Understanding the average monthly payment for life insurance is crucial for anyone considering this essential financial protection. Life insurance provides a safety net for loved ones in the event of the insured's passing, and the cost of this coverage can vary significantly based on several factors. The average monthly payment for life insurance depends on various elements, including the type of policy, the insured's age, health, and the desired coverage amount. This guide will explore these factors and provide insights into how much one can expect to pay for life insurance, helping individuals make informed decisions about their financial security.

What You'll Learn

- Term Life Premiums: Average monthly costs for term life insurance vary by age and coverage amount

- Whole Life Rates: Monthly payments for whole life insurance are typically higher due to cash value accumulation

- Variable Policies: These offer flexible premiums, but monthly costs can fluctuate based on investment performance

- Group Insurance: Employers often provide group life insurance with lower monthly payments compared to individual policies

- Senior Citizens: Older individuals may face higher monthly premiums due to increased health risks

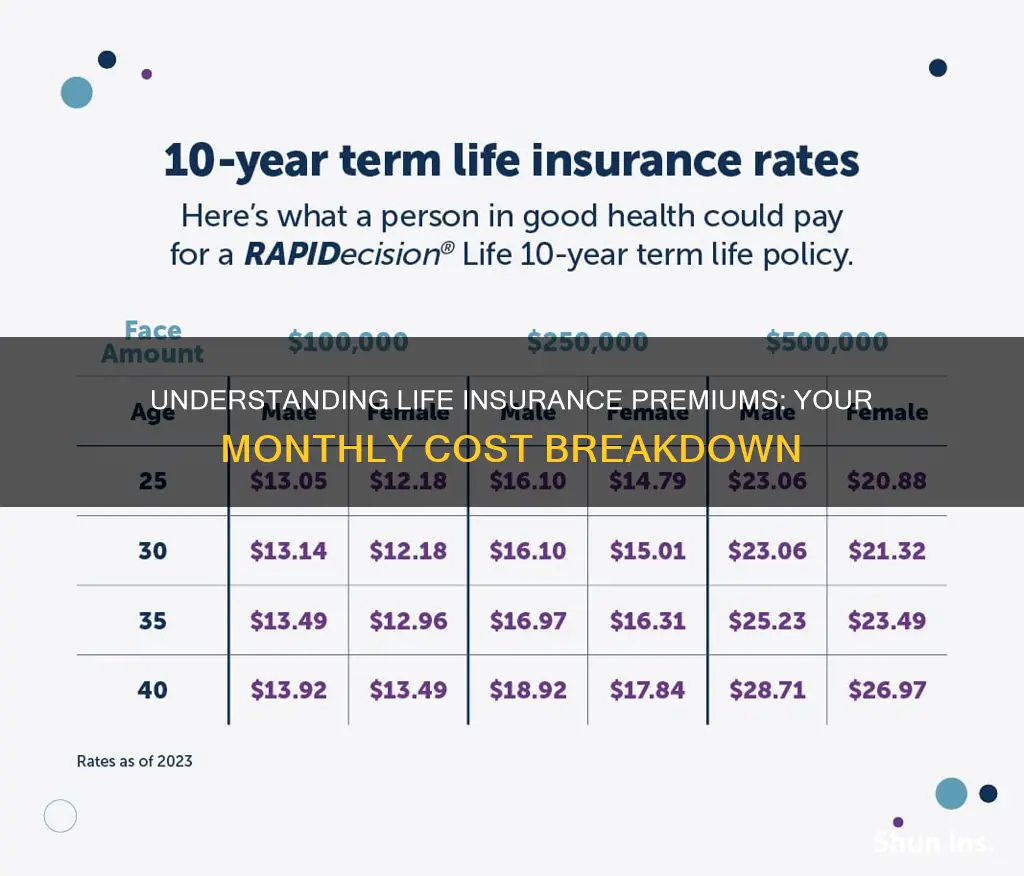

Term Life Premiums: Average monthly costs for term life insurance vary by age and coverage amount

Term life insurance is a popular and affordable way to secure financial protection for your loved ones. It provides coverage for a specific period, typically 10, 20, or 30 years, and offers a death benefit if the insured individual passes away during the term. One of the most significant advantages of term life insurance is its cost-effectiveness, especially when compared to permanent life insurance policies.

The average monthly premium for term life insurance can vary significantly depending on several factors, primarily the age of the insured individual and the coverage amount. Younger individuals generally pay lower premiums as they are considered less risky by insurance companies. This is because younger people have a longer life expectancy, and the likelihood of claiming the death benefit is lower. For instance, a 30-year-old might pay around $25 per month for a $100,000 term life insurance policy with a 10-year term.

As individuals age, the premiums tend to increase. This is due to the higher risk associated with older individuals, as the chances of developing health issues or facing unexpected events increase. For a 50-year-old, the same $100,000 coverage for a 10-year term might cost approximately $50 per month, which is twice the amount paid by the younger individual. Similarly, a 60-year-old could expect to pay even higher premiums, sometimes double or more, for the same coverage.

The coverage amount also plays a crucial role in determining the monthly premium. Higher coverage amounts result in higher premiums. For example, increasing the coverage from $100,000 to $250,000 for a 30-year-old might increase the monthly premium by 50% or more. This is because a larger death benefit indicates a more significant financial loss to the insurance company if the insured individual were to pass away.

In summary, the average monthly payment for term life insurance is influenced by age and coverage amount. Younger individuals with lower coverage needs typically pay lower premiums, while older individuals and those with higher coverage amounts face higher costs. It is essential to consider these factors when evaluating term life insurance options to ensure you receive adequate coverage at a price you can afford.

Canceling Zurich Life Insurance: A Step-by-Step Guide

You may want to see also

Whole Life Rates: Monthly payments for whole life insurance are typically higher due to cash value accumulation

When considering whole life insurance, it's important to understand that the monthly payments can vary significantly depending on several factors. One of the primary reasons for this variation is the concept of cash value accumulation. Whole life insurance policies are designed to provide lifelong coverage, and a portion of each premium payment goes towards building a cash value reserve. This cash value grows over time, and it can be borrowed against or withdrawn, providing financial flexibility. As a result, the monthly payments for whole life insurance are generally higher compared to other types of life insurance.

The higher monthly premiums are directly linked to the long-term benefits of whole life insurance. With each payment, the policyholder contributes to both the death benefit and the cash value. The death benefit ensures that a financial safety net is provided to the policyholder's beneficiaries upon their passing. Simultaneously, the cash value grows, offering a substantial sum that can be utilized for various financial goals. This dual purpose of providing immediate coverage and building long-term wealth justifies the higher costs associated with whole life insurance.

The accumulation of cash value is a unique feature of whole life insurance, setting it apart from term life insurance. In term life policies, the focus is solely on providing coverage for a specified period, typically 10, 20, or 30 years. In contrast, whole life insurance offers permanent coverage, ensuring financial protection throughout the policyholder's lifetime. The higher monthly payments reflect the extended coverage period and the additional benefit of cash value accumulation, which can be a valuable asset for the policyholder.

It's worth noting that the specific monthly payment amount will depend on individual circumstances, such as the policyholder's age, health, and the desired death benefit. Younger individuals generally pay lower premiums as they are considered less risky by insurers. Additionally, the health and lifestyle choices of the policyholder can impact the premium rates. For instance, non-smokers or individuals with a healthy lifestyle may qualify for lower rates.

In summary, the higher monthly payments for whole life insurance are a result of the policy's dual function of providing immediate coverage and building long-term cash value. This comprehensive approach to life insurance ensures that policyholders and their beneficiaries are protected financially, both in the short term and over the course of their entire lives. Understanding these factors can help individuals make informed decisions when choosing the right life insurance policy for their needs.

Bankers Life: Term Insurance Options and Features

You may want to see also

Variable Policies: These offer flexible premiums, but monthly costs can fluctuate based on investment performance

Variable life insurance policies offer a unique approach to life insurance, providing policyholders with a level of flexibility and potential for growth that is not typically found in traditional fixed-rate policies. These policies are designed to adapt to the changing needs and goals of the policyholder, offering a dynamic insurance experience.

One of the key features of variable policies is the ability to customize premiums. Unlike traditional whole life insurance, where monthly payments are fixed for the entire term of the policy, variable policies allow for more flexibility. Policyholders can choose to pay a higher premium during periods of financial abundance and lower amounts when their financial situation demands it. This flexibility is particularly appealing to those who want to ensure they have adequate coverage without the burden of fixed monthly payments that might be challenging to maintain over time.

However, this flexibility comes with a trade-off. The monthly costs of variable life insurance can fluctuate, and this is where the 'variable' aspect comes into play. The investment performance of the policy's underlying assets directly impacts the policy's value and, consequently, the monthly payments. If the investment portfolio performs well, the policy's cash value can grow, potentially leading to lower monthly premiums. Conversely, during market downturns, the policy's value may decrease, resulting in higher monthly costs to ensure the policy remains in force. This dynamic nature of variable policies means that policyholders should be prepared for some level of variability in their monthly expenses.

For those considering variable life insurance, it is essential to understand the investment options available within the policy. These policies often provide access to a wide range of investment vehicles, such as mutual funds, stocks, and bonds. Policyholders can choose to allocate their premiums across these investments, allowing them to potentially benefit from market growth while also managing risk. The investment choices made will directly influence the policy's performance and, ultimately, the monthly payment amounts.

In summary, variable life insurance policies offer a flexible and potentially rewarding approach to life insurance. While they provide the freedom to customize premiums, they also introduce a level of uncertainty due to the variable investment performance. Policyholders should carefully consider their financial goals, risk tolerance, and ability to manage potential fluctuations in monthly costs when deciding on the most suitable life insurance option for their needs.

Life Insurance: Eligibility Requirements and Their Impact

You may want to see also

Group Insurance: Employers often provide group life insurance with lower monthly payments compared to individual policies

Group life insurance is a valuable benefit that employers often offer as part of their comprehensive compensation packages. This type of insurance provides financial protection for employees and their families in the event of the insured individual's death. One of the key advantages of group insurance is its affordability, which is a significant factor for many employers when deciding on employee benefits.

When it comes to cost, group life insurance typically offers lower monthly premiums compared to individual life insurance policies. This is primarily because the insurance company calculates the risk and premium based on the entire group's demographics and health factors. By pooling the risk across multiple individuals, the insurance provider can offer more competitive rates. In a group policy, the monthly payment is usually a fixed amount, determined by the employer and the insurance company, and it is often deducted directly from the employees' paychecks, making it convenient and cost-effective for both parties.

The lower cost of group insurance is a result of several factors. Firstly, the risk assessment for a group is generally more favorable. Insurance companies can analyze the overall health, age, and lifestyle of the group members, allowing them to set premiums that reflect a lower risk profile. This is especially beneficial for employers who want to provide a valuable benefit without incurring significant financial burdens. Additionally, group insurance policies often have lower administrative costs, as the employer handles the enrollment and management process, reducing the insurance company's overhead expenses.

For employees, this means they can access life insurance coverage at a more affordable price. The lower monthly payments make it easier for workers to afford the protection for themselves and their loved ones. Group insurance policies may also offer additional benefits, such as higher coverage amounts or term lengths, which further enhance the value proposition for employees.

In summary, group life insurance provided by employers is an attractive option due to its cost-effectiveness. The lower monthly payments are made possible by the group's collective risk assessment, making it an efficient and beneficial way to secure life insurance coverage for employees. This arrangement benefits both the employer, who can attract and retain talent with a competitive benefits package, and the employees, who can access essential protection at a more affordable rate.

Life Insurance: Can You Insure Someone Else's Life?

You may want to see also

Senior Citizens: Older individuals may face higher monthly premiums due to increased health risks

As individuals age, the cost of life insurance can significantly increase, and senior citizens often find themselves facing higher monthly premiums. This is primarily due to the increased health risks associated with advancing age. Insurance companies consider older individuals to be at a higher risk for various health issues, such as chronic diseases, heart problems, and reduced overall health. As a result, they may charge more to compensate for the potential higher payout in the event of a claim.

The risk assessment for senior citizens is based on statistical data and medical research. Older adults are generally less likely to be approved for certain types of life insurance, especially those with lower coverage amounts, as their life expectancy may be shorter. This is a standard practice in the insurance industry, and it reflects the higher likelihood of claims for older policyholders.

For senior citizens, the key to managing higher premiums is to maintain a healthy lifestyle. Regular exercise, a balanced diet, and avoiding smoking can significantly improve health and potentially lower insurance costs. Additionally, older individuals can explore different insurance options, such as term life insurance, which may offer more affordable rates compared to permanent life insurance.

Another strategy for reducing costs is to consider group life insurance, which is often provided by employers. Group policies typically have lower individual premiums because the risk is spread across a larger pool of members. Senior citizens can also look into state-sponsored programs or government-backed initiatives that offer affordable life insurance options for older adults.

In summary, senior citizens should be aware that age-related health factors can impact their life insurance premiums. By understanding these risks and taking proactive steps to improve their health, older individuals can potentially secure more affordable insurance coverage. It is essential to research and compare different insurance providers to find the best rates and coverage options tailored to individual needs.

Life Insurance Beneficiary: Can I Choose My Boyfriend?

You may want to see also

Frequently asked questions

The average monthly payment for life insurance can vary significantly based on several factors. These include the type of policy (term or permanent), the coverage amount, the insured's age, health, and lifestyle factors. Younger individuals with good health may qualify for lower premiums, while older individuals or those with pre-existing health conditions might face higher costs.

The amount of coverage you choose directly impacts the premium. Higher coverage amounts typically result in higher monthly payments. For instance, a policy with a $500,000 death benefit will generally cost more per month than a policy with a $100,000 benefit.

Yes, term life insurance is generally more affordable than permanent life insurance. Term policies provide coverage for a specified period, such as 10, 20, or 30 years, and they typically have lower monthly premiums compared to whole life or universal life policies. After the term ends, you can choose to renew or shop for a new policy.

Yes, there are strategies to potentially lower your monthly payments. These include choosing a higher deductible, opting for a larger payment frequency (annual or less frequent payments), or bundling life insurance with other insurance products like home or auto insurance. Additionally, maintaining a healthy lifestyle and getting regular health check-ups can also help keep premiums lower.

It's recommended to review your life insurance policy at least once a year or whenever there are significant life changes, such as marriage, the birth of a child, or a major purchase. Adjusting the coverage amount or policy type may be necessary to ensure it aligns with your current financial situation and needs. Regular reviews can help you avoid overpaying and ensure you have adequate coverage.