Tertiary insurance, also known as supplemental insurance, is an additional layer of coverage that complements a primary life insurance policy. It provides extra financial protection beyond the basic benefits offered by the primary policy, ensuring that policyholders and their beneficiaries receive comprehensive support in the event of unforeseen circumstances. This type of insurance is designed to address specific needs or concerns that may not be fully covered by the primary policy, such as long-term care, critical illness, or disability. Understanding the role and benefits of tertiary insurance is essential for individuals seeking to enhance their financial security and ensure their loved ones are protected in multiple aspects of life.

What You'll Learn

- Tertiary Benefits: Additional coverage beyond core insurance, like critical illness or accident insurance

- Tertiary Market: Focus on niche markets where specialized insurance products are offered

- Tertiary Care: Long-term care services provided after primary and secondary healthcare needs

- Tertiary Prevention: Measures taken to prevent complications from existing medical conditions

- Tertiary Education: Training for insurance professionals to enhance their knowledge and skills

Tertiary Benefits: Additional coverage beyond core insurance, like critical illness or accident insurance

When it comes to life insurance, the term "tertiary" refers to additional coverage options that go beyond the basic or primary insurance policy. These tertiary benefits are designed to provide extra protection and peace of mind to policyholders, ensuring that their loved ones are financially secure in the event of unforeseen circumstances. While the core insurance policy typically covers essential aspects such as death, disability, and critical illness, tertiary benefits offer specialized coverage for specific risks.

One common example of a tertiary benefit is critical illness insurance. This type of coverage provides financial assistance when the insured individual is diagnosed with a critical illness, such as cancer, heart attack, or stroke. It offers a lump sum payment or regular income to help with medical expenses, rehabilitation, and other related costs. Critical illness insurance can be a valuable addition to a life insurance policy, especially for those with a family history of certain diseases or individuals who want to ensure comprehensive protection.

Another tertiary benefit is accident insurance, which focuses on providing financial support in the event of accidental injuries or disabilities. This coverage can include medical expenses, rehabilitation costs, and even income replacement if the accident results in a prolonged inability to work. Accident insurance is particularly useful for individuals with physically demanding jobs or those who engage in high-risk activities, as it offers an extra layer of protection against accidental injuries.

Tertiary benefits are often customizable, allowing policyholders to tailor their insurance plans to their specific needs. For instance, some insurance providers offer the option to add disability insurance, which provides income replacement if the insured individual becomes unable to work due to illness or injury. Other tertiary benefits may include long-term care insurance, which covers the costs of extended medical care, and waiver of premium insurance, which ensures that the policy remains in force even if the insured individual cannot pay the premiums due to illness or accident.

By offering these additional coverage options, life insurance companies empower individuals to create a comprehensive protection plan. Tertiary benefits provide an extra layer of security, ensuring that policyholders and their families are adequately prepared for various life events and financial challenges. It is essential to carefully review and understand the terms and conditions of these tertiary benefits to make informed decisions about one's insurance coverage.

Uncover the Benefits: Understanding Employee Voluntary Life Insurance

You may want to see also

Tertiary Market: Focus on niche markets where specialized insurance products are offered

The tertiary market in life insurance refers to a specialized segment of the insurance industry that caters to unique and often complex risk profiles. This market is characterized by its focus on providing tailored insurance solutions to specific niches or industries that may not be adequately served by mainstream insurance providers. In the context of life insurance, the tertiary market involves offering specialized products to address the needs of high-net-worth individuals, professionals in specific fields, or businesses with unusual risk factors.

One key aspect of the tertiary market is its ability to provide customized insurance policies that go beyond standard offerings. For instance, high-net-worth individuals may require comprehensive coverage for their substantial assets, including homes, businesses, and valuable collections. Insurance companies operating in this niche market can design policies with higher coverage limits, specialized riders, and unique benefits to meet these specific needs. This level of customization ensures that clients receive a tailored solution, providing them with the protection they require for their unique circumstances.

Professionals in certain fields, such as extreme sports enthusiasts, pilots, or those in high-risk occupations, also fall into the tertiary market category. These individuals often require specialized insurance coverage that extends beyond the standard life insurance policies. For example, an insurance company might offer extended coverage for extreme sports enthusiasts, including adventure sports-specific riders, or provide pilot insurance with coverage for medical expenses, legal liability, and aircraft-related risks. By catering to these niche markets, insurance providers can offer products that are not readily available in the mainstream market.

Additionally, the tertiary market in life insurance can cater to businesses with unique risk factors. For instance, a small business owner might require insurance coverage for their business's specialized equipment or inventory, which may not be adequately addressed by standard business insurance policies. Insurance companies in this niche can offer extended business interruption coverage, specialized equipment insurance, or industry-specific riders to provide comprehensive protection. This level of specialization ensures that businesses with unusual risk profiles can access the necessary insurance coverage.

In summary, the tertiary market in life insurance is a specialized segment that caters to unique and complex risk profiles. It involves providing customized insurance solutions to high-net-worth individuals, professionals in specific fields, and businesses with unusual risk factors. By offering tailored products, insurance companies in this market can address the specific needs of these niche markets, ensuring that clients receive the protection they require for their unique circumstances. This specialized approach allows insurance providers to differentiate themselves and offer valuable solutions that are not readily available in the mainstream market.

Life Insurance Agents: Financial Consultants or Not?

You may want to see also

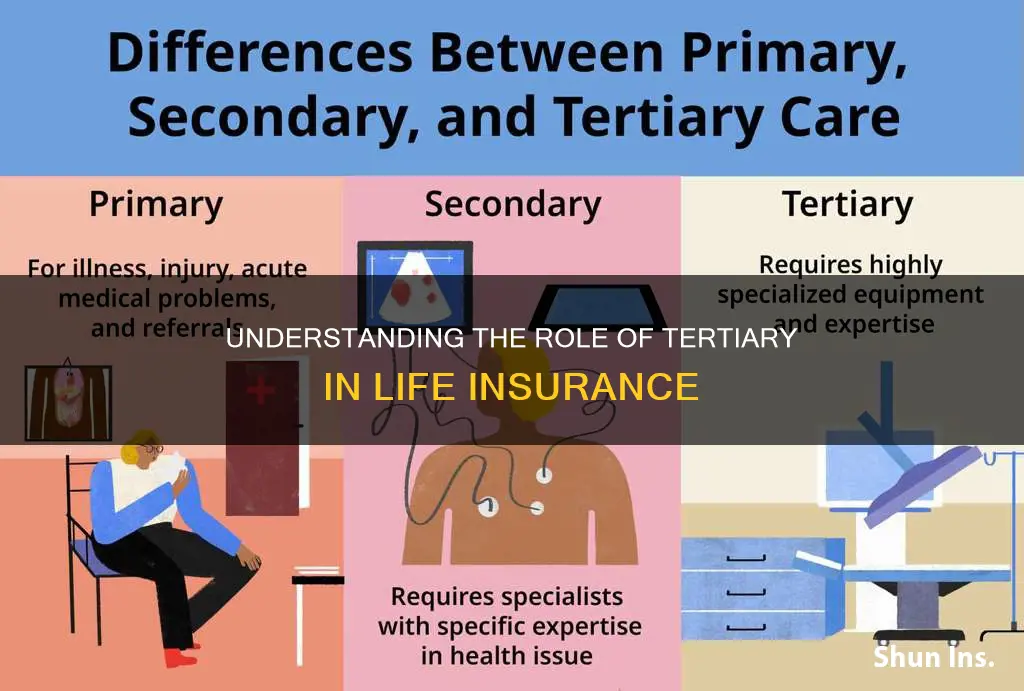

Tertiary Care: Long-term care services provided after primary and secondary healthcare needs

Tertiary care in the context of life insurance refers to the specialized and often long-term support and services provided to individuals who have already received primary and secondary healthcare. This level of care is crucial for managing chronic illnesses, disabilities, and other complex medical conditions that require ongoing attention and resources. It is designed to enhance the quality of life for those with long-term health needs, ensuring they receive the necessary support to maintain their well-being and independence.

In the realm of insurance, tertiary care services are typically covered under long-term care insurance policies. These policies are specifically tailored to address the unique challenges faced by individuals with chronic or disabling conditions. The goal is to provide financial security and peace of mind, knowing that the long-term care needs will be met. This type of insurance is essential for those who want to ensure they have access to the best possible care as they age or deal with prolonged health issues.

Tertiary care often involves a range of services, including skilled nursing care, rehabilitation therapies, and assistance with daily living activities. For example, individuals with severe disabilities may require 24-hour care, including help with dressing, bathing, and eating. Rehabilitation services might include physical, occupational, and speech therapy to help patients regain or improve their functional abilities. These services are typically provided in a variety of settings, such as nursing homes, assisted living facilities, or even at home, depending on the individual's needs and preferences.

The focus of tertiary care is on maintaining and improving the overall health and functionality of the individual. It aims to prevent or minimize the decline in health that can occur with prolonged illness or disability. By providing comprehensive and specialized care, tertiary care services contribute to the long-term well-being and quality of life of the insured individual. This level of care is particularly important for those who have outlived their primary and secondary healthcare needs, ensuring they receive the ongoing support they require.

Understanding the role of tertiary care in life insurance is essential for individuals and families to make informed decisions about their long-term healthcare needs. It highlights the importance of having a comprehensive insurance plan that covers not only primary and secondary care but also the specialized services that may be required in the future. By recognizing the value of tertiary care, individuals can ensure they have the necessary financial protection and access to high-quality long-term care services when they need them most.

Farmers Life Insurance: Is It a Participating Whole Life Policy?

You may want to see also

Tertiary Prevention: Measures taken to prevent complications from existing medical conditions

Tertiary prevention in the context of healthcare and insurance refers to a specific phase of medical intervention aimed at preventing complications and further deterioration of existing medical conditions. This stage is crucial as it focuses on managing and minimizing the impact of diseases or injuries that have already developed, often with the goal of improving the patient's quality of life and preventing additional health issues.

In the realm of life insurance, the concept of tertiary prevention is less directly applicable but can be extended to the idea of proactive measures taken by individuals to safeguard their health and well-being. This involves a shift in focus from treating illnesses to preventing them, which is a fundamental aspect of tertiary prevention. For instance, individuals with pre-existing medical conditions might take additional steps to manage their health, such as adhering strictly to prescribed medications, attending regular check-ups with specialists, and adopting a healthy lifestyle to reduce the risk of complications.

Tertiary prevention strategies often involve a combination of medical interventions and patient-driven actions. For chronic conditions like diabetes or heart disease, this could mean regular monitoring of blood sugar or cholesterol levels, maintaining a balanced diet, and engaging in regular physical activity. These measures are designed to prevent the onset of complications such as kidney damage, nerve damage, or heart attacks, which can significantly impact an individual's health and longevity.

In the context of life insurance, understanding and implementing tertiary prevention can be beneficial for policyholders. It encourages individuals to take a proactive approach to their health, potentially reducing the likelihood of developing severe medical conditions that could lead to higher insurance premiums or even denial of coverage. This might include regular health screenings, maintaining a healthy weight, and avoiding or managing risk factors such as smoking, excessive alcohol consumption, or high-stress levels.

By embracing tertiary prevention, individuals can contribute to their overall health and potentially reduce the financial burden associated with medical care. This proactive approach can lead to better management of existing conditions, improved quality of life, and a reduced risk of developing severe health issues that might impact life insurance policies. Ultimately, tertiary prevention is about empowering individuals to take control of their health, which can have significant benefits in both personal and financial terms.

Life Insurance: Protecting Your Loved Ones and Their Future

You may want to see also

Tertiary Education: Training for insurance professionals to enhance their knowledge and skills

Tertiary education plays a crucial role in the insurance industry, providing professionals with advanced knowledge and skills to excel in their careers. This level of education is specifically tailored to enhance the expertise of insurance practitioners, ensuring they are well-equipped to handle complex insurance products and services. The focus of tertiary education in insurance is to bridge the gap between basic understanding and specialized expertise, enabling professionals to offer comprehensive solutions to clients.

In the context of life insurance, tertiary education often involves specialized courses and programs that delve into the intricacies of various insurance products, including life, health, and annuity policies. These programs are designed to educate professionals on the technical aspects of insurance, such as policy structuring, risk assessment, and claims processing. By gaining a deeper understanding of these concepts, insurance professionals can provide more accurate advice and tailored solutions to their clients.

One key aspect of tertiary education in insurance is the development of critical thinking and problem-solving abilities. Insurance professionals are often required to analyze complex scenarios, assess risks, and make informed decisions. Through structured learning, they learn to apply theoretical knowledge to real-world situations, ensuring they can navigate the challenges of the insurance industry effectively. This includes understanding regulatory frameworks, industry trends, and emerging technologies that impact the insurance sector.

Tertiary education also emphasizes the importance of customer-centric approaches. Insurance professionals are trained to develop strong communication and interpersonal skills, enabling them to build trust and rapport with clients. They learn to understand clients' needs, explain complex insurance concepts in simple terms, and provide personalized recommendations. This customer-focused training ensures that insurance professionals can deliver exceptional service, fostering long-term client relationships.

Furthermore, tertiary education in insurance often includes practical training and industry-specific certifications. Professionals may engage in workshops, seminars, and simulated scenarios to apply their knowledge in controlled environments. These practical experiences allow them to refine their skills, make informed decisions, and develop a competitive edge in the job market. By combining theoretical learning with hands-on practice, insurance professionals can become adept at handling various insurance-related challenges.

Credit Checks: Revealing Life Insurance Payments?

You may want to see also

Frequently asked questions

Tertiary coverage, also known as additional or supplementary insurance, is an optional feature offered by life insurance companies. It provides an extra layer of financial protection beyond the primary death benefit. This coverage is designed to offer additional benefits and customization options to policyholders, ensuring that their loved ones receive comprehensive support in the event of the insured's passing.

Tertiary coverage typically allows policyholders to enhance their existing life insurance policy by adding riders or endorsements. These riders can provide benefits such as accelerated death benefits, which allow policyholders to access a portion of their death benefit if they are diagnosed with a critical illness or terminal condition. Other tertiary options may include waiver of premium riders, which cover insurance premiums if the insured becomes disabled, and income replacement riders, which provide a regular income stream to beneficiaries.

One significant advantage is the ability to tailor the insurance policy to individual needs. Policyholders can choose specific riders that align with their unique circumstances and preferences. For example, someone with a chronic illness might opt for accelerated death benefits to cover medical expenses early on. Additionally, tertiary coverage can provide peace of mind, knowing that the policy can be customized to offer more comprehensive financial protection.

While many life insurance companies offer tertiary coverage options, the availability and terms may vary. It's essential to review the policy details and consult with an insurance advisor to understand what riders or endorsements are offered and their respective costs. Some policies might have restrictions or limitations on certain tertiary benefits, especially for individuals with pre-existing health conditions.

Evaluating your personal and financial situation is crucial when deciding on tertiary coverage. Consider your health status, family responsibilities, income, and long-term financial goals. Consult with a financial advisor or insurance specialist who can provide professional guidance based on your specific needs. They can help you understand the potential benefits and costs associated with different tertiary options, ensuring you make an informed decision.