the other hand, are more formal agreements where insurers commit to contributing a certain percentage of their premiums to a central fund, which is managed by a reinsurance company. This central fund then provides coverage for large-scale events, ensuring that the participating insurers are protected.

By aggregating risks in this manner, reinsurance pools enable insurers to manage large-scale events more effectively, providing a safety net that supports the stability and resilience of the entire insurance industry. This is particularly vital in the life insurance sector, where the long-term nature of policies and the potential for significant payouts make risk management a critical aspect of business operations.

Term Life Insurance: Loan Collateral Options Explored

You may want to see also

Reinsurance Capacity: The ability of a reinsurer to accept and manage risk

Reinsurance capacity is a critical aspect of the reinsurance market, referring to the financial and operational ability of a reinsurer to accept and manage risk on behalf of its ceding companies (the insurers who transfer the risk). This capacity is a key differentiator in the reinsurance industry, as it directly impacts the reinsurer's ability to fulfill its primary function: providing risk mitigation and financial stability to its clients.

The capacity is determined by various factors, including the reinsurer's financial strength, risk management capabilities, and operational efficiency. Financial strength is assessed through credit ratings, which indicate the reinsurer's ability to meet its financial obligations. High credit ratings signify a strong financial position, allowing the reinsurer to accept larger and more complex risks. Risk management capabilities involve the reinsurer's expertise in assessing, evaluating, and mitigating risks. This includes sophisticated modeling, data analytics, and risk assessment tools that enable reinsurers to understand and quantify potential losses.

Operational efficiency is another crucial aspect of reinsurance capacity. It encompasses the reinsurer's ability to process claims, manage administrative tasks, and provide timely support to ceding companies. Efficient operations ensure that reinsurers can quickly respond to claims, reducing the potential for delays and financial losses for the ceding insurers. This efficiency also contributes to the overall stability and reliability of the reinsurance relationship.

Reinsurance capacity is not static and can vary over time due to market conditions, regulatory changes, and the reinsurer's strategic decisions. Reinsurers may choose to expand their capacity by increasing their financial resources, diversifying their risk portfolio, or investing in advanced risk management technologies. Conversely, they might decide to reduce capacity to focus on specific markets or risk types, ensuring a more targeted and specialized approach.

Understanding and assessing reinsurance capacity is essential for ceding companies when selecting reinsurers. It allows insurers to choose partners with the financial strength and risk management capabilities to effectively transfer and manage their risks. By carefully evaluating reinsurers' capacity, insurers can ensure they receive the necessary support to maintain their financial stability and meet their obligations to policyholders.

Setting Up Life Insurance Benefits for Veterans

You may want to see also